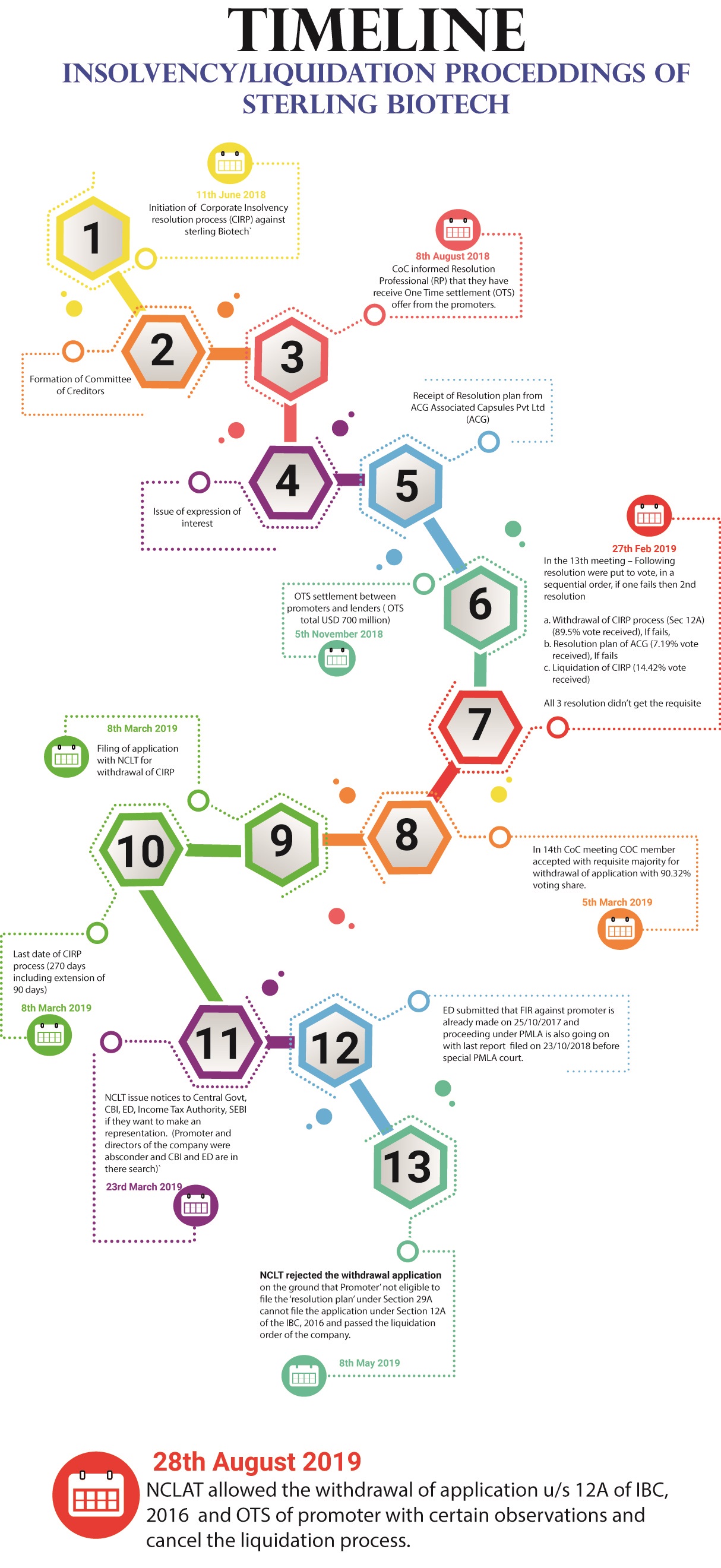

In a landmark ruling, the National Company Law Appellate Tribunal (NCLAT) has set aside National Company Law Tribunal (NCLT) order to liquidate Sterling Biotech. It has also directed that the management should be handed over to its promoters if the dues of creditors are settled.

In an oral order, a three-member NCLAT bench presided over by justices SJ Mukhopadhyay and AIS Cheema along with member (technical) Kanti Narahari, set aside the May 8 order of the National Company Law Tribunal’s Mumbai bench and allowed withdrawal of a petition filed under Section 7 of the Insolvency and Bankruptcy Code (IBC).

In June, the NCLAT had stayed the corporate insolvency resolution process of Gujarat-based Sterling Biotech after its workmen and lenders challenged the NCLT order before the appellate tribunal. The appellate tribunal further directed the resolution professional of Sterling Biotech to manage the company till the conditions of section 12A are complied. Section 12A of the Insolvency and Bankruptcy Code (IBC) allows corporate debtor to settle its defaults and get the company out of insolvency proceedings after settling the claims of lenders.

