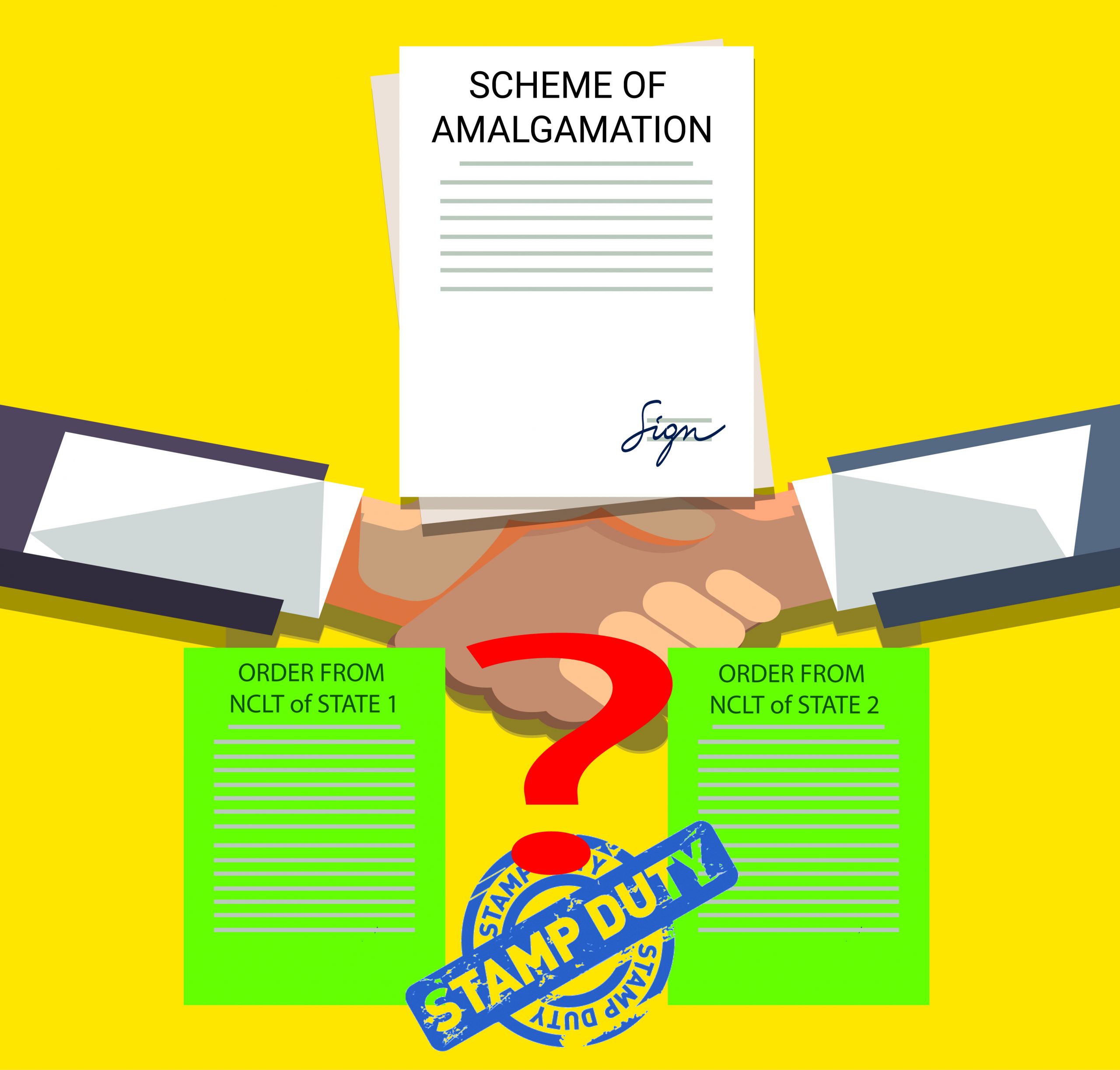

There have been a lot of mergers/amalgamations over the years where the transferor and transferee companies are registered in different states and have assets in different states. Any Amalgamation is carried out by drafting a scheme detailing the transfer of business in whole for consideration in equity or cash. Currently, the schemes are to be presented to the NCLT of each state where the transferor and transferee companies have its registered office. Respective NCLT passes the order sanctioning the scheme. The ORDER, thus passed, is liable to levying of stamp duty.

This is where the trouble is right now, payment of stamp duty is fine but the questions of which state should the stamp duty be paid, how much rebate can one get in case of paying stamp duty in both states, paying stamp duty in the respective state as per the value of assets which are transferred is to be considered or the worst to pay stamp duty in all the relevant states without rebate at full amount applicable. So, the question is the order of which NCLT is primary instrument by which assets and liabilities are transferred hence liable to full stamp duty

There are numerous cases in the past where the companies have gone to their state high courts seeking clarity on the same but there is a need for some clarity and guideline as to what is the best way to levy stamp duty and by whom in case of companies in different states.

