The equity market will see a spate of initial public offerings (IPOs) of general insurance companies, predominantly of government-owned companies. The Finance Minister in his Budget speech had announced the listing of four state-owned non-life insurers and also the only reinsurance company to make them financially strong and enable them to expand business.

The four state-owned general insurance companies are – New India Assurance, Oriental Insurance, National Insurance, United India Insurance and the only one national reinsurance company General Insurance Company. The listing of insurers will help in improving the quality of disclosures and make companies answerable to investors. It will also help customers to make informed decision regarding their policies, claims and other products-related features.

The listing will help analysts understand the business of non-life insurance companies better. Overall, listing of companies will help focus on profitable growth and consequently enhance their ability to raise capital in the future. The money raised through listing of PSU non-life companies will also help reduce the Central government’s fiscal deficit. The government has set an ambitious target to raise Rs 72,500 crore in 2017-18 from disinvestment, of which it expects to get 15% from the listing of state-owned general insurance companies.

General insurance: industry matrix

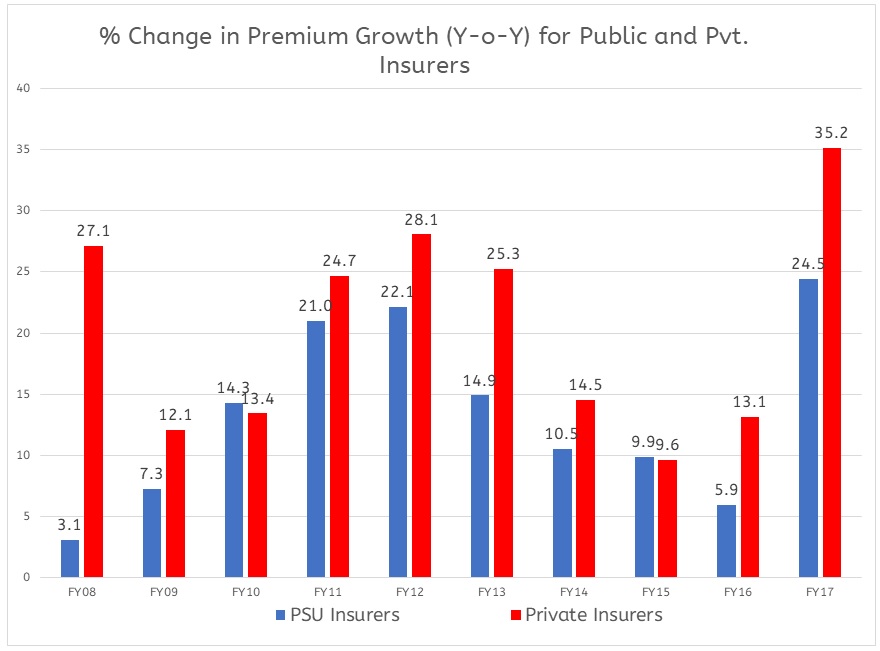

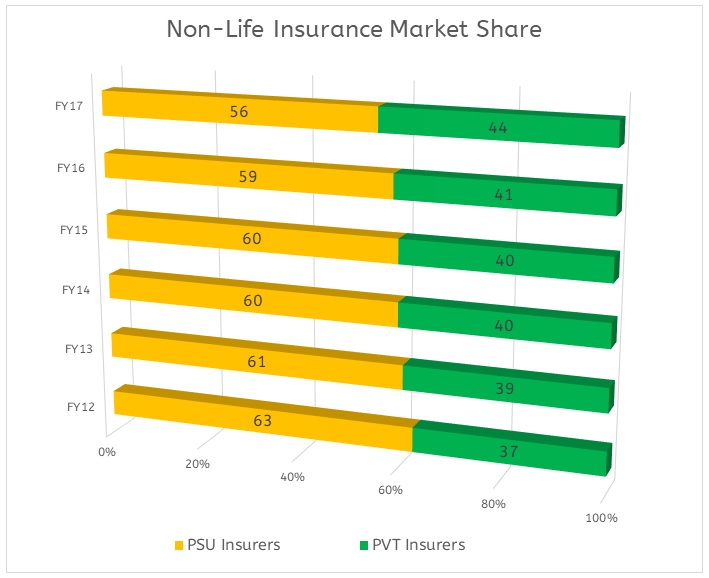

The general insurance industry reported highest ever year-on-year growth of 32% in premium collection in FY17 because of crop insurance. There is a steady increase in private sector market share over the last five years to 44% in Fy17. And in July this year, for the first time ever, private sector non-life insurance companies moved ahead of the four state-owned companies in premium collection.

