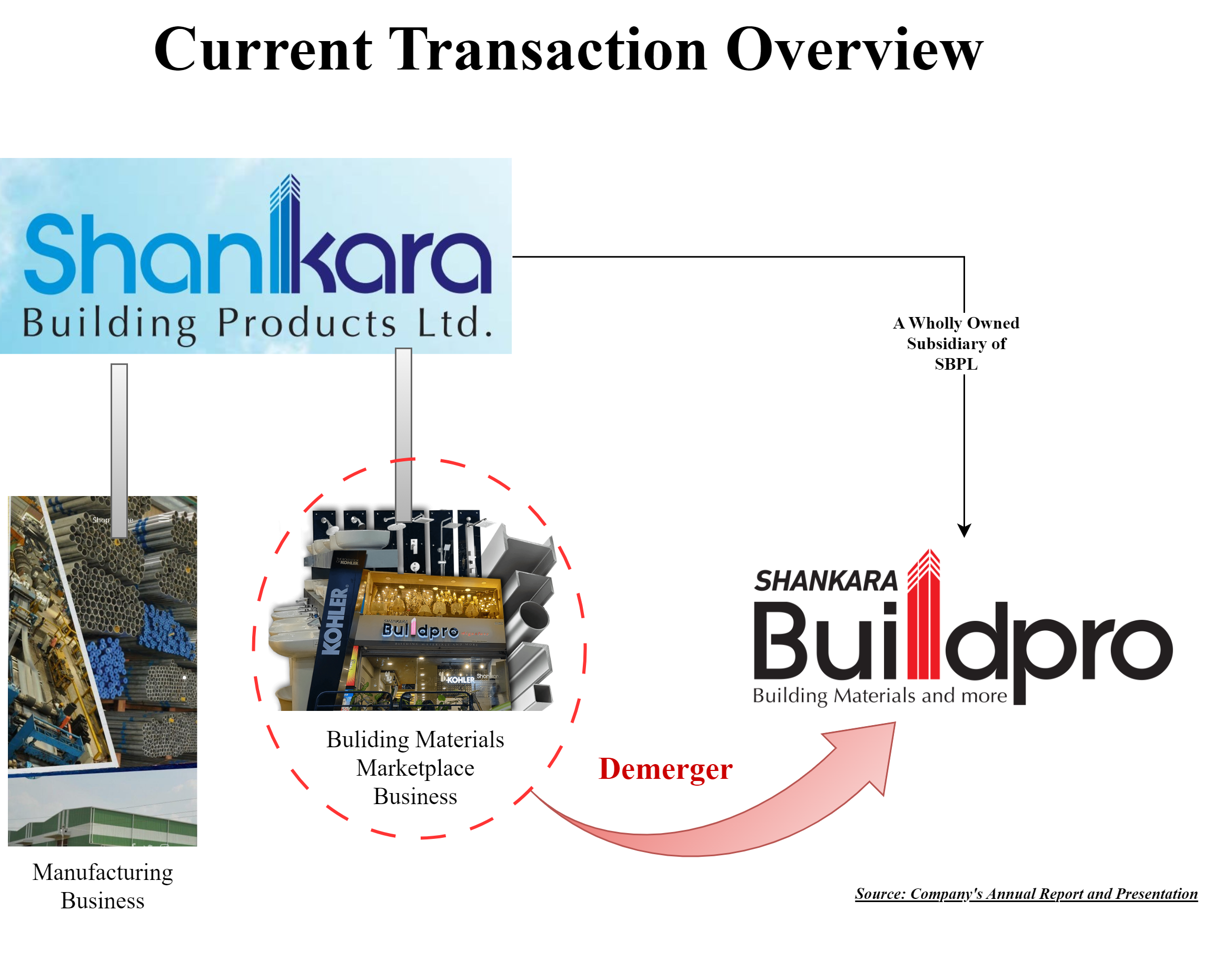

Recently, Shankara Building Products Limited announced the demerger of its trading/building material marketplace business from its manufacturing business.

