Siemens AG announced its Vision 2020+ which included the spin-off of its Gas & Power (G&P) i.e., Energy Business into Siemens Energy. The rationale was to give the energy division the independence to pursue its own strategy. The global decision has finally come to fruition in the Indian Entity. Siemens India announced the demerger of its energy arm. The decision will facilitate the separation of its matured business from emerging businesses.

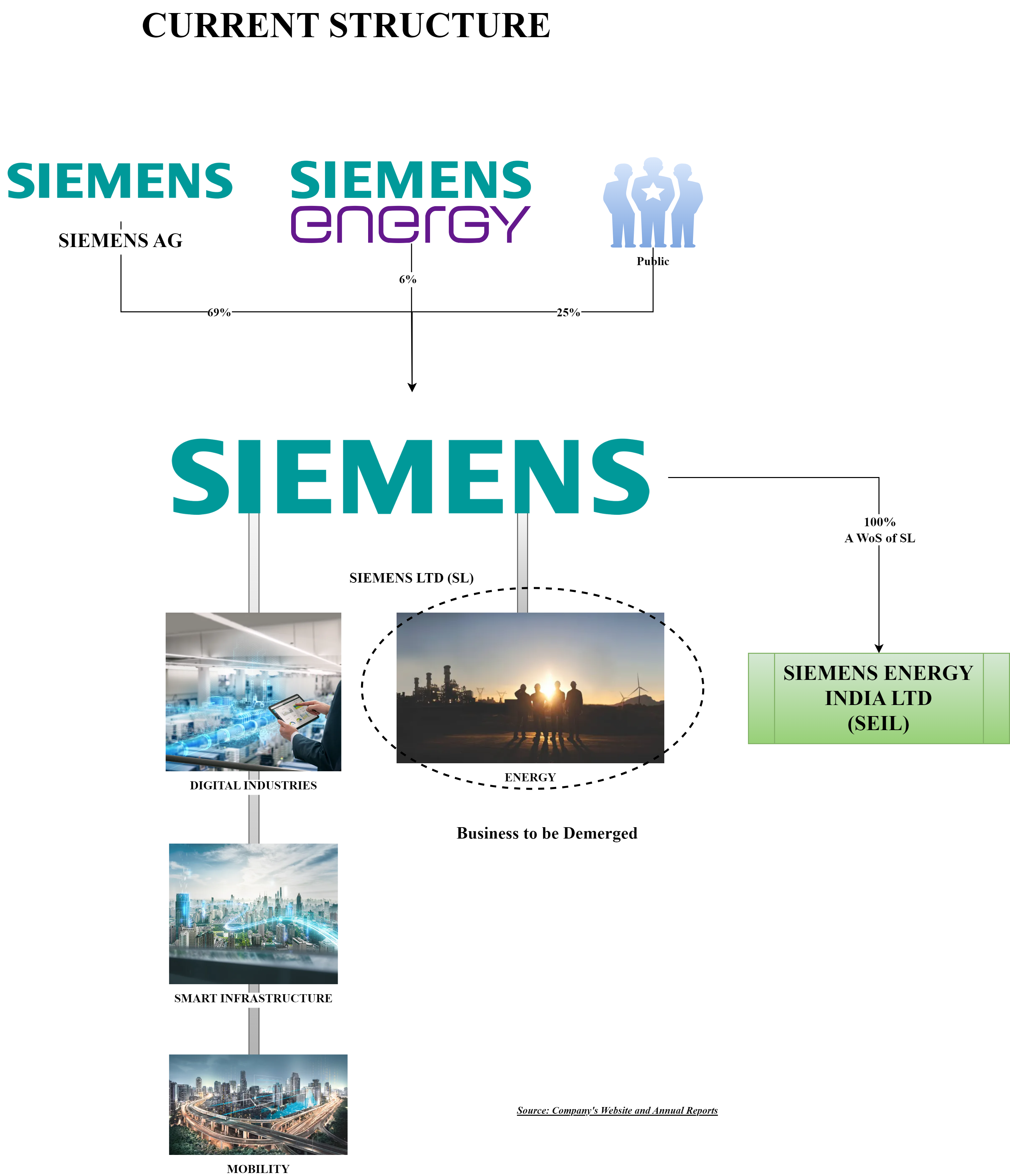

Siemens Limited (“Demerged Company”) is a technology company focused on industry, infrastructure, transport as well as transmission and generation of electrical power. The equity shares of Siemens Limited are listed on the nationwide stock exchanges. Siemens Limited operates in India through four major businesses:

- Digital Industries

- Smart Infrastructure

- Mobility

- Energy

Siemens Energy India Limited (“Resulting Company”) is a wholly-owned subsidiary of Siemens Limited incorporated to facilitate the proposed demerger.

