KOLKATA: Overseas investors in Ujjivan Financial Services have sold part of their stakes in the company in a desperate attempt to bring down aggregate foreign holding to below the 49 percent limit, a rule for small finance banks, three people in the know said.

Foreign investors who were on board for more than a year have pared their holdings over the past few weeks, sources pointed out.

The details if the stake sale exercise is not known yet but It has learned the foreign players have sold stakes in favor of long-term local investors.

Ujjivan, which is in midst of transforming itself into a small finance bank, has remained silent about the development, with Samit Ghosh, its managing director, refusing to comment.

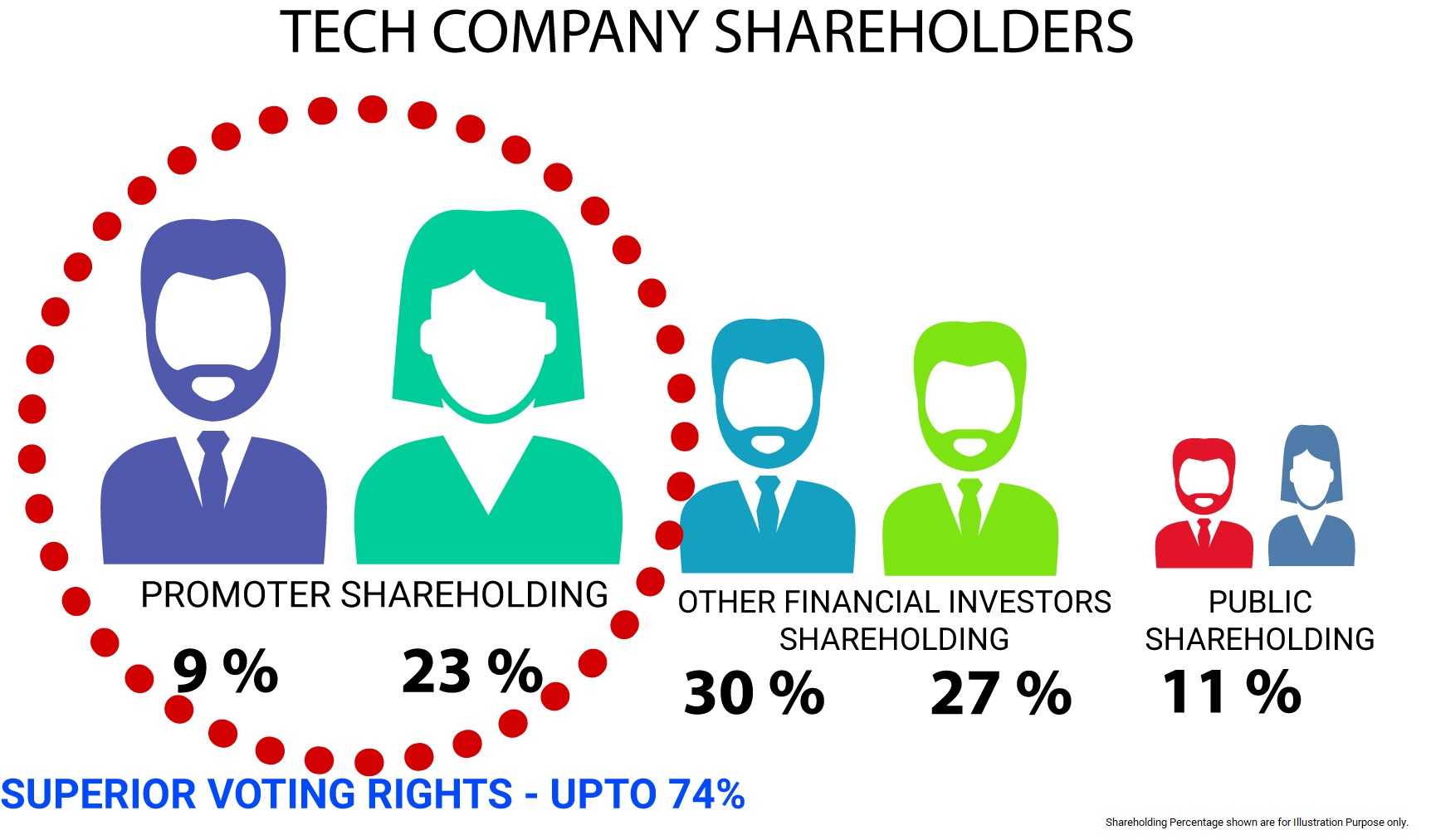

Leading foreign shareholders in Ujjivan includes the UK’s CDC Group Plc with 9.23 per cent holding and International Finance Corporation with 6.03 percent stake at the end of September, according to a BSE filing.

Earlier, Ujjivan had reduced foreign holding to 44 per cent from 70 per cent as on April 13 through a combination of initial public offer and strategic stake sale. It has listed the shares on stock exchanges in May at 10.4 percent premium over the issue price of Rs 210.

Market sources said that foreign institutional investors kept on buying Ujjivan shares post-listing, raising foreign holding to 54 percent, prompting the small finance bank licensee to prepare a fresh formula for foreign investors to offload stake.

Meanwhile, in June, the Reserve Bank of India issued a public notice to bar overseas investors from buying Ujjivan shares through stock exchanges, as the aggregate foreign shareholdings crossed the permissible limit.

Three weeks later, the central bank had also put similar restrictions on Equitas Holding — another MFI-turned small finance bank — as its foreign holding reached the trigger limit. Equitas got itself listed in April.

Like in private sector banks, foreign holding in small finance banks is allowed up to a maximum of 49 per cent of the paid-up capital of the bank through automatic route without the regulator’s prior approval. The limit can be raised to 74 percent through a special approval.

Ujjivan had earlier said that it would launch a small finance bank in the first quarter next fiscal. It has announced on Tuesday that it would provide the benefits of ATMs to its unbanked and under-served customers across the country by using biometrically enabled machines. It has partnered with Financial Software and Systems (FSS), a leading global payment and fintech firm.

Recent Articles on M&A

Source: Economic Times