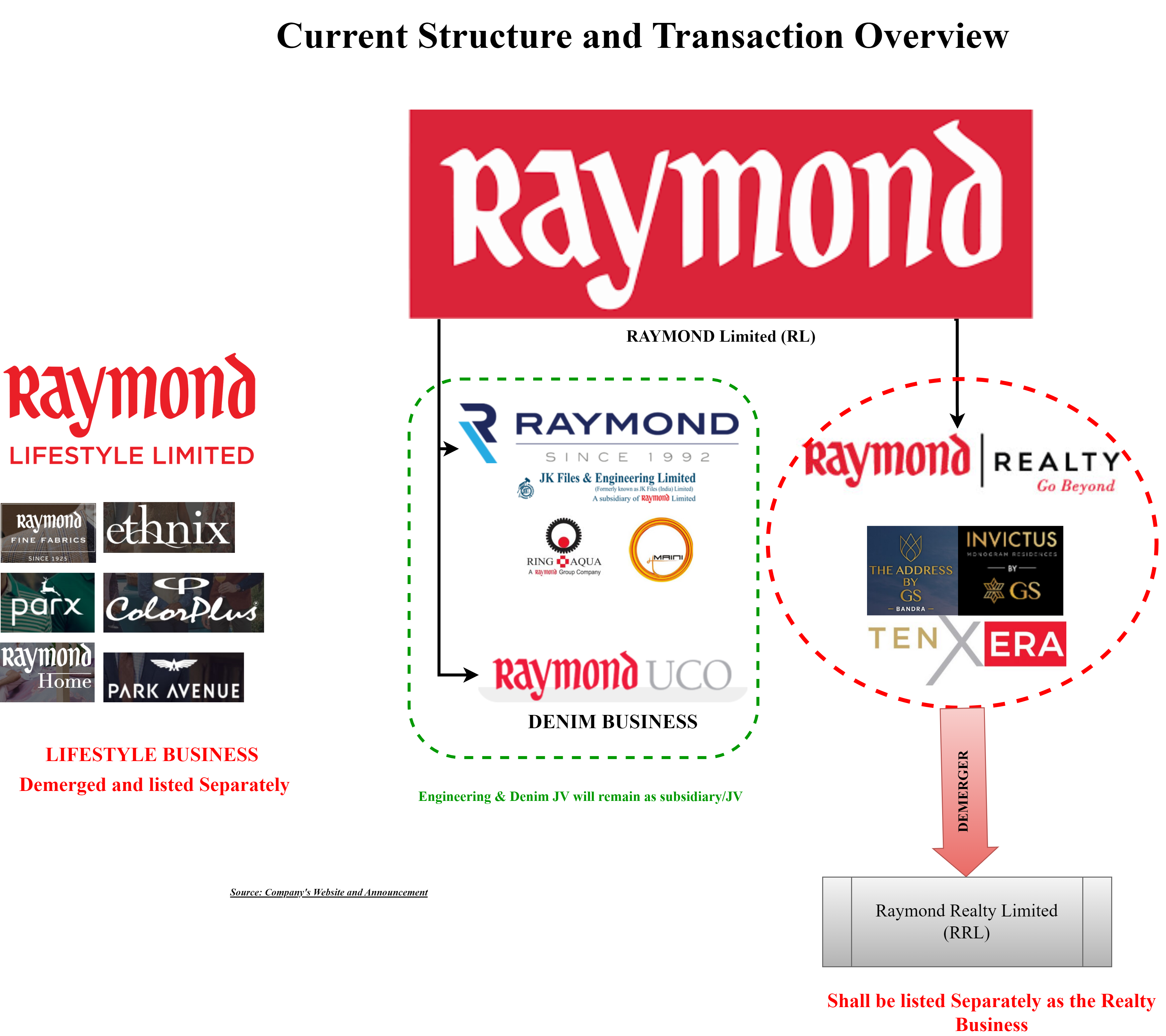

After the successful demerger of “Lifestyle Business”, Raymond Limited announced yet another restructuring to unlock further value for stakeholders. In a recent move, Raymond Limited has announced its plan to demerge its “Real Estate Business” into a separate entity which shall be listed pursuant to the demerger.

Raymond Limited (“RL” or “Demerged Company”), post demerger of “Lifestyle Business” is now having Real Estate Business and Engineering & Auto Components Business (“Engineering Business”) through its subsidiaries. The equity shares of RL are listed on nationwide bourses.

In the recent past, RL did numerous restructurings to create value for shareholders mainly:

- Selling of FMCG business to repay debts

- Demerger of Lifestyle Business

- Expansion of engineering business by acquisition of 59.25% equity stake in Maini Precision Product Limited for a consideration of INR (Indian Rupees) 682 crore.