Siemens AG, the holding company of Siemens Limited demerged its energy business globally in the year 2020. As per the statement issued by Siemens AG, the separation of energy business in India was not feasible at that point. Post completion of global separation, Siemens AG & Siemens Energy AG proposed to Siemens Limited for separation of its energy business now and in continuation of the aforesaid strategy, it is now proposed to demerge the Energy Business of Siemens Limited into an independent company which will be listed separately.

The Proposed Transaction

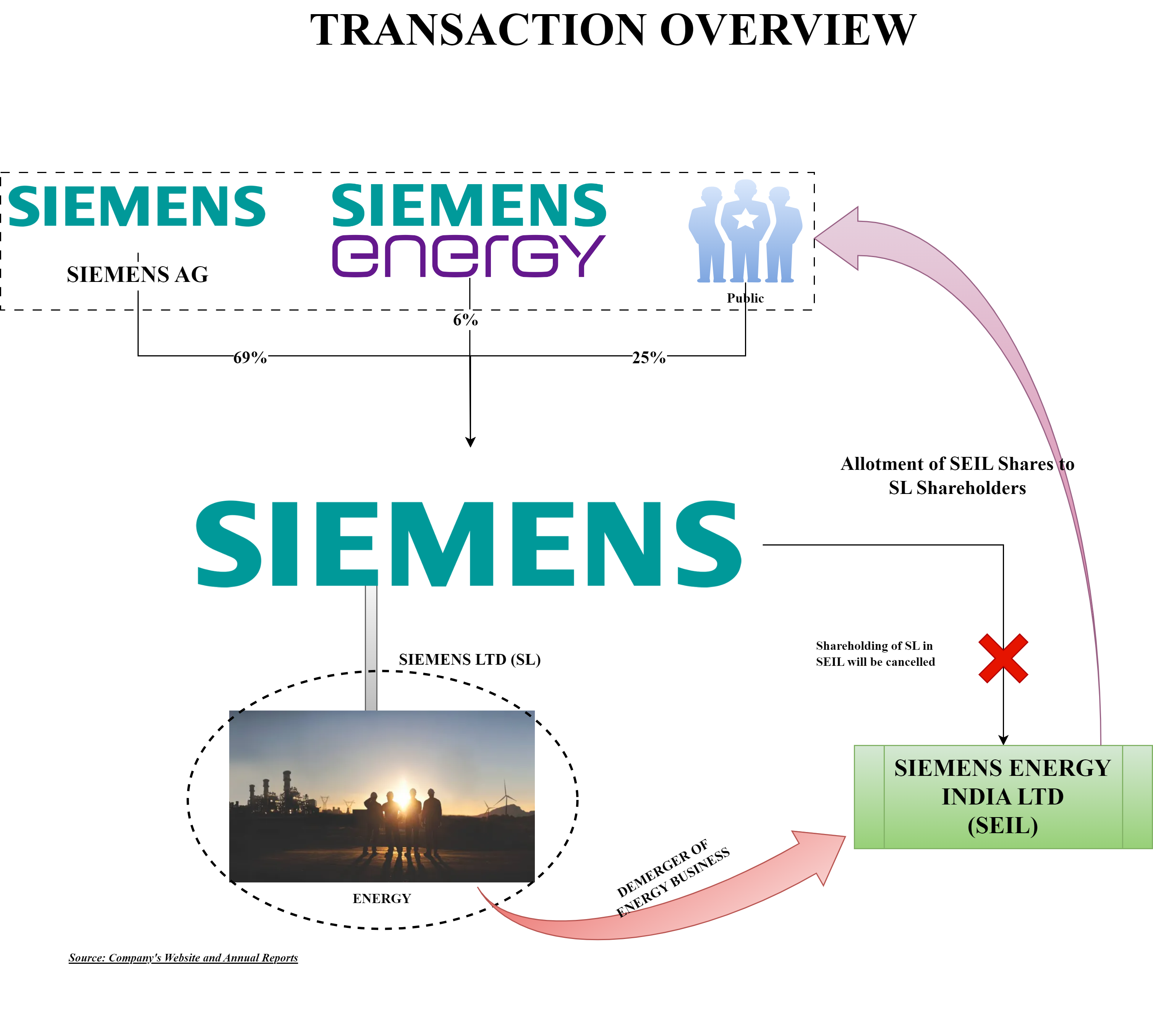

The Board of Directors of Siemens Limited today approved the proposal to demerge the Company’s Energy Business into Siemens Energy India Limited, a wholly-owned subsidiary of the Company currently, which will get listed pursuant to the proposed demerger, subject to requisite regulatory, statutory, shareholders and creditors approvals.

