TVS group has grown into a large business conglomerate with an interest in several businesses including a few listed entities. Ownership of those diverse ranges of businesses was through various entities in which branches of the TVS Family hold shares. The present shareholders of the ultimate holding companies of the group consists of third & fourth generations of the founder, Mr. T. V. Sundaram Iyengar. To avoid conflict situations involving friction amongst TVS Family members and legal proceedings, TVS Family entered into a family arrangement to achieve an equitable partition of ownership and management interest of family branches amongst various businesses.

As a part of the family arrangement, recently, the TVS Group entered into a series of amalgamations & demergers (“Group’s Corporate Restructuring”) involving the splitting of the group’s holding companies i.e., T. V. Sundaram Iyengar & Sons Private Limited, Sundaram Industries Private Limited and Southern Roadways Private Limited and separating the businesses along with ownership to the respective family branches. This group’s corporate restructuring doesn’t directly involve any of the group’s listed entities.

Immediately, after the effectiveness of the above scheme, Sundaram Clayton Limited announced a composite scheme of arrangement involving the demerger of non-ferrous gravity and pressure die castings along with the amalgamation of its holding company and other group entity. In addition, Sundaram Clayton Limited will also give bonus preference shares to its equity shareholders which have been clubbed with the composite scheme. In this article, we have tried to evaluate whether this scheme has to relation with the group’s arrangement and its implications on various stakeholders mainly minority shareholders.

Companies involved

Sundaram – Clayton Limited (“Transferee Company” or “Demerged Company” or “SCL”) is engaged, inter alia, in the business of manufacturing non-ferrous gravity and pressure die castings and has four manufacturing plants located in Tamil Nadu. Other than that, it is also engaged in the business of manufacturing and distributing two & three-wheeler vehicles through TVS Motor Company Limited (“TVS Motors”).

TVS Motor is the group’s flagship/largest company. Currently, SCL holds circa 50.26% of TVS Motors. The equity shares of SCL are listed on nationwide bourses.

