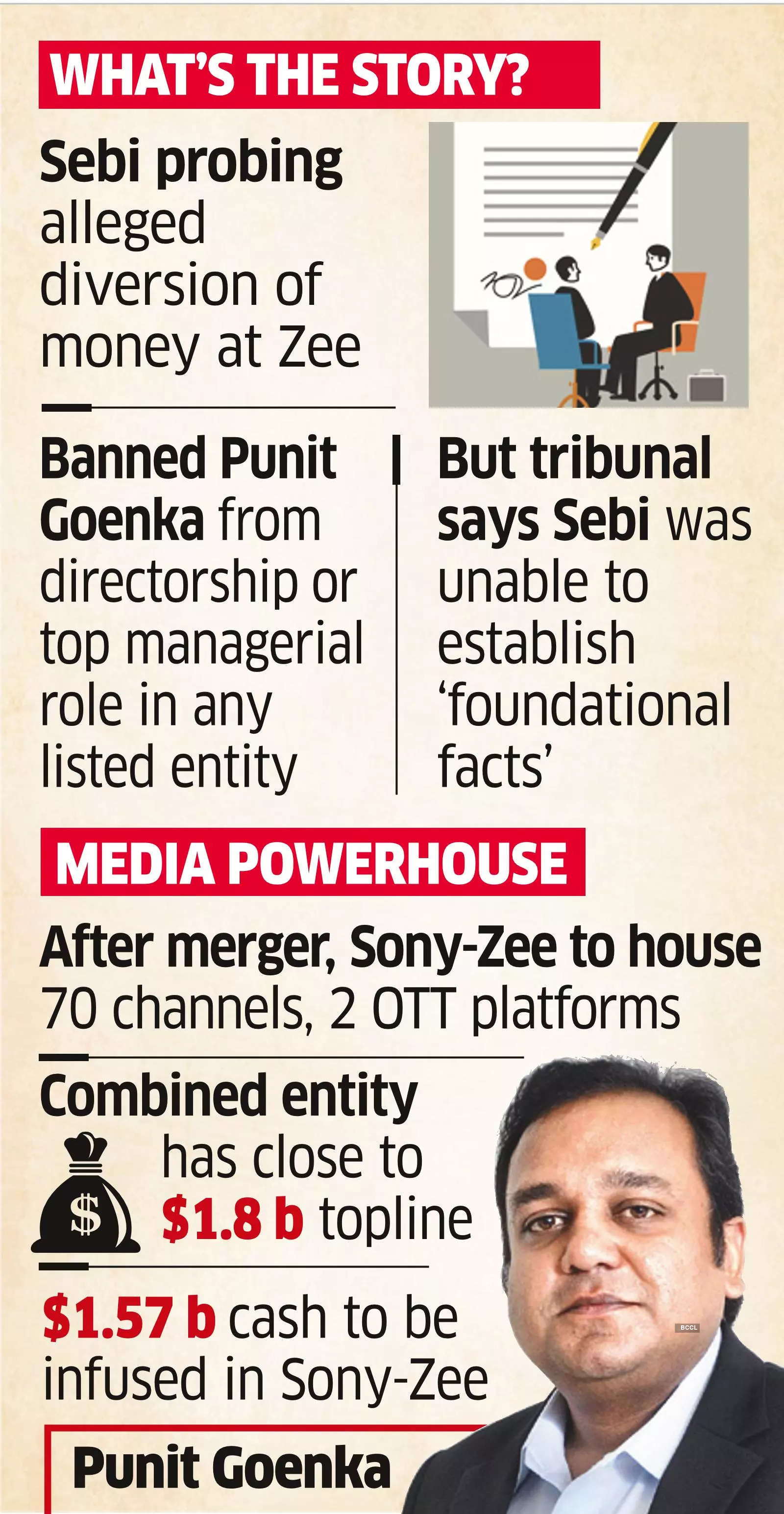

The Securities Appellate Tribunal (SAT) overturned a regulatory ban on Punit Goenka, managing director and chief executive of Zee Entertainment Enterprises, that prevented him from holding a directorship or top managerial role in a listed entity.