NCLAT Observations

On applicability of sec 29A on applicant in case of withdrawal of application:

If any person, including the ‘Promoter’/ ‘Director’, is ineligible in terms of any one or more clauses of Section 29A, he/she is not entitled to file any ‘resolution plan’ individually or jointly or in concert with another. In so far Section 12A is concerned, it relates to withdrawal of the application filed by an “applicant” under Section 7 or Section 9 of the I&B Code, if the ‘Committee of Creditors’ with more than 90% voting share approves the proposal as is apparent from Section 12A.

It is clear that the Promoters/Shareholders are entitled to settle the matter in terms of Section 12A and in such case, it is always open to an applicant to withdraw the application under Section 9 of the ‘I&B Code’ on the basis of which the ‘CIRP’ was initiated.

Section 29A is not applicable for entertaining/considering an application under Section 12A as the Applicants are not entitled to file application under Section 29A as ‘resolution applicant’

On assets of the company, if based on the proceeds of the crime:

If it is based on the proceeds of crime, it is always open to the ‘Enforcement Directorate’ to seize the assets of the ‘Corporate Debtor’ and act in accordance with the ‘Prevention of Money Laundering Act, 2002.

If the asset of the ‘Corporate Debtor’ is held to be proceeds of crime, the Adjudicating Authority cannot reject the prayer for withdrawal of application under Section 7, if the ‘Promoter’ / ‘Director’ or ‘Shareholder’ in their individual capacity satisfy the creditors.

Setting aside liquidation order passed by NCLT:

CIRP initiated against the Sterling Biotech Ltd.’ stands set aside subject to the payment of the amount as payable by the ‘Promoters’/Shareholders to all the stakeholders/financial creditors and operational creditors in terms of Section 12A as approved with 90% voting share of the ‘Committee of Creditors’.

However, proceeding under PMLA will continue and will not have any impact due to this order.

Impact of the order

Another opportunity to promoter to settle the debt and take back control:

Once the CIRP process is initiated, promoter loses the control and CoC becomes in charge and take decision about fate of the company either to resolve or liquidate, though promoter can’t bid for the company directly, but indirectly they can settle the debts of lenders and can ask them to withdraw CIRP application.

Derailment of CIRP Process:

It is important to note that though OTS offer accepted and withdrawal of application resolution passed is post issuance of expression of interest, and application of withdrawal is filed after passing of time limit provided which is against the provisions of the code, even though NCLT in one of its order held that an application for withdrawal may be allowed in exceptional cases even after issue of invitation of expression of interest (in the matter of Brillant Alloys Pvt Ltd Vs. Mr. S Rajagopal and Ors, SLP), NCLAT has not made any comments / observation in this regards. This will lead to a situation where promoters will try to try to take back the company till the last movement and derail the entire purpose of CIRP process

Interest of all stakeholder?

Since the withdrawal application is to be approved by the CoC with 90% vote, CoC members which comprise of financial creditors will look for their best interest and there recoveries percentages and likely to ignore the interest of all other stakeholders such as operational creditors, government, etc.

Whether it will be mode to settle debt or restructuring by promoter?

Promoter will explore option to use this medium of settling the lenders debt during the CIRP process to restructure their debt while retaining control of the company by filing sec 10 application (application by the corporate debtor himself) for CIRP.

Impact on other cases

The Sterling Biotech order will set a precedent that will have ramifications for companies willing to clear dues after they are admitted for insolvency resolution like ArcelorMittal that has paid over Rs 8,000 crore to settle Uttam Galva’s debt to bid for Essar Steel. Bhushan Power and Steel could also demand a generous OTS.

Conclusion

This judgement will open the pandora’s box, OTS offered is allowed subject to payment by promoters in their personal capacity and without involving assets of the corporate debtor. This OTS is a type of resolution plan without complying provisions related to resolution plan and ignoring interest of all other stakeholders, only lenders interest is taken care of by settling their dues.

CIRP process cessed but the proceedings and investigation against the company including under PMLA Act or any other Act will continue. Also if it found that assets of the company are proceeds from the crime, same can be seized by the authorities.

OTS done with further infusion of funds make revival of the business easier, if it is finally held under PMLA Act that assets of the corporate debtor are not based on the proceeds of the crime.

We believe PMLA Act overrides CIRP process and hence those assets are not available to settle dues of any creditors including secured lenders against the same assets till matter under PMLA is not resolved reason being PMLA is Criminal Act and IBC is a Civil Act.

Add comment