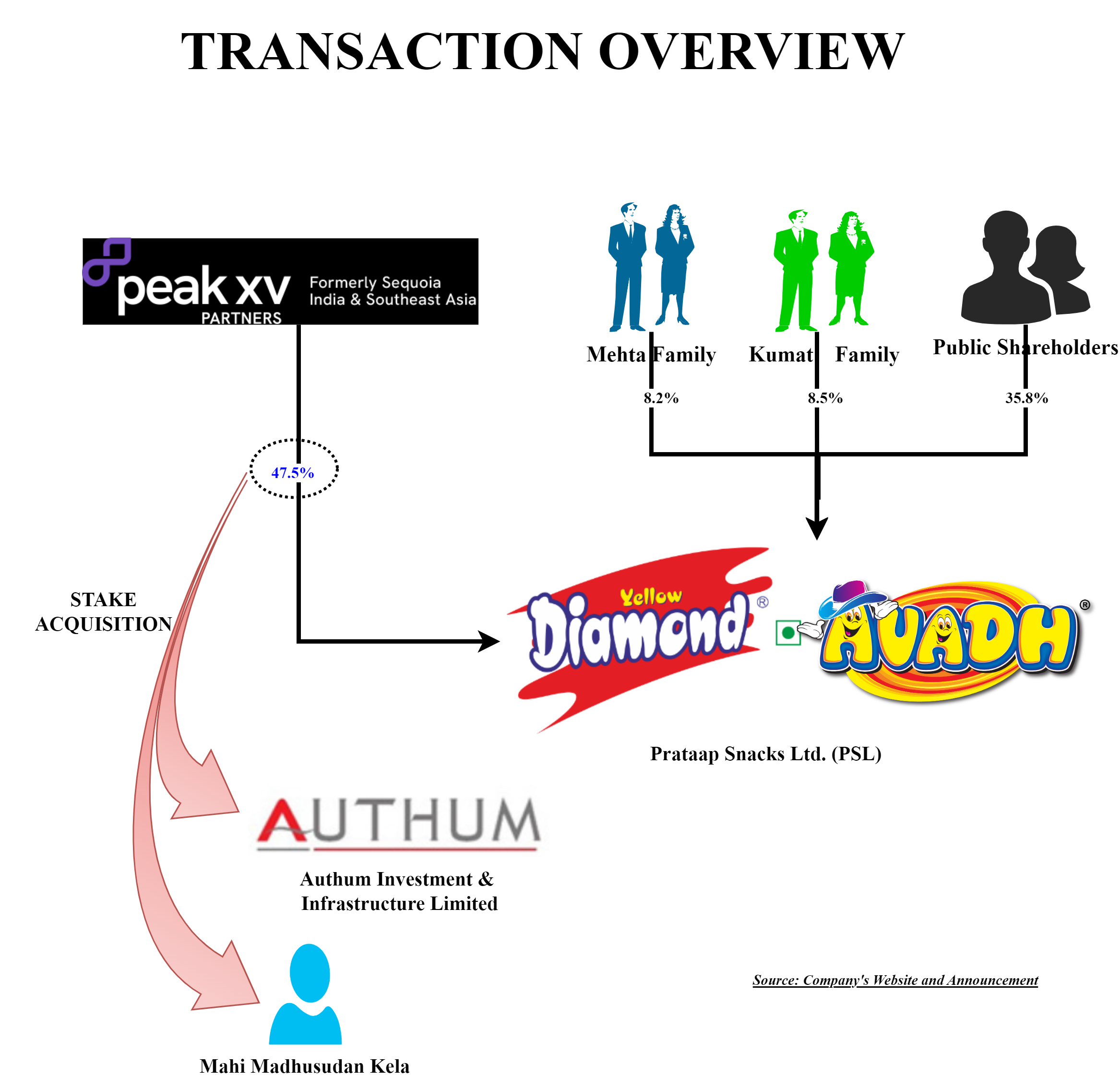

After many efforts, Sequoia Capital (Now known as Peak XV partners) are able to take a complete exit from Prataap Snacks Limited, maker of Diamond Chips. Interestingly, Sequoia’s stake has been taken over by one of the domestic institutions.

Prataap Snacks Limited (“PSL” or “Target Company”) is a snack food company. It offers multiple variants of products across categories of potato chips, namkeen including extruded snacks, pellets and traditional Indian namkeen under the popular and vibrant “Yellow Diamond” and “Avadh” brands. The Equity Shares of the Target Company are listed on nationwide bourses.

Currently, the company is jointly promoted by Mehta & Kumat family along with Peak XV partners. Peak XV holds the largest chunk of promoters holding thus, making it decision maker.

Authum Investment & Infrastructure Limited (“Acquirer” or “AIIL) is a non-deposit taking Systematically Important Non-Banking Financial Company (NBFC) registered with the RBI under Section 45-IA of Reserve Bank of India Act, 1934 and primarily engaged in the business of providing loans and making investments/trading in shares and securities. The Company is being promoted by Mr. Sanjay Dangi & his family. The equity shares of the company are listed on the nationwide bourse.

