Enough whining already, Verizon.

Verizon is steaming mad — and with good reason — that Yahoo maybe didn’t disclose a tiny problem of a hulking cyber attack before Verizon agreed to fork over $4.8 billion to buy it. And now inside the corridors of Verizon HQ, executives are mulling whether Yahoo’s lack of transparency about the hacking might be enough to jeopardize the deal.

It would be so Yahoo if the company that can do nothing right botched this sale to Verizon, too. But it’s also hard to see Verizon finding a way to walk away.

Even if Yahoo didn’t know the full scope of the theft of personal information from at least 500 million people, it’s not great if the company didn’t share what it did know with Verizon. Verizon is right to have misgivings about Yahoo’s failure to be forthcoming before and apparently after the deal was struck. But does Verizon have any realistic choice but to shut up and move ahead with its purchase more or less as is? Not really.

Yahoo has the power here. There’s a contract. Signed and notarized. Yahoo didn’t exactly get the marriage off on the right foot by perhaps obfuscating about the cyber attack. But, hey, that’s what you get for buying a company with a track record of hiding unpleasantries during the sale process and fibbing about its business prospects before that.

I confess I took a perverse pleasure at Yahoo’s backbiting by press release in Tuesday’s third-quarter earnings report, which seemed aimed squarely at its partners-turned-antagonists at Verizon. Yahoo is “busy preparing for integration with Verizon,” CEO Marissa Mayer said in a canned quote. That’s right, Verizon. She’s putting her fingers in her ears to shut out your grousing.

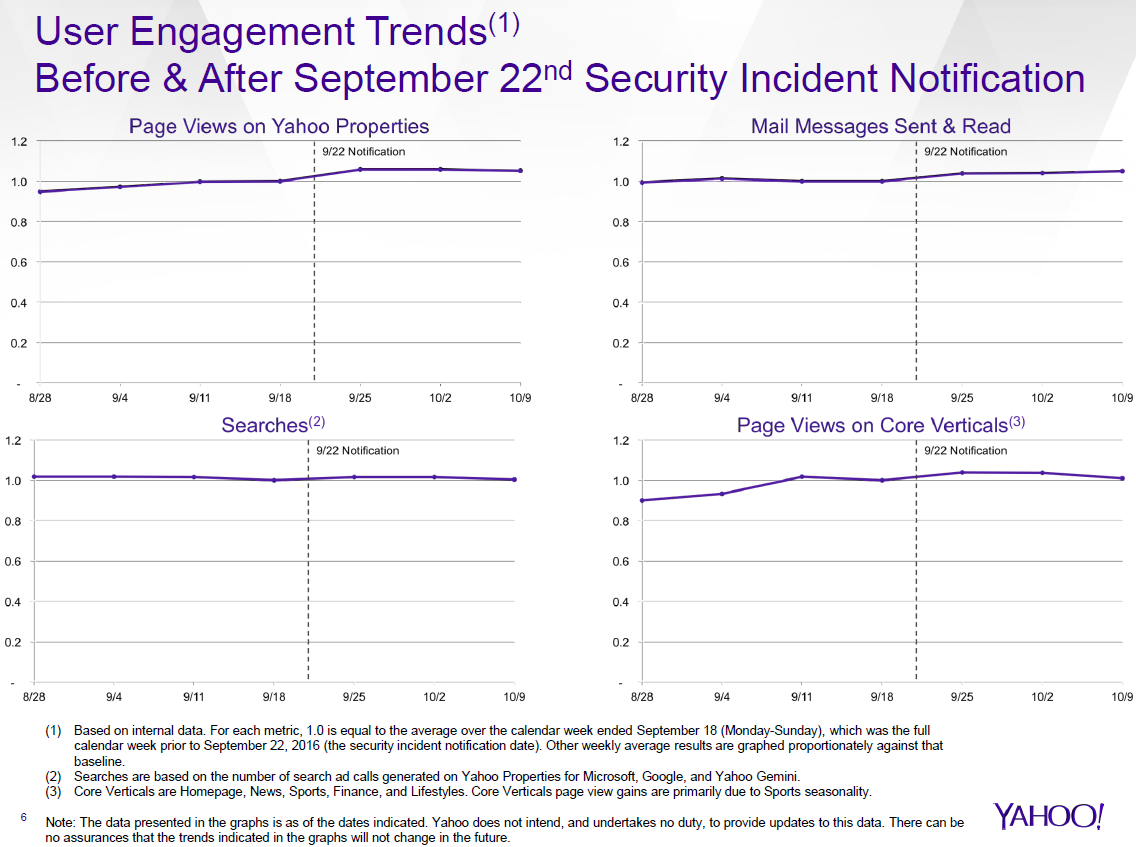

And Yahoo tucked in its presentation slides this gem, showing what the company says is little to no change in people’s use of Yahoo websites, email, and some other internet offerings after the September disclosure of the cyber attack.

This slide was designed to counter a claim by Verizon’s top lawyer that Yahoo’s failure to tell Verizon about the cyber theft dating back to 2014 represents a material impact on the acquisition deal. Experienced mergers-and-acquisition hands know what it means to raise the specter of the dreaded “MAC” — or material adverse change. MAC is the magic legal word that lets an unhappy buyer return its busted toy without penalty.

But MAC escape hatches in deal contracts are notoriously tough to enforce in court. The business being acquired has to have something go seriously wrong — and for that calamity to be lasting, unique to the acquired company and unforeseen at the time of the deal. Cyber attacks happen basically every day. And while Yahoo seems to have done some incredibly boneheaded things that left the company vulnerable to digital intruders, hacking is a risk the buyer of any internet company takes.

Presumably, Verizon has seen the data in the slide before. Mayer again in her canned quote said her company was “heartened” by users’ loyalty to Yahoo, “as seen in our user engagement trends.” That’s how you say, “Heck no, this isn’t a MAC” in press release-speak.

Yahoo’s business also isn’t going like gangbusters. But Verizon knew that, too. Yahoo’s third-quarter revenue, excluding commissions to its partners, dropped more than 14 percent from the same period in 2015. And even after Yahoo slashed expenses, including cutting 20 percent of its staff from a year ago, the company still couldn’t generate profit from its operations. Both the revenue decline and the operating loss, however, were improvements from comparable figures in prior quarters. It’s Yahoo. The company gets graded on a steep curve.

Verizon’s private and semipublic grumbling about Yahoo is most likely saber-rattling to push for a lower acquisition price. Everyone wants a discount, of course, particularly for a purchase that works out to an illogical 79 times Yahoo management’s forecast for 2018 earnings before interest and taxes. But there’s risk to Verizon, too, in dragging out a deal to haggle over a price that amounts to 4 percent of its yearly sales.

Yes, it’s understandable for Verizon to have a bad case of buyer’s remorse over Yahoo’s truthiness. But it’s hard to imagine Verizon can abandon the deal it signed. And the cyber attack doesn’t change the rationale for Verizon’s purchase of Yahoo. It’s time for Verizon to suck it up, or squeeze Yahoo so it can pay a bit less and get the deal done. Either way, Verizon, Yahoo is your broken toy and now you have to play with it.

- A few people have noted that use of Yahoo’s web services should have increased after the cyber attack, if only because people with dormant accounts might be logging in to change their passwords.

- It’s unclear whether Yahoo knew about the scale and scope of the cyber attack when it agreed to sell the company to Verizon in July. If Yahoo knew but didn’t tell Verizon, it may be that clauses in Verizon’s acquisition contract may let it back out of the deal. That would swing the power back to Verizon.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Recent Articles on M&A

Source: Bloomberg.com