Shankara Building Products Limited (“Demerged Company” or “SBPL”) is one of the leading organized retailer of home improvement & building products. The equity shares of the company are listed on nationwide bourses.

The demerged entity is currently inter-alia and operates in two segments:

- Trading Business comprises retail, supply, distribution, and promotion of home improvement and building products.

- Manufacturing Business which comprises manufacturing of products such as cold rolled strips, precision tubes & pipes, roofing sheets etc.

Shankara Buildpro Limited (“Resulting Company” or “SBL”) was recently incorporated to facilitate the demerger transaction. Currently, SBL is a wholly-owned subsidiary of SBPL.

The Proposed Transaction:

SBPL in its board of directors meeting announced its plans to separate its trading/ building material marketplace business from its manufacturing business through a Scheme of Arrangement (Scheme) which inter-alia provides for demerger.

The Demerged Undertaking means trading business comprises of retail, supply, distribution, and promotion of various home improvement and building products in India including but not limited to steel pipes and tubes, structural steel products, infrastructure materials, PVC products, aluminium and metal products, fabrication, electrical products, tiles, and sanitary wares, through multiple sales channel(s).

The Appointed Date for the proposed demerger shall be 1st April 2024 or such other date as may be approved by the Hon’ble National Company Law Tribunal.

Key rationale for the proposed transaction:

- Overall business structure will be simplified.