The Transaction:

Authum Investment & Infrastructure Limited (the “Acquirer”) and Mahi Madhusudan Kela (“PAC”) entered into a share purchase agreement dated September 26, 2024 (the “Share Purchase Agreement” or “SPA”) with Peak XV (“Sellers”), pursuant to which

- the Acquirer has agreed to acquire from the Sellers 1,02,48,582 Equity Shares of the Target Company representing 42.93% of the paid-up equity capital of PSL and

- PAC has agreed to acquire from the Sellers 11,00,000 Equity Shares of the Target Company representing 4.60% of the paid-up capital of PSL

at a price of ₹ 746 per Equity Share for an aggregate consideration of ₹ 8,46,60,42,172. Pursuant to the above transaction, open offer in compliance with the requirements of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 has triggered and the Acquirer along with PAC has made an open offer for 62,98,351 representing 26.00% of the paid-up capital held by public shareholders, at a price of ₹ 864 per Offer Share aggregating to a total consideration of ₹ 5,44,17,75,264 has been made.

Peak XV Journey in Prataap Snacks:

Peak XV was one of the early investors in Prataap Snack. In 2011, Peak XV onboarded Prataap Snacks with initial investment of INR 620 crores. It did pick up above ~50% stake in Prataap Snacks making it Co-promoters. Six years after its investment, Peak XV planned initial public offering of Prataap Snacks which got overwhelming response. During the IPO, Peak XV took a partial exit by offering its shares directly to public shareholders. Pursuant to IPO, Peak XV's stake in the company came down to 48.39%.

Thereafter, the focus was improving PSL’s number and offload stake with sizable returns in the next 2-4 years. However, things did not work well and finally, in 2024, Peak XV is now able to exit its entire stake in PSL with almost at same value as that during IPO times.

The return game for Peak XV:

| Particulars | Amount |

| Total investment in PSL | 265 crores |

| Partial exit during IPO | 167 crores |

| Sale of remaining stake to Acquirer | 847 Crores |

| Total Gains | 749 Crores |

It may appear to be one of the best deals for Peak XV. Though it is, there is one aspect which is essential to consider. During the IPO in 2017, PSL derived price was circa INR 938 per share. The current deal is happening at INR 746 per share which translates ~20% less value than it fetched 7 years ago.

What went wrong for PSL:

PSL was one of the early companies in the sector that invited substantial investment from private equity at a very early stage of its journey. Run by Mehta & Kumat Family, within a small span PSL became a well-known brand in multiple states. In 2017, it came out with an IPO which got an overwhelming response.

With funds received in IPO, PSL acquired Avadh Snacks, which sold savoury items predominantly in Gujarat. Prataap Snacks kept adding capacity through its own units as well as by outsourcing production. However, expansion did not go well for PSL. PSL, being focused on small packs (INR 5) and thin margins, took a hard toll on its numbers. It went on to change its product portfolio with new launches, restructured its distribution network, consolidation of manufacturing facilities etc. However, nothing seems to have been working significantly yet which can be seen from financials compared from 2018 and 2024.

Authum Plans for PSL

Authum is being acquired by Mr. Sanjay Dangi in 2020. Post-acquisition, Authum focused on expanding into the financial market. It also acquired Reliance Commercial Finance Limited and Reliance Housing Finance Limited after emerging as the highest bidder. PSL is the 2 key acquisition for Authum which is totally into different sectors. The plan for Authum could be to become domestic private equity for PSL, turn around the operations and take an exit in the next 5-8 years.

With respect to funding the transaction, assuming a full open offer is being subscribed, Authum will require circa INR 1400 crore. Considering the size of the liquid investment, as on 31st March 2024, the entire investment will be funded through internal accruals.

For remaining promoters

Mehta & Kumat families are the founding promoters who are still riding the horse for PSL. Together they own circa 16% of the stake in the company. However, at various stages, they are also encashing their shares by selling them to third parties. Immediately after IPO, their stake in the company was 23%. In March 2024, Mehta family sold a 2.8% stake in the company to Cohesion Mk Best Ideas Sub-Trust which is a joint venture between Cohesion & Madhu Kela, a related person of PAC at circa INR 805 per share. It will be interesting to see whether both/any of the existing promoters continue to run the show for acquirers & PAC or the new jockey would be appointed.

Conclusion

After a joyful pre-IPO ride for PSL, things turned out to be bumpy. In one hand it was trying to streamline its operations to have better margins, the valuation remained same for the company. Rather, PSL has given negative returns since IPO. Peak XV, being the largest promoter and shareholder, was in the quest of increasing value for the Company but unable to do so. As per the reports, Peak XV started exit planning a couple of years ago. It approached various FMCG guys to acquire its stake. However, the deal did not sail through. Now with Authum being on board, it will be interesting to see whether it has become successful in doing what global private equity failed to?