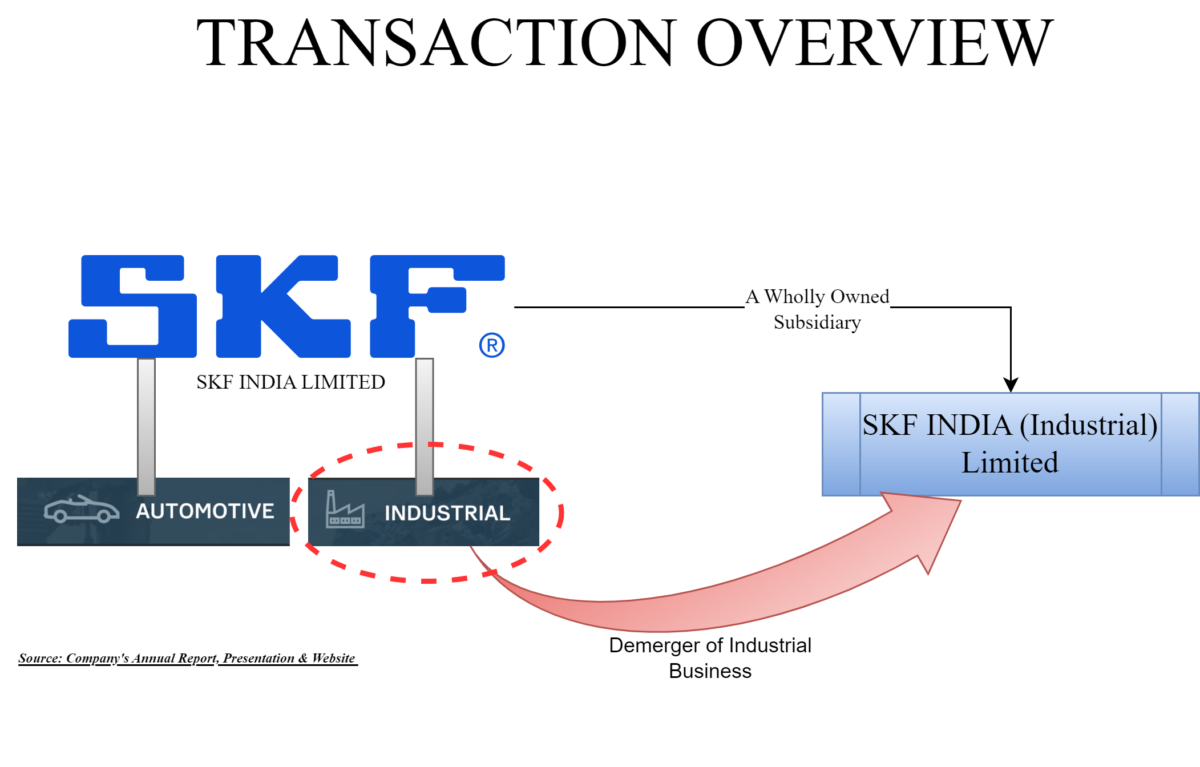

Following the footprints of the global announcement made by AB SKF, SKF India Limited decided to split its Industrial business from the automotive business.

SKF India Limited (“SKF India” or the “Demerged Company”) is inter-alia, engaged in the manufacturing and dealing with products, solutions and services within rolling bearing, seals, mechatronics, and lubrication systems for the automotive sector and other industrial sectors (including railways, defence, wind energy, metal industry, etc.). The shares of the Demerged Company are listed on the Stock Exchanges.

SKF India (Industrial) Limited (“SKF Industrial” or the “Resulting Company”) is incorporated to facilitate the proposed demerger of the industrial businesses from SKF India. Currently, the entire paid-up capital of SKF Industrial is held by SKF India.

The proposed transaction

Board of Directors of SKF India Limited and SKF India (Industrial) Limited at their respective board meetings approved a Scheme of Arrangement (“Scheme”) between SKF India Limited and SKF India (Industrial) Limited and their respective shareholders and creditors under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013, which provides for the demerger of “Industrial Business” of SKF India into SKF Industrial.

The “Demerged Undertaking” or “Industrial Business” shall mean and include all the activities, businesses, operations and properties as identified by the Board of Directors of the Demerged Company, forming part and relating to the manufacturing, trading, marketing and dealing with products, solutions and services within rolling bearing, seals, rotating shaft services, and lubrication systems for the industrial sector (including railways, defence, wind energy, metal industry, etc.), as on the Appointed Date.

As mentioned in the press release by SKF India, nearly 63% of the total revenue in FY 2024 was derived from the Industrial business. Apart from this, there is no segmental disclosures given by SKF India.

The “Appointed Date” shall be the “Effective Date,” or such other date as may be mutually decided by the Boards.

Rationale for the demerger as envisaged in the scheme:

- in view of the separation of automotive and industrial businesses at a global level, each business would be able to address independent growth plans, pursue efficient capital allocation, attract different sets of investors, strategic partners, lenders and other stakeholders, leverage on their strategies as standalone companies and stronger leverage of specific global resources within the group;

- the proposed demerger will de-risk both the businesses from each other, allow the businesses to tailor capital deployment, adapt faster to the global trends, enhance operational efficiency, increased responsiveness, and enhanced end-user experiences, and allow potential investors and other stakeholders the option of investing in both businesses

The global announcement for separation

In 2022, AB SKF (Holding company for SKF Group) announced a new strategy which means to create an autonomous automotive business to adapt to the rapid changes happening across the globe in automotive sector. Following this, in September 2024, AB SKF took move to separate the “automotive business” and list automotive business separately by 2026 through Lex Asea distribution to the shareholders (Tax free distribution of subsidiary shares to list it separately as per Sweden laws).

The move was taken considering different business dynamics, end markets and success drivers for the Industrial and Automotive business segments, a separation will facilitate a clearer focus on distinct opportunities to enhance customer value, accelerate growth as well as improve efficiency and competitiveness.

Interestingly in India, SKF Group is separating “Industrial Business” than “Automotive Business” as proposed at global level. No doubt, the result will be the same. Key reasons for the same could be optimal internal compliances, stamp duty savings and ease of compliances of other laws and dealership relations etc.

Global segmental split between segments for Calendar Year 2024

From the above, Industrial business is larger business globally for SKF. As industrial products are more customised (smaller batches) and shorter sales cycle, the margins are much better than the automotive one which are mainly to OEM’s and less customised.

Above bifurcation is not available for Indian operation except Industrial business constitute circa 63% of total revenues. Considering the nature of business, it can be assumed that Industrial business will have better margins in India also as is the case for consolidated global business.

Share Capital & Swap Ratio

“1(One) fully paid-up equity shares of INR 10/- (Indian Rupees Ten only) each of the Resulting Company for every 1 (One) fully paid-up equity share of INR 10/- (Indian Rupees Ten only) each held in the Demerged Company.

Thus, effectively SKF Industrial will have a mirror image shareholding of SKF India as on the record date.

Bifurcation of Resources

Though there has been no mentioning of how some of the key assets like plants, machinery, surplus assets etc, human resources, distribution network will be bifurcated, it is likely that post-demerger both companies may have an agreement to share common resources between them at agreed terms.

Conclusion

The proposed demerger is following footprints of global restructuring but with different hive-off of the undertaking. Unlike in past, the India separations will also be completed within the same time proposed for global separation.

SKF did a large corporate restructuring exactly 100 years before in 1926 which paved the way for the creation of “Volvo”. Hopefully, the proposed demerger will also manage to repeat the history for the SKF Group.