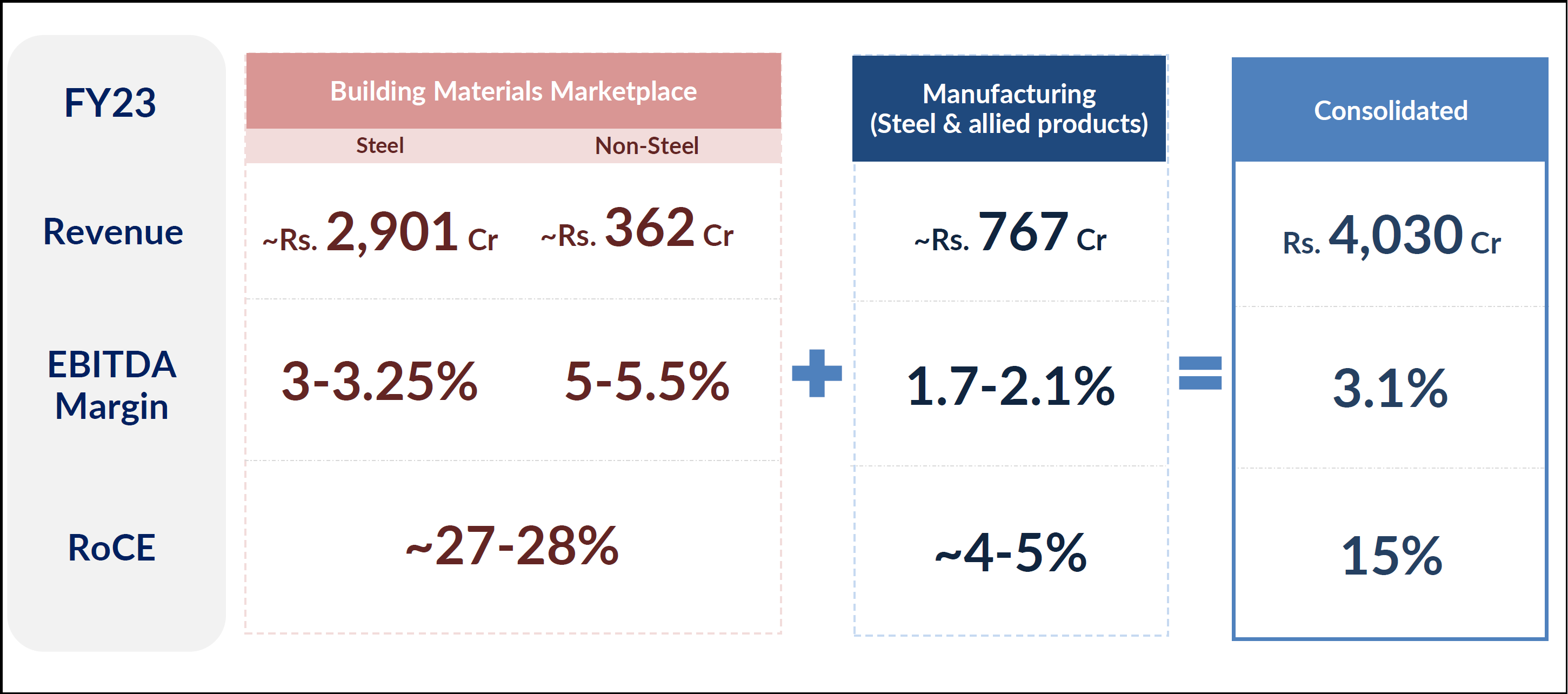

- Profit margins and return indicators present a clear view of the strength of demerged business.

- The demerger will enable the company towards a focused capital allocation strategy.

- Fourthly, the company has decided to augment by bringing new generation managers to lead from the front the marketplace business and focus more on value-added avenues.

- A dedicated management team is being instituted for the manufacturing business. There is a need to explore potential ways to turn around the manufacturing by expanding the product range, identifying value-added products, and improving capacity utilization.

