Orient Paper & Industries Ltd (OPIL) is India’s second largest and biggest exporter in the paper industry. Orient consumer electric business introduced revolutionary idea and the most sought-after benchmark in the fan, lights & luminaries and household appliance industry.

OPIL believes that resources must be dynamically matched with a strong commitment to excellence in products and processes. All to serve the customer better.

TRANSACTION

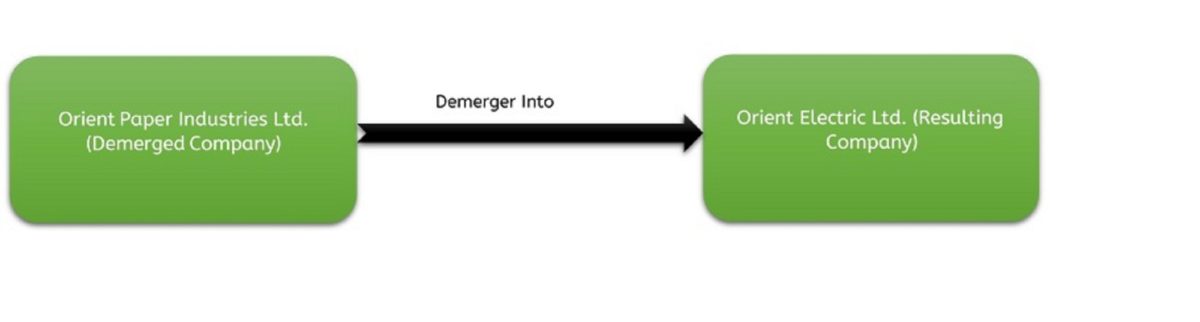

In September, C K Birla group company announced that it will separate its paper and electrical appliance businesses to unlock shareholders’ value and raise capital ofINR. 50 crore through rights issue. Proceeds from the right issue shall be used to reduce debt of OPIL and for general corporate purpose.

The new entity viz. Orient Electric Ltd (OEL)has been incorporated is wholly owned subsidiary of Orient Paper Industries Ltd.The scheme would be effective from 1st March 2017, subject to regulatory approvals.

COMPANY PROFILE

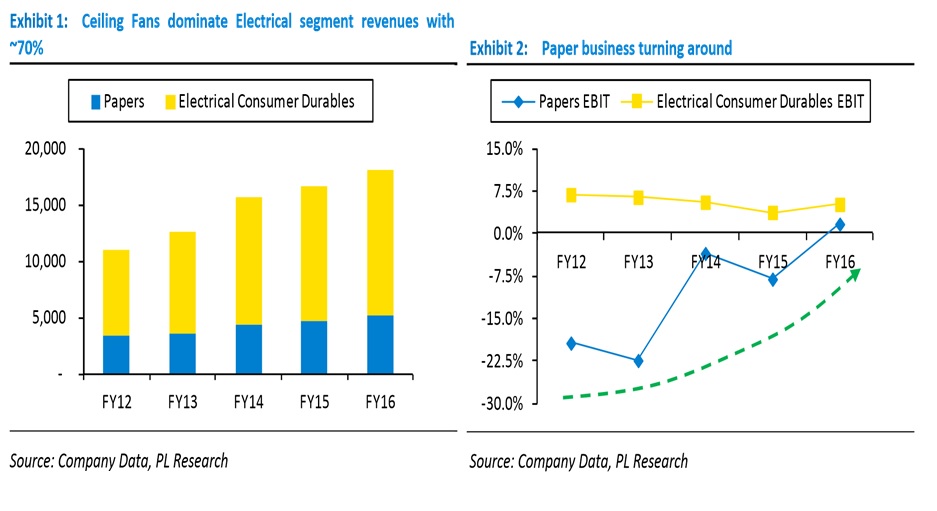

Orient Paper and Industries since its demerger of the cement business in FY13 is engaged in the manufacture of paper and electrical durables. Electrical durables segment primarily consists of ceiling fans and LED lights growing at a CAGR of 12.5% for the past 3 yrs. Paper division which was facing a double whammy during FY15 on account of falling realizations and rising costs of key raw materials like Pulp, wood, and coal, has shown a sharp turnaround in FY16.

