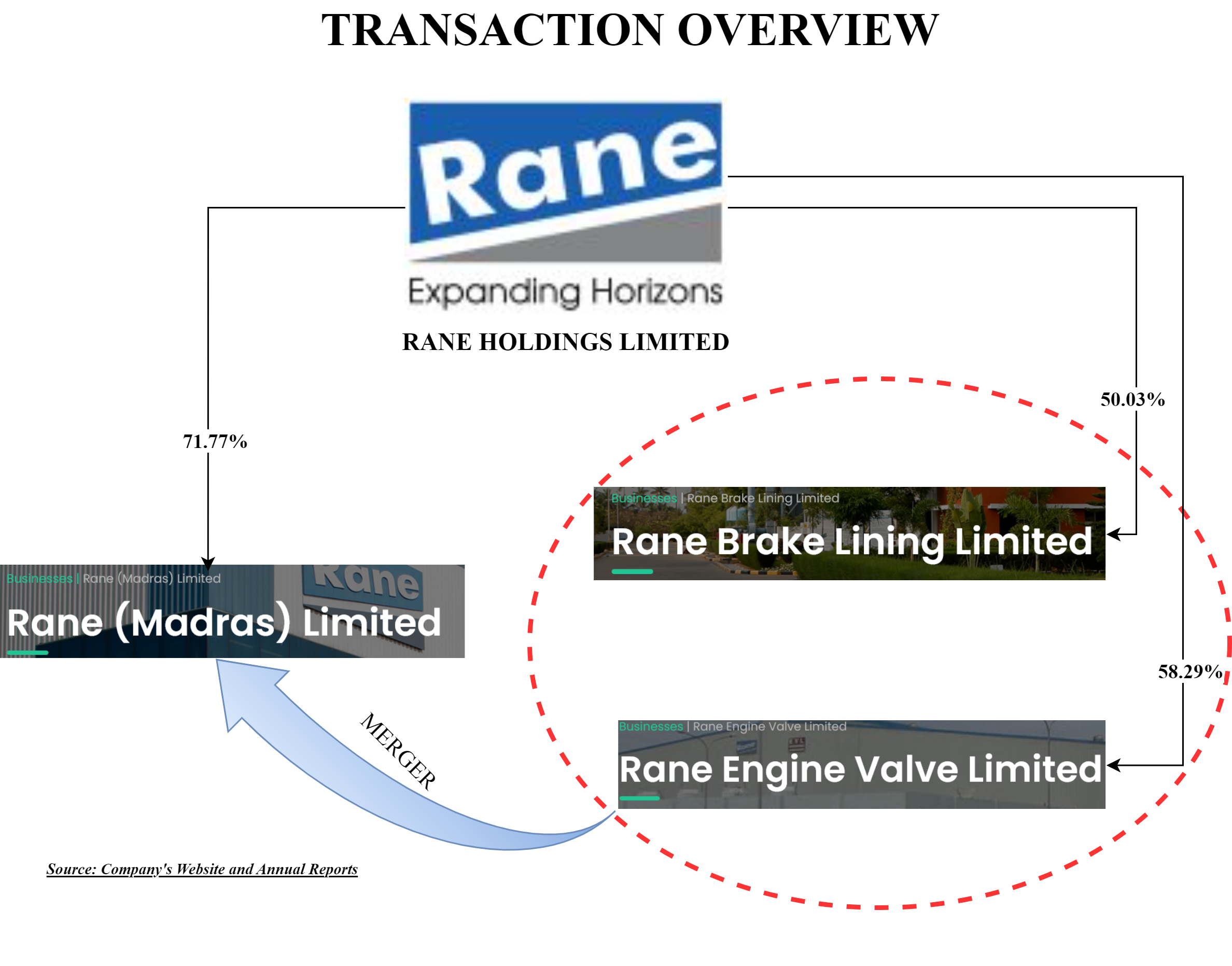

After keeping different operational listed entities for years, Rane Group, one of the key players in the Auto Ancillary space has decided to consolidate its listed operational companies under Rane (Madras) Limited.

Rane Engine Valve Limited (hereinafter referred to as “REVL” or “Transferor Company-1”) was incorporated in 1972, is engaged in the business of manufacturing and marketing of auto components for the transportation industry viz., engine valves, valve guide and tappet. The equity shares of Transferor Company-1 are listed on BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”).

Rane Brake Lining Limited (“hereinafter referred to as “RBL” or “Transferor Company-2”) was incorporated in 2004 and engaged in the business of manufacturing and marketing of auto components for the transportation industry viz., friction material (Disc Pads, Brake Shoes, Clutch Facings, Clutch Buttons, Brake Linings and Brake Blocks). The equity shares of the Transferor Company-2 are listed on BSE and NSE.

