RBL Bank is seeking buyers for its Rs 105-crore loan exposure to Future Corporate Resources Pvt Ltd (FCRPL), which holds a majority stake in Future Coupon, a 51:49 joint venture with Amazon, said people with knowledge of the matter.

FCRPL is among 25 corporate loans for which RBL is seeking offers, the people said. The decision to sell it comes in the wake of considerable delay in the two-stage merger of 19 Future Group companies with Future Enterprises, followed by a slump sale to Reliance Group entities.

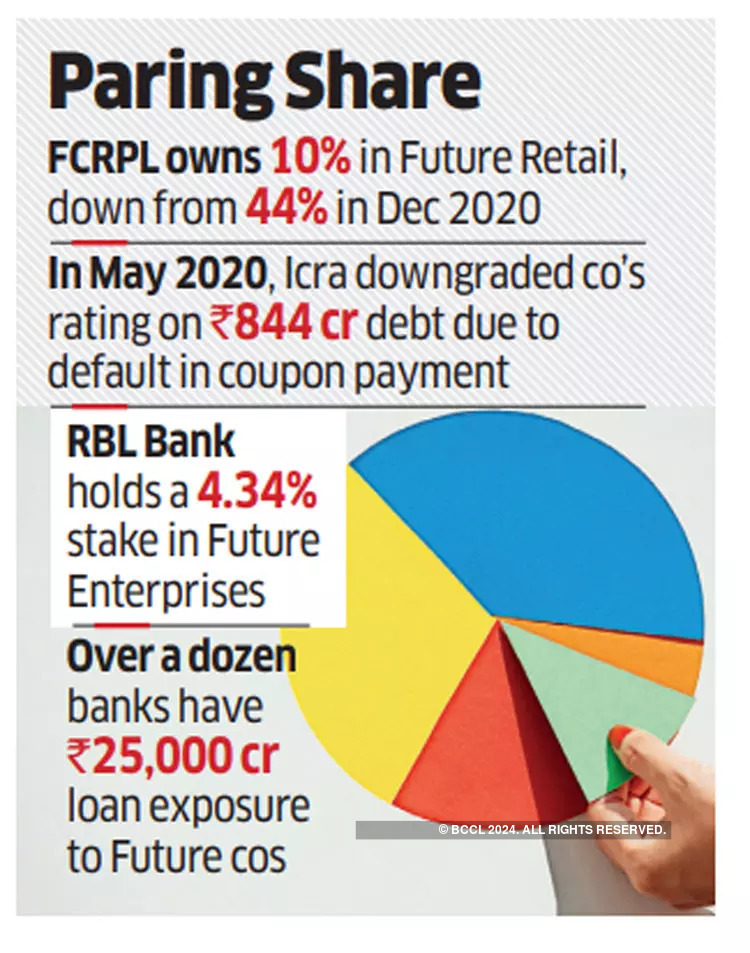

RBL is the first private bank to invite offers for a Future company. Over a dozen lenders have a cumulative loan exposure of over Rs 25,000 crore to companies of the Kishore Biyani-promoted group.

“The long stop date to close the deal has been extended to March 31, 2022, and yet there is no certainty over timelines,” said one of the persons aware of the private bank’s list.

The delay is because of a legal dispute between Future and Amazon, with the US ecommerce giant seeking to block the proposed deal with Reliance Industries.

Amazon claims its agreement with Future Coupons bars Future Retail from selling its assets to some parties, including Reliance. The Supreme Court is scheduled to hear the matter on January 11.

Early this week, the private bank invited preliminary expressions of interest for 25 corporate accounts aggregating to Rs 1,078 crore. The bank has neither indicated a reserve price for any of the accounts nor a deadline for submitting offers, the people said.

Some of the other large accounts include KKR-backed Sintex BAPL and Coffee Day Enterprises-promoted Sical Logistics, the people said. Both these companies have been admitted to the bankruptcy court for debt resolution. In both cases, the resolution professional is yet to receive binding bids.

Other Corporate A/cs

The list also includes McLeod Russel India (Rs 300 crore), Simplex Infrastructure (Rs 148.5 crore), Peninsula Land Ltd (Rs 62 crore) and Veria Lifestyle (Rs 74 crore)

“ARCs (asset reconstruction companies) are likely to make offers for Future Corporate and Sintex BAPL since for these two assets, resolution is visible,” said one of the persons quoted above.

RBL did not respond to a request for comment.

ICRA downgraded the Rs 844-crore debt facilities of FCRPL to D rating in May 2020 after it defaulted on coupon payments on bonds. FCRPL had a 44% stake in Future Retail in December 2019, which is now at 10% after several lenders invoked share pledges, according to disclosures to the stock exchange.

RBL Bank holds 4.34% shares in Future Enterprises as of September 30 after it invoked a pledge on shares belonging to a Biyani group entity.

Some ARCs may also make an offer for Sical Logistics, which received about 38 expressions of interest after it restarted the process last month since the resolution professional received very low binding offers, the people said.