Now it has embarked on one more demerger of the real estate business in its subsidiary and get it listed.

Raymond Realty Limited (“RRL” or “Resulting Company) is a wholly owned subsidiary of RL engaged in real estate business. However, till 31st March 2024, the company has not done any active business.

The Proposed Transaction

The board of directors of RL & RRL have approved a scheme of arrangement which provides for the demerger of “Real Estate Business” of RL into RRL.

The Real estate business of RL consists of:

- Development of owned land (Circa 100 acres) in Thane

- Joint Development Agreements in Mumbai region (4 different projects)

The Appointed Date for the proposed demerger will be 1st April 2025.

Some of the key rationale for demerger:

- Real Estate & other businesses have their own strengths, dynamics, risk & return and competition leading to different growth potentials. Hence, the segregation of two undertakings would enable a focused management to explore growth potentials.

- Better canalization of resources available and enhance management structure.

- Flexibility with shareholders to retain either or both businesses.

- Inviting partners if required.

Consideration & Share Capital

RRL shall issue “One (1 only) equity share of Raymond Realty Limited of/NR 10/- each fully paid up for One (1 only) equity share of Raymond Limited of INR 10/- each fully paid up”.

Being a vertical demerger, consideration for the proposed demerger is based on the management decision regarding intended capital structure of Real Estate business after listing. Pursuant to the Scheme, all the shareholders of Raymond Limited would also become the shareholders of RRL, and their shareholding in RRL would mirror their shareholding in Raymond Limited.

| Particulars | RL (Pre & post) | RRL (Post) |

| No. of equity shares of INR 10 each | 6,65,73,731 | 6,65,73,731 |

| Promoters Stake | 49.06% | 49.06% |

RRL paid up capital has increased in FY-25 from INR 15,00,000 to INR 1,65,00,000.Financials

Please note that the Engineering business numbers include numbers for Maini Precision Product Limited which was acquired in March 24.Engineering business consists of all three verticals, steel files & hardware, Auto & EV (Electric Vehicle) component business and Aerospace & Defense business. In an earlier presentation by RL, 59% of the revenues of the Engineering business are from Auto parts, 30% from tools & Hardware & 11% from the Aerospace & Defense segment.

Remaining Business of RL

After “Real Estate Business” demerger, RL will remain with Engineering Business which shall constitute three different verticals:

- Steel files & Hardware,

- Auto & electric vehicle component business and

- Aero & Defense Business.

Maini Precision Product Limited (MPPL) has engaged in the business of Auto components as well as sectors such as Aerospace & Defense. Acquisition of MPPL marks the foray of RL into Aerospace & Defense business. RL acquired MPPL through Ring Plus Acqua Limited (engaged in Auto component business), a subsidiary of JK Files & Engineering Limited (engaged in Tools & hardware business) which is a subsidiary of RL i.e., MPPL acquisition is done through a step-down subsidiary of RL.

RL has earlier announced its plan to execute an internal reorganization of the Engineering business which shall amount to the consolidation of Ring Plus Acqua Limited (engaged in Auto component business), JK Files & Engineering Limited (engaged in Tools & hardware business) and Maini precision Product Limited (Engaged in Auto and Aerospace & Defense business) followed by creation of two different companies under RL (Catering to Engineering Business) mainly:

- Company 1: Files business along with Auto Business.

- Company 2: Aerospace & Defense Business.

This consolidation followed by separation will be carried out through a composite scheme which shall result in a shareholding pattern of engineering business (Company 1 & 2) as RL will own 66.3%, Maini Precision’s founders will own 28.5% & the rest will be with minority shareholders.

Conclusion

Like Godrej Group, Raymond forayed into Real Estate business using its own land where earlier Raymond manufacturing plant was situated however which got shifted due to expansion of city limits. After gaining confidence, Raymond started to grow its real estate business along with other businesses.

Raymond Limited has tried hard to create value for its shareholders after COVID-19. It executed a couple of transactions including selling its FMCG (Fast Moving Consumer Goods) business to become debt free entity followed by demerger of its core “Lifestyle Business.” It has also expanded the engineering business by the acquisition of Maini Precision Product Limited. With another demerger, Raymond is set to have three listed companies operating into different businesses. Interestingly, one may ponder on whether there was any commercial reason for the announcement date for the demerger of real estate just before the record date for the demerger of lifestyle business.

Post demerger, Raymond Limited is likely to be holding company for engineering business. Eventually, we may witness further re-structuring /raising funds in Engineering business or part thereof. With multiple restructuring, it seems Raymond Limited is systematically creating focused businesses with huge future potential for each of the business with dedicated financial and managerial resources and easily measurable efficiency and return of each of the business and maybe with a plan to invite strategic partner or even exit one of the businesses.