Rane (Madras) Limited (hereinafter referred to as `RML’ or “Transferee Company”) was incorporated in 2004 and is engaged in the business of manufacturing and marketing of auto components for the transportation industry viz., steering and suspension systems, linkage products, steering gear products and aluminium alloy based high pressure die-casting products. The equity shares of the Transferee Company are listed on BSE and NSE.

All three entities involved, REVL, RBL and RML are subsidiaries of Rane Holdings Limited which is also a listed company.

The Proposed Transaction

The Scheme of Amalgamation (“Scheme”) of Rane Engine Valve Limited (“Transferor Company-1”) and Rane Brake Lining Limited (“Transferor Company-2”) with and into Rane (Madras) Limited (“Transferee Company”) and their respective shareholders is presented under Sections 230 – 232 of the Companies Act, 2013 and the rules and regulations made thereunder.

The Appointed Date for the amalgamation is 1st April 2024 or such other date as may be fixed or approved by the Hon’ble NCLT. As per clause 20 of the proposed scheme, post effectiveness of the company, Transferee Company may change its name to another such name.

Some of the key rationale as envisaged under the scheme:

- Consolidation of all operating businesses under a single listed entity will simplify the group structure.

- Integration of businesses under a common unified platform will enable more coordinated and comprehensive business management with greater focus and attention.

- Revenue and cost synergies and enhance operational, organizational, and financial efficiencies from increase in scale of operations.

Rane Group is one of the preferred auto ancillaries for suppliers of global auto parts. It’s three of the operational listed companies RML, REVL and RBL manufacture different products catering to different segments. The merged entity will be balanced having a couple of key products catering to all segments.

RBL amongst other twos enjoys better margins. The merger may be an initial drag for RBL shareholders but may improve the return in the long run and especially, avoid the cyclicality of the business.

Clearly, RML is the only company which has improved its revenue significantly in the last 7 years however, it enjoys pretty less margins than RBL. REVL return is too cyclical and continues to swing. The merged entity will facilitate to absorb the cyclicality and may give stable returns.

Plant Locations

The merged entity will have multiple plants (circa 15 plants) mainly in southern part of India. Some of the plants are located in the same area/city. Going ahead, there could be consolidation of plants.

Swap Ratio:

For Transferor Company 1

9 (Nine) Equity Shares of RML having face value of INR 10/- each fully paid up shall be issued for every 20 (Twenty) equity shares held in REVL having face value of INR 10/- each fully paid up.

For Transferor Company 2

21 (Twenty-one) Equity Shares of RML having face value of INR 10/- each fully paid up shall be issued for every 20 (Twenty) equity shares held in RBL having face value of 1NR 10/- each fully paid up.

| Particulars | RML-Pre | REVL | RBL | RML-Post |

| No. of paid up equity shares | 1,62,65,267 | 72,34,455 | 77,29,871 | 2,76,37,137 |

| Face Value | 10 | 10 | 10 | 10 |

| Promoters* Holding | 72.7% | 58.3% | 70.9%* | 70.45% |

| Rane Holdings Limited % | 71.77% | 58.2% | 50.03% | 63.80% |

*Nisshinbo Holdings Inc, Japan being a strategic partner (classified as promoter) in RBL holding 20.64% will hold 6.06% in the merged entity and be continuing to be classified as a promoter.Accounting Treatment

Upon the Scheme becoming effective and with effect from the Appointed Date, the Transferee Company shall account for the transfer and vesting of the assets, liabilities and reserves of the Transferor Companies in its books of accounts as a common control business combination as per "Pooling of Interest Method" prescribed under the Indian Accounting Standard Ind-AS 103 - "Business Combination”.

Valuations

Being all three companies involved are listed on bourses, joint valuers have arrived at a relative valuation using discounted cash flow method, market price and comparable company multiple method.

The valuation as envisaged by one of the joint valuers is as follows:

| Particulars | Assigned equity valuation (In Crore) | Tentative Enterprise Value | EV/EBITDA Multiple |

| RML | 1490 | 2118 | 10.7 |

| REVL | 290 | 403 | 8.76 |

| RBL | 743 | 739 | 11 |

Conclusion

Finally, it appears that the steps are being taken by one of the oldest auto ancillary companies in India for shareholder value optimisation. The proposed merger will not only consolidate the business but is likely to provide stability and growth opportunities for the merged business. Value creation will be dependent on how each other core strength and infrastructure will be utilised to enhance the ROCE of the merged entity. However, one may opine that collapsing the holding subsidiary structure i.e. Rane Holdings Limited would create more value.