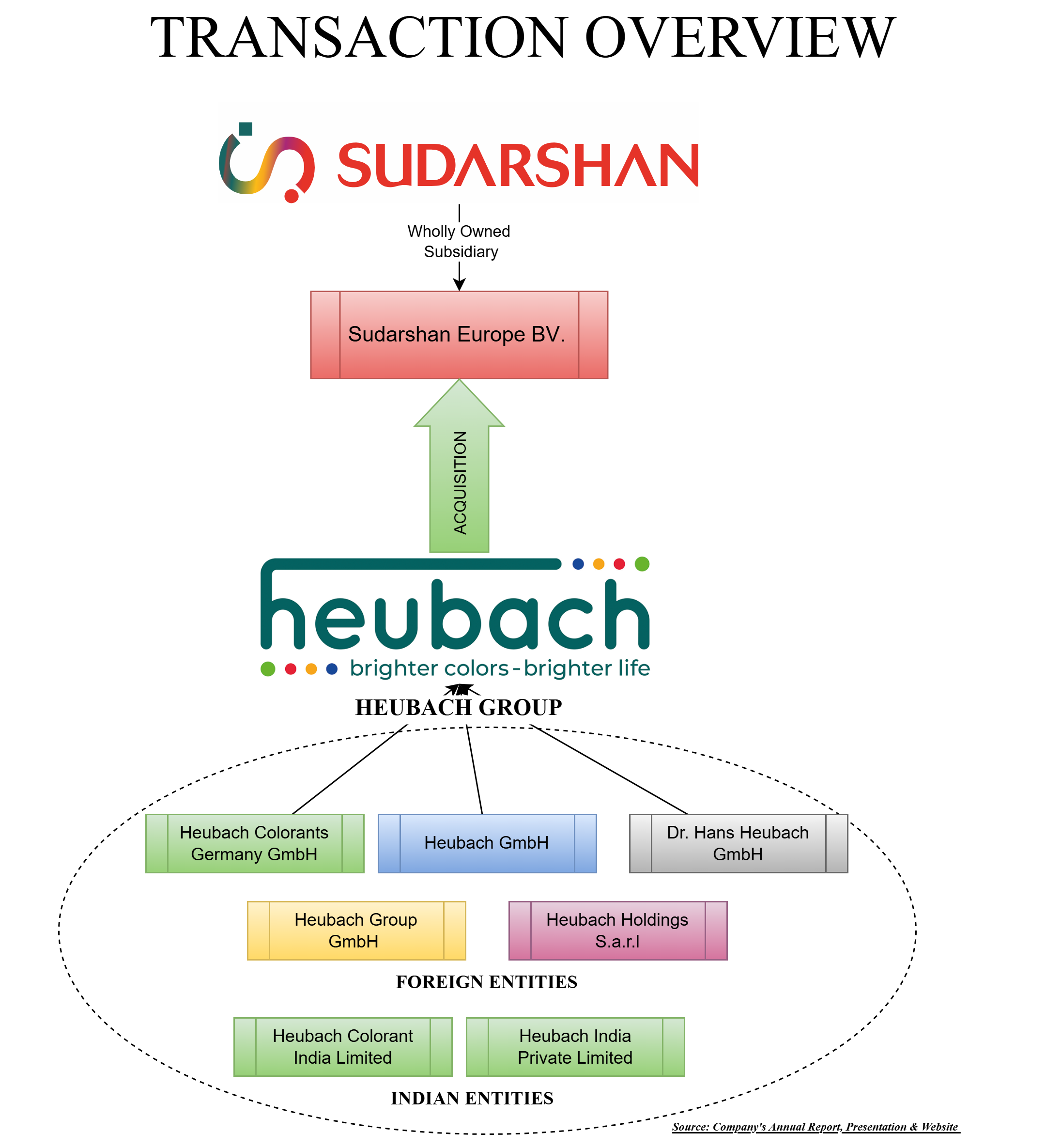

In October 2024, Pune based Sudarshan Chemical Industries Limited (“SCIL”) took a bold step by announcing the acquisition of “Global Pigment Business Operations of the Heubach Group” (“Heubach”) of Germany. To put in perspective, SCIL shall acquire a company with almost 3-4x of its existing revenue. Recently, SCIL announced that it has completed the proposed acquisition through its wholly owned subsidiary Sudarshan Europe BV.

