In line with its strategy to expand its footprint in India, multiplex chain INOX Leisure Ltd (INOX) has acquired Satyam Cineplexes Ltd. This is Inox’s third acquisition since 2007 when it acquired Kolkata’s Calcutta Cine Private Ltd. In 2013, it bought out Fame India Ltd.

The Deal

Multiplex chain INOX Leisure Ltd (INOX) has bought 100% share equity capital in New Delhi-headquartered Satyam Cineplexes Ltd making it the wholly owned subsidiary.

The deal is valued at Rs 182 crore. With this acquisition, Inox’s screen count in India has risen to 358, across 91 multiplexes and 50 cities. It is fast catching up with market leader PVR Cinemas, which has 400 screens across the country. The acquisition will give Inox an entry into Delhi and strengthen the company’s position in north India.

Vivek Gupta, partner (mergers and acquisitions), BMR Advisors, says, “Satyam has three marquee properties in Delhi—Nehru Place, Janak Place and Patel Nagar. This gives Inox a strong entry into the Delhi market; it was definitely one of the drivers for the deal.” Satyam Cineplexes has a total of 38 screens. The company also has multiplexes in Indore, Jodhpur, Aurangabad, Rohtak and Mysore and is setting up screens in Amritsar, Bhilwara and Bangalore.

About INOX:

INOX Leisure Limited is the diversification venture of the INOX Group into entertainment. INOX Leisure’s mission is to be the leader in the cinema exhibition industry, in every aspect right from the quality and choice of cinema to the varied services offered and eventually the highest market share. INOX has traversed its own path by bringing in a professional and service-oriented approach to the cinema exhibition sector. With strong financial backing, impeccable track record and strong corporate ethos, INOX has established a strong presence in the cinema exhibition industry in a very short span. It must be noted that INOX was chosen post a nationwide tender to design, construct and operate the prestigious multiplex in Goa. Since the launch of the multiplex in 2004, INOX is the venue of the prestigious International Film Festival of India (IFFI) every year. Since its inception in 1999, INOX has been active in exploring acquisition and/or expansion opportunities on continuous basis with a view to consolidate its position in the multiplex industry. INOX currently operates 82 multiplexes and 320 screens in 45 cities making it a truly pan-Indian multiplex chain. INOX Leisure Ltd. will continue its expansion into places like Jammu, Mangalore amongst others. All INOX cinemas have state of the art facilities in terms of modern projection and acoustic systems, interiors of international standards, stadium styled high back seating with cup holder arm-rests, high levels of hygiene, varied theatre food, a selection of Hindi, English and regional movies, computerized ticketing and most importantly high service standards upheld by a young and vibrant team.

About Satyam Cineplexes:

3 decades in the world of cinema exhibition, pioneering and contributing towards the evolution of Indian Cinema into a 3 billion USD industry is how each employee working at Satyam Cineplexes Ltd. relates to the company. Mr. Subhash Chachra the Chairman of the group has had a formidable journey in evolving India’s well known ‘Satyam Cineplexes’ brand.

Mr. Deven Chachra, Managing Director of the group joined hands after studying from the Wharton Business School specializing in the detailed study of the most successful multiplex market which is the USA including their technology and development trends. Deven pioneered the first multiplex cinema of Satyam Cineplexes Ltd in 2002 at Patel Nagar and since have led a successful passage to an expansion of the Satyam Cineplexes Ltd Brand.

The three 4 screen independent units that cover the national capital, New Delhi from Patel Nagar, Janak place and Nehru Place are a well-known landmark to every Delhiite and remain synonymous with a complete cinema entertainment. The team at Satyam Cineplexes work hard and creatively, to package the finest experience for their consumers. Today this experience is further enjoyed by the people of Indore, Jodhpur, Aurangabad, Rohtak and Mysore. The people of Amritsar, Bhilwara and Bangalore would be welcomed this year to be part of the Satyam Cineplexes experience.

Rationale of the scheme:

As per our opinion acquisition has taken place to extend geographical presence rather than financial viability.

- Satyam’s operational properties which will now be a part of INOX are:

Source: https://www.inoxmovies.com

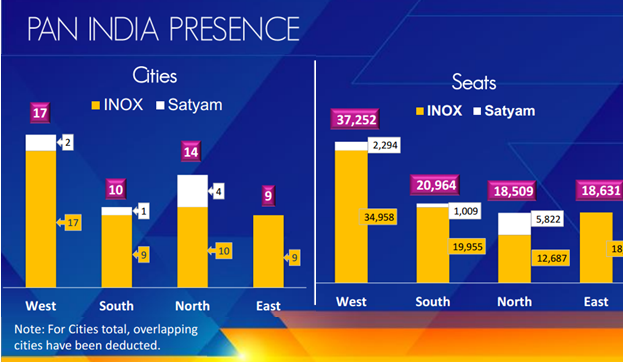

Note: For cities total, overlapping cities have been deducted

Source: https://www.inoxmovies.com

Prior acquisitions:

In 2007, INOX acquired Calcutta Cine Pvt Ltd (“CCPL”). Board of Directors of the company and CCPL approved issue of 33 equity shares of Rs 10/- each of the company for every 1 equity share of Rs 1,000/- of CCPL

In 2013, INOX acquired 1,75,65,288 Equity Shares of Fame India Ltd. standing at 50.27% of the issued and paid-up capital by making Fame India Ltd. subsidiary.

