Online food-delivery platform Zomato has held discussions to acquire Blinkit, formerly Grofers, in a share-swap deal, multiple people briefed on the matter said. This comes on the back of Zomato investing $100 million in the Gurgaon-based quick-commerce startup last year, picking up an about 10% stake.

The merger has been speculated as an eventual outcome ever since the time Zomato invested in Blinkit. In fact, ET had reported in 2020 about the two companies possibly striking a deal to come together.

While the contours of the deal are being finalised, it is expected that shareholders of Zomato would get 10 Blinkit shares for each held in their company, the people said. That would value Blinkit at around $700-800 million, based on Zomato’s current market capitalisation. This is lower than Blinkit’s previous valuation of a little over $1 billion.

Zomato and Blinkit founder Albinder Dhindsa did not respond to ET’s queries.

Meanwhile, in an exchange filing on Tuesday, Zomato said it would grant a loan of up to $150 million to Grofers India Pvt Ltd, Blinkit’s Indian entity. Interest will be charged at 12% annually, with a tenure of not more than a year.

The proposed share-swap deal would result in Blinkit’s largest investor, SoftBank Vision Fund, getting a stake in the food delivery firm. Tiger Global, which is an existing investor in Zomato, would increase its stake.

Interestingly, SoftBank took a major bet on Zomato’s rival, Swiggy, last year with an investment of $450 million. The Japanese group is expected to corner a 4-5% stake in Zomato as part of the deal, the people said.

In an interaction with ET in October last year, Zomato founder and chief executive Deepinder Goyal had called the investment in Blinkit “a strategic bet”. “We’ll see whether it makes sense for us to merge at some point or not. But right now it’s too early to say anything,” Goyal had said.

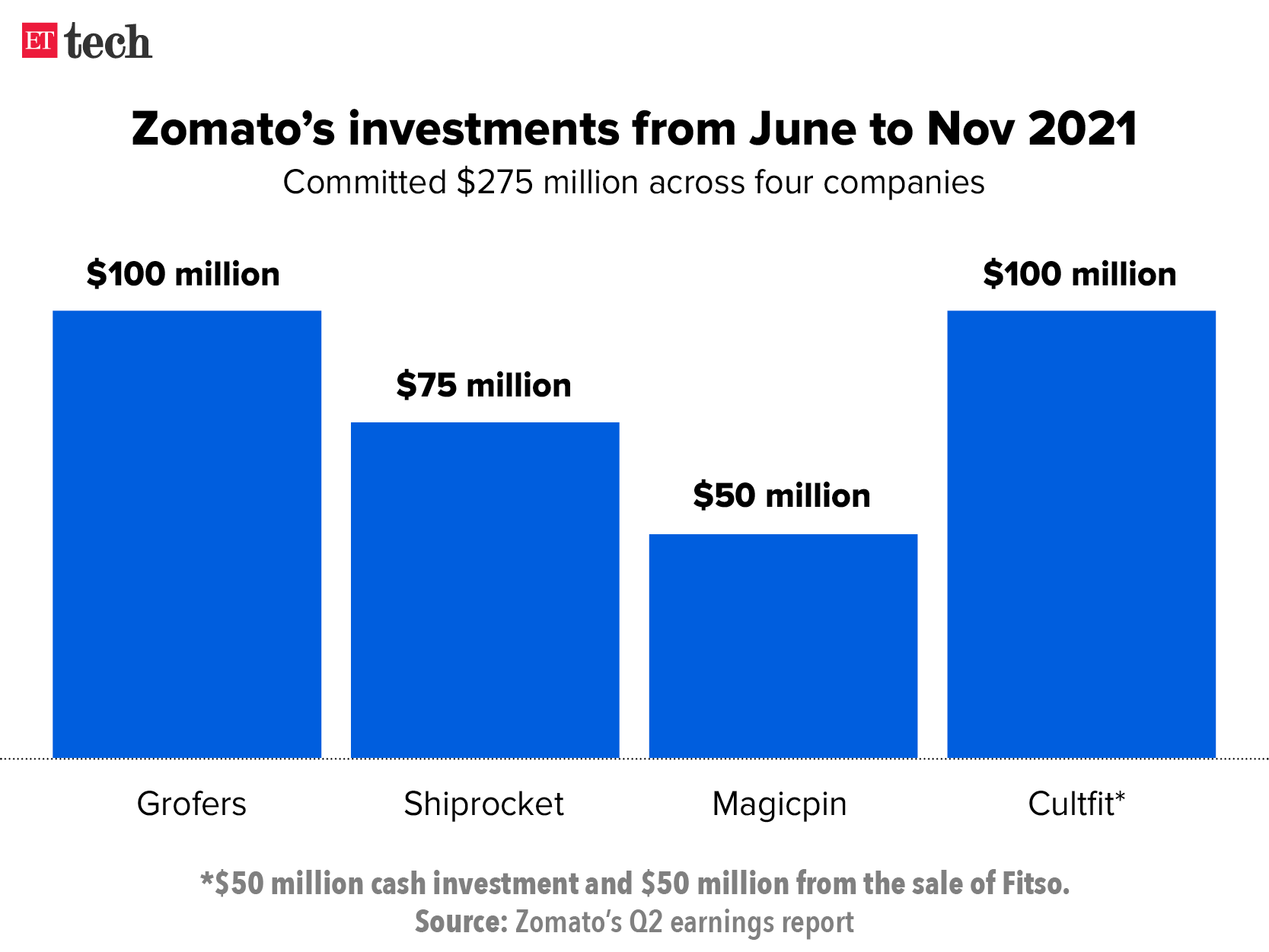

Zomato said the investment was in line with its stated intent of investing up to $400 million in the quick-commerce segment in India. The food tech major also added that it would be acquiring a 16.66% stake in food robotics company Mukunda Foods.

Quick-commerce troubles

The talks for Blinkit’s sale come at a time when the company continues to face tough competition in the quick-commerce space, and has been struggling to gain market share. Swiggy last year announced that it would be investing $700 million in its Instamart service, while Mumbai-based Zepto has built a war chest of $160 million. Dunzo has also raised $240 million from Reliance Retail to focus on this category, with Ola running pilots.

Further, market volatility due to the ongoing geopolitical conflict coupled with a crash in the share price of Zomato and other tech firms has come as a double whammy for Blinkit.

ET reported on November 18 that Zomato was looking to invest $500 million in Blinkit, which has not happened yet. Due to market volatility, Zomato’s investors and shareholders wanted to renegotiate the terms of the investment, people aware of the discussion said.

With aspirations to scale in a heavily contested quick-commerce space, Blinkit has also been burning $6-8 million a month at least, the above-mentioned people said. Blinkit has shut close to 40 warehouses and dark stores to streamline cash, as funding opportunities dry up for the quick-commerce entity.

At present, Blinkit has an on-ground workforce of 30,000 and opened 450 new warehouses and dark stores to scale its quick commerce plans.

“It is interesting that Zomato is going out and making these investment bets, while there is still more money to be made by investing in their core operations (considering the large base),” said Ajay Garg, managing director of Equirus Capital, an investment bank. “When Info Edge (Zomato’s investor) started making investments in new-age companies, it was profitable. With the current meltdown in public markets, there is pressure on these (tech) stocks to show some performance. An investment strategy can act as a short-term distraction for investors, but with current market conditions, it has to show profitability first.”

Source: Economic Times