A consortium of Warburg Pincus and Abu Dhabi sovereign wealth fund Mubadala has emerged as the frontrunner to acquire a majority stake of up to 74% in Mumbai-based Encube Ethicals, a generics and pharmaceutical contract manufacturer known for popular brands like Soframycin skin ointment, according to people familiar with the matter.

The Warburg-Mubadala combination, expected to value the company at around Rs 16,500 crore ($1.8 billion), is competing with Swedish buyout firm EQT, the only other serious contender ahead of binding offers scheduled next week.

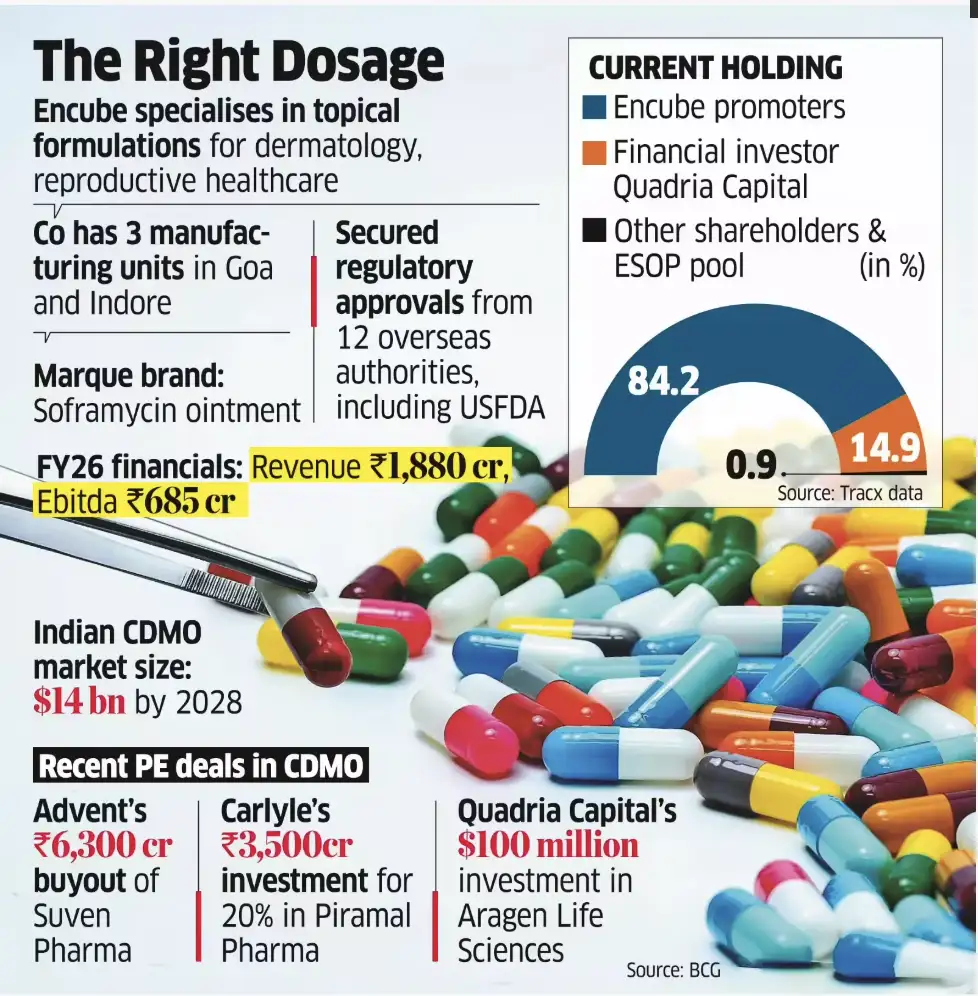

At this level, the company will get valued at close to 24x its projected FY26 ebitda, underscoring the strong demand for scaled contract development and manufacturing organisation (CDMO) homegrown businesses among private equity investors. The industry is poised for rapid expansion driven by global supply chain diversification away from China, the positive long-terplrm impact of the US BioSecure Act that aims to restrict federally funded agencies and companies from partnering with Chinese companies, India’s cost advantages and rising demand for complex biologics.

