Telecom and Power Transmission Solution provider Sterlite Technologies Limited is set to spin-off its power business into a separate unlisted entity named ‘Sterlite Power Transmission Limited’ while retaining its telecom business in the listed entity. Sterlite Technologies will be demerging its power and telecom businesses in order to focus on each separately. The demerger will be effective from April 1, 2015, subject to all necessary approvals.

ABOUT STERLITE TECHNOLOGIES LTD:

Sterlite Technologies Limited (STL) is a BSE and NSE listed Company that shares the same lineage as the US $13 Bn Vedanta Group. It develops & delivers products, solutions, and infrastructure for telecom & power transmission networks, globally. STL is among the global leaders in all its business areas of Optical Fiber, Fiber Optic Cables Power Conductors, and HV / EHV Power Cables. The Company has a Global sales presence with sales offices in countries like China, India, Netherlands, Russia, South Africa, Turkey, UAE, and the UK. It also has manufacturing locations in India, China, and Brazil. The Company has over 50 patents in its name in USA, EU, India and China. Its joint ventures include – China -75%:25% with Tongguang for drawing optic fiber and Brazil -50:50 JV with Conduspar for fiber cabling. The company has over 1500 full-time employees.

ABOUT STERLITE POWER TRANSMISSION LTD:

Sterlite Power Transmission Ltd (STPL)is a public company recently incorporated to carry on the business, of manufacturing of power transmission products such as power conductors and high voltage and extra high voltage cables, providing turnkey solutions for power industries and participating in the creation of power transmission infrastructure across the country. It is a wholly owned subsidiary of Sterlite Technologies Limited.

RESTRUCTURING:

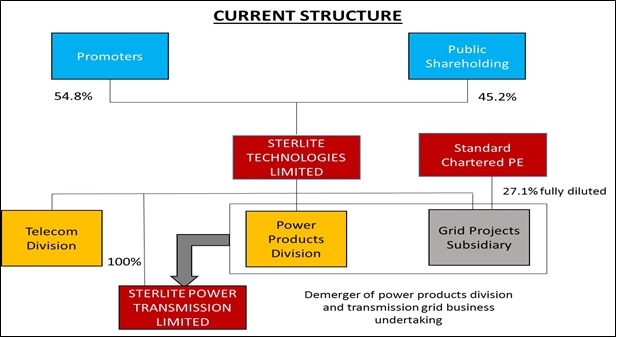

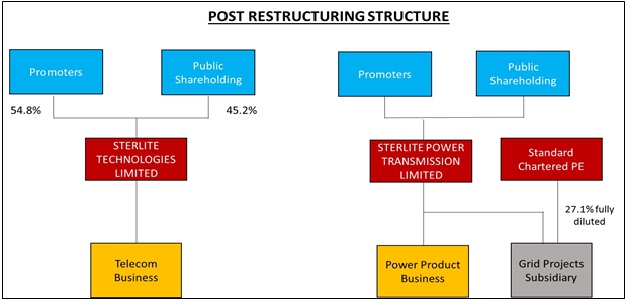

SterliteTechnologies Limited essentially operates in two distinct sectors — that is Telecom and Power. Currently, both the Telecom business and Power Products and Transmission Grid are housed under the same company though operates as separate business units. As a result of the restructuring, Sterlite Technologies Limited will become a pure-play Telecom Products & Solutions company providing Broadband Solutions for Fully Converged Networks. The Board has approved to demerge the Power Products Business and the Power Transmission GridBusiness into a separate entity named ‘Sterlite Power Transmission Ltd.’

Considering the differentiated attributes, the inherent business models and capital requirement of each of this business, the equity shares of the telecom business will continue to be publicly listed, while those of the demerged power business will remain unlisted. The decision to keep the equity shares of the power business unlisted is in line with the global model for such infrastructure companies, which are not amiable to quarterly public market reporting requirements and need operational freedom and capital structure flexibility.

The businesses are well poised in their respective segments with multiple growth drivers. The demerger will essentially provide two separate and distinct platforms, one for Telecom business, which is in a high growth stage in the backdrop of huge data consumption opportunity and the other for Power business, which will be a strategic vehicle for the creation of infrastructure assets in the growing transmission sector.

