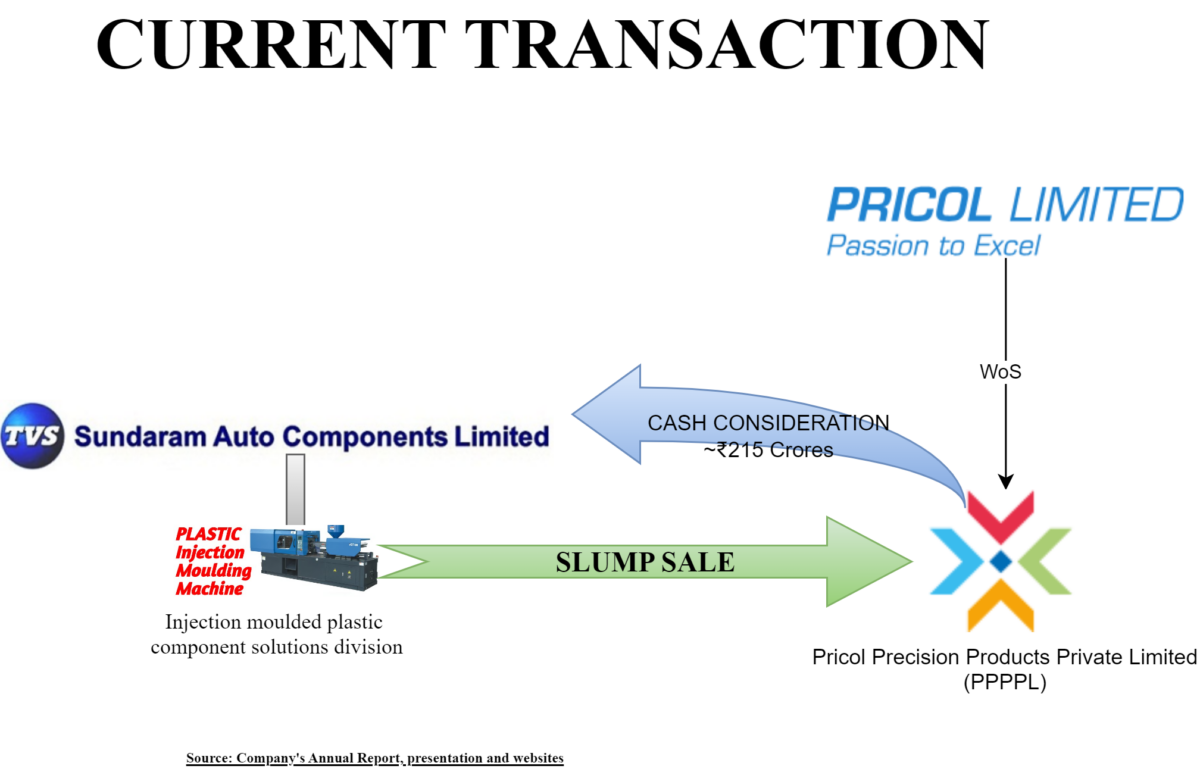

Recently, Sundaram Auto Components Limited, a wholly owned subsidiary of TVS Motor Company Limited approved the sale of its injection moulded plastic component solutions division to Pricol Precision Products Private Limited, a wholly owned subsidiary of Pricol Limited, as a going concern on a slump sale basis.

Sundaram Auto Components Limited (“SACL” or “Transferor Company”) is engaged in the business of manufacturing automotive plastic components for passenger vehicles (Two-wheelers, Four-wheelers) and commercial vehicles. The Company is a wholly owned subsidiary of TVS Motors Company Limited which is a leading automotive Original Equipment Manufacturers (OEMs) across the world. The equity shares of TVS Motors Company Limited are listed on nationwide bourses.

Pricol Precision Products Private Limited (“PPPPL” or “Transferee Company”) is yet to commence any business. The company is a wholly owned subsidiary of Pricol Limited which is a preferred partner to many leading automotive Original Equipment Manufacturers (OEMs) across the world. Pricol Limited’s operations are classified into two verticals, Driver Information and Connected Vehicle Solution (DICVS) and Actuation, Control and Fluid Management System (ACFMS). The equity shares of Pricol are listed on nationwide bourses.

Getting ready for divestment:

TVS Motor Company Limited planned its exit from the injection moulded plastic component solutions division of SACL last year itself. In 2023, the Hon’ble National Company Law Tribunal approved a Scheme of Capital Reduction of SACL’s paid-up capital from Rs. 44,56,90,000/- divided into 4,45,69,000 Equity shares of Rs.10/- each to Rs. 11,93,74,220/- divided into 1,19,37,422 equity shares of Rs.10/- each by cancelling and extinguishing the paid-up equity share capital of Rs. 32,63,15,780/ divided into 3,26,31,578 Equity shares of Rs.10/- each for a consideration of INR 95 per equity share. Pursuant to the capital reduction, SACL paid back INR 310 crore to TVS Motor Company Limited.

Amongst other options, this could be tax tax-efficient way available for SACL as the accumulated profits available with SACL was significantly lower than consideration and TVS Motor Company Limited might have the option to pass through the dividend received to its shareholders with minimal tax. With this, TVS Motor Company Limited was able to hive off the surplus assets available with SACL to make it ready for sale.