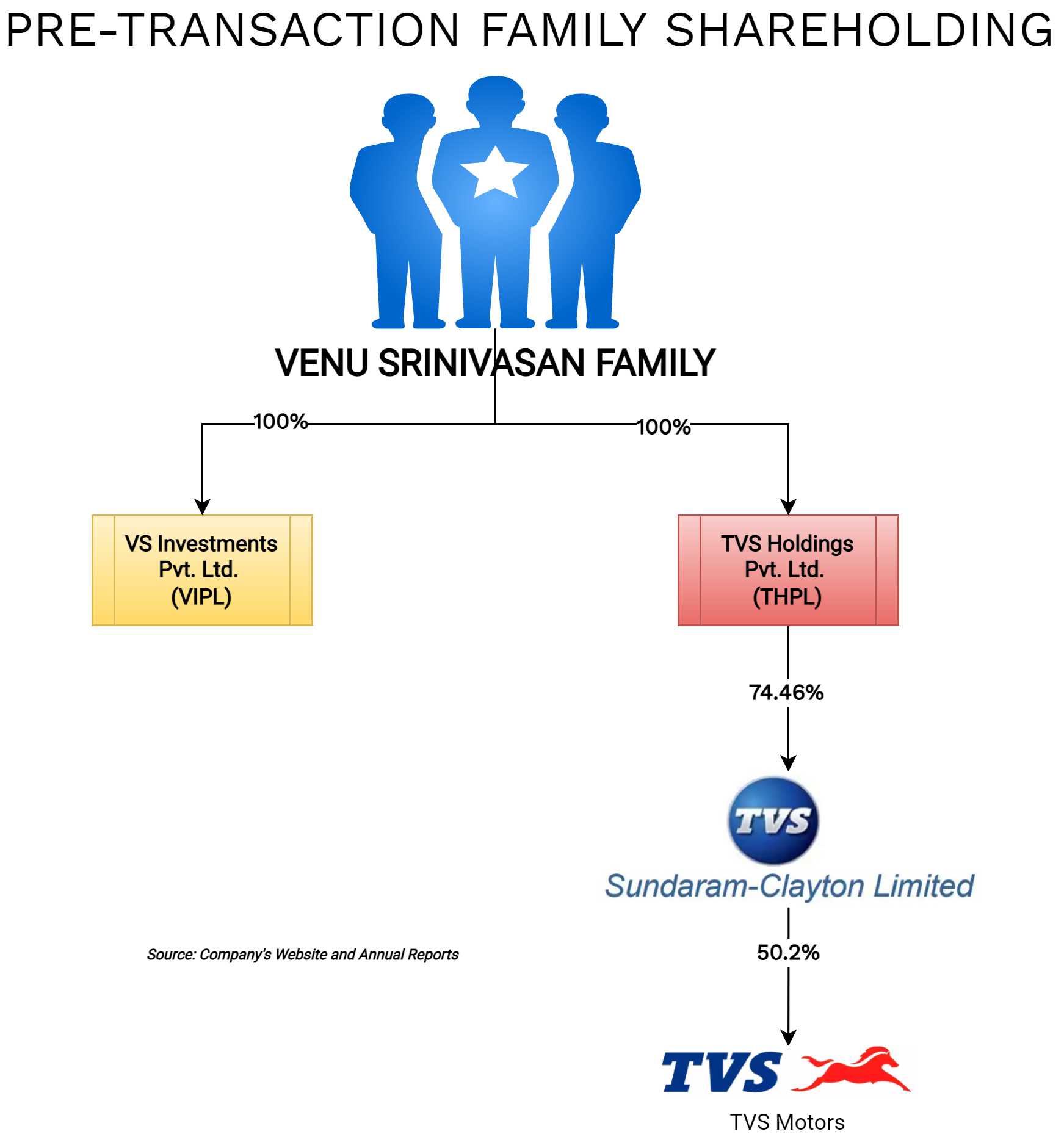

As a result of family arrangement, the ownership of SCL along with TVS Motors has been vested with Venu Srinivasan Family.

TVS Holdings Private Limited (“Transferor Company 1” or “THPL”) is a private company engaged in the business of making and holding investments and trading in automobile spare parts. As a part of the group’s corporate restructuring, 64.72% of the shareholding of SCL has been transferred to THPL, thus making it a holding company of SCL.

VS Investments Private Limited (“Transferor Company 2” or “VIPL”) is a private company engaged in the business inter alia of making and holding investments and trading in raw materials and components relating to automobiles. The company has been incorporated in September 2021. VIPL has taken significant borrowing which in turn has been given to the promoters. It looks like the loan taken in pursuant to the group’s corporate restructuring. Currently, VIPL does not hold any shares (equity or preference) of SCL. However, pursuant to the arrangement mentioned below, before the appointed date for amalgamation of VIPL with SCL, VIPL will hold significant preference shares which are to be issued by SCL as a bonus share.

Sundaram-Clayton DCD Limited (“Resulting Company” or “SCDL”)) is a public company incorporated to carry on the business of manufacturing non-ferrous gravity and pressure die castings. The Resulting Company is a wholly-owned subsidiary of SCL.