The turnaround was on account of internal efficiencies, better realizations, and reduction of costs. Orient Paper is in a sweet spot currently with both businesses generating steady cash and limited capex. Further, demerging its electrical durable business can create substantial value for shareholders.

Focus shifting towards high margin tissue paper

Orient has 85,000T of paper capacity split as – 60,000T of writing and printing paper and 25,000T of tissue paper. Tissue paper demand in India continues to register double-digit growth with an equally strong export market (more than 50% of Orient’s tissue production is exported). Orient is doubling its capacity in tissue plant to 50,000T by importing a second-hand machine from P&G at a cost of Rs700m. This plant has the potential to generate Rs1.25bn/annum at the current realizations of Rs 62,000/T. However, it should start contributing fully from FY18 only.

Paper division turnaround to extend in FY17

Paper division is expected to show further improvement in margins for FY17 as the benefits of better realizations and lower costs were felt only for five months in FY16. Hence, considering a full year impact of the turnaround, FY17 looks significantly better for earnings in the paper division.

Electrical division to grow in double digits for FY17

Orient is expecting double-digit growth in its fans & lighting segment for FY17 and is further expecting to scale up its Appliances and Switchgear segment. Orient command a market share of 18% in the domestic fan segment and is the largest exporter of fans from India. They have a range of over 200 varieties of fans in price points ranging from Rs 500 to Rs 4,000. Further, Orient has scaled up its LED lighting segment through government orders which come at wafer-thin margins of 5%. FY17 has started off on a strong note and there is a possibility that Orient will record a turnover of Rs 14.8 bn implying a 14% YoY growth.

Strategic assets include land bank and quoted equity of Birla Group companies

Orient paper has a land parcel measuring around 800 acres at Brajarajnagar, Odisha, where they used to have a paper mill unit which was shut in 1999 and adjacent to Vedanta Plant. Further, they have small parcels of land/buildings in different locations in India. Their quoted investments include 1.54m shares of Century Textiles and 0.9m shares of Hyderabad Industries.

Demerger of Electrical business

The electrical business on an estimated basis will be able to generate Rs 14.5‐15 bn turnover for FY17 with PAT estimates of Rs 500m.

Table 1: Financial Business Segment-Wise (All figures in Rs. Million)

| Particulars | FY 2012 – 13 | FY 2013 – 14 | FY 2014 – 15 | FY 2015 – 16 | (April to Sep), 2016 |

| Segment Revenues | |||||

| 1) Papers | 3492 | 4301 | 4731 | 5185 | 2259.403 |

| 2)Electrical Consumer Durables | 9118 | 11386 | 11898 | 12961 | 5756.185 |

| Segment EBIT | |||||

| 1)Papers | (780) | (148) | (378) | 90 | -3.988 |

| 2)Electrical Consumer Durables | 591 | 639 | 453 | 676 | 250.037 |

| Capital Employed | |||||

| 1)Papers | 4537.11 | 4264.681 | 4033.681 | 4390.830 | 4115.392 |

| 2)Electrical Consumer Durables | 3121.57 | 3618.165 | 3846.020 | 4239.451 | 3538.392 |

| 3)Others | 15.830 | 14.090 | 15.777 | 20.451 | 17.023 |

| Total | 7674.51 | 7896.936 | 7895.478 | 8650.732 | 7670.807 |

| Segment ROCE (%) | |||||

| Paper | (17.1915) | (3.4703) | (0.09371) | 2.04972 | (0.0969) |

| Electrical Consumer Durables | 18.9327 | 17.6609 | 11.7784 | 15.9454 | 7.0664 |

The turnover of the demerged business division is Rs 1,3018.3 million. Percentage of the turnover of the demerged division to the total turnover of the company is 71.51 per cent.

Capital employed in both the business is almost equal in FY 2015-16.

Analysis of Financials

As we can see that there is growth in revenue from paper business in last 5 years and earnings turned to positive during FY 15 – 16.