Consideration & Swap Ratio

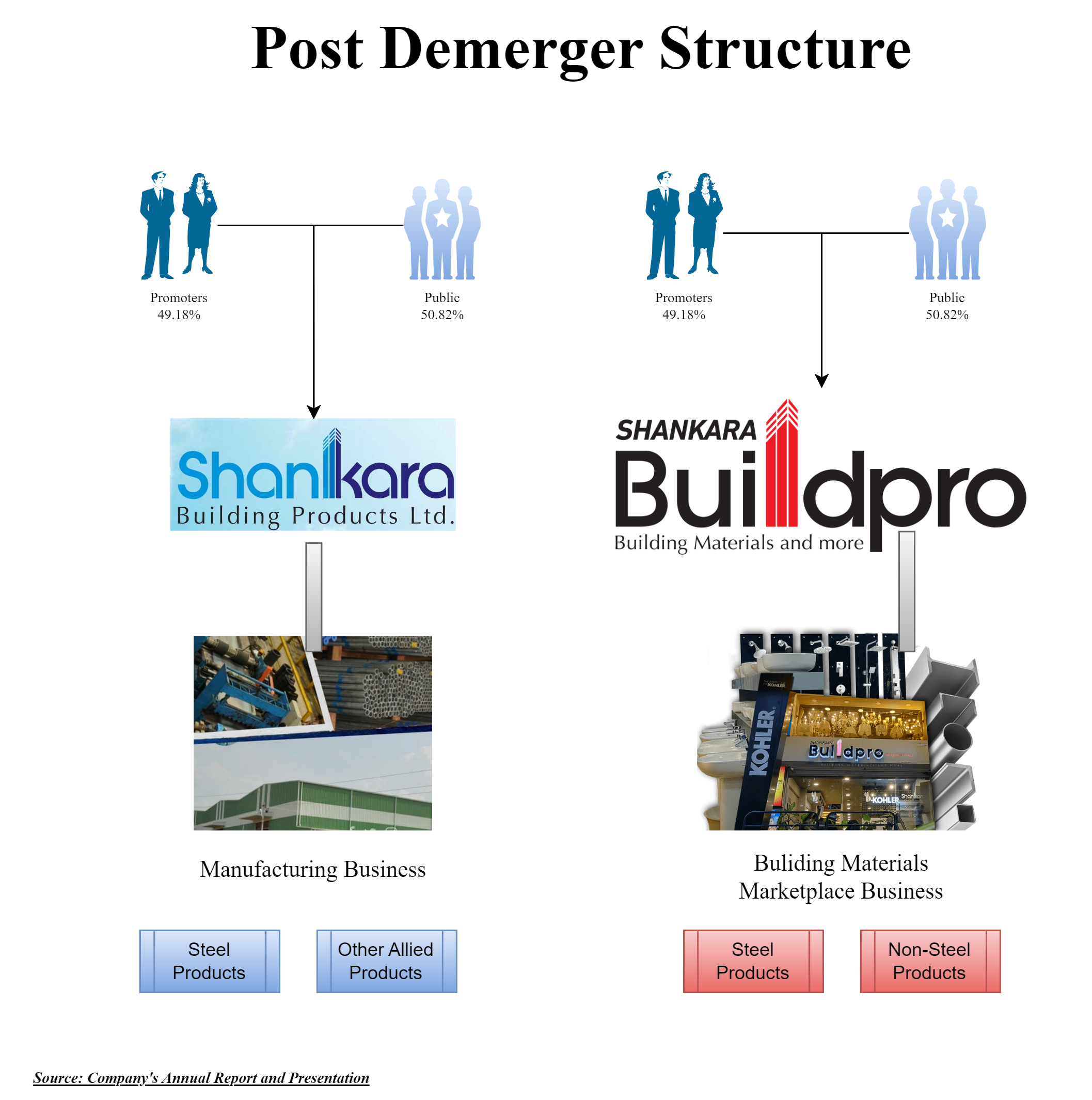

As consideration for the proposed demerger, the resulting company shall issue 1 (one) equity share of INR 10 each fully paid up of the Resulting Company for every 1 (one) equity share of INR 10 each fully paid upheld in the Demerged Company

| Particulars | SBPL-Pre & Post | SBL-Post |

| Paid-up number of equity shares of INR 10 each | 2,42,49,326 | 2,42,49,326 |

| Promoters stake | 49.18% | 49.18% |

"Please note that the existing shares held by SBPL in SBL will be cancelled pursuant to the proposed demerger"Post Demerger Structure

Post-transaction Scenario:

Shankara was started as a steel distributor in 1995. In 2008, they forayed into retail operation with the start of their own store in Bengaluru. Post-COVID, the company enhanced its retail operations by starting its own marketplace app and inviting funds from APL Apollo.

APL Apollo being manufacturer of steel & allied products, invested in SBPL through its wholly owned subsidiary APL Apollo Mart Limited. This is a strategic initiative to strengthen our presence in South India – a large and growing construction market. APL Apollo decided to invest INR 180 crore (Circa INR 75 crore through secondary sale & 105 crore through warrants).

