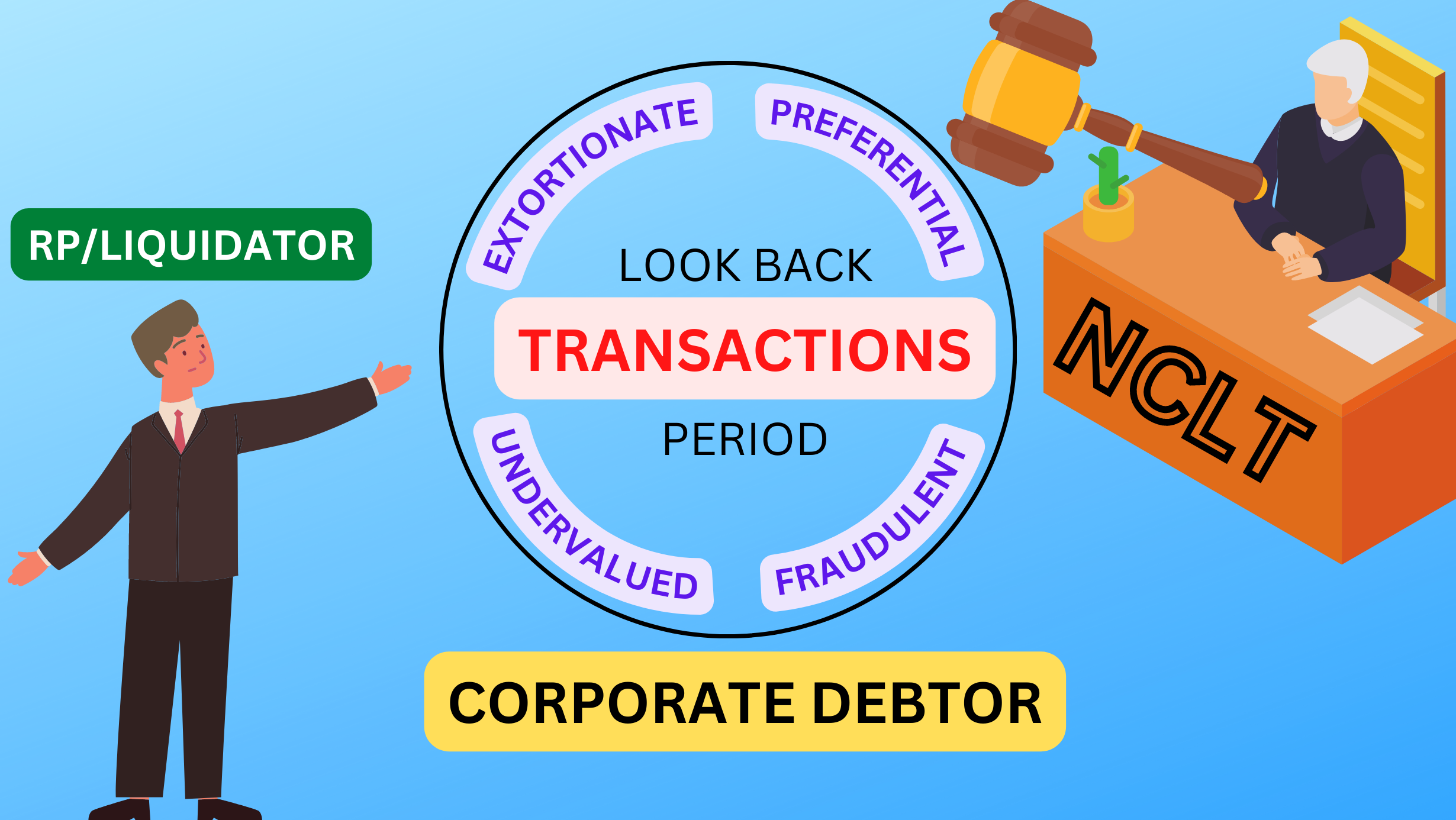

The Code has identified set of transactions, whereby a Corporate Debtor may lose value, in the run-up to commencement of the Corporate Insolvency Resolution Process (CIRP). They are known as Avoidance Transactions, comprises Preferential Transactions, Undervalued Transactions and Extortionate Transactions and Fraudulent Transactions, comprises fraudulent trading or wrongful trading. The Code requires the CIRP to recover the loss made through these transactions. These avoidance transactions and fraudulent trading together are known as PUFE (Preferential, Undervalued, Fraudulent and Extortionate) Transactions.

The Code empowers the National Company Law Tribunal (Adjudicating Authority) to claw back the value lost through PUFE transactions, based on an application of an Insolvency Professional (IP), either as Resolution Professional (RP) or Liquidator. Sections 43, 45, 50, 54F, and 66 of the Code require the RP or Liquidator to file applications in respect of PUFE transactions with the Adjudicating Authority during the CIRP or liquidation process.

To ensure that the RP files an application without fail, the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (CIRP Regulations) provide timelines, requiring the RP to form an opinion if the CD has been subjected to any PUFE transactions, by 75th day of commencement of the CIRP, make a determination by 115th day, and file an application by 130th day with the Adjudicating Authority, for appropriate relief. This timeline has been held to be directory because the CD must not suffer loss for lapse on the part of the RP.

