TRANSACTION BACKGROUND

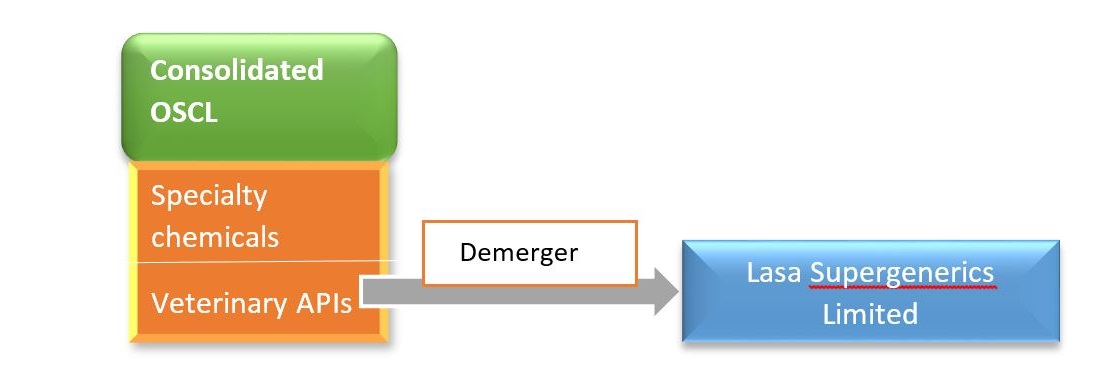

On March 28th, 2016 the Board of Directors of Omkar Specialty Chemicals Limited (OSCL) unanimously approved the Composite Scheme of Arrangement which provides for:

- The merger of Lasa Laboratory Private Limited, Urdhwa Chemicals, Rishichem Research & Desh chemicals with OCSL. All are 100% subsidiaries of OSCL

- Demerger of Veterinary API Undertaking of Merged OSCL into Lasa Supergenerics Limited.

Transferor Companies:

Lasa Laboratory

Lasa is an unlisted company engaged in the business of anthelmintic / Veterinary API. Lasa is a Wholly Owned Subsidiary of OSCL.

Urdhwa Chemicals

Urdhwa is an unlisted Company engaged in the business of anthelmintic / Veterinary API. Urdhwa is a Wholly Owned Subsidiary of OSCL.

Rishichem Research

Rishichem is engaged in a business of preparing, producing and manufacturing of chemicals of all sorts. Rishichem is a Wholly Owned Subsidiary of OSCL.

Desh chemicals

Desh is an unlisted Company engaged in the business of preparing, producing and manufacturing of chemicals of all sorts. Desh is a Wholly Owned Subsidiary of OSCL.

Transferee Company:

Omkar Specialty Chemical’s Limited (OSCL)

The company headed by Mr. Pravin Herlekar is primarily engaged in the production of Specialty Chemicals and Pharma Intermediates. The Company has total 7 Units, of which 4 Units are located at MIDC, Badlapur (Maharashtra), India.

CONSOLIDATION OF GROUP – MERGER

RATIONALE FOR MERGER

- Simplification of the corporate structure by reducing the number of legal entities

- Reduction in multiplicity of legal /regulatory compliances carried out by subsidiaries

- Elimination of duplication of administrative costs and multiple record keeping

- Concentrated effort and focus by senior management towards business growth

FINANCIAL DETAILS – As on March 2015

| Particulars | OSCL | Lasa | Urdhawa | Rishichem | Desh |

| Networth (Cr) | 162.95 | 184.49 | (3.71) | 0.87 | 0.643 |

| Turnover (Cr) | 193.31 | 71.004 | 52.54 | 1.066 | – |

ALTERNATION TO MOA/ AOA OF TRANSFEREE COMPANY (OSCL)

The authorized share capital of Lasa, Urdhwa, Rishichem & Desh aggregating to Rs. 9,70,00,000 consisting of 33,50,000 equity shares of Rs 10 each, 3,60,000 equity shares of 100 each and 27,50,000 Preference shares of Rs 10 each shall stand transferred to and combine with authorized capital of OSCL

CONSIDERATION

Upon Merger of Lasa Laboratory , Urdhwa Chemicals, Rishichem Research & Desh chemicals with OCSL pursuant to the scheme becoming effective on the effective date, OSCL will not issue and allot any equity shares to the shareholders of the respective Transferor companies as these are wholly owned subsidiaries of OSCL & the entire share capital of these four subsidiaries shall be cancelled and extinguished.