Source: Investor Presentation

Source: Investor Presentation

SHARE ENTITLEMENT RATIO:

The equity shares of the telecom business will continue to be publicly listed, while those of the newly-formed power business will remain unlisted. Investors will have the choice to continue to be associated with one or both of these two businesses.

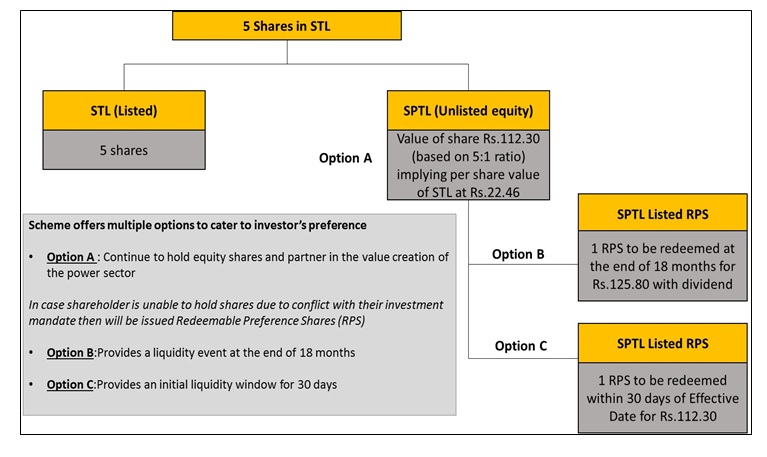

For every 5 equity shares held in STL, investors will retain 5 shares of STL+ option to receive either:

- One equity share of face value Rs. 2/-in SPTL; or

- One Redeemable Preference Shares (RPS) of a face value of Rs. 2/-each at a premium of Rs. 110.30 in SPTL with a dividend of 8% of Face value per annum. The RPS can be redeemed for cash of Rs. 125.80 per RPS with dividend after 18 months from the allotment, further an alternative window to sell within 30 days of allotment to the promoter or any other entity appointed by promoters for Rs. 112.30/- per share.

The value of the demerged undertaking after taking into consideration the allocation of debt would be Rs. 885 crores, implying a value of Rs. 22.46/- per equity share of STL. Post this, as of 31st March 2015, on a proforma basis STL will retain a consolidated net debt of Rs. 674 crores against a pre-restructuring consolidated net debt of Rs. 4881 crores. The share entitlement ratio report has been prepared by Price Waterhouse & Co LLP with a fairness opinion done by Axis Capital who are acting as financial advisers to STL.

RATIONALE FOR DEMERGER:

The nature of risk and competition inherent in each of the Telecom and Power Products and Transmission Grid Business is distinct since both are subject to distinct business cycle and operate inter alia, under different regulations and market structure, necessitating different management approaches and focus. Moreover, the capital intensity and return profiles of this business are very different and do not enjoy material synergistic benefits from being housed together. Further, both businesses have now reached a meaningful scale and will be able to benefit by becoming independently focused businesses.

Thus, separation of the Power Products and Transmission Grid Business together with its business, undertakings, and investments (including the investment of the Demerged Company in power transmission infrastructure companies) as a going concern, pursuant to the scheme of arrangement, from the Demerged Company would lead to significant benefits for both businesses including:

- allowing each business to create a strong and distinct platform which enables greater flexibility to pursue long-term objectives;

- enabling accelerated growth of the telecom business and allowing the power business to explore suitable strategies to fund its growth plans;

- offering shareholders a clear focused investment opportunity in the telecom sector and thereby unlocking the value of their holding; and

- allowing shareholders an option to align with their investment philosophy by continuing to participate in the long-term capital-intensive power sector if they choose or select available options to fairly and appropriately exit.

