US private equity firm Warburg Pincus has fully acquired Shriram Housing Finance Ltd (SHFL) from its promoter Shriram Finance and minority shareholder Valiant Capital Management for Rs 4,630 crore in the largest M&A deal in the housing finance sector.

The deal, struck at 2.8 times Shriram Housing’s net worth, will allow Warburg to foray into the expanding affordable housing space in the world’s fifth-largest economy.

ET had on April 3 reported that Warburg Pincus had emerged the frontrunner to acquire SHFL, leaving behind competitors such as Bain Capital, CVC and Advent.

New Brand Name

The New York-headquartered private equity firm finalised the deal on Monday with Chennai-based non-banking finance company (NBFC) Shriram Finance, which held 84.82% of the mortgage lender.

San Francisco-based PE Valiant Capital Management owned the remaining stake in SHFL, which is one of the fastest growing housing finance companies in the country.

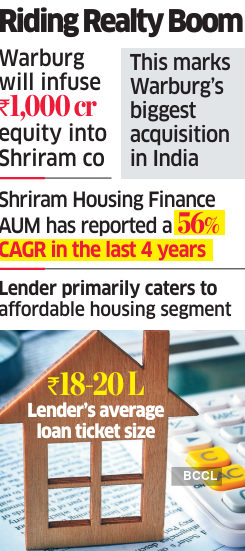

“This is the first ever sale by the Shriram Group. This also marks Warburg’s biggest acquisition in India and the biggest deal in the housing finance sector,” Shriram Housing Finance managing director Ravi Subramanian told ET.

Warburg Pincus will acquire the stakes through affiliate Mango Crest Investment Ltd from all the sellers. The transaction, which covers equity and all convertible instruments of SHFL, is subject to regulatory approvals.

The private equity firm will infuse Rs 1,000 crore in equity, Subramanian said.

“Warburg Pincus remains excited about the affordable housing finance segment in India,” said Narendra Ostawal, head of India private equity at Warburg Pincus.

According to the deal, the entire management of SHFL, including Subramanian, will stay on. The company has a pan-India presence with 155 branches and had assets under management (AUM) of Rs 13,762 crore at the end of March with a net worth of Rs 1,924 crore. AUM has expanded at 56% CAGR over the last four years.

The company will also have a new brand name even if it has a 1-year window to retain the Shriram identity.

SHFL raised Rs 400 crore in compulsorily convertible debentures in the last week of March. This was excluded from the net worth when the valuation metric for the deal was calculated.

“Under Ravi’s leadership, Shriram Housing Finance has embarked on a remarkable journey, positioning itself as one of India’s leading affordable housing finance companies,” Ostawal said. “Warburg Pincus has a deep history of partnering with exceptional teams, particularly within financial services and we are excited to support Ravi and the management team as the company advances into its next phase of growth.”

Negotiations over the deal started in December last year and gathered steam in April.

This came after protracted negotiations with some private equity firms to sell a minority stake of 15-20% for growth capital did not fructify. Subsequent negotiations with suitors such as EQT (formerly Baring EQT) also failed.

“With Warburg Pincus’ global expertise and as partners in growth, we’re well-positioned to further build out SHFL and create a larger impact in the Indian housing finance sector,” Subramanian said.

Shriram Finance executive vice-chairman Umesh Revankar said that the transaction aims to maximise value creation for both Shriram Finance and SHFL, as both companies independently fulfill their respective long-term vision.

JM Financial, Barclays and Avendus were financial advisors to SFL, SHFL and Valiant. Trilegal and Anagram were legal advisors to Shriram Group and Valiant, while Cyril Amarchand Mangaldas advised Warburg Pincus.

Source: Economic Times