<td”>34.23%

| Particulars as on March 2015 | Pre shareholding (as on 31.12.2015) | Post Shareholding |

| Promoter & Promoter Group | 65.77% | 65.77% |

| Public | 34.23% |

ACCOUNTING TREATMENT

- OSCL shall account for the merger of Lasa, Urdhwa, Rishichem & Desh as per the purchase method as set out in Accounting Standard 14 (AS 14) referred to in Section 210 and 211 of the Companies Act.

- With effect from the appointed date (April 01, 2015), all the assets & liabilities appearing in the books of Lasa, Urdhwa, and Rishichem & Desh shall be transferred to OSCL at their respective fair values as may be decided by the Board of Directors of OSCL.

- Any intercompany balances and investments between OSCL and Lasa, Urdhwa, Rishichem if any, appearing in the books of accounts of OSCL will stand canceled.

- The difference between the fair value of assets & fair value of liabilities transferred to OSCL pursuant to the scheme will be credited to capital reserve or debited to share premium account as the case may be.

DEMERGER OF VETERNIERY API INTO LASA SUPERGENERICS LIMITED

Post-Merger, the whole of Veterinary API undertaking of OSCL including all taxes, refunds, claims, and properties shall stand transferred to and vested in Resulting Company (Lasa Supergenerics Limited). In addition, the residual undertaking and all the assets, liabilities and obligations pertaining thereto shall continue to belong to and vested in and be managed by the Demerged company.

API Division’s turnover, as on March 31, 2015, was Rs. 71 Crores, amounting to 26.8% of total turnover of OSCL

CONSIDERATION / SWAP RATIO

Share exchange ratio – 1:1 i.e. for every one fully paid up Equity Share of Face value Rs. 10 each held with OSCL, Shareholders are entitled to one Equity Share of face value Rs. 10 each of Lasa Supergenerics

As a consequence, the Resulting Company shall cease to be wholly owned subsidiary of OSCL as its post demerger shareholding in the Resultant Company shall reduce to 10%

The residual undertaking after the Demerger will be retained, managed and operated by OSCL.

| Particulars | OSCL | Lasa super generics Limited (LSL) | ||

| Pre shareholding (as on 31.12.2015) | Post shareholding | Pre shareholding (as on 31.12.2015) | Post shareholding | |

| Promoter Group/ | 65.8% | 65.8% | Nil | 59.2% |

| OSCL | NA | NA | 100% | 10.0% |

| Public | 34.2% | 34.2% | Nil | 30.8% |

RATIONALE FOR DEMERGER

- Nature of Businesses of OSCL & Veterinary API is different having different risk-rewards, product lines, growth potential, regulatory and capital requirements

- To have a dedicated management team for segregated businesses

- Achieving operational efficiency

FINANCIAL HIGHLIGHTS

| Sales (Crores) | H1FY16 | FY15 | FY14 |

| LSL | 63.4 | 71.8 | 46.2 |

| OSCL | 128.3 | 193.3 | 194.1 |

| Total | 191.7 | 265.1 | 240.3 |

| PAT (Crores) | H1FY16 | FY15 | FY14 |

| LSL | 6.2 | 6.0 | (1.1) |

| OSCL | 11.0 | 18.3 | 14.7 |

| Total | 17.2 | 24.3 | 13.6 |

Balance sheet highlights – Post Demerger

| As on Sept 30, 2015 (Crores) | LSL | OSCL |

| Fixed Assets | 140 | 100 |

| Investment | Nil | 2.39 |

| Current Assets | 89.05 | 200.78 |

| Non-current Assets | Nil | 1.18 |

| Total Assets (A) | 229.05 | 304.36 |

| Borrowings | 107.17 | 84.44 |

| Current Liabilities | 49.94 | 154.87 |

| Noncurrent Liabilities | Nil | 3.42 |

| Total Liabilities (B) | 157.12 | 242.73 |

| Total Networth (A) – (B) | 71.94 | 61.63 |

Source: OSCL Presentation

CONCLUSION

Omkar Specialty chemicals (OSCL) by the proposed restructuring not only wants to simplify its corporate structure but also at the same time create two focused listed entities focusing on its own business. In view of the management, there is a major growth opportunity in API business and hence it needs proper attention, both technical and financial. Probably it may have to invite strategic partner in Lasa Supergenerics post demerger. OSCL may also generate few years down the line cash flow by exiting its minority stake in Lasa Super generics to fund its present business.