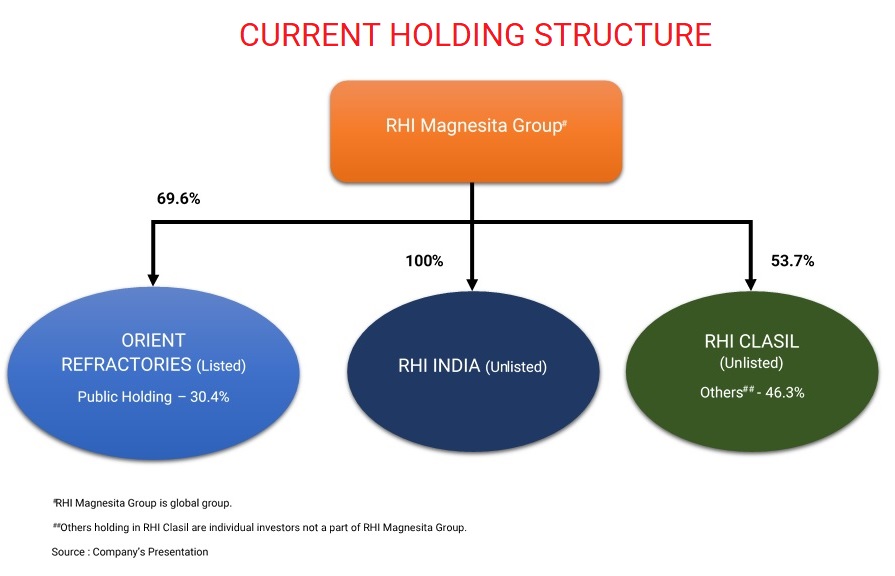

RHI Magnesita Group, a leading global supplier of the high-grade refractory product, systems and services has a presence in India through its acquired listed entity Orient Refractories and two other unlisted companies. The group has decided to consolidate its refractories business in India.

Orient Refractories Limited (Orient) is in the business of manufacture and marketing of refractory products, systems and services and has various global partners for its international quality products

In 2011, Orient Abrasives Limited demerged its refractory business into Orient. In January 2013 RHI Acquired 43.6% share capital of the Orient and further 26% via open offer. The transaction price for 69.6% totalled approximately INR 360 cores.

RHI India Private Limited (RHI India), incorporated in 2007 is a subsidiary of Dutch Brasil Holding B.V., which is ultimately owned by RHI Magnesita N.V. RHI India is engaged in the business of purchase, sale, import, export and marketing of refractories, refractory products, chemicals, formulations, and related equipment.

RHI Clasil Private Limited (RHI Clasil), incorporated in 2005 is a subsidiary of VRD Americas B.V., which is ultimately owned by RHI Magnesita N.V. Apart from VRD Americas B.V., the shares of RHI Clasil are held by the Clasil Group. RHI Clasil is engaged in the business of manufacture and marketing of refractories and allied products.

Current Holding Structure

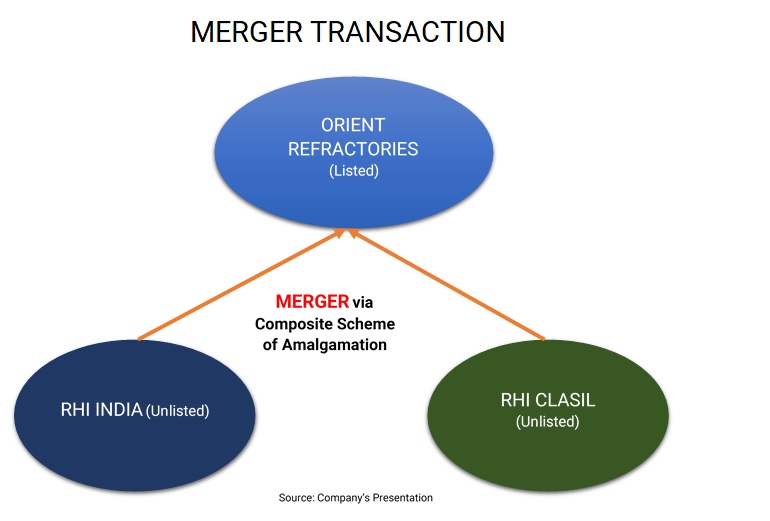

The Transaction

The board of directors of Orient Refractories Limited, RHI India Private Limited, RHI Clasil Private Limited approved the proposal to merge RHI India & RHI Clasil with Orient.

