The US-based buyout fund Platinum Equity Advisors has signed its debut private equity deal in India. It has acquired a significant majority stake in Inventia Healthcare, Mumbai-based pharmaceuticals company, at a valuation of Rs 2,500 crore ($300 million), said multiple people aware of the development.

Existing PE investors – InvAscent Capital and Jacob Ballas have exited their investments, while promoter Janak Shah and family have sold part stake. Platinum has acquired about 75% stake in Inventia, said sources. Presently, both the investors hold together about 40% stake in Inventia. Promoter Janak Shah and family own the rest of the stake. Rothschild and Stifel Financial Corp (Torreya) advised the funds, while Barclays advised Platinum. ET first reported in January on the discussions with Platinum Equity.

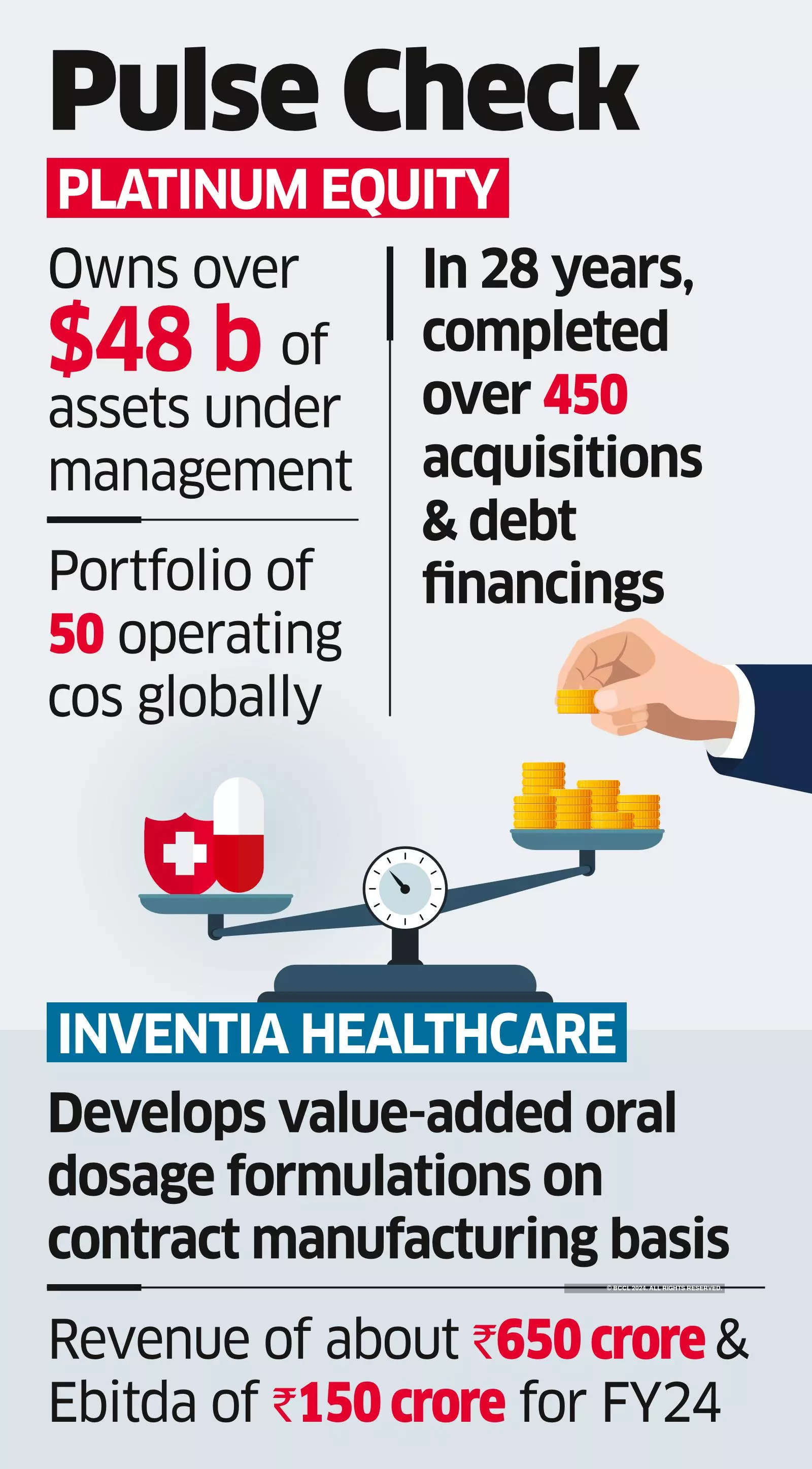

As per plans, the promoter family will retain a minority stake and manage the business, added sources. Mails sent to Platinum, Inventia Healthcare, InvAscent Capital and Jacob Ballas did not elicit any responses. Founded in 1995, California-based Platinum Equity owns more than $48 billion of assets under management and a portfolio of approximately 50 operating companies globally. Over the past 28 years Platinum Equity has completed more than 450 acquisitions and debt financings, according to a company website. In healthcare, Platinum owns LifeScan – a US-based manufacturer of glucose management products and solutions; and NDC, the US-based healthcare supply chain company.