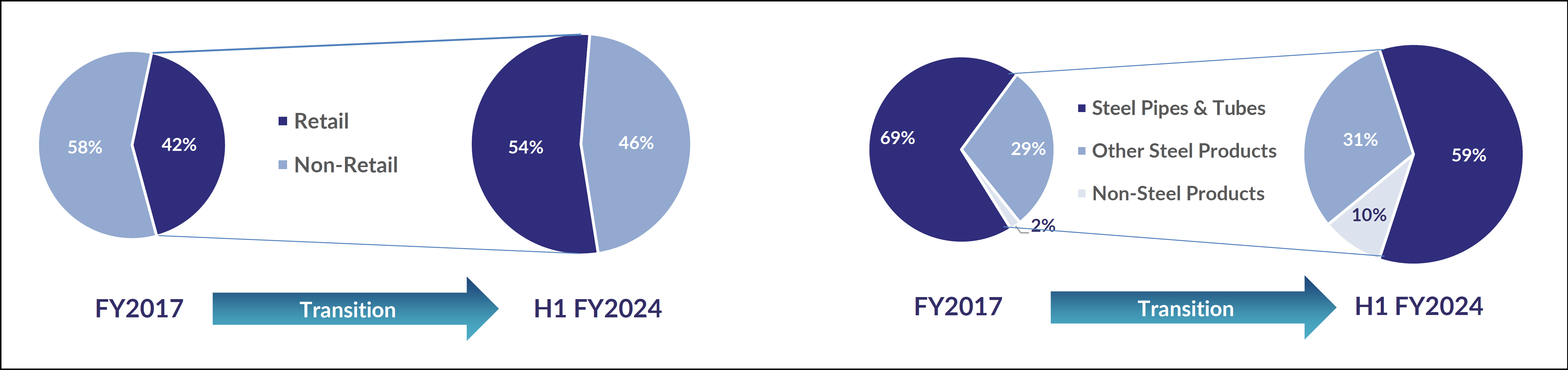

With focus on expanding its trading business in last couple of years, the company wider its footprints and now have more than 1,00,000 stock keeping units, 125+ brands onboarded and more than 75+ product categories. The revenues for the company also grew from INR 2038 crore in FY 2021 to INR 4030 crore in FY 2023.

