UK’s Vodafone Group Plc raised around Rs 1,443 crore by selling a 2.4% stake in Indus Towers through a block deal to unnamed investors on Thursday.

Vodafone sold 63.6 million shares held by unit Euro Pacific Securities at Rs 226.84 a share, bulk deal data released late Thursday night on the NSE showed. After the block deal, Vodafone UK’s stake in the telecom tower company reduced to 25.7%.

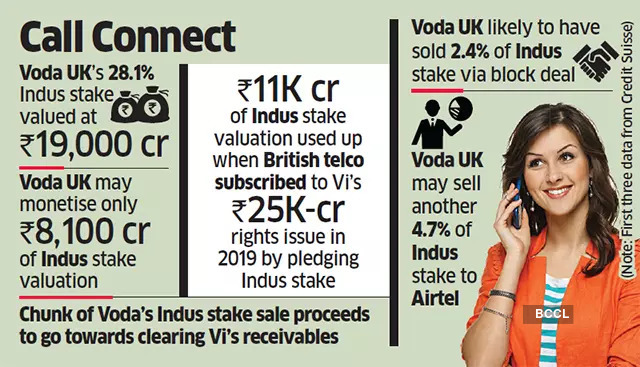

The British telco, which held a 28.1% stake in Indus, said on Wednesday that it would sell a 2.4% stake on Thursday through a block deal and was also in talks with one of the tower firm’s largest shareholders to sell another 4.7%. People aware of the matter told ET that Bharti Airtel was this shareholder.

The UK company has also said it was in talks with “several interested parties” to sell its balance stake in the tower company.

Vodafone said the cash it raised via these stake sales would be infused in loss-making Vodafone Idea (Vi). The UK company and India’s Aditya Birla Group wish to subscribe to an issue of equity shares by Vi in their capacity as co-promoters.

Shares of Indus Towers crashed more than 18% to Rs 205.75 on the BSE Thursday. Vi shares slumped 10% to close at Rs 9.64.

Sector experts said any additional stake purchase by Bharti Airtel in Indus would be viewed negatively, given that the market sees Airtel’s 41.7% stake in the company as a lever for future monetisation. Airtel shares closed nearly 4.8% lower at Rs 670.05 on the BSE Thursday.

Analysts said UK’s Vodafone would at best be able to inject only Rs 3,000-4,000 crore into Vi while participating in the stressed telco’s fundraise via a potential equity infusion. This is because a chunk of its proceeds from the Indus stake sale would be used to settle outstanding receivables with the tower company, say analysts.

Credit Suisse said the British telco can “effectively monetise only Rs 8,100 crore” of its overall Indus stake valuation. This, since around Rs 11,000 crore of the estimated Rs 19,000 crore valuation of Vodafone’s 28.1% Indus stake has already been used up by the UK company when it subscribed to Vi’s Rs 25,000 crore rights issue in 2019 by pledging the Indus stake with banks.

Of this, Vodafone UK will be able infuse only around Rs 3,000-4,000 crore into Vi, Credit Suisse said. “Vodafone Plc will look to use the Rs 81 billion (Rs 8,100 crore) of its stake in Indus for participating in Vi’s fundraise, but the effective cash flow available for Vi will be only Rs 30-40 billion as Rs 40 billion of (such) equity infusion would be utilised to clear Vi’s existing overdue balance with Indus,” it said.

Vodafone’s sale of Indus stake comes at a time when its local telecom joint venture, Vi, is racing against time to raise funds to fund operations. The company in an investor call recently had pegged March 2022 as the deadline for completion of its fundraising exercise.