Encube’s promoters, led by founder Mehul Shah and family currently hold about 84.2% of the company, while financial investor Quadria Capital own around 14.9% with employees owning the rest.

The financial investors are expected to fully exit as part of the transaction, the people cited said. The promoter group will also dilute significantly and will become a junior partner with a 15-20% stake. An IPO is expected in about four years.

However, Shah will continue as a co-promoter till the company gets listed by the new shareholders. There is also unlikely to be any change in management, at least in the short term. Even though it’s clear that the incoming financial investor will own a minimum of 51%, the exact quantum of shareholding is still being discussed. However, it will be below the 75% threshold.

Founded in 1998 by Shah, a first-generation entrepreneur, Encube Ethicals is a pharmaceutical CDMO focused on topical formulations. Its portfolio includes marquee brands along with a wide range of creams, gels and ointments used in dermatology and reproductive healthcare.

Warburg Pincus declined to comment. Mubadala, Quadria and Encube did not respond to ET’s queries.

In September, ET reported that Quadria Capital had mandated JP Morgan to run the sale process, which had attracted interest from global private equity firms including Blackstone, KKR and Partner’s Group. The management is hoping to sign a share purchase agreement in the next two-three weeks.

The company operates three manufacturing facilities in Goa and Indore and serves customers in India and the US. Encube has secured regulatory approvals from 12 overseas authorities, including the US Food and Drug Administration (US FDA).

In 2021, Encube entered the Indian consumer healthcare (B2C) segment by acquiring topical anti-microbial brands Soframycin, Sofradex, Sofracort and Soframycin-Tulle from Sanofi for the India and Sri Lanka markets for about Rs 125 crore.

Encube Ethicals has raised $65.5 million in two funding rounds. This includes a $34.2 million Series D round in 2021 led by Quadria Capital and GII, and a $31.3 million Series C round in 2016 from Plenty Investment Advisors and Multiples Alternate Asset Management.

Growth has surged in recent years and the company expects to achieve Rs 4,000 crore in sales in the next three years, up from Rs 500 crore in 2021. FY26 revenue is projected at Rs 1,880 crore. The company is hopeful of achieving a 30% ebitda margin in FY27.

The CDMO unit accounts for nearly half the business while the rest comes from India and the US. The Rs 150 crore domestic formulations business is mostly Soframycin. The company has filed for abbreviated new drug applications (ANDAs) in the US for several new products. That’s expected to add over Rs 800 crore to the topline going forward.

“This is a high-margin business with a clear visibility of revenues for the next 12-24 months,” said an investor who had evaluated the opportunity. “But they intend to get into complex products in gynaecology and dermatology, which has taken several years for even the big pharma players to master. Shah is a very ambitious entrepreneur.”

Warburg Pincus has been an aggressive investor in the global pharmaceuticals and healthcare space. In 2023, it partnered Advent International to acquire Baxter International’s BioPharma Solutions business for $4.25 billion. The CDMO platform was later carved out and rebranded Simtra BioPharma Solutions. In India, the firm acquired a majority stake in Chennai-based cataract lens manufacturer Appasamy Associates in April 2024 at a valuation of ₹3,000–3,200 crore. In 2022, it bought a stake of about 11% in medical devices major Micro Life for $210 million, valuing the company at about $2 billion.

Warburg, which started the PE boom in India in the mid-1990s, has so far deployed $10 billion in more than 80 investments. It recently partnered Sunil Mittal’s family office to buy a majority stake in Haier’s India business. It teamed up with Abu Dhabi Investment Authority (ADIA) to double down on IDFC First Bank with a Rs 7,500 crore bid. It also backed hotelier Patu Keswani for the second time with a Rs 960 crore cheque in a subsidiary company of Lemon Tree Hotels called Fleur.

Chairman Chip Kaye, who was recently in India to celebrate the firm’s 30th anniversary in the country, told ET that the biggest change among local entrepreneurs is their willingness to monetise businesses that they have founded and are emotionally attached to. “As a result of our long presence in India, we may be the most referenceable private equity firm in the industry,” he said.

Source: Economic Times