The Heubach Group has a 200-year history and became the second largest pigment player in the world after acquiring Clariant’s BU Pigments in 2022. Heubach had over 1 billion Euros in revenue in FY21 and FY22, with a strong global footprint especially in Europe, Americas, and the Asia Pacific region. In 2022, Heubach team up with S.K. Capital to acquire Clariant’s global pigment business, at a valuation of about Euro 850 million making the combined entity worth more than Euro 1 billion.

The Acquisition

The transaction comprises of acquisition by Sudarshan Europe B.V. of:

(i) assets and business operations of

(a) Heubach Colorants Germany GmbH,

(b) Heubach GmbH

(c) Dr. Hans Heubach GmbH, and

(d) Heubach Group GmbH and participations held by Heubach Holding Switzerland AG, in downstream Group Companies in various countries from the insolvency administrator in the aforesaid countries.

(ii) 100% shareholding of Heubach Holdings S.a.r.l., a Luxemburg based Heubach Group Company having investments in shareholding in companies based in India and USA.

Heubach operates in India through its two companies, Heubach Colorant India Limited (erstwhile Clariant Chemicals (India) Limited), which is listed and Heubach India Private Limited. As part of the transaction, SCIL has acquired the entire ownership of the promoter entities owning stake in these two companies. As the acquisition falls under indirect change of control, SCIL has given an open offer as per SEBI Takeover Code regulations to acquire up to 26% equity stake from the public shareholders of Heubach Colorant India Limited.

Acquisition glory for SCIL

No doubt, the acquisition gives an opportunity to SCIL to catapult to number 2 global player in the pigment industry. The acquisition helps SCIL to truly be a global player with a global asset footprint. Post-acquisition, the combined entity will have a comprehensive pigment portfolio of high-quality products and a strong presence in major markets including Europe and the Americas. It will enhance SCIL’s product portfolio, giving it deeper access to customers and a diversified asset footprint across 19 sites globally. It gives SCIL access to 17 manufacturing sites and 33 stock points. All manufacturing sites are very well maintained, and all are in good running condition with a very respectable capacity utilization.

The legacy of Heubach has been for more than 200 years which gives a strong foothold across its customers. Heubach has strongly focused products and markets in the coatings and digital inks area. SCIL is quite strong in plastics and some of the cosmetic industries. So, from that perspective, SCIL & Heubach do have complementary strengths.

In just two years, Heubach failed to create any value out of the Clariant acquisition and went for liquidation. As told by the management of SCIL, there were a few macro aspects which triggered the recession for Heubach, and the large debt taken for acquisition happened to be the final nail in the coffin for Heubach, which directly took Heubach to its insolvency.

As per SCIL, they have identified key drivers which will ensure the swift revival of Heubach. Except for Germany, which accounts for circa 30% of the revenue, no other operation of Heubach is loss making which makes it easy for SCIL to revive the company. Being in the pigment business, SCIL is sure about turnaround. The first step will be the consolidation of operations along with creating the European manufacturing sites only into specialty which shall be serving the specialty markets and any commodities, intermediate and raw materials manufacturing would be shifted to low-cost countries/India. This will assist SCIL to gain the margins and effectively serve the debt.

Acquisition Cost & its Funding

The upfront cost for acquisition to SCIL will be circa ₹ 1180 crore. Additionally, some cash infusion for working capital, restructuring, meeting some of the regulatory requirements with a tune of about INR 900 crore, will be required. Further, SCIL has also given a mandatory open offer to acquire up to 26% equity shares from the public shareholders of Heubach Colorant India Limited. If all shares are tendered, SCIL will require additional INR 347 crore.