FINANCIAL OVERVIEW:

(Rs. In Crore)

| Particulars | Standalone FY 2014-15(Carve out) | Consolidated FY 2014-15(Carve out) | ||

| Telecom | Power | Telecom | Power | |

| Revenue | 1530 | 1500 | 1619 | 1478 |

| EBIDTA | 345 | 41 | 345 | 167 |

| EBIDTA Margin | 23% | 3% | 21% | 11% |

| Depreciation | 76 | 32 | 96 | 89 |

| Interest | 53 | 126 | 75 | 252 |

| Cash Profit | 292 | (85) | 270 | (84) |

| Tax | 54 | (40) | 55 | (52) |

| PAT | 161 | (77) | 118 | (121) |

| EPS | 4.09 | (1.95) | 2.99 | (3.08) |

| Balance Sheet as on Mar 2015 | ||||

| Net Worth | 668 | 575 | 600 | 469 |

| Borrowings | 502 | 875 | 674 | 4207 |

| Minority Investment in Grid Business | – | – | 0 | 450 |

| Total | 1,170 | 1,450 | 1,275 | 5,126 |

| Investment in Grid Business | – | 1197 | – | – |

| Fixed Assets | 705 | 242 | 984 | 5264 |

| Net Fund Involvement | 465 | 11 | 290 | (138) |

Source: Investor Presentation

SCHEME ANALYSIS:

The corporate restructuring scheme envisages various options for the investors of Sterlite Technologies. The promoters of STL which account for 54.82% will be compulsorily allotted equity shares in STPL, i.e. 432 lakhs equity shares. [(3940.6*54.82%)/5]

As per the restructuring scheme, STPL equity shares would remain unlisted, thus it would be more beneficial for the public shareholders to opt for the RPS. Holding unlisted equity shares won’t be beneficial considering the capital gains implications as well as difficulty in selling the unlisted shares in future.

| No. of equity shares held by public shareholders in STL | 1780 lakhs |

| Share entitlement ratio | 5:1 |

| No. of RPS to be allotted in STPL (Shares of Face Value of Rs. 2 would be allotted at the premium of Rs. 110.30) | 356 lakhs |

| Amount per share to be given on redemption after 18 months | Rs. 125.80 |

| The total amount that STPL would have to pay to shareholders on redemption after 18 months | Rs. 44784.8 lakhs |

If the shareholders hold on to RPS up to 18 months they would get Rs.125.80 per share. Alternatively, the shareholders can sell their shares to the promoters within 30 days of allotment at a price of Rs. 112.30.

CHALLENGES IN APPROVAL:

Approval of RBI and relevant authorities would be required to issue shares to Foreign Portfolio Investors. Non- resident shareholders excluding FPIs shall be issued equity shares of STPL and they shall sell the same to promoters and/ or their affiliates.

The Power business would have a debt of Rs. 4207 crores against a net worth of Rs. 469 crores. The company is heavily debt-ridden and on redemption, net worth will come down to almost nil (without considering a further issue of capital). So it will be a challenge to explain to secured creditors and lenders and get their approval to the scheme without offering other securities and guarantees.

Redemption of preference shares can be done only out of profits or fresh issue of capital. As on date power business is not making money so the option is to raise further capital before redemption of preference shares. One needs to examine whether exit option offered to shareholders is reasonably considering delisting regulations and takeover regulations. We believe SEBI and stock exchange approval may not come in easily.

Another question that can be asked is why demerge the power business into a separate company? Why not demerge the power business directly into Vedanta? The direct demerger would have given the shareholders of STL an opportunity to hold shares in Vedanta. This question becomes more relevant if in near future Vedanta subscribes to the further issue of equity capital to facilitate redemption of preference shares or even before redemption the scheme to merge STPL with Vedanta is announced.

The equity in Power business will mostly be held by promoters. In future, the power business (STPL) can be merged with Vedanta, thereby maintaining the promoter’s stake.

If a shareholder who bought share above Rs. 70 per share will end up incurring loss based on cost allocated to STPL shares ( which will be 40%+ of the purchase price).

CONCLUSION:

The corporate restructuring is a potential value creator for all shareholders combined with an objective of bringing a sharper and independent focus on both the segments, which have reached a certain scale and addressing two distinct opportunities of sustainably large magnitudes. The shareholders have been given an exit option to choose to depend on their investment preference but considering STPL shares are not going to be listed, it works out as compulsory exit without following delisting guidelines.

Link to the Actual News Post on Sterlite’s Website.