Table 1: Premium Collection (All Figs. in INR Crores)

| Year | Premium Collection | |

| PSU Insurers | PVT. Insurers | |

| FY07 | 17283 | 8647 |

| FY08 | 17814 | 10992 |

| FY09 | 19107 | 12321 |

| FY10 | 21839 | 13977 |

| FY11 | 26417 | 17425 |

| FY12 | 32263 | 22315 |

| FY13 | 37072 | 27951 |

| FY14 | 40980 | 32010 |

| FY15 | 45017 | 35090 |

| FY16 | 47691 | 39703 |

| FY17 | 59358 | 53663 |

In FY17, private sector general insurers reported smart growth of 35% driven by crop insurance as they had 73% share in crop insurance business. The government’s focus to improve acreage under insurance will continue to drive volume. State-owned companies reported lower growth of 24.5%. Motor insurance remains the largest segment with 44% market share, followed by health and personal accident cover.

The solvency level of public sector general insurance continues their downward trend amidst high underwriting losses and reluctance to churn equity book. However, despite strong demographic profile, the penetration of general insurance is still abysmally low at 0.72% of GDP. In terms of profitability, private insurance companies have lower claims ratio than state-owned companies.

So, for the state-owned general insurance companies to grow at 20% CAGR over the next five years, the capital requirements is estimated at around Rs 37,000 crore and the private sector will require around Rs 9,000 crore. As part of the government’s plans to list non-life insurers in which it holds stakes, New India Assurance Company Ltd has filed the prospectus for its initial public offering (IPO). Similarly, National Insurance Company will also go for public offering. The country’s only state-owned reinsurer GIC filed its draft documents to raise over Rs 10,000 crore through an IPO. In private sector, ICICI Lombard General Insurance will also go public.

Regulatory clearance

In 2016, the insurance regulator, Insurance Regulatory Development Authority of India allowed all non-life insurance companies including standalone health insurers with over 10 years of existence (for life insurance companies, it is 8 years) to mop up money through listing from the primary market. The regulator had also underlined that all companies meeting the stipulation on minimum years of existence for listing for listing should initiate steps to get listed by 2020.

The insurance regulator had also scrapped the usual embedded value norm for listing non-life insurance companies. Embedded value is an actuarial practice used to value an insurance company. In other words, it is the present value of the future profits expected from the business. Instead, these companies will be required to make additional disclosures on risk factors which are specific to these companies such as reserves, asset-liability mismatch, adequacy of premium and current financial position.

Filing for IPOs

General Insurance Company

To kick start the listing process, state-owned reinsurer General Insurance Company (GIC Re) filed a draft red herring prospectus with the Securities and Exchange Board of India to list its shares through an IPO to raise around Rs 10,000 crore. The government will be selling about 107.5 million shares in GIC Re’s IPO, while the insurer will sell 17.2 million new shares, comprising a total of 124.7 million, or 14.2% of the company’s post-issue share capital. The face value of each share will be Rs 5. GIC’s initial share sale is part of the Central government’s divestment plan, under which the department of investment and public asset management has appointed bankers to sell government stakes across over a dozen public sector enterprises through various routes such as IPOs, offers for sale and strategic sales. GIC intends to use the primary proceeds for augmenting its capital base to support the growth of its business and to maintain current solvency levels and for general corporate purposes, according to the DRHP.

In terms of financials of GIC Re, it posted a profit after tax of Rs 3,141 crore in FY17, up 11.2% from Rs 2,823 crore in FY16. The gross premium earned by the company rose 82% in FY17 to Rs 33,741 crore from Rs 18,534 crore in FY16. The solvency ratio, which indicates an insurance company’s financial capacity to meet its short-term and long-term liability was 2.4 in FY17. The regulator’s approved solvency ratio is 1.5.

New India Assurance

Similarly, New India Assurance, the country’s biggest non-life insurer, also filed for an IPO to sell 14.56% stake to raise around Rs 9,000 crore. The government will sell 96 million shares and the company will sell 24 million shares. The company has hired Kotak Mahindra Capital Co. Ltd, Axis Capital Ltd, IDFC Bank Ltd, Nomura Financial Advisory and Securities (India) Pvt. Ltd and YES Securities (India) Ltd to manage the public offering. The company will use the money to augment its capital base to support growth of its business and maintain solvency levels. The government, which owns nearly 100% stake in the company, will get three years from the date of listing to meet the minimum public shareholding norm of at least 25% public float.

