Vodafone Group Plc has valued its 42% stake in Indus Towers, the largest telecom tower company in India, at $5 billion (around Rs 32,720 crore) and its group CEO Vittorio Colao said that the competitive South Asian telecom market was showing some positive signs amid rapid consolidation and the gradual raising of tariffs by Reliance Jio Infocomm.

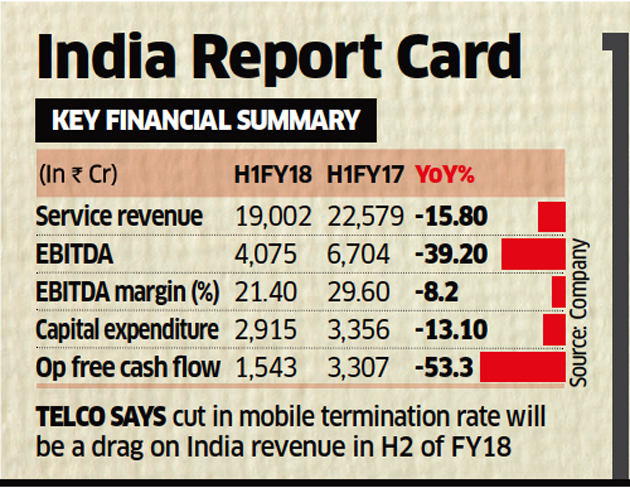

The country’s second-largest operator, which saw a 15.8% drop to Rs 19,002 crore in its service revenue and a 39.2% fall in its operating profit to Rs 4,075 crore in the first half of the financial year amid intense price competition, is seeing a “quicker-than-expected progress” on its equal merger with No. 3 telco Idea Cellular, which it expects to be closed by September 2018, Colao said at an analyst call on Tuesday.

Vodafone India’s average revenue per user (ARPU) fell to Rs 132 in the second quarter from Rs 141 in the first quarter of the current financial year and its cash flows were hurt by “continued targeted capital investments and reduced margins due to competitive intensity”.

But Colao sounded cautiously upbeat about the future. “In India, competition remains intense.

There are, however, signs of positive developments in the Indian market, with consolidation of smaller operators and recent price increases from the new entrant. Jio has raised its prices in October which is good,” he said.

He added that operating margins were stabilising and that the company was investing in leadership circles and high-value customers.

Reliance Jio’s launch last year has shaken the Indian telecom market. In addition to steep reduction in voice and data tariffs and sharp drop in profits and revenues, it has also accelerated the process of consolidation in the sector, which has now dominated by three players — Jio, Bharti Airtel, and the Idea-Vodafone combine.

Jio started charging from its customers in April this year, and has since then effectively raised tariffs twice. This has led industry analysts and experts to hope that some sort of price stability would return to the sector, though these expectations were partially dashed when it introduced attractive discounts for its popular Rs 399 prepaid plan earlier this month.

In the runup to closing the merger, Vodafone hopes to monetise its 42% stake in Indus, and may well plough the proceeds in some form back into its India business which it had deconsolidated from its global operators in the April-June quarter.

“We are in talks with multiple players for a partial or full stake sale or an IPO (initial public offer).

We will focus on the option that gives us maximum long-term value,” Nick Read, chief financial officer of Vodafone Group, told analysts. Vodafone’s 42% stake in Indus was kept out of the Idea-Vodafone India merger, and hence the proceeds will belong to the UK-based parent company.

Read said that Bharti Infratel, India’s only listed tower unit, had estimated a valuation of “over $5 billion for its 42% stake in Indus Towers”, and Vodafone expects a similar number for its own stake.

Vodafone and Idea on Monday agreed to sell their roughly 20,000-odd standalone, or directly-owned, towers to a local arm of American Tower Corp for Rs 7,850 crore. Vodafone India will receive Rs 3,850 crore if the tower deal gets completed before its merger with Idea Cellular.

IDEA-VODA MERGER

Colao said there was good progress on the Idea-Vodafone merger and it was moving quicker than expected. ‘We are making good progress in securing regulatory approvals for our merger with Idea Cellular and in monetising our tower asset. Court and DoT approvals are pending. We expect it to happen in 2018. We had earlier mentioned 12-18 months so that leads to September 2018,” he said. Some analysts expect the merger to close even faster, by March 2018.

The telco said it had a capex investment of Rs 2,915 crore in the six months ended September, and saw its earnings before income, tax, depreciation and amortisation (EBIDTA) margins drop to 21.4% from 29.6% when compared on a like-forlike basis. Its revenue in the July-September quarter fell sequentially, reflecting price competition, seasonal weakness as a result of the monsoon, and the impact of the new Goods and Services Tax regime, “which increased the tax burden on our gross revenues to 18% (previously 15%)”. It had a debt of Rs 61,800 crore as on September 2017.

The brass of the UK-based telecom operator noted that the drop in mobile termination rate (MTR) or IUC – the charge that the operator on whose network a call originates pays to the operator on whose network the call terminates – will put pressure on revenue in the second half of the current fiscal.

“MTR is a drag but the fundamentals have started to improve,” said Read. India’s telecom regulator has slashed the IUC to 6 paise a minute from 14 paise a minute effective October 1. Vodafone, Bharti Airtel and Idea Cellular have challenged the move in the Bombay High Court.

Source: Economic Times