Numbers at the time of acquisition:

| INOX | FAME | Total | |

| operational properties | 38 | 25 | 63 |

| screens | 144 | 95 | 239 |

| seating capacity | 40,140 | 26,487 | 66,627 |

| Presence in cities | 25 | 12 | 37 |

Advantages of the Merger to INOX :

- Strong presence across all the major markets in the country

- Strong foothold in Northern India, especially Delhi region

- Catering to approximately 5 crore guests this year

- Marginal geographical overlap = wider penetration

Benefits for the industry:

- Consolidation of the fragmented exhibition industry

- Ability to provide broader release platform for films of all genres

- Enhances influence over strategic decisions in industry and

Revenue enhancement:

- One stop shop for pan India advertising campaigns.

- Larger footfall and eyeball numbers to improve advertising and marketing revenues.

- Better pricing power.

Strategic plan of INOX:

- 1000+ Films commercially released every year in India.

- The highest number of admissions anywhere in the world with around 4 billion tickets sold annually. In a country where movies are a way of life, we are grossly under-screened.

- Approximately 9500 number of screens across India, i.e., 8 screens per million population

Compare this with:

- 30 screens per million in China; 60 screens per million in the UK, 120 screens per million in the USA.

Future growth plan of INOX & comparison with its peer i.e. PVR Cinema:

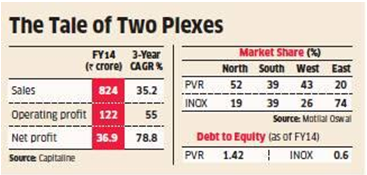

The stock of multiplex company Inox Leisure BSE 2.95 % has lagged behind its larger peer PVR over the past three years, delivering 237per cent returns compared with 472per cent of its rival. This gap can be attributed largely to PVR’s higher market share in the northern and western regions of the country where Inox did not scale up its presence.

Inox did not address the issue in the two regions even as it ramped up its total capacity to 380 screens from 240 screens in 2011, while PVR went up to 444 screens from 335 screens. However, with its recent strategic acquisition of Gurgaon-based multiplex company Satyam Cineplex, Inox Leisure has scaled up its presence considerably in the highly profitable northern region, where it has a 19% market share at present.

“For the next few years, we are in for high organic and inorganic acquisitions. Being a part of Gujarat Fluorochemicals, we have a strong reputation. We will fuel our screen expansion through debt and treasury shares which are worth 300 crores, “said Deepak Asher, director at Inox Leisure.

“In the next two years, we will add 127 screens through organic expansion. Adding Satyam’s screens, the management plans to take the screen count to 500 by the first half of 2014-15.”

Source: http://articles.economictimes.indiatimes.com

Much of the company’s capacity expansion will happen in the northern region, where the company plans to enhance its presence. Northern and western regions have a higher share in all-India ticket collections. Hence, enhancing its presence in the North works well for Inox in the coming quarters.

In the last 3 years, the multiplex industry has undergone considerable changes. With two crucial acquisitions – PVR acquiring Cinemax BSE -2.76 % and Inox acquiring Fame India – equations in terms of market share have been defined better.

The multiplex industry, which had six players three years ago, is now more concentrated, with just two players PVR and Inox accounting for over 45% of the industry’s total screen capacity of 1,800-2,000

With its expansion on track, Inox is expected to make the most of film business, which is expected to grow at a CAGR of 11.5% to reach Rs.19,330 crore by 2017. At present, Inox has debt of Rs.210 crore. After considering the value of treasury stocks, the company’s net debt turns out to be Rs.100 crore and its net debt to equity ratio is 1.

This is acceptable given the company’s size and presence. On the valuation front, on one year forward earnings basis, Inox is trading at 28 times while PVR is trading at 44 times.

Conclusion:

It is not yet clear whether Satyam will merge into INOX. We can say by referring to previous acquisitions and current acquisition of Satyam Cineplexes, INOX aims at acquiring ready set up of theatres rather than building new theatres and thereby avoiding set up costs. INOX’s strategy is cost saving and it enjoys cost advantages like:

- Sharing of best practices across the chains.

- Savings in duplication of infrastructure costs.

- Huge potential for reducing supply chain costs due to economies of scale.

This has definitely a positive impact on the valuation and stock prices and it seems synergy will enhance overall valuation of the company. We believe it may be a good idea to merge acquired business.