The Transaction

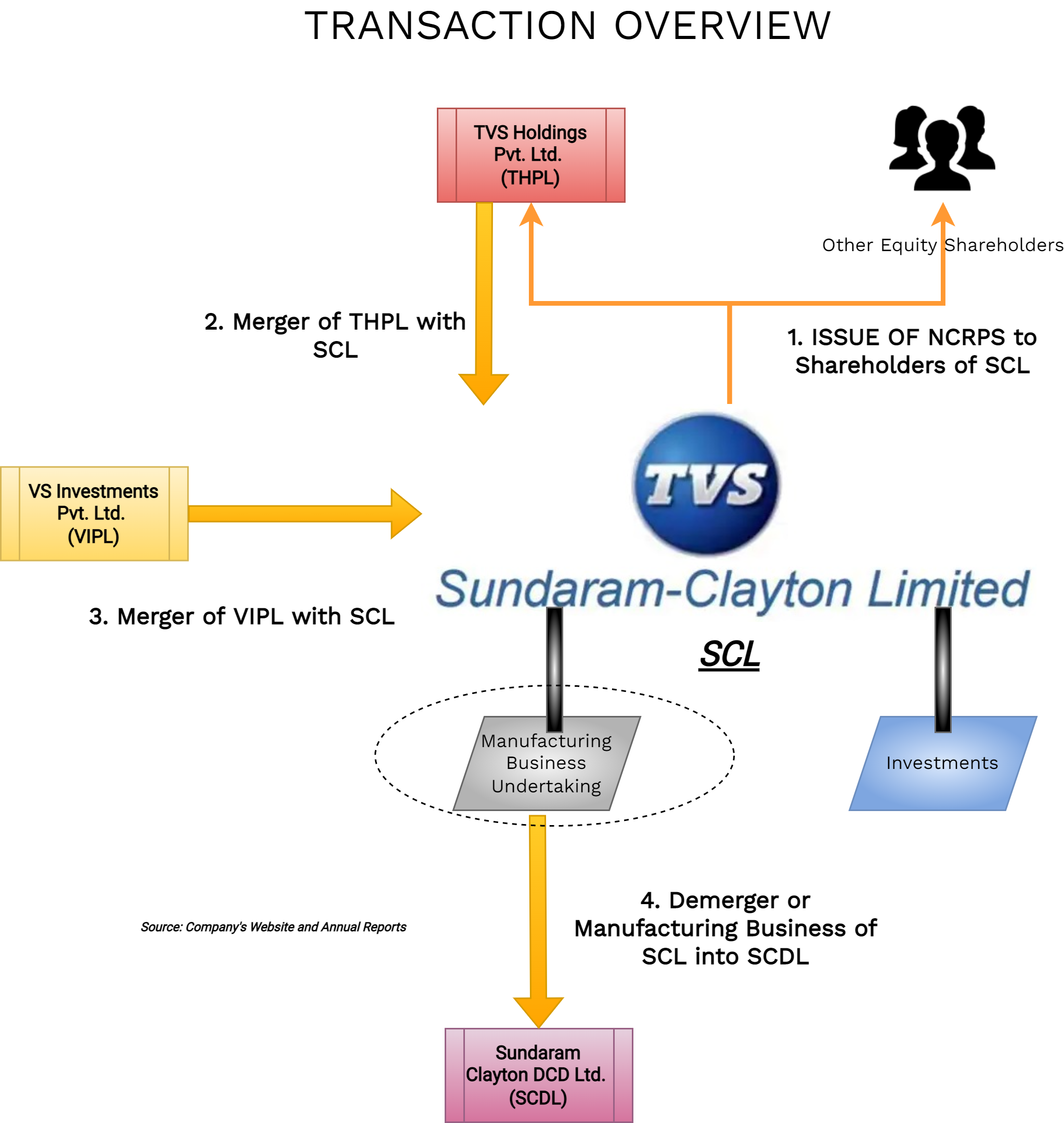

The Composite Scheme of Arrangement inter-alia provides for amalgamation of the holding c & group company with SCL followed by the demerger of non-ferrous gravity and pressure die castings business of SCL to SCDL. In addition, SCL will also give bonus preference shares to its equity shareholders through the same scheme.

The chronology of the events as envisaged under the scheme:

- Issue of 116 Non-Convertible Redeemable Preference Shares (“NCRPS”) of INR 10 each fully paid up of SCL for every 1 equity share of INR 5 each fully paid up, by way of bonus to its equity shareholders;

- Amalgamation of the THPL with SCL;

- Amalgamation of the VIPL with SCL;

- Demerger of “Demerged Undertaking” of SCL to SCDL

“Demerged Undertaking” of SCL is a business of manufacturing non-ferrous gravity and pressure die castings and has four manufacturing plants located in Tamil Nadu. SCL supplies aluminium castings for commercial vehicles, passenger vehicles and two-wheeler segment for the automotive industry. The revenue of the demerged division of SCL is derived from Medium & Heavy Commercial Vehicles (MHCV) (61%), followed by the two-wheeler industry (23%) and the car industry (16%).

Post-demerger, SCL will house only investment in TVS Motors and may also keep borrowings which will get transferred as a result of the amalgamation of THPL & VIPL.

The Scheme provides for multiple Appointed Dates. For each of the four transactions mentioned above, the Appointed Date is the respective Effective Date. The Effective Date for each transaction occurs after the Effective Date of an earlier transaction.