Total cost for the acquisition of Heubach Group

| Particulars | INR in Crore |

| Upfront acquisition cost | 1180 |

| Working capital and other requirements over one/two year | 900 |

| Open offer cost (if all shares are tendered) | 348 |

| Total | 2428 |

The management expects there won’t be any significant contingent liabilities or employee related expenses which will create an additional burden for SCIL/Heubach group in the near future.

The entire acquisition will be funded through a mix of equity and debt. Immediately after the announcement of the acquisition, SCIL announced a qualified institution placement of circa ₹ 1000 crore to mutual funds and domestic institutions. Further, SCIL raised circa ₹ 100 crore from its existing promoters as well through the issuance of convertible warrants. The remaining amount will be funded through debt. Thus, the debt will be about INR 980 to 1328 crore. The Heubach acquisition of Clariant Chemicals was without any debt thus, there won’t be any additional debt coming from Heubach.

Heubach Financials

Because of various regulatory restrictions, SCIL has not given any financial details except revenue and certain other broad financial aspects regarding Heubach. In coming months, SCIL will guide on brief details. Considering the CY 2023 revenue, Heubach revenue will be Circa ₹ 8000 crore.

However, one needs to consider its declining trend of revenue over the recent years and the possibility of few contracts lost on account of insolvency and losses in CY 2024. Further, margins are going to play an important role. SCIL has not guided for any margins. Indian listed entity, Heubach Colorant India Limited has the following numbers for 9M ended on 31st December 2024 as follows:

It looks difficult to have double-digit margins for all global business and especially when Germany, which contributes 30% of revenue is loss making. One may assume blended operating margins in the range of mid-to-low single-digit numbers. The good part for SCIL is no debt except for acquisition will be coming from Heubach.

SCIL Financials & Valuation

Balance sheet items as on 30th September 2024

| Particulars | Amount in ₹ Crore |

| Net worth | 1212 |

| Borrowings | 530 |

| PPE | 1003 |

In the last couple of years, SCIL did expand into speciality products which has started giving results. As told by the management, from next year there will be good margin expansion and revenue growth on account of increase capacity utilisation of speciality products. However, with the Heubach acquisition things will change for SCIL drastically.

Tentative working for FY 2025

| Particulars | SCIL | Heubach Group | Combined |

| Revenue | 2800 | 7000 | 9800 |

| EBITDA | 364 | 350 | 714 |

| % | 13% | 5% | 7.29% |

| Debt | 530+1000 | 0 | 1530 |

| Debt coverage ratio | 2 |

Please note that this is tentative working and likely to undergo significant change. There could also be acquisition costs, which will reduce EBITDA margins further.As no other details except revenues are available, let us try to evaluate the valuation multiple on limited numbers.

| Particulars | SCIL | Heubach |

| Market value in crore | 8000 | 1080 |

| Yearly Revenue | 2800 | 7000 |

| Revenue Multiple | 2.85 | 0.15 |

One may find the transaction very lucrative from SCIL’s standpoint however, there are other significant factors which need to be evaluated. Foremost, Heubach group has announced insolvency plus currently large part of it is loss-making/low-margin business. Thus, sustainable revenue and margin will likely be a challenge. Being a global acquisition, integration remains a vital challenge, and a few unknown challenges can come anytime.

Conclusion

In pursuit of becoming a global company, Sudarshan Group has taken a bold step. The Heubach acquisition does not only brings the scale but also a rich history of more than 200 years. However, the acquisition will bring a lot of challenges for Sudarshan.

- Revival of customers and margins lost

- Integration with its Indian operation

- Cultural integration

Overcoming the above challenges shall be key for the growth of Sudarshan Group and we hope that the acquisition of Heubach isn’t too big to chew. In past, a large number of companies have failed to derive value from the European acquisition. Let’s see how Sudarshan reaps the acquisition.