The Proposed Transaction:

Through a business transfer agreement, SACL will transfer its injection moulded plastic component solutions division to Pricol Precision Products Private Limited as a going concern on a slump sale basis. The consideration for the slump sale will be INR 215.3 crore subject to some adjustments which may include adjustments on account of working capital, contingent liabilities etc. The entire consideration will be discharged through in cash and no securities will get issued. The transaction is proposed to be completed by 31st January 2025. On closing date, the injection moulded plastic component solutions division will get transferred to PPPPL.

In terms of revenue, injection moulded plastic component solutions division contributes almost 100% to the crore revenue generated by SACL & 95.1% of total revenues. Thus technically, entire business operations carried by SACL will be transferred to PPPPL and SACL will likely to remain with selected assets & liabilities which parties do not want to be part of the transaction.

For TVS Motor Company Limited, this seems to be a decision which allows them to focus on their core business and evaluate growth opportunities in the upcoming electric two-wheeler business. This will also free up capital which can be allocated in prudent manner. For business continuity for its OEM business, there could be a chance of having a continuing supply of injection moulded plastic component solutions division products used by TVS Motor for a certain time at an agreed price.

For Pricol Limited, this will be a substantial acquisition which will turn up its revenue by circa 30%-35% on a yearly basis. Advancing its growth in allied business verticals thereby cementing its leadership in the automotive components sector. Foremost, there could be few customers, acquired from SACL, for cross-selling its existing products. Pricol Limited will place the acquired business independently (in PPPPL) which will allow them to have flexibility and ring-fencing against any contingencies which may be identified/unidentified at the acquisition stage. Once streamlined, Pricol Limited may announce consolidation.

Funding of transaction:

The consideration of INR 215 crore will be funded by Pricol partly through internal accruals and external borrowings. Pricol Limited will infuse circa INR 120 crore by way of subscription of shares of PPPPL (not clear whether equity or preference/convertible shares) and the remaining will be funded through borrowing raised by PPPPL. Pricol Limited will provide a corporate guarantee for the loan obtained by PPPPL. Considering the loan obtained & cash flows available, it may be able to repay the debts within a couple of years.

Financials & Valuation:

Please note that almost the entire revenue pertains to the injection moulded plastic component solutions division which is getting transferred. Further, in 2024, SACL returned INR 310 crore to TVS Motor Company Limited through a capital reduction of equity shares.

From the above financials, the SACL was doing good and have a clientele like TVS Motors Company Limited, Ather, Royal Enfield and Ashok Leyland amongst other marque clients.

As provided in the press release by both SACL & PPPPL, the undertaking will be transferred on debt-free basis which means borrowings to the tune of circa INR 88 crore shall remain with SACL which can be repaid from the consideration SACL will receive for the Slump Sale. There could be some other assets which may remain with SACL. As the net worth of SACL is circa INR 146 crore, if one excludes borrowings the transferred net asset value comes to circa 234 (INR 146 plus INR 88 crore) which is in line with the purchase consideration of 215 crore which in other way indicate consideration equivalent or near to net asset value transferred.

Valuation multiple assigned to the deal (Remaining income is not excluded)

| Particulars | Amount |

| Enterprise Value/Equity value for transferred business (as no debt will get transferred) | 215 |

| EV/EBITDA (FY2024 basis) | 3.4 times |

| PE Multiple (FY 2024 basis) | 11 times |

| Revenue Multiple (FY 2024 basis) | 0.29 times |

Considering the current market scenario, it appears that the assigned multiple to the deal is at discount. This provides a great opportunity for Pricol to acquire substantial business at reasonable valuations.

What next to SACL/TVS Motors:

After completion of the deal, SACL will have circa INR 215 crore which partly be used to repay any existing debt and tax liability on account of slump sale (which is likely to be insignificant amount as transferred net assets could be equivalent to purchase consideration). The net amount will likely to be upstreamed to TVS Motor Company Limited through merger or any other means provided there is no other commercial plans available with management for SACL.

What next for Pricol:

This acquisition gives much boost to the existing operations of Pricol Limited with the addition of customers and products. This will open up cross-selling opportunities.

As indicated above, the acquisition will significantly boost the existing revenue & margins of Pricol Limited. However, considering the FY 2024 numbers, the consolidated margins and return on capital employed could fall slightly as injection moulded plastic component solutions division has lower margins and in short term increased financing cost pursuant to additional borrowings. However, in long run, Pricol Limited might able to turn around things.

Other ways available for executing the proposed transaction:

The proposed transaction could have executed through two means demerger and acquisition as technically PPPPL is purchasing almost the entire operations of SACL. Demerger could not be suitable considering TVS Motors Company Limited have received the shares (and not cash immediately) and the approval process (NCLT) have consumed considerable time.

Acquisition could have better alternate option, but it could have rejected as PPPPL may not have interest in certain assets/liabilities of SACL and direct tax implications. In our opinion (without much of the data available), we feel the acquisition could have resulted more tax liability of TVS Motor Company Limited than the proposed slump sale. With the commercial and other factors, the slump sale could have come up as the best choice to execute the transaction.

Conclusion

Auto ancillaries are trying to increase its product offerings while OEMs are trying to focus on its core business to adapt to upcoming technologies. No doubt all-cash acquisition will create value creation for all concerned. This transaction is a classic example for the same. The transaction could become a win-win solution for both companies while having cherry on the cake for Pricol as it is getting substantial business at a decent valuation. However, amount of value creation it will create for shareholders of PRICOL will depend on two things, one is constructive collaboration and two when WoS is merged with the listed holding company.

Like most of the transactions, this has also been planned much earlier and executed in a manner to have optimal benefits.