“Energy Business” means the business unit (including allocated support functions) of the Demerged Company engaged in providing fully integrated products, solutions and services across the energy value chain of oil and gas production, power generation and transmission for various customers such as utilities, independent power producers and engineering, procurement and construction (EPC) companies comprising of the entire part of the business and activities which is reported within the Demerged Company under the ‘Energy Business Segment’.

Some of the key rationale for the proposed demerger:

- Both entities will have sharper business focus – in other words, the proposed demerger will create two strong, independent companies, focusing on their core activities, portfolios and capital allocation.

- Both entities will have stronger market focus – as independent entities, they will be able to execute their own strategy, with a tailored go-to-market and operational approach to leverage the full potential of the Indian market.

- As two listed entities, Siemens Limited and Siemens Energy India Limited will unlock shareholder value – the proposed demerger will unlock the value of the Energy business for the shareholders through an independent, market-driven valuation.

Roland Busch President and CEO (Chief Election Officer), Siemens AG mentioned that “We strongly believe that India is really taking off. The last years have shown that the growth rates are amazing. You are attracting more high-quality products; more complex products are manufactured in India”. The proposed demerger will likely accelerate its plan to grow India business.

The appointed date for the proposed demerger will the 1st day of the month in which the Effective Date occurs, or such other date as may be approved by the Boards of the Demerged Company and the Resulting Company. The “Effective Date” means the date of the final order passed by the Tribunal sanctioning the Scheme.

