MUMBAI: India’s top pharmaceutical companies are set to embark on an acquisition spree to bulk up their overseas presence. LupinBSE 0.60 %, Torrent, ZydusBSE -0.05 % Cadila, Intas, AurobindoBSE 1.34 %, Dr. Reddy’s and No. 1 Sun PharmaBSE 0.37 % are said to be examining proposals of varying sizes, cherry-picking those that can fill gaps in the product range. These companies are all looking at popular brands.

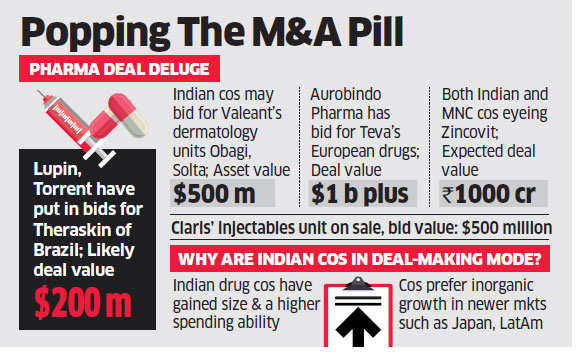

They are scouting for niche manufacturing sites, promising experimental drugs, specialty firms in emerging markets and opportunities in the US, Europe or Japan, putting the industry on the verge of an inflection point, experts said. At the same time, a bunch of small Indian firms is also emerging as prime acquisition targets. The overseas companies on shopping lists include Brazil’s skin care-focused Theraskin, which has attracted interest from Torrent Pharma and Lupin. While Torrent is seen placing bids for a long list of assets to catch up with its homegrown peers, Lupin has shown an appetite for snapping up acquisitions that it finds a good fit.

After taking over Gavis for a record $880 million last year, Lupin recently picked up a set of brands from Shionogi in Japan, further strengthening its hold in the world’s second-largest pharmaceutical market after the US. Lupin and Torrent did not respond to questions from ET. With an EBITDA (earnings before interest, taxes, depreciation, and amortization) of $15 million, an investment banker said Theraskin could be valued at above $200 million.

EAGER TO FLEX MUSCLE

Indian companies are eager to flex their growing financial muscle by expanding overseas inorganically by picking up established drugmakers. And with Lupin, Sun, Dr. Reddy’s and others exceeding the $2-billion sales mark, Indian companies are also exceeding the qualifying threshold when it comes to bidding for such targets. Strikingly, this also marks an inversion of the trend some years back of overseas companies buying Indian assets. “With sales edging past the $2-billion mark for most Indian drugmakers, markets like Japan, LatAm and Europe will need a well-thought-out inorganic plan to gain scale,” said an investment banker. Brazil, for instance, is a $25-27-billion market, making it the largest in Latin America. Slowing economic growth and volatility in exchange rates notwithstanding, experts believe conditions are ripe for drugmakers to clinch fast-moving dermatology assets there.

Brazil ranks among the world’s leading consumer of skin care and cosmetic products where products sold over the counter or through prescriptions have profit margins of 25-40%. There was no response to questions from Theraskin. Hyderabad-based Aurobindo PharmaBSE 1.29 % also fits the pattern. The drugmaker is said to be gunning for its most ambitious deal yet, targeting products put on sale by Teva in Europe. While progress is expected after September, industry experts said Aurobindo has galvanized well over $1 billion in funding to see the deal through. Dr. Reddy’s, which entered into a $350-million deal with Teva in June for a few filing-stage drugs in the US, is also stepping up efforts to expand into markets identified as growth areas.

Indian companies are also closely watching Obagi and Solta, the two dermatology units of US-based Valeant Pharma that may be valued at about $500 million. Morgan Stanley is reported to have started the search for buyers.

DEALS IN INDIA

Back home in India, at least three deals are brewing. One of the most sought-after acquisitions is Zincovit, a hit multivitamin brand marketed by little known Chennai-based Apex Labs. Top Indian and multinational drugmakers are said to be eyeing the company. With sales of roughly Rs 160 crore annually, according to market data from AIOCD PharmaTrac, and an average growth in excess of 10%, Zincovit heads a high-octane segment. “Zincovit has built an unshakeable branding among doctors, especially in the southern markets,” said the CEO of a large Indian company that examined the proposal closely. While a boutique banker put the expected value at Rs 1,000 crore, a record valuation for a single brand sale in India, the final tag may be Rs 600 crore.

Apex Labs didn’t respond to queries. Ahmedabad-based Claris is back on the M&A map, a year after it reportedly neared a deal with Zydus CadilaBSE 3.29 %. That deal was jettisoned due to issues raised by the US Food and Drug Administration over its manufacturing unit. Cleared by the FDA in May and boosted by a strong set of filings, the asset is seeing drug companies and financial investors queuing up again with valuations pegged at over $500 million. Claris denied that a deal was in the works but said the company evaluates various growth options from time to time. Dealmakers say bids have been invited till the end of the month.

Injectable assets such as those made by Claris are priced at a premium due to their complex manufacturing processes, lower competition, high demand and a relatively better profit level. Last month, in a move that surprised the industry, China’s Fosun beat a number of rivals to buy Hyderabad-based Gland for $1.4 billion. Sunways, a Mumbai-based ophthalmology drug company, also figures in the list of potential buyout candidates. Two top executives told ET that the company is looking for a valuation of above Rs 200 crore, or 3.5 times its sales of around Rs 60 crore. “Some large companies are interested in expanding into areas like eye care that have less competition. Sunways could be a good bet,” said the source. A mail from ET to Sunways went unanswered.

Recent Articles on M&A

Source: Economic Times