Waaree Renewable Technologies has agreed to acquire a 55% stake in Gujarat-based Associated Power Structures Ltd (APSL) for ₹1,225 crore, marking the Waaree Group’s entry into grid and transmission infrastructure, a key enabler for large-scale renewable deployment.

The transaction will involve an investment in new shares of APSL as well as the purchase of secondary shares, Waaree Renewable, a subsidiary of Waaree Energies, said in a news release Monday.

Upon completion of the transaction, APSL will become a subsidiary of WRTL. APSL will be valued at ₹2,800 crore after the investment.

Founded in 1996, APSL operates power transmission and distribution infrastructure in India and some global markets. In FY25, it reported a turnover of ₹1,226.64 crore and total assets of ₹834.15 crore. APSL business complements Waaree’s renewable portfolio, said Waaree Renewable chief financial officer Manmohan Sharma.

End-to-end Solutions

Waaree Renewable said the acquisition will enhance its ability to deliver end-to-end clean energy solutions by integrating generation, EPC, and enabling grid infrastructure under one platform.

It is building an integrated multi-energy global platform. It is investing in battery storage, inverters, transformers, power infrastructure, and electrolysers as part of green energy ecosystems.

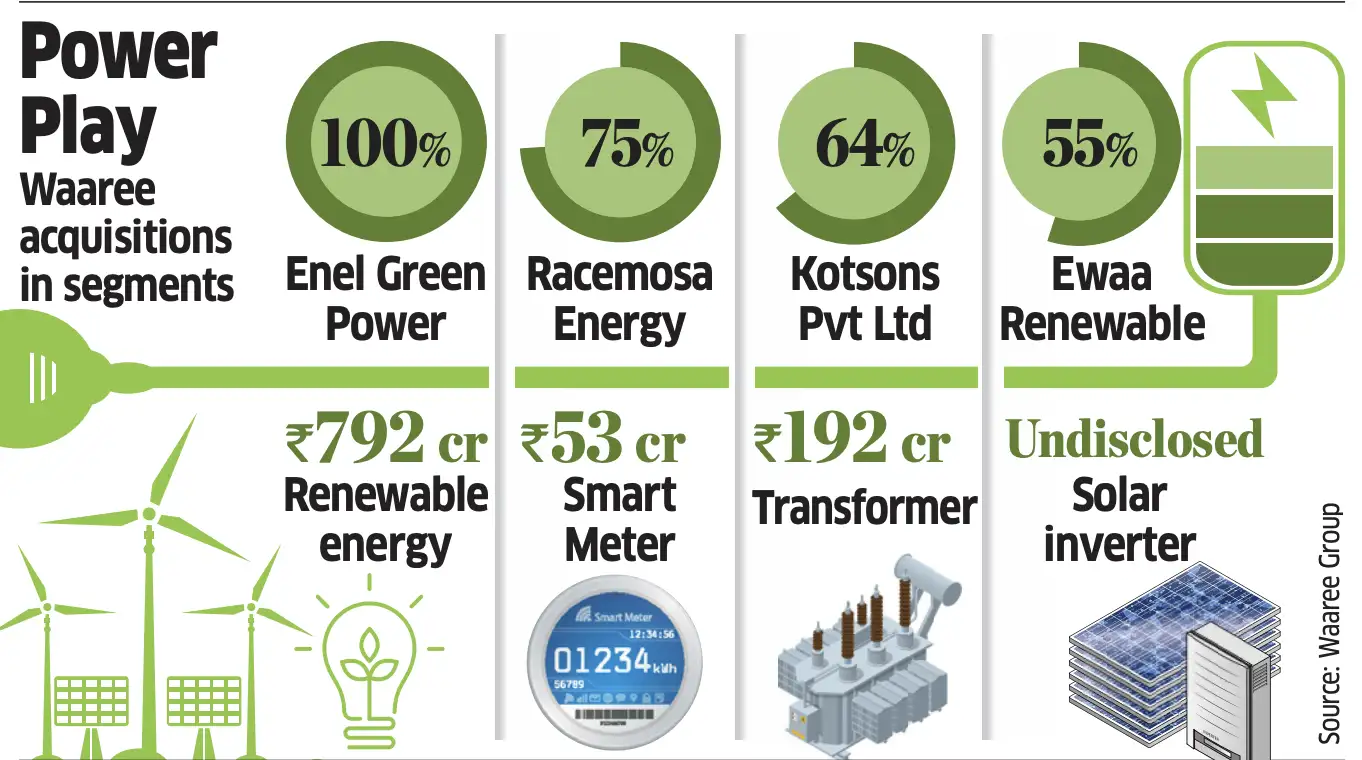

In the past year, the Waaree Group has acquired transformer maker Kotsons and smart meter company Racemosa Energy. It has planned a capital expenditure of about ₹30,000 crore in solar manufacturing, energy storage and adjacent segments.

It recently raised ₹1,000 crore in its battery arm, Waaree Energy Storage Solutions, which will commission a 4 GWh lithium-ion cell manufacturing plant next year.

With 25 GW of capacity currently, Waaree Energies is the largest solar module manufacturer outside China. In the next five years, the company intends to have less than 40% of revenue from solar modules.

Beyond modules, Waaree Energies operates 5.4 GW of solar cell capacity, which is projected to cross 15 GW next financial year, followed by 10 GW of ingot and wafer capacity the year after.

Waaree Power, another subsidiary of Waaree Energies, has commissioned phase I of its 3-gigawatt inverter facility at Sarodhi, Gujarat, with phase II, comprising 1 gigawatt, to become operational by FY27.

The transaction with Associated Power is expected to close by April 30, subject to customary conditions and due diligence. Singhi Advisors acted as the strategic and financial advisor to Waaree Renewable on the transaction.