Table showing Appointed Date for four transactions:

| Appointed Date | Particulars/Transaction | Comment |

| 1 | Issue of NCRPS | Means Effective Date 1 which is the date on which last of the conditions specified in Clause 37 (Conditions Precedent) of the Scheme are complied with |

| 2 | Merger of THPL | Means Effective Date 2 which is the 1st (first) Business Day after receipt of approval of the Stock Exchanges for the listing and trading NCRPS issued by SCL |

| 3 | Merger of VIPL | Means Effective Date 3 which is the 5th (fifth) Business Day after receipt of approval of the Stock Exchanges for the listing and trading NCRPS issued by SCL and equity shares issued in terms of Clause 10 of this Scheme |

| 4 | Demerger | Means Effective Date 4 which is the 5th (fifth) Business Day after the Effective Date 3 |

Further, the scheme provides for two Record Dates: one (after Effective Date 1) for the issue of NCRPS & other (After Effective Date 4) for the issue of equity & preference shares by the resulting company to the shareholders of the demerged company for demerger.

Further, after the scheme becomes effective, the name of SCL will be changed to TVS Holdings Limited & SCDL will be changed to “Sundaram-Clayton Limited”. The Scheme also provides that the current joint managing director of SCL, i.e. Dr. Lakshmi Venu, will be appointed as joint managing director of SCDL and SCL will appoint a new joint managing director.

Equity Share-Exchange Ratio

THPL does not have any other significant assets or liabilities except 64.72% equity stake of SCL and it has also been assigned a loan of INR 80 crore which will be paid out of the internal accruals or sale proceeds from the sale of SCL equity shares. Thus, it is likely that THPL may sell some of its holdings in SCL before the Effective Date to repay its assigned loan.