SAT’s ruling has potentially hastened the Indian media company’s proposed merger with the local arm of Japan’s Sony Group Corp – Culver Max Entertainment (Sony Pictures).

Monday’s order, which now supersedes a restrictive ruling by the Securities and Exchange Board of India (Sebi) in August, ensures Goenka will continue to hold leadership positions in Zee and, in the future, as a key executive of the merged entity.

The capital markets regulator could challenge the SAT ruling in the Supreme Court.

The process to reinstate Goenka and dissolve the interim committee currently running Zee’s operations has been initiated, said people close to development. Goenka and his father, Subhash Chandra, earlier failed to secure any interim relief from SAT against Sebi’s order.

SAT presiding officer Justice Tarun Agrawala and technical member Meera Swarup, setting aside the Sebi ruling, noted that the regulator has not been able to establish the “foundational facts” related to Goenka.

It further said in its ruling that Goenka was restrained from holding directorship and managerial positions “on a preponderance of probabilities.

Boost for merger

SAT said it was a rejection of “genuine documents on the ground that they do not prove the transactions beyond a reasonable doubt.”

Sebi passed an interim order on June 12, followed by a confirmatory order on August 14, against Goenka and Subhash Chandra, who is chairman emeritus at Zee, for allegedly diverting money from the company to other promoter entities without board approval.

“The withdrawal of the ban placed by Sebi on Punit Goenka – over his appointment as a key managerial person (KMP) of Zee, and merged or amalgamated entities arising from the Zee and Sony merger – will allow him to be appointed as chairman & managing editor and chief executive, as envisaged under the scheme of the merger,” said Manmeet Kaur, partner at litigation firm Karanjawala & Co. “Further, he can take up the role of director or any other KMP.”

However, Sangeeta Jhunjhunwala, partner, Khaitan Legal Associates, said Sebi may challenge the SAT order in the Supreme Court, and intensify ongoing investigations.

The Zee stock, which climbed marginally after the order was announced during market hours, ended flat at Rs 249.3 apiece on the National Stock Exchange. Zee now has a market capitalisation just north of Rs 24,000 crore.

Elara Capital media analyst Karan Taurani pointed out that the SAT order will quicken the Sony-Zee merger process. Coupled with a potential deal between Reliance and Disney, the merger could redraw the boundaries of India’s media and entertainment industries, he added.

Meanwhile, SAT, while allowing Goenka’s appeal, made it clear that any observation made in this order is only prima facie. It also said the ruling will neither influence the investigation nor will it be utilised by either of the parties.

SAT said Sebi has not provided any reason for needing eight months to complete the investigation. Sebi had stated so in its confirmatory order. “We have seen that on numerous occasions, whenever this tribunal or the superior court has directed Sebi to complete the investigation within a stipulated period, (it has) not been done, and application after application (is) filed by Sebi, seeking time to extend the period of investigation,” the SAT noted.

Rejecting Sebi’s argument for upholding the order, SAT added that Goenka’s position as MD and CEO of the merged entity will not have any bearing on the investigation, since Sony Corp will appoint key executives in line with its majority holding in the new business.

Money trail

The Sebi investigation against Zee promoters pertains to November 2019, when three independent directors of the company resigned after raising concerns over several issues, including the alleged appropriation of a Zee fixed deposit of Rs 200 crore by Yes Bank for squaring off the loans of related parties of Essel Group, the promoter entity.

The market watchdog had come to the prima facie conclusion that the Goenkas had allegedly withdrawn funds from Zee and other listed companies of Essel Group, which ultimately benefited the promoter family.

Sebi also established the alleged modus operandi through which Rs 143.90 crore of Rs 200 crore had been transferred from Zee and other listed Essel companies to falsely portray repayment of dues.