Welspun Corp is set to acquire over 70% of the debts of KKR-backed Sintex BAPL, paving the way to take control of the distressed plastic products-maker amid insolvency proceedings, said two people aware of the development.

Avenue Capital-backed Asset Reconstruction Company of India (Arcil), in partnership with Welspun, has been acquiring Sintex BAPL loans from lenders since the beginning of this fiscal year.

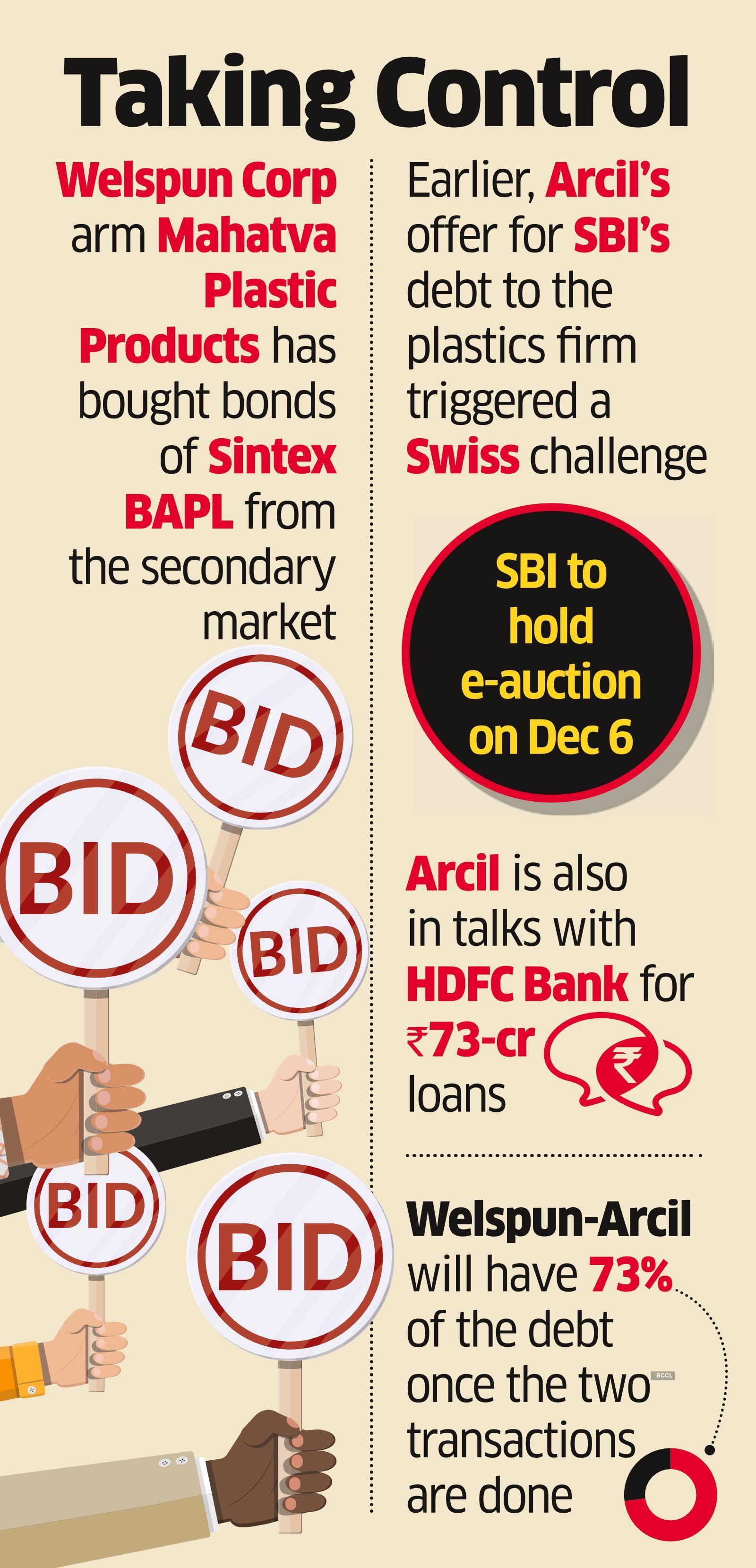

Separately, Welspun Corp subsidiary – Mahatva Plastic Products & Building Materials Pvt Ltd – has purchased bonds of Sintex BAPL from the secondary market.

Last week, an offer by Arcil for the Sintex BAPL debt of the State Bank of India triggered a Swiss challenge auction, one of the persons cited above said. The ARC offered SBI Rs 135 crore for Rs 198 crore loans of Sintex BAPL, that would entail a 68% recovery for the bank.

SBI will hold e-bidding on December 6 for the sale of Sintex BAPL debt, according to a notice posted by the bank on its website. Separately, Arcil is in talks with HDFC Bank to acquire their Rs 73 crore loans, one of the persons quoted earlier said.

Arcil and HDFC Bank did not respond to ET’s request for comment.

Following the purchase of loans from these two banks – SBI and HDFC Bank, the Arcil and Welspun combine will gain control of about 73% of the debt.

Welspun’s subsidiary Mahatva Plastic has acquired Rs 1223 crore bonds of Sintex BAPL from the secondary market, according to a stock exchange disclosure by the company on November 3. The bonds were acquired at Rs 418 crore, the same notice said.

Propel Plastic Products Pvt Ltd, another special purpose vehicle of Welspun, had submitted an expression of interest to acquire Sintex BAPL, Welspun informed the exchange.

In May this year, Arcil acquired Rs 561 crore unsecured loans from Axis Bank, RBL and Deutsche Bank, as reported by ET on May 19. The recovery of three lenders was around 25 paise on a rupee.

The resolution professional Ashish Chhawchharia, backed by Grant Thornton, has admitted Rs 3150 crore claims from financial creditors.

Sintex BAPL was admitted for insolvency proceedings in December 2020 on a petition by a trade creditor. It is a subsidiary of Sintex Plastics Technology and was demerged from Sintex Industries, which too is undergoing bankruptcy proceedings. Lenders of Sintex Industries have voted for a resolution plan submitted by Reliance Industries, but it is yet to be approved by the bankruptcy court.