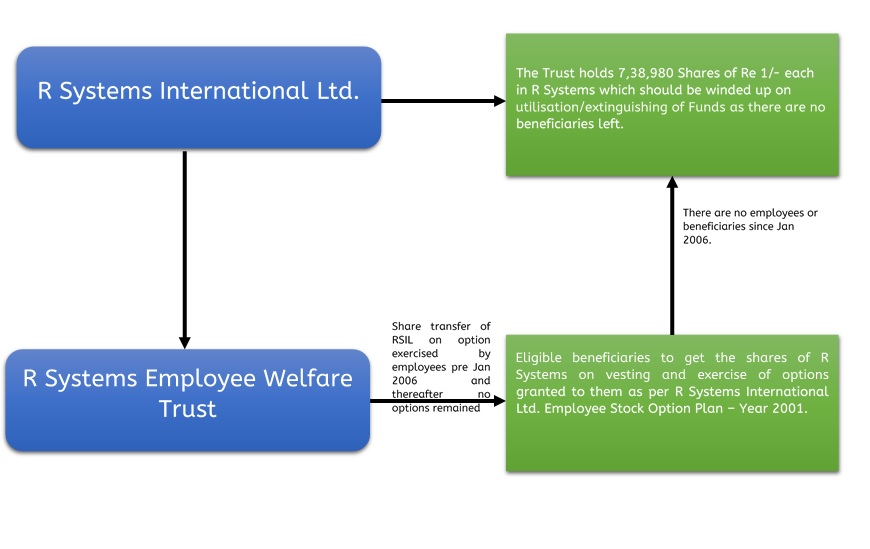

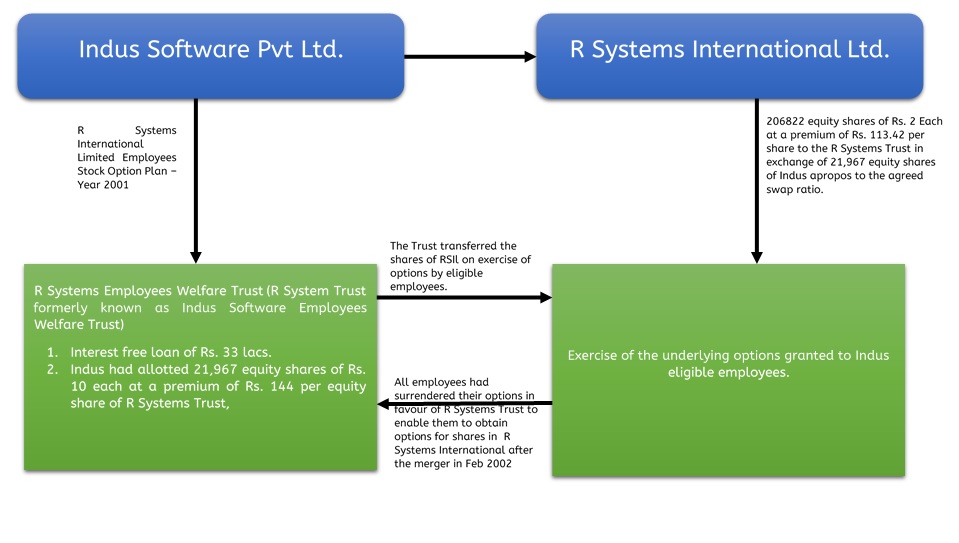

R Systems International Limited executed a Scheme of Arrangement with its shareholders and creditors to reorganize and reduce the equity share capital of R Systems International Limited. The proposed capital reduction will not cause any prejudice to the interest of the creditors of the company as there will not be any reduction in the amount payable to the respective Creditors. Further, in absence of any payment to the Trust pursuant to the capital reduction, it does not alter, vary, or affect the rights of the Creditors in any manner. The company would honour its commitments and meet its obligations in ordinary course of business and there is no pay-out to Trust pursuant to the proposed capital reduction.

About R Systems International Limited

Transaction

Shareholding Pattern

Table 1: Shareholding (Pre & Post Transaction)

| Pre-Scheme of Arrangement | Post Scheme of Arrangement | |||

| Particulars | Nos of shares | Percentage | Nos of shares | Percentage |

| Promoter and Promoter Group | 6,30,87,034 | 50.90% | 6,30,87,034 | 51.20% |

| Public | 6,08,65,891 | 49.10% | 6,01,26,911 | 48.80% |

| Total | 12,39,52,925 | 100.00% | 12,32,13,945 | 100.00% |

7,38,980 Shares of Re 1 held by Trust in R Systems International Ltd will be cancelled post scheme of arrangement and accordingly the Public shareholding percentage will change from 49.10% to 48.80%.

Share Valuation

Equity Shares are valued at fair value by using Market Price Method.

| Face Value | INR 1 per equity share |

| Fair Value | INR 56.67 per equity share |

Accounting Treatment

| Share Capital Account ……………Dr | 7,38,980 |

| To Capital Reserve Account | 7,38,980 |

The reduction of share capital won’t result in any payment to the Trust and hence the reduced share capital will be transferred to the Capital Reserve Account.

Compliances

- There will be no stamp duty because scheme does not involve any conveyance of transfer of any property and does not involve any issue of shares. Consequently, the order of the NCLT of Judicature at new Delhi approving the scheme shall not attract any stamp duty.

- The Company may be exempted to use the words “and reduced” as a suffix to its name and the company shall continue in its existing name considering that the Company would be able to discharge its liability in the due course of business.

Tax Implications

The income received on capital reduction would be taxable as under:

- Amounts distributed by the company on capital reduction to the extent of its accumulated profits will be considered as deemed dividend under section 2(22)(d) and the company will have to pay dividend distribution tax on the same,

- Distribution over and above the accumulated profits, in excess of original cost of acquisition of shares would be chargeable to capital gains tax in the hands of the shareholders.

However, in this case, there will not be any tax implication as the company is not paying any amount to the trust on reduction of share capital.

Financial position of R Systems International

The company is having excessive cash. The cash balance of Rs 113.60 crores at the December 2016, out of which the company has utilized Rs 19.5 crores for buyback purposes.

Share Capital issue/buyback

| Particulars | 2016 | 2015 | 2014 |

| Share Capital in Rs | 12,31,31,445 | 12,61,31,445 | 12,67,19,600 |

| Buy Back of shares | 30,00,000 @ Rs 65 | 6,78,155 FV Re 1 market offer price Rs 100 | Nil |

| Issue of Shares-ESOP | Nil | 90,000 Shares @ Rs 12.07 | 8,04,000 Shares @ Rs 12.07 |

Conclusion

The shares of the Trust amounting to Rs 7,38,980 held in R Systems International Limited had no real owner as on 31st Dec 2016. This was reflecting in R Systems International Ltd.’s books as double share capital. The said capital reduction should have been done much earlier. Therefore, presently this transaction is nothing but reorganisation of share capital of the company.