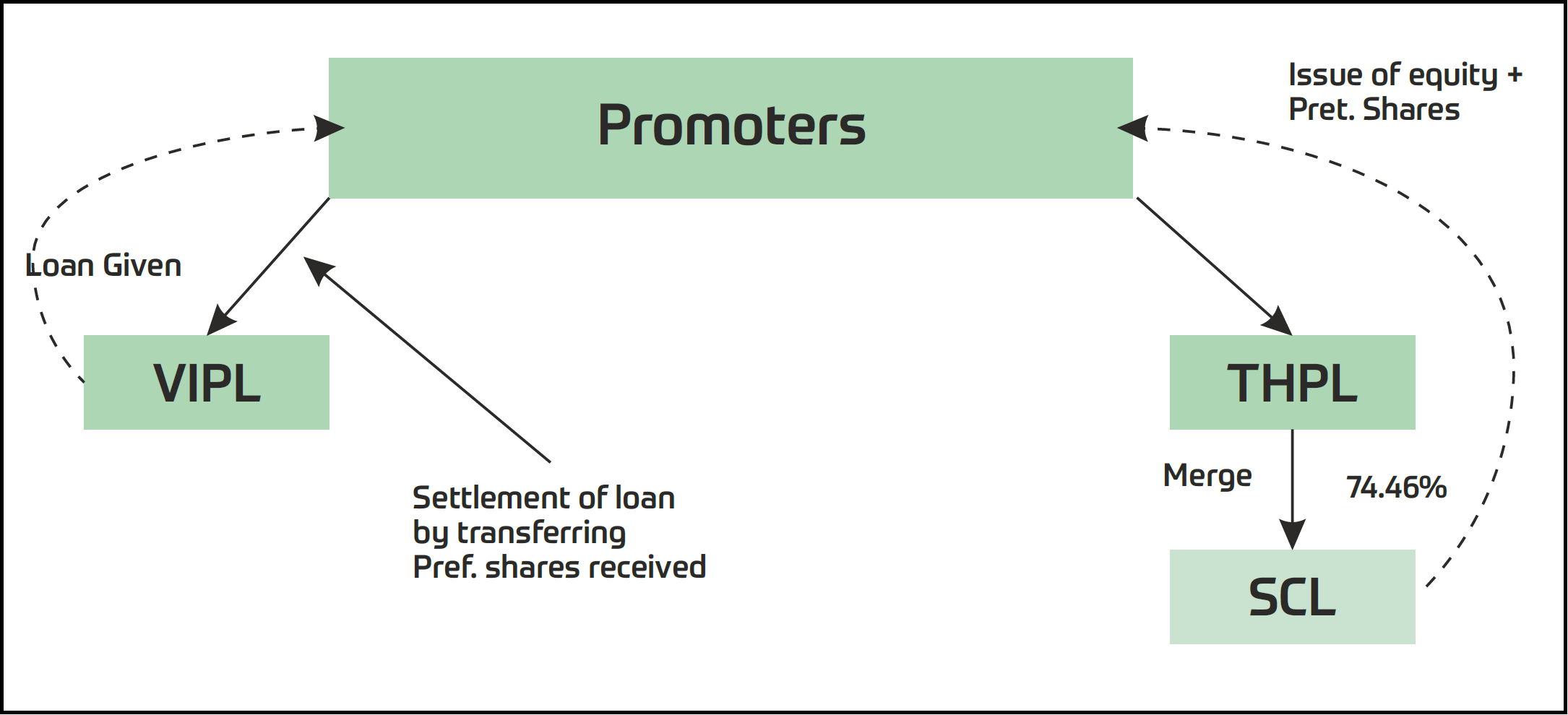

It looks like VIPL has been incorporated to facilitate the smooth transfer of borrowings that promoters may have taken due to family arrangements. Based on the provisional balance sheet of VIPL as on 8th February 2022, VIPL has borrowed INR 1720 crore and simultaneously it has given a loan to the promoters of INR 1649 crore. The remaining amount is cash available with VIPL. The net worth of VIPL on the same date is only INR 78,504.

Merger

Pursuant to the merger of THPL with SCL, SCL will issue the exact number of shares held by THPL of SCL i.e. 1,30,94,460 representing 64.72% stake in SCL to the shareholders of THPL.

Pursuant to the merger of VIPL with SCL, SCL will issue 19 equity shares which will be distributed among all shareholders of VIPL proportionately.

Demerger

For demerger, SCDL will issue 1 equity share for every 1 equity share of SCL.

Post scheme, there will be no change in % of promoters holding in SCL, however, promoters will directly own equity shares in SCL. Further, demerger will result in a mirror-image shareholding pattern, promoters and public shareholding in SCDL will be similar to SCL.

Issue of Preference Shares as Bonus & Re-organization of Preference Shares:

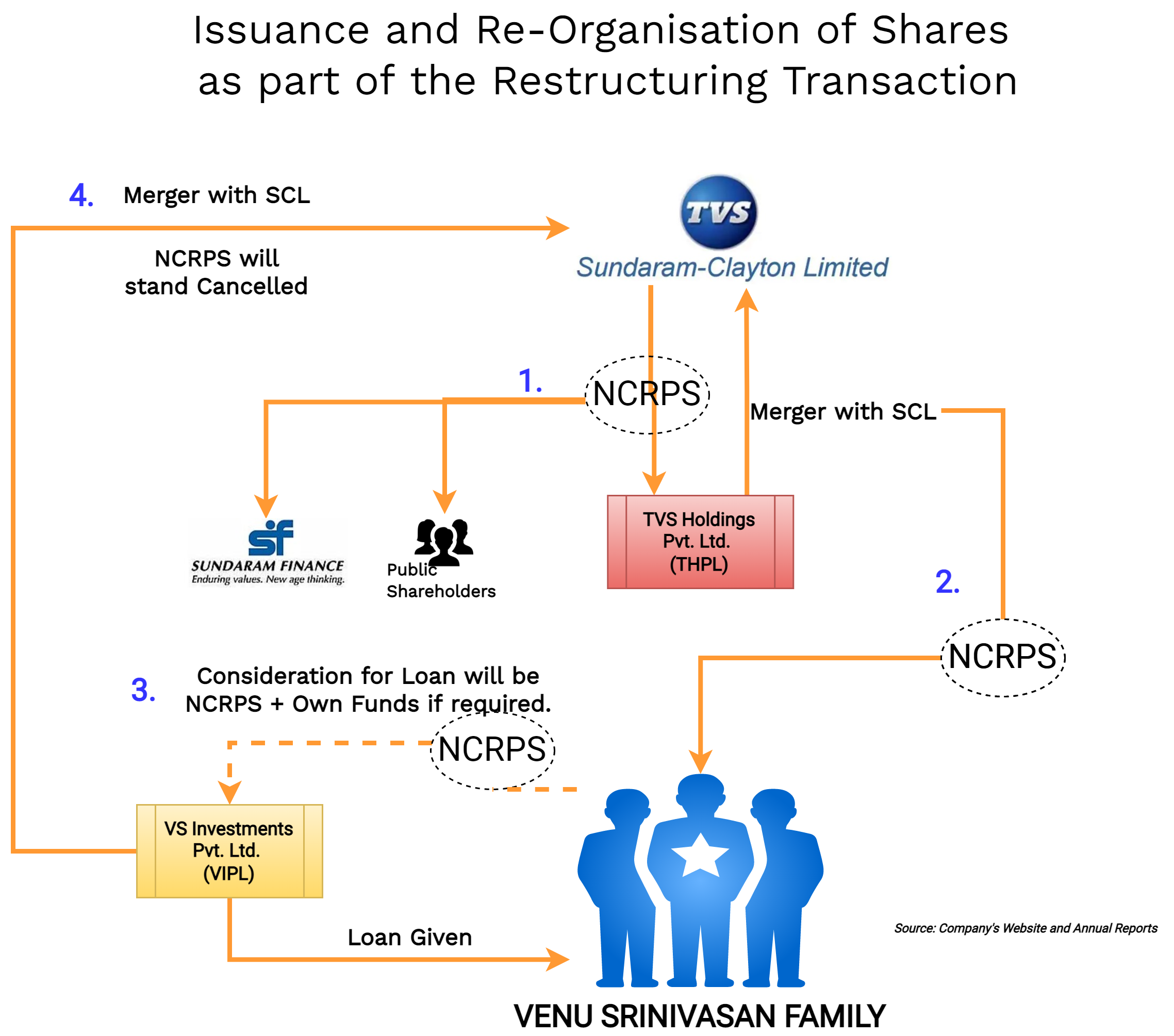

- SCL will issue NCRPS of INR 10 each as a bonus share before the merger or demerger. Further, NCRPS issued to the equity shareholders of SCL will be redeemable at par on 2nd February 2024 or 12 months from the date of allotment, whichever is later. Further, NCRPS will be listed on stock exchanges and will carry a coupon of 9% p.a.

- THPL, being the shareholder of SCL, will also get NCRPS and as a result of the subsequent merger of THPL with SCL, NCRPS will get cancelled and the same number of NCRPS will be issued to the equity shareholders of THPL i.e. ultimate promoters.

- Immediately after issuing NCRPS, the ultimate promoters will settle their loan with interest which they have taken from VIPL by transferring the NCRPS of SCL (received by them pursuant to the merger of THPL with SCL) to VIPL. As a result of this, VIPL will hold NCPRS issued by SCL to the shareholders of THPL. Clause 37.2.3 of the Scheme (Condition Precedent) provides that the NCRPS will be transferred at face value by the shareholders of THPL i.e. ultimate Promoters to VIPL immediately after Effective Date 2 but before Effective Date 3. Further, any shortfall between the loan given by VIPL to promoters & amount of NCRPS transferred shall be settled by the promoters with their own funds.

- Subsequently, as a result of the merger of VIPL with SCL, the NCRPS transferred to VIPL will get cancelled and no new NCRPS will be issued to the shareholders of VIPL. Consequently, NCRPS will get issued to the public and only one of the promoter entities i.e. Sundaram Finance Holding Limited. However, with the merger of VIPL with SCL, the borrowings of INR 1649 crore will be transferred to SCL. Thus, instead of getting NCRPS/redemptions, promoters will utilize the same amount to settle their outstanding debt directly through SCL.

Further, immediately after the scheme becomes effective, the outstanding debt of VIPL may be paid by SCL. However, the redemption of NCRPS issued to public shareholders & one of the promoter entities will get redeemed by 2nd February 2024 or 12 months from the date of allotment, whichever is later, but they will be compensated with 9% coupon & additional NCRPS of SCDL.

As a result of the demerger, the NCRPS holder of SCL will receive 1 (One) NCRPS of SCDL credited as fully paid up of INR 10 each, for every 1,000 (One thousand) NCRPS of SCL. NCRPS issued by SCDL will be redeemable at par on 2nd February 2024 or 12 months from the date of allotment, whichever is later. Further, NCRPS will not be listed on stock exchanges and will carry a coupon of 0.1% p.a.