In case of Electric business, there is fall in earnings till FY 2014 -15. But In FY 2015-16, there is a slight increase in earnings (From 3.81% to 5.21%) and Orient is expecting double-digit rise in May 2017, due to change in strategy, separate management assigned in the course of restructuring (demerger) made at the end of the year 2016.

As on September 30th, 2016, Earnings before Interest and Taxes is negative Rs 3.98 million in case of paper business as the plant was shut in the month of May due to non-availability of water and company has incurred loss of Rs.86.559 million in first quarter, but in second quarter of FY 2016-17 (July to Sep), company has made profits (before Interest and taxes) of Rs. 82.472 million.

Revenue from electric consumer durables product is very high in the First quarter. This might be due to seasonal sale of household appliances in the month of April and May i.e. summer season.

Overall if we look at the situation, things are getting better from the second quarter and we can expect more from 2017 as demerger will help in increasing shareholders’ value.

Peer Comparison

Table 2: Paper Industry Peer Comparison (All figures in Rs. Million)

| Particulars (As per y/e 31-03-2016) | Orient Paper & Industry | JK Paper | Tamil Nadu Newsprint | International Paper APPM |

| Capacity (Production) | 85000T | 455000T | 245000T | 240000T |

| Revenue | 5185 | 25637.2 | 26501.7 | 11349.7 |

| Net Profit | 452.8 | 1135.9 | 2825.4 | 296.2 |

| Net Margin (%) | 8.7328 | 4.40 | 10.56 | 2.59 |

| RoE (%) | 2.04972 | 9.08 | 19.19 | 8.53 |

- The production capacity of Orient paper is too small as compared to all other companies in the industry.

- It is almost 1/3rd of other companies viz. TNN and APPM. If revenue is considered, TNN and APPM are making very good profits.

- We also have to take into consideration that main business of TNN is production of newsprint & writing papers and that of APPM is writing, printing & copier papers and JK Paper produces paper products of various categories such as office documentation, uncoated and coated paper & board & packaging board.

- This shows that Orient paper is the only company in above-mentioned companies in the industry which is heading towards tissue paper production. There is lot of scope for Orient Paper to grow and capture larger share of the market in tissue paper in future.

- According to Pachisia, M.D. of Orient Paper Industries Ltd, the company doesn’t have any immediate plan to sell shares in either of the two businesses.

- Therefore, Orient has to either increase the production capacity to compete with other entities in the industry or to focus only on one production category i.e. tissue paper to have focused growth in the segment.

Electrical Consumer Durables Industry

Bajaj Electricals is leading the electrical durables industry with its total market capitalisation of Rs. 2316 crore and revenue of Rs.10057.5 million on September 30th,2016., whereas the Revenue from Orient electric business is Rs 575.6 million and market capitalisation as on date is Rs.15215 crores. (considering both the segments).

Management

Mr. Chandra Kant Birla – Chairman

Mr. Manohar Lal Pachisia – Managing Director

Rationale

This vertical demerger is to facilitate both paper and consumer electric businesses to focus on their core competencies and to pursue their independent strategies.

The nature of risk and competition involved is completely distinct, it was necessary to make separate teams of professionals to manage the two divisions.

This separation will enable the access to varied sources of funds for the rapid growth of both businesses.

Orient Paper and Industries has touched its 52 weeks high of Rs. 84.30, up to 13% on the BSE after the company made this announcement (In September 2016).

Consideration

The demerged company OPIL will issue one equity share of Re 1/- each of resulting company OEL for every share held in OPIL. The Equity Shares of OEL will be listed post demerger.

Name of merchant banker giving Fairness Opinion: IDBI Capital Markets and Securities Ltd.

Business Strategies

The timing of the demerger coincides with the improvement in the company’s paper business performance and sustained steady performance of the consumer electric business.

CONCLUSION

We all are the witness of earlier successful demerger of OPIL into its wholly owned subsidiary Orient Cement Ltd. (OCL)as Market Capitalisation value of Orient Cement Ltd as on January 6, 2016, is INR 2616.17 crore and that of Orient Paper Industries Ltd is INR 1526.27 crore.

We can expect no less benefits from this restructuring also as it has already set the benchmarks of excellence.