The Bombay High Court on Friday directed the National Company Law Tribunal (NCLT) to expeditiously hear an application filed by Yes Bank, wherein it has sought the tribunal’s direction to Dish TV to convene an extraordinary general meeting.

In an oral order, the division bench of justices SV Gangapurwala and RN Laddha directed the tribunal to hear the petitions filed by the private sector lenders, as pleaded by Yes Bank. The court also granted liberty to the other lenders of Dish TV to file a separate suit in case they were seeking any relief.

Last month, Yes Bank moved to the court, seeking direction from the NCLT to expeditiously hear and dispose of its application to convene an EGM of Dish TV shareholders.

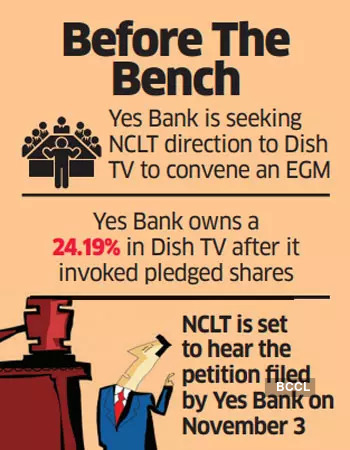

Yes Bank owns a 24.19% stake in Dish TV after it invoked pledged shares (through Catalyst Trustee) under some loan arrangements with a few Subhash Chandra-owned Essel group companies.

Yes Bank, which was represented by senior advocates Venkatesh Dhond and Gathi Prakash of the law firm Cyril Amarchand Mangaldas (CAM), said that it is the largest shareholder of Dish TV and had asked NCLT under Section 98 of the Companies Act to hold an EGM. This request has been pending for more than a year.

Senior advocates Navroz Seervai and Zal Andhyarujina appeared for Dish TV along with Rugved More of DSK Legal and opposed the application.

The NCLT Mumbai bench is set to hear the petition filed by Yes Bank along with other applications filed in the case on November 3.

In May 2020, Yes Bank invoked promoters’ pledged shares in Dish TV, taking control of a 24.19% stake in the company.

Later, it raised corporate governance issues at the company and sought an EGM of the shareholders to dissolve the entire board, oust Jawahar Goel from the position of the managing director and remove the promoter family.

Yes Bank said the board was functioning in cahoots with the minority shareholders (the promoters), who should not have representation on the board.

Incidentally, Jawahar Goel stepped down on June 24 as the managing director of the DTH company after the resolution of his reappointment failed at the EGM.

Meanwhile, Axis Finance Ltd, a subsidiary of the country’s third largest private sector lender Axis Bank, also sought similar relief in a case against other affiliates of Essel Group, Primat Infrapower & Multiventures and Cyquator Media Services.

A subsidiary of Axis Bank had approached the court through counsel Karl Tamboly and Yash Dhruva of law firm MDP & Partners, where the court had asked them to approach through a fresh petition.

Axis Finance has also approached the NCLT against Primat Infrapower & Multiventures to admit the company under the Corporate Insolvency Resolution Process (CIRP) after the company failed to repay its dues of over Rs 87 crore. The lender is seeking to recover about Rs 150 crore from Cyquator Media Services.