In our previous article, we saw the following case, the lack of understanding of our judiciary to consider the increase in the transaction cost of amalgamation.

Amalgamation of Reliance Industries, Mumbai and Reliance Petroleum, Gujarat

In the matter of amalgamation, Bombay High Court held that

- Amalgamation scheme is not document chargeable to duty. Order passed by the Court sanctioning such a Scheme under Section 394 of the Companies Act,1956 which effects transfer is a document chargeable to Stamp Duty.

- The Amalgamation Order of High Court is the instrument. It is not incidental.

- Amalgamation Scheme is not a document chargeable to duty. Hence Section 19 of the Maharashtra Stamp Act is not applicable in the subject matter. Accordingly, no rebate will be granted to Transferee Company in payment of Stamp duty on its High Court order on account of stamp duty paid by the Transferor Company on the respective Order issued by the High Court within whose jurisdiction it falls.

Reasons quoted by Courts on payment of Stamp duty separately on each Order:

- Stamp duty is payable on Instrument and the Court Order is Instrument.

- Definition of Conveyance is inclusive and hence whether or not there is transfer of assets and liabilities between the companies, when new shares are allotted by Transferee Company as a part of the Scheme, Stamp duty is liable to be paid.

Analysis

Spirit of stamp duty law

No transaction entered through an instrument as specified by Stamp Law shall left unstamped. To capture the respective transaction, stamp duty is levied on the underlying instrument. That doesn’t mean that any instrument giving same effect to the same transaction shall also be stamped again if another instrument to effectuate the transaction is also stamped.

The purpose and the object as to why both, the transferor and the transferee company had to obtain order from the court sanctioning the Scheme of Amalgamation is that, such a scheme of amalgamation must bind the dissenting members, as also, all the creditors of both the companies and not to transfer the rights in the assets and liabilities. There cannot be any doubt that the order of Transferee company cannot be the order by which rights etc. in any property are getting transferred.

Maharashtra Stamp Act

Sec. 4 of Maharashtra Stamp Act states that when there are several instruments for a single transaction, stamp duty to be paid on principal instrument and nominal stamp duty of Rs. 100/- to be paid on another instrument. This shows intention of the legislature to charge stamp duty on a transaction and hence ultimately on the instrument which effects the transaction. Going by this principle, in amalgamation, though there are separate instruments in the form of NCLT orders of two different NCLTs, the transaction of amalgamation under consideration is same at both places and hence the duty chargeability should be transaction specific and not Order Specific. Out of the two orders, one order is principal instrument and on other order nominal stamp duty to be paid.

Conveyance

Various Courts in their decisions have referred the definition of the term ‘conveyance’, stating it is inclusive to cover Instruments like High Court Orders to make them chargeable to duty. However, the decisions are in view of the Orders which provide for the transfer of any property or liabilities from Transferor Company to Transferee Company. Hence the Amalgamation Scheme which does not provide for transfer of any movable or immovable property should not be termed as conveyance and not to be charged to Stamp duty, at least in the state where there are no assets of Transferor company are situated.

Even if one considers above argument not tenable in law, most important is the definition of instrument as per Maharashtra stamp act Section 2(l): “instrument” includes every document by which any right or liability is, or purports to be created, transferred, limited, extended, extinguished or recorded,

To consider any order as conveyance it must be the instrument as defined above. The order of Transferee company cannot be the document by which any right or liability is, or purports to be created, transferred, limited, extended, extinguished or recorded, If the order of the Transferee Company is not an instrument as defined under Sec 2(I), it is not possible to consider the same as conveyance more so the order does not create any rights and in fact it cannot create because The Transferor Company ceases to exit and all the assets and liabilities of the transferor company becomes assets and liabilities of The Transferee company

What we think

In our opinion, without prejudice, we feel that order of the transferor company should be considered as principal document and hence stamped in the state in which the registered office of /the transferor company is situated. Various honorable high court decisions have failed to consider the purpose of Mergers & Acquisitions as it will have a huge impact on total transaction cost in the case of amalgamation involving group companies as in a single amalgamation, the stamp duty payment may have to be paid twice or thrice depending on where the group companies are located.

The judgement also leaves ambiguity on the timing difference of the order passed on the scheme sanction by High Courts of different states. It’s high time the government rationalized stamp duty provisions by making it a Central Act and avoid such kind of mishaps. This could prove self-defeating move in the context of a motto of ease of doing business and may affect the larger cause of the economic development of our country.

Add comment