US fund house Tilden Park Capital Management has sounded out the Reserve Bank of India (RBI) for buying a sizeable stake in Lakshmi Vilas Bank(LVB), an old private sector lender which is scouting for investors to shore up capital.

An official of the New York-headquartered asset manager and senior members of LVB management recently met RBI to explore the possibility.

Tilden was introduced to LVB by Cantor Fitzgerald, the New York-based financial services firm where former Deutsche Bank co-CEO Anshu Jain is part of the top leadership team.

In any ‘control transaction’, where the investor plans to acquire a substantial — even if not a majority — interest, the regulator as well as the investee bank have to do a detailed check of the background and credentials of the investor. In such cases, RBI may even consult the regulator of the overseas investor’s home country. Any investment of 5% or more in a private bank requires prior approval of RBI.

There is regulatory precedence of allowing a strategic investor to acquire a large stake in a private bank with the condition that it has to dilute holding to 15% over a period of time following a lock-in term.

According to regulatory circles, after RBI disallowed the merger of LVB with Indiabulls Housing Finance, the bank wants to make sure that the regulator approves the investor.

Talks with Tilden at preliminary stage

It is understood that talks with Tilden are at a preliminary stage and key issues such as pricing or fund infusion have not been discussed.

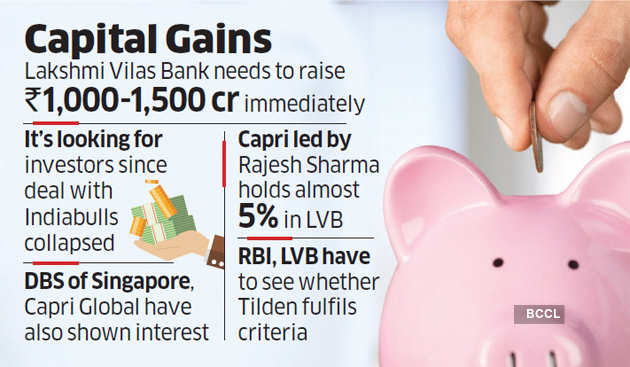

LVB is operating under regulatory restrictions laid down in RBI’s prompt corrective action (PCA) framework. The bank, with an asset size of Rs 31,500 crore, will need at least Rs 1,000-1,500 crore of immediate fund infusion with its capital adequacy level at 5.56% at the end of September against the minimum 8% required under regulations. It suffered a loss of Rs 357 crore after providing Rs 312 crore for bad loans in the quarter ended September.

DBS of Singapore, which is keen to expand its presence in India, has also shown interest in the Indian bank. “LVB’s 560-odd branches is an attraction for the Singapore bank. DBS, which functions as a subsidiary of the Singapore parent, is believed to have approached Indian authorities on the matter,” said an industry source.

ET’s email queries to Tilden went unanswered till the time of going to press while LVB CEO S Sundar could not be reached. A DBS spokesperson said: “As a matter of policy, we do not comment on such matters.”

The LVB stock has declined 69% to Rs 18 in the past one year. During the period, entities belonging to Capri Group led by Rajesh Sharma have bought more than 4.6% of LVB shares from the open market. Last year, Capri had expressed interest to infuse capital in the bank, but this was not pursued by the board which had initiated talks with Indiabulls.

Source: Economic Times