The appointed date of the transaction is 1st January 2019. Following completion of the merger, Orient will be renamed as RHI Magnesita India Limited.

Swap Ratio

- For every 100 equity shares of RHI India, Orient will issue 7,044 equity shares.

- For every 1000 equity shares of RHI Clasil, Orient will issue 908 equity shares.

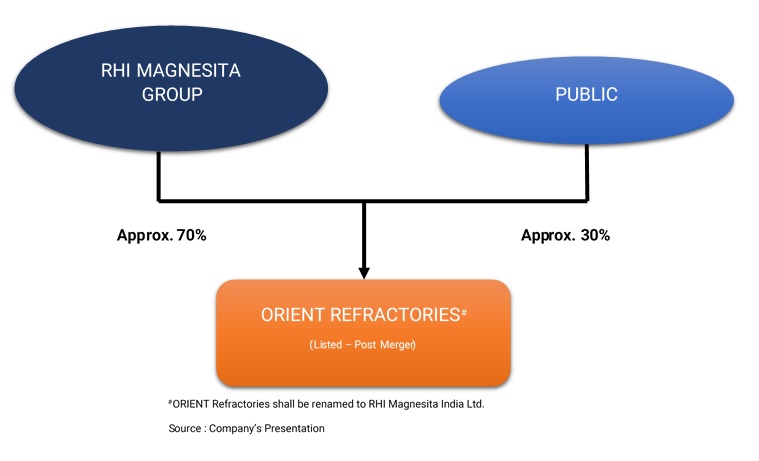

Shareholding Pattern

Post Transaction, number of equity shares of Orient will get increased to 16.09 lakhs from 12.01 lakhs. 100% stake of RHI Magnesita is held by Promoter group. RHI Magnesita group holds 53.7% in RHI Clasil, while rest stake is held by the Clasil Group i.e. earlier promoter of RHI Clasil. Post-transaction, RHI Magnesita group stake in Orient will be increased slightly. However, its stake in RHI Clasil will get increased substantially.

Financial

Table 1: Financials of all Companies (All Figs in INR Crores as of 31.03.2018)

| Particulars | Orient | RHI India | RHI Clasil | Combined |

| Revenue | 636 | 460 | 266 | 1,362 |

| EBITDA % | 20% | 16% | 12% | 17% |

| PAT % | 14% | 9% | 5% | 10% |

| Networth | 323 | 150 | 39 | 512 |

| Loans | 0 | 35 | 77 | 112 |

| Capital Employed | 323 | 185 | 116 | 624 |

| RoCE | 37.20% | 44.50% | 27.20% | 30-32% |

| RoE | 28.80% | 31.50% | 38.20% | – |

| Implied Value | 2194 | 441 | 305 | – |

| PAT Multiple | 25.51 | 10.75 | 21.79 | – |

Transaction of Orient with group companies for FY 2018

| Particulars | RHI India | RHI Clasil |

| Sales | 7 | 7 |

| Purchases | 6 | 6 |

Orient is a leading manufacturer and supplier of special refractory products, systems and services. RHI India is a trading arm of RHI Magnesita hence it has a higher RoCE compared to Orient. RHI Clasil manufactured mainly alumina-based refractories. After the consolidation, Margins and RoCE of the orient likely to be hampered.

Conclusion

In 2013, RHI Magnesita group acquired Orient with an intention to scale its refractories business in India. All the three entities have a slightly different business model. Orient is a leading manufacturer and supplier of special refractory products, systems and services. RHI India is a trading arm of RHI Magnesita group which offers a range of refractories product sourced from various RHI Magnesita group entities to Indian customers. RHI Clasil is a manufacturer and supplier of mainly alumina-based refractories. It seems for the next phase of growth; the group is consolidating its Indian operation. The restructuring will simultaneously lead to better corporate governance and other shareholders of RHI Clasil i.e. Clasil group will also get the option of an exit in future without following many compliances.