Swap Ratio & Capital

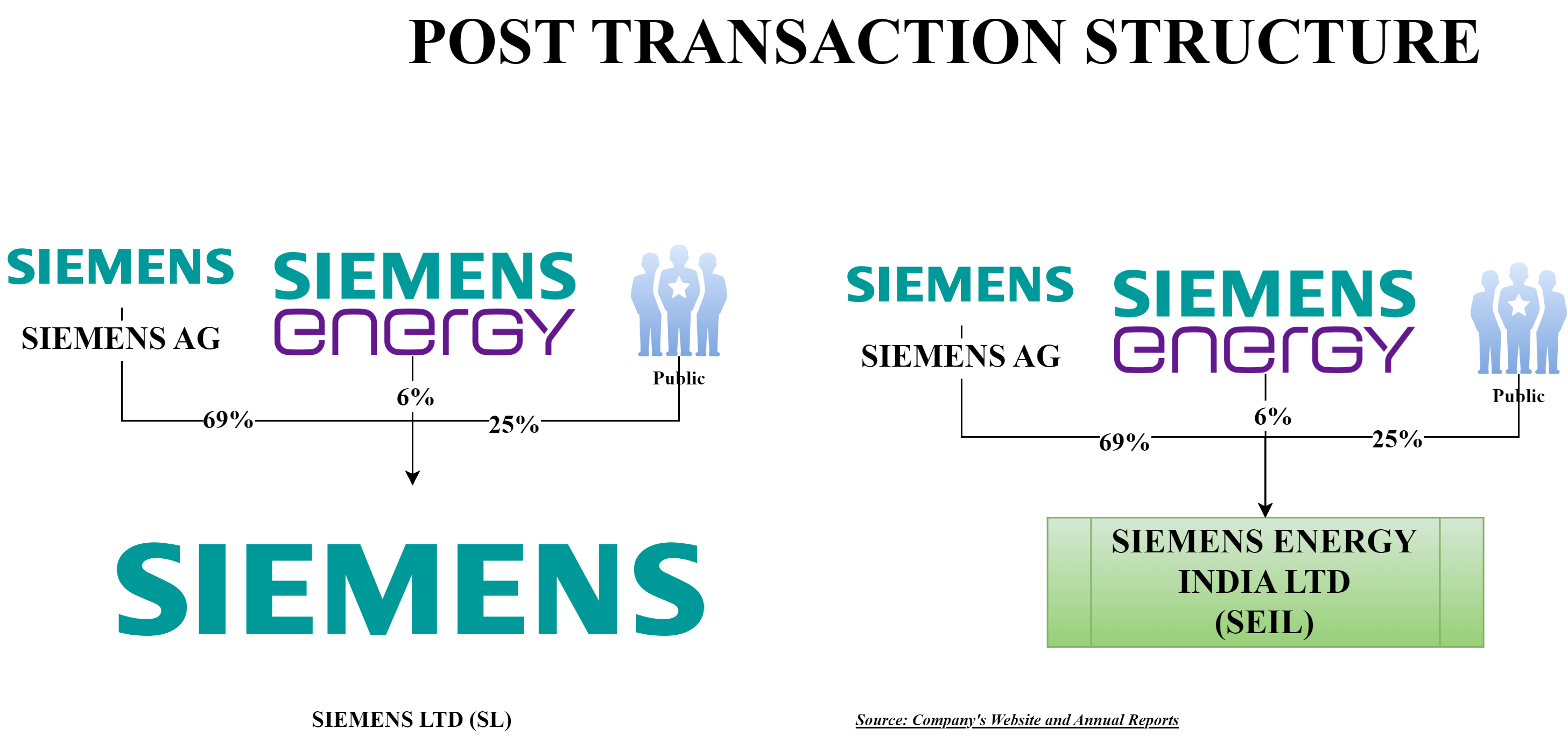

Post the demerger, both companies would have identical shareholding – 69% by Siemens AG, 6% by Siemens Energy and 25% by the public. Shareholders of Siemens Limited will receive one share of Siemens Energy India Limited for every share held in Siemens Limited.

| Particulars | Siemens Limited | Siemens Energy (post demerger) |

| Paid-up Share Capital | 35,61,20,255 | 35,61,20,255 |

| Face Value | 2 | 2 |

| Total promoter Stake | 75% | 75% |

| Siemens AG | 69% | 69% |

| Siemens Energy AG | 6% | 6% |

Till March 20, the promoter shareholding of Siemens Limited was held through two entities: Siemens Aktiengesellschaft, Germany (71.70%) & Siemens Metals Technologies Vermogensverwaltungs GmbH (3.30%). In June 2020, there was an internal realignment of shareholding pursuant to the demerger of the global energy business such that Siemens AG held 51% & Siemens Energy AG held 24% in Siemens Limited.

In December 2023, Siemens Energy AG sold its 18% stake in Siemens Limited to Siemens AG for cash consideration of circa INR 19,000 crore. The move was to support the stability of Siemens Energy AG.

As the above transfers were inter-se transfer among promoter, there was no applicability of the Securities and Exchange Board of India (SEBI) takeover code. Post demerger, Siemens AG will likely transfer its stake in Siemens Energy to Siemens Energy AG.

Further, to support customer guarantee in the Energy Business in India, Siemens has agreed with Siemens Energy AG indirect financial measures totalling one billion euros to allow third parties to arrange guarantees for Siemens Energy. Firstly, Siemens AG allows Siemens Energy AG to use its 5% shareholding in Siemens Ltd. India, worth 750 million euros, as collateral for guarantees. If the collateral is drawn, Siemens AG has committed to buy up to 5% of shares in Siemens Ltd. India for 750 million euros. Secondly, Siemens AG grants payment deferrals at market conditions in the amount of 250 million euros, also to be used as collateral for guarantees. These commitments enable Siemens Energy AG to provide appropriate collateral for the bank consortium providing a guaranteed line.

Financials

Please note that the above financials are sourced from the published financial results by Siemens Limited & without giving any inter-segment adjustments & unallowable capital employed.

Energy business is core business for Siemens Limited which is one of the largest businesses with stable revenues. Other businesses are emerging businesses for Siemens Limited where order book is increasing continuously and thus, Siemens Limited is looking to expand the same. Even Siemens is looking to expand margins in these areas with increased focus on localisation.

On other hand, the Energy business is matured business with diminishing capital employed (thus improving returns) but also witnessing sea changes in its dynamics thus requires special attention to grow. With super normal return on capital employed, the energy business looks to be well placed to grow independently.

Siemens Limited also have unallocated assets worth INR 9218 crore (as on 30th September 2023) and unallocated liabilities of INR 600 crore. There is no clarity available on how the same will be divided.

Conclusion

The proposed demerger is in line with the global group re-structuring and in compliance of various Indian laws, accounting standards and is completely tax neutral. The group waited to give effect to its global strategy in India likely on account of regulatory nitty-gritties in separation. Post demerger, we may witness inter-se shareholding transfer between Siemens AG & Siemens Energy AG for both demerged & resulting entity.

Few years ago, a similar restructuring was done by ABB group whereby they hived off the energy business to Hitachi and a similar strategy was followed for the India business. The ABB demerger created substantial value for all stakeholders mainly shareholders. There is no doubt, if stated objectives of the demerger is captured by both the businesses post demerger, it will be a win-win for all the stakeholders.