The proposed merger between Reliance Industries-owned Viacom18 and Walt Disney’s Star India is likely to go through greater scrutiny by the Competition Commission of India (CCI) given the impact it could have on the media & entertainment sector, legal experts said.

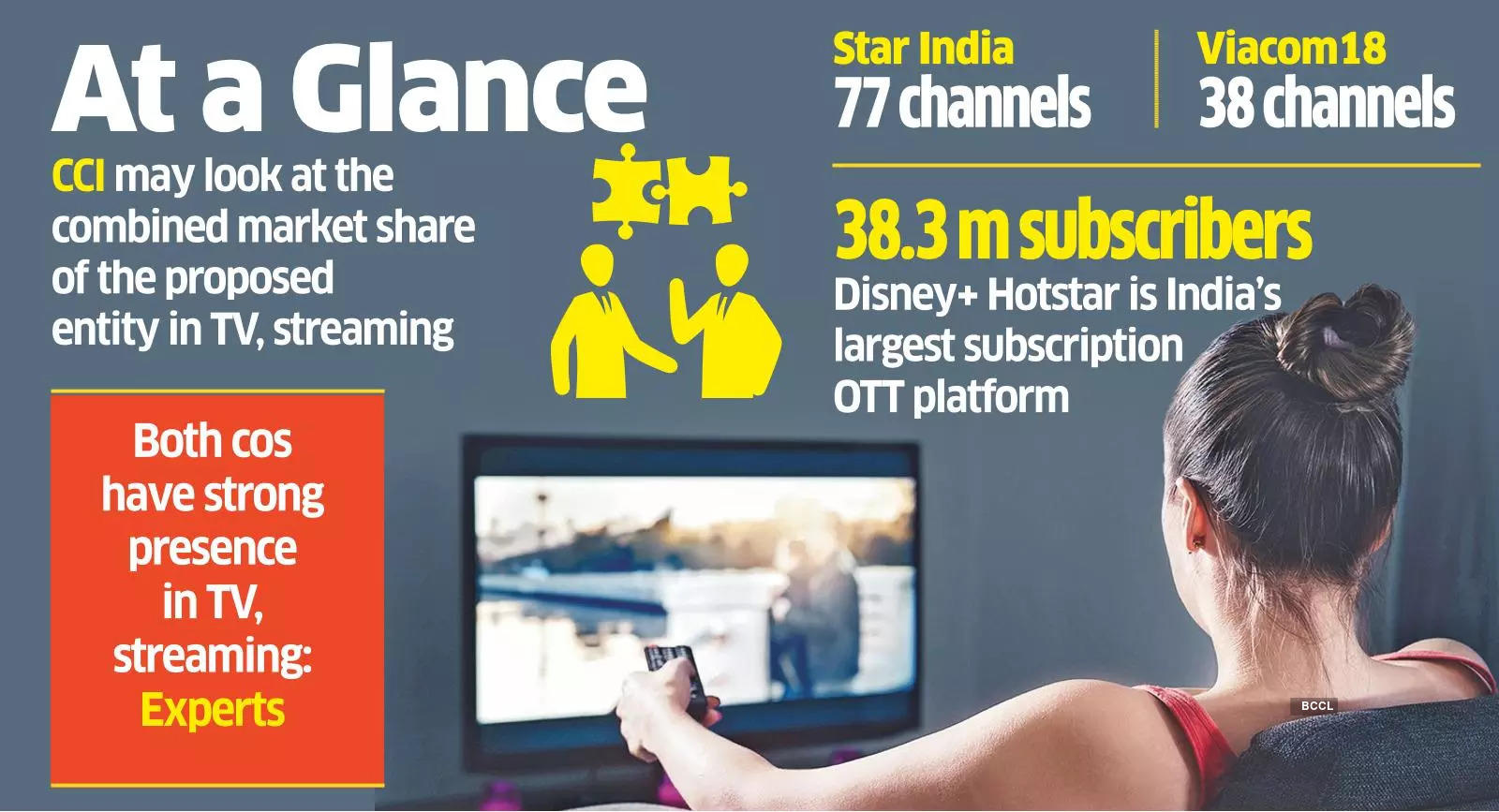

The anti-monopoly watchdog might look at the combined market share of the proposed merged entity in the TV and streaming segments as the duo has a commanding presence in both segments, they added.

While referring to the CCI’s order in the Sony-Zee combination plea, legal experts said the competition watchdog could also order Star and Viacom18 to divest channels in categories where they have market shares beyond the acceptable threshold level.

The CCI had given conditional approval to Sony-Zee in October 2022 by asking them to shut down three channels, Big Magic, Zee Classic, and Zee Action.

The CCI usually conducts a detailed investigation if the combined market shares of the parties exceed 40-50% in any market.

In the TV broadcasting segment, the Star-Viacom18 combine has over 40% viewership share at the network level, as per market estimates. Star boasts a market share of over 30%, while Viacom18 has over 10%.

Star-Viacom18 has a near monopoly in the live sports segment with properties like the Indian Premier League (IPL), the International Cricket Council (ICC), and media rights to Indian, Australian, and South African cricket boards, besides Pro Kabaddi, the Indian Super League, and the English Premier League.

“While the two entities have agreed to consummate the merger, the Viacom-Disney deal will demand greater scrutiny by the CCI, especially given the market share that this combination would achieve,” says TMT Law Practice Founding and Managing Partner Abhishek Malhotra.

“This is especially so since the cricket rights accorded to the combination and the resultant advertising rates that they will be able to command are quite pervasive.”

Within TV broadcasting, the combined entity’s might in certain genres like Hindi and Marathi will be unmatched, with a market share of over 50%. The two also have significant viewership shares in the Bengali and Kannada markets.

In streaming, Disney+ Hotstar is India’s largest platform, with 38 million subscribers, much ahead of Netflix and Prime Video. JioCinema has become one of the strongest streaming platforms on the back of free streaming of IPs like IPL and Bigg Boss.

“Given the strong presence of the parties in the broadcasting sector, the deal is likely to attract closer scrutiny from the CCI and may get into a detailed Phase II investigation,” said Vaibhav Choukse, Partner and Head of Practice at JSA Advocates and Solicitors.

Choukse added that the CCI assessment would focus on the ability of Star-Viacom18 to increase ad rates and the level of bargaining power with downstream players like distribution platforms.

Shreevardhan Sinha, Senior Partner at the law firm Desai & Diwanji, said the proposed consolidation may necessitate divestment of assets, particularly TV channels, to alleviate apprehensions regarding their collective market dominance.

“When reviewing the now-failed Sony-Zee merger in 2022, the CCI identified the supply of TV channels as a relevant market, with general entertainment channels forming a sub-segment,” he added.

Reliance, Viacom18, and Walt Disney had on February 28 signed definitive agreements to form a joint venture by merging Viacom18’s media operations into Star India through a court-approved scheme of arrangement.

The Mukesh Ambani-led RIL has committed to investing Rs 11,500 crore ($1.4 billion) in the JV, which is valued at Rs 70,352 crore ($8.5 billion) post-money, excluding synergies.

RIL, Viacom18, and Disney will own 16.34%, 46.82%, and 36.84% of the JV, respectively.