New India Assurance was incorporated in 1919. It is the country’s largest general insurance company in terms of net worth and profitability. The company reported a consolidated net profit of Rs 839.36 crore for FY17 on total net premiums of Rs 17,674.77 crore. The net profit stood at Rs 930.35 crore in FY16 and Rs 1,377.32 crore in FY15. As of June 30, New India Assurance has issued 27.10 million policies across all its product segments. The company’s gross written premium expanded at a compounded annual growth rate of 15.18% from Rs 13,200 crore in FY13 to Rs 23,230 crore in FY17. From financial year 2011-12 to financial year 2016-17, NIA’s market share in terms of gross direct premium rose from 14.7% to 15.0%.

Table 2: Profitability of top 10 non-life insurers for F.Y. 17 (All Figs in Rs. Crores)

| Gross written premium | Gross incurred claims | Gross Profit | |

| New India | 23021 | 20239 | 12% |

| United India Insurance | 16422 | 14145 | 14% |

| National Insurance | 14569 | 13443 | 8% |

| Oriental Insurance | 11493 | 10512 | 9% |

| ICICI Lombard | 10960 | 9410 | 14% |

| Bajaj Allianz | 7687 | 5063 | 34% |

| HDFC ERGO | 5935 | 4379 | 26% |

| IFFCO Tokio | 5636 | 4123 | 27% |

| Tata-AIG | 4297 | 2359 | 45% |

| Reliance | 4007 | 3828 | 4% |

| Source: IRDAI, General Insurance Council, ICRA | |||

The company offers general insurance as well as cover for threats from accidents such as fire, engineering, aviation, liability, marine, motor and health insurance. As of June 2017, its distribution network across India included 68,389 individual agents and 16 corporate agents, bancassurance arrangements with 25 banks in India and a large number of OEM and automotive dealer arrangements through its agent and broker network. The company has 2,452 offices in India across 29 states and seven union territories. Besides, it has international operations across 28 countries, through a number of branches, agency offices, subsidiaries and associated companies.

New India Assurance has a solvency margin of around 2.2%, better than the 1.5% minimum mandated by the insurance regulator, limiting the need for additional capital for the insurance company. The IPO proceeds will go to the company, which will help to support the fast growth by capital contribution without diluting the solvency margin.

Private sector listing

In the private sector, ICICI Lombard General Insurance, the joint venture of ICICI Bank Ltd and Fairfax Financial Holdings Ltd has also filed the draft red herring prospectus for its initial public offering (IPO). In the IPO, ICICI Bank and Fairfax sell around 86.24 million shares, which will see a dilution of around 20% stake. In May, Fairfax sold 12.18% stake in ICICI Lombard to a bunch of buyers including private equity firm Warburg Pincus Llc for around $383 million (around Rs 2,372.5 crore then). The transaction valued the firm at Rs 20,300 crore. ICICI Lombard offers a range of insurance products such as motor, health, crop/weather, fire, personal accident, marine, engineering and liability insurance, through multiple distribution channels.

To facilitate the IPO, the private sector insurer has appointed Bank of America Merrill Lynch, ICICI Securities Ltd, IIFL Holdings Ltd, CLSA among others to manage the share sale. In fiscal 2017, the insurer issued 17.7 million policies and had a gross direct premium income of Rs 10,725 crore. As of 31 March, it had Rs 15,079 crore in total investment assets. ICICI Lombard General Insurance is the second insurance company from the ICICI group to go public. In fact, in the life insurance business, last year ICICI Prudential Life Insurance Co. Ltd raised Rs 6,000 crore in an IPO, the first public offering by an Indian life insurer. Similarly, Reliance General Insurance Ltd, the non-life insurance arm of Reliance Capital, is also planning to list.

Conclusion

Listing of state-owned non-life insurance companies as well as private non-life and life insurance companies will help in improving the corporate governance structure of the companies. Post listing, the companies will attract top talents and also increased competition will lead to introduction of new products and rationalization of premium charged by them. It will also give opportunity to public at large to invest in one of the safest businesses with a large float. While doing the valuation will be a challenge for insurance companies, there will be enough disclosures to be done by the insurers which include embedded value, segment-wise lapsation of policies and contribution to profitability, which will bring in transparency. These disclosures will help individuals and investors take informed decision and will be a win-win situation for the companies, individual policy holders, investors and other stakeholders in the long run. For the government, listing of PSU insurance companies will help it to unlock significant value and make the sector more vibrant and robust.