Nature of Transactions

1. Preferential Transactions: – As per Section 43 of IBC, Transactions where RP or liquidator as the case may be is of opinion that the corporate debtor has at a relevant time given a preference in such transactions as below: –

- there is a transfer of property or an interest thereof of the corporate debtor for the benefit of a creditor or a surety or a guarantor for or on account of an antecedent financial debt or operational debt or other liabilities owed by the corporate debtor; and

- the transfer under clause (a) has the effect of putting such creditor or a surety or a guarantor in a beneficial position than it would have been in the event of a distribution of assets

2. Undervalued Transactions: – As per Section 45 of IBC, Transaction is undervalued where the corporate debtor–

- makes a gift to a person; or

- enters into a transaction with a person which involves the transfer of one or more assets by the corporate debtor for a consideration the value of which is significantly less than the value of the consideration provided by the corporate debtor, and such transaction has not taken place in the ordinary course of business of the corporate debtor.

3. Extortionate credit transactions: As per Section 50 of IBC, where corporate debtor has been a party to an extortionate credit transaction involving the receipt of financial or operational debt during the period within two years preceding the insolvency commencement date.

Authority to make an application in case of Undervalued Transaction

[rml_read_more]

Section 47 of the Code provides that in case of Undervalued Transaction is taken place and the same is not reported by RP/Liquidator as the case may be then a Creditor, Member or Partner of a corporate debtor, as the case may be, may make an application to the Adjudicating Authority to declare such transactions void and reverse their effect.

Where if Adjudicating Authority is satisfied that Undervalued Transaction has taken place then it shall pass the following orders: –

- Restoring the position as it existed before such transactions and reversing the effects thereof in the manner as laid down in section 45 and section 48 of Code and

- Requiring the Insolvency and Bankruptcy Board of India (IBBI) to initiate disciplinary action against the RP or the Liquidator, where he has not reported undervalued transactions to the Adjudicating Authority.

Case Laws: – Can Financial Creditor file an application with NCLT (National Company Law Tribunal) for PUFE Transactions Except Undervalued Transaction

In the matter of Ambit Finvest Pvt. Ltd Vs. Rakesh Niranjan Ranjan & Ors., an application was filed by a dissenting financial creditor for PUFE transactions. The AA (Adjudicating Authority) dismissed the application on the following ground: –

“That a financial creditor has no right to file such an application under section 66 of the Code, which could be done only by the RP, while noting that the RP was satisfied that there was no cause to file an application.”

Transactions during the period of CIRP/ Liquidation Process

Section 66 of Code Provides that If during the corporate insolvency resolution process or a liquidation process, it is found that any business of the corporate debtor has been carried on with intent to defraud creditors of the corporate debtor or for any fraudulent purpose, the Adjudicating Authority may on the application of the resolution professional pass an order that any persons who were knowingly parties to the carrying on of the business in such manner shall be liable to make such contributions to the assets of the corporate debtor as it may deem fit.

On an application made by a resolution professional during the CIRP, the Adjudicating Authority may by an order direct that a director or partner of the corporate debtor, as the case may be, shall be liable to make such contribution to the assets of the corporate debtor as it may deem fit.

Case Law: – Can look back period be extended to ascertain whether transactions entered into by management of Corporate Debtor was Undervalued, Preferential, Fraudulent?

Hon’ble National Company Law Tribunal (Hon’ble NCLAT) in its recent judgement in the matter of Company Appeal (AT) (Insolvency) No. 671 of 2020 and in the matter of Asian Natural Resources (India) Limited (Corporate Debtor) has upheld decision of Hon’ble NCLT for allowing liquidator of corporate debtor to scrutinize/investigate transactions executed/entered by corporate debtor beyond 2 years from Insolvency Commencement Date (“Look Back Period”).

Facts of the case

In the said case, liquidator applied to Hon’ble NCLT on the grounds following grounds:

- Members of Suspended Management of Corporate Debtor has entered into certain transactions which can be termed as Undervalued Transactions, Preferential Transactions and fraudulent Transactions beyond look back period specified under IBC (“Prior to Two Years from Insolvency Commencement Date”) and

- Management is not co-operating with liquidator for providing documents to investigate/scrutinize the transactions.

Hon’ble Ahmedabad NCLT allowed application of Liquidator and directed the suspended management to co-operate liquidator and provide required documents.

One of the Suspended Director of Corporate Debtor filed an appeal against aforesaid order of Hon’ble NCLT on the ground that Hon’ble NCLT has erred in its judgement by allowing investigation of transactions beyond look back period provided under IBC.

Grounds on which Hon’ble NCLAT upheld the decision of Hon’ble NCLT

“Section 66 of the Code does not contemplate any lookback period; and also having regard to the fact that unless the Liquidator scrutinizes the documents, he would not be able to finalize or conclude whether the transaction also falls under Sections 43 or 46 of the Code.”

Reversal of PUFE Transactions

The Bankruptcy Law Reforms Committee, which conceptualized the Code, has identified avoidance transactions as a key source of additional value in corporate insolvency, over and above the existing assets of the CD. The Code accordingly enables the processes to undo these transactions and thereby claw back the value lost through them. If these transactions are undone and the lost value is clawed back to the CD, creditors would stand to realise higher value than they would otherwise. Also, Code requires the beneficiaries of avoidance transactions to disgorge the value unlawfully appropriated by them through such transactions.

The Code provides a waterfall for the distribution of liquidation proceeds among stakeholders. It requires resolution plan in a CIRP to consider the order of priority in the said waterfall. This prioritization balances the interests of various stakeholders of the CD.