Warburg Pincus and Kedaara Capital are in separate discussions to acquire Watertec India, a domestic bathroom fittings and accessories maker. The proposed deal will value the unlisted company at ₹3,500 crore ($450 million), said multiple people aware of the development.

Watertec (India) Pvt Limited was set up in 1997 as a three-way joint venture among Coimbatore-based UMS Group, Watertec Malaysia and Sri Lanka-based South Asian Investments. It is the leader in the plastic bath fittings and accessories market. It sells bathroom fittings, accessories and sanitaryware across polymer, chrome-plated, and affordable luxury categories.

Another PE fund Multiples Alternate Asset Management was also one among the contenders for Watertec.

EY India is advising the promoters.

A spokesperson with Warburg Pincus declined to comment while mails sent to Watertec and Kedaara did not elicit any responses.

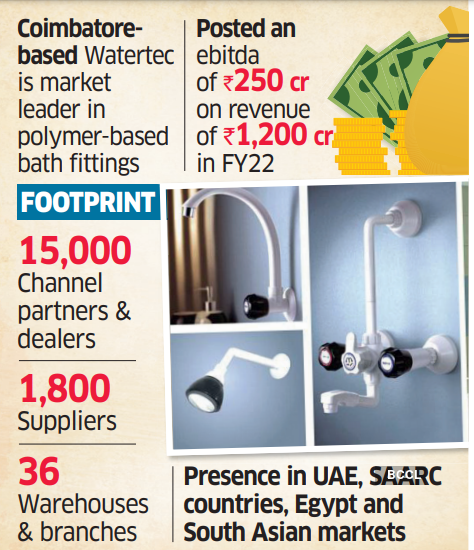

The company has posted an ebitda, or operating profit, of ₹250 crore ($30 million) on revenue of ₹1,200 crore last fiscal, said sources.

Watertec has a pan-India distribution network, comprising 15,000 channel partners and dealers, 1,800 suppliers, 36 warehouses & branches with presence in global markets like the UAE, SAARC Countries, Egypt and South Asian markets. A market leader in the polymer-based bath fittings industry, Watertec has three manufacturing units in Coimbatore with annual production capacity of about 24 million pieces of bath fittings and 20 million pieces of pipes and fittings.

It plans to set up new manufacturing units in Gujarat and Odisha and more retail showrooms across the country.

Currently, 70% of Watertec’s business comes from bath fittings and accessories, while remaining revenue comes from pipes and fittings segment and sanitaryware.

“South India offers quite a few high-quality, family-owned privately held manufacturing businesses,” said Venkat Subramanyam, founder of mid-market investment bank Veda Corporate Advisors.

“Multiple factors such as entry of next-gen, family restructuring, succession challenges or appetite for faster growth are prompting them to pursue private equity/control PE opportunities, which they had resisted for long. However, deal closure strike rates in this segment are not yet high with valuation and terms mismatch often playing spoilsport,” Subramanyam added.

The Rs 14,000-crore bathroom fittings and sanitaryware market in India is dominated by players such as Jaquar, Kohler, Duravit, Hindware, Cera, Roca (Parryware), Toto, Grohe, Johnson and Delta.

Other PE deals in this space include Carlyle’s $100 million investment fr a 40% stake in Ahmedabad-based tile and bathware brand Varmora Granito, Lighthouse Advisors India’s investment in Sanitary ware maker Cera Sanitaryware, and Creador’s investment in sanitaryware manufacturer Somany Ceramics.

Warburg Pincus, which has invested about $6 billion in India since 1995, has a wide consumer portfolio such as Kalyan Jewellers, Boat, Biba, Medplus and Parksons Packaging.

However, India Inc sees significant decline in M&A and PE transactions as investors stay away from the deal market. February saw the second-lowest deal volumes and lowest values recorded since 2014, with only 89 deals valued at $1.8 billion, according to Grant Thornton Bharat’s Dealtracker.