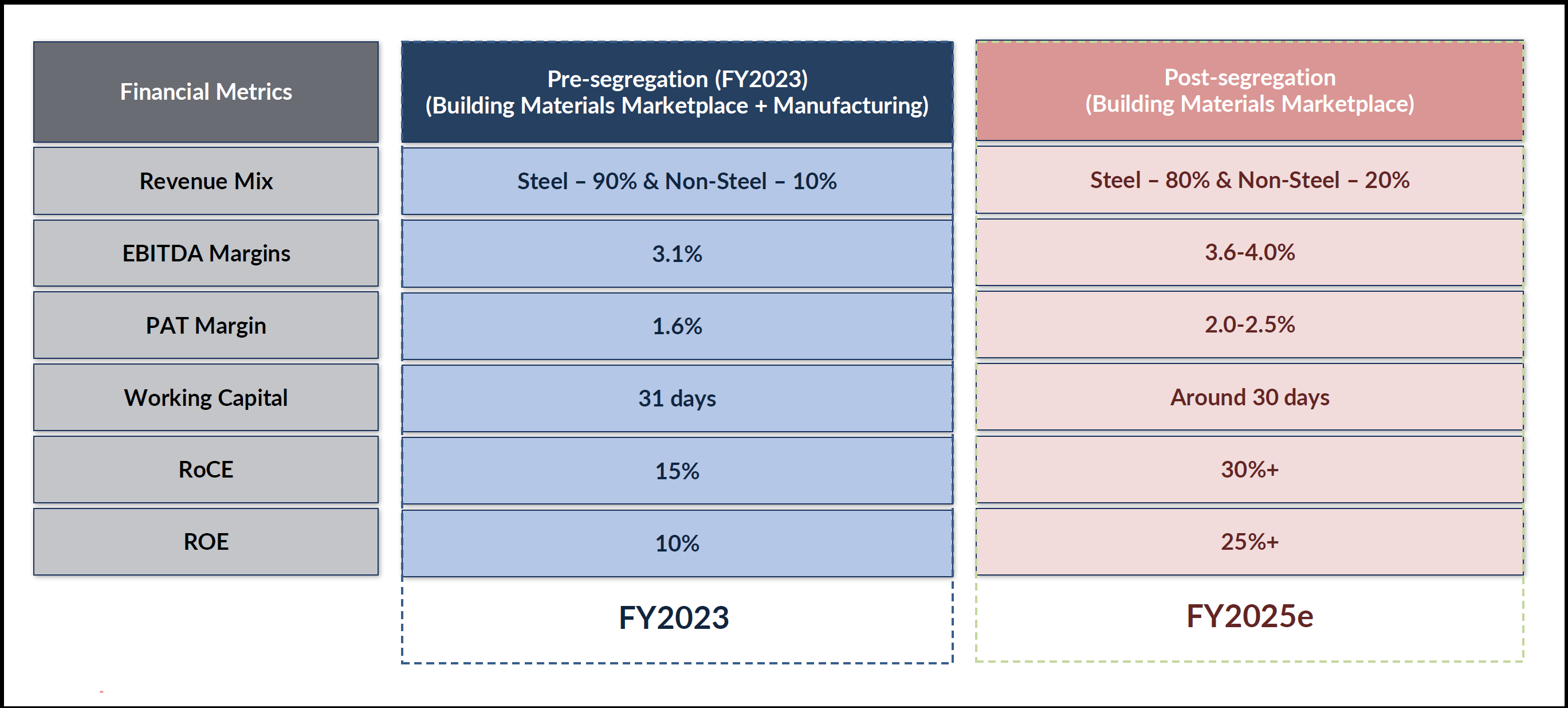

Currently, both manufacturing & trading business is skewed towards steel & allied products. Currently, almost 90% of the revenue of the combined entity is from steel products. Considering the cyclicality in steel prices & margins, SBPL forayed into other value-added segments in its trading business. Now with a demerger, trading business will have a more value-added products proportion in total revenue and thus, blended margins will increase.

Another probable reason for a demerger could be to avoid conflict of interest. With Retail division onboarding more & more brands, this shall offer them flexibility.

The focus towards expanding trading business has started impacting its manufacturing business. Currently, the company is barely operating at about 40% of capacity. Post-demerger there are plans to increase the utilization of its extensive network of processing facilities across South India, which are currently underutilized.

According to the management, the demerger presents a unique opportunity to optimize this entity by establishing a focused team dedicated to maximizing the capacity utilization of these assets. Operating independently, this team will chart a strategic growth path, optimizing supply chain management through improved vendor relations, enhanced planning, and faster manufacturing turnarounds.

Currently, almost 80% of the manufactured goods by SBPL is being sold through its own marketplace. Post demerger, both companies shall look for their own growth. However, this will be slightly challenging for SBPL for finding its own channel for sales & marketing.

Financials Scenario

Tentative Standalone Assets & Liabilities pertaining to the demerged undertaking as on 30th September 2023:

| Particulars | Demerged Undertaking | Remaining Undertaking |

| Fixed Assets (₹ Crores) | 38 | 164 |

| Investments (₹ Crores) | 0 | 39 |

| Inventories (₹ Crores) | 344 | 0 |

| Receivables (₹ Crores) | 565 | 0 |

| Trade Payables (₹ Crores) | 536 | 0 |

| Borrowings (₹ Crores) | 152 | 0 |

| Net Assets (₹ Crores) | 282 | 201 |

Clearly, SBPL entire remaining business i.e. Steel & Allied products is being carried by its wholly owned subsidiary. The only significant assets left with SBPL post demerger will be land, building and investment in subsidiaries. For FY 2023, almost entire steel & allied product sale is being through is retail segment.

Conclusion

APL Apollo & Shankara’s relations are not new. In 2019, APL Apollo also bought steel production unit in Hyderabad from Taurus Value Steel & Pipes, a subsidiary of SBPL. Post that, APL also announced investment into SBPL. It is also not clear fund infused by APL will be with which division. One of the key reasons for the demerger could be to facilitate deeper business integration with APL’s steel business. The key question remains what SBPL will do post demerger? Its steel business is significantly underutilised & almost entire sales are captive (through its own retail channel). Though, the management have said to grow its steel unit, the journey could be filled with roller-coaster ride. Post demerger, we may see action from APL side to increase stake or merger with APL.

There is no doubt SBPL’s manufacturing entity will be not able to create value for shareholders on its own and must have strategic partner whether APL or otherwise. The transaction will likely unlock value for shareholders of SBL.