NCRPS Pattern of SCL & SCDL

| Particulars | SCL & SCDL |

| Promoters | |

| THIL | - |

| Sundaram Finance Holding Limited | 27.59% |

| VS Trust | - |

| Individual Promoters | - |

| Total-Promoters | 27.59% |

| Public | 72.41% |

| Total | 100% |

Tax Aspect of the Transaction

The amalgamation of holding & group company with SCL & subsequent demerger of non-ferrous gravity and pressure die castings business of SCL will be tax neutral for all the parties. To facilitate no tax at the time of issuance of NCRPS, it looks clause 4.8 inserted in the composite scheme of arrangement which provides that the issue of such a bonus to equity shareholders does not involve any release of assets by SCL to shareholders at the time of issuance of Preference Shares of SCL by way of bonus. However, at the time of redemption/transfer it will be taxable as a deemed dividend. Further, one needs to evaluate tax implications in the hands of promoters for the transfer of NCRPS to VIPL in lieu of settlement of the outstanding loan.

With regards to the earlier group’s corporate restructuring, looking at the balance sheet of THPL & valuation report given for the composite scheme of the arrangement, THPL acquired 64.72% stake of SCL along with a loan of INR 80 crore through demerger of two-wheeler auto parts and die casting business undertaking of T.V. Sundram Iyengar & Sons Private Limited into THPL. It looks two-wheeler auto parts and die casting business undertaking’s substantial part was only investment i.e. 64.72% equity shares of SCL. One needs to evaluate whether it will comply with “Undertaking” and so compliant demerger under section 2(19AA) of the Income Tax Act, 1961. If any liability comes on account of an uncompliant demerger to THPL, the same will now be transferred to SCL as THPL merged with SCL.

Financials & Amount to be utilized

The scheme envisaged issuance of 82,79,64,500 NCPRS plus a loan to the tune of INR 1649 will get transferred to SCL which will translate to the cash outflow of around INR 2477 crore. As on 31st March 2021, SCL has a Cash & Cash Equivalent (including investment in other companies except for group companies) of circa INR 228 Crore. In Q1-FY 21, SCL sold 5.14% stake in TVS Motors and realized circa INR 1506 crore. As a result, SCL holding in TVS Motors reduced to 52.26% from 57.40%. Recently, SCL further sold 2% stake in TVS Motors for INR 604 crore. The amount so realized will be effectively used to pay borrowings (SCL will get on the merger of VIPL) and redeem the NCRPS.

Financials of Automotive Components (demerged undertaking) of SCL

Value game for shareholders

The Scheme envisages for issuance of NCRPS as bonus plus will receive equity shares demerger of business of manufacturing non-ferrous gravity and pressure die castings. In addition, they will also receive NCRPS of SCDL.

A shareholder holding 10 shares of SCL as of date will get:

| Particulars | Amount |

| Cost to acquire 10 Equity Shares of SCL* | -36,080 |

| 1160 NCRPS of SCL | 11,600 |

| 1 NCRPS of SCDL | 10 |

| Implied value of 10 Equity shares of SCL & SCDL (Post Demerger) | 24,470 |

| No. of Underlying TVS Motors Equity Shares per Equity Share of SCL (Approximate) | 11.80 |

| Implied valuation of 10 Equity Shares of SCL (Remaining Business Post-Demerger) * | 73,440 |

*: Closing price of SCL & TVS Motors as on 30.03.2022.

After the demerger, SCL will become a pure holding company for TVS Motors and cash realized by selling circa 7.14% stake will be used to repay borrowing and redeem NCRPS. After the demerger, SCL being the holding company, it will continue to trade at a discount on its underlying value. SCDL on other hand will be pure play non-ferrous gravity and pressure die castings company. In the last couple of years, SCL has done capacity expansion in its non-ferrous gravity and pressure die castings business and will look to expand further.

Conclusion

The Family arrangement of TVS group was aimed toward re-aligning ownership & management control of various TVS listed as well as unlisted companies. TVS Motors being the largest & flagship company, there might be strong chances that the family member getting controlled of TVS Motors shall end up paying something to other members. The group arrangement being a private affair, limited information is available in the public domain.

The likely reason behind the issue of NCRPS & its reorganization is the payout required to be made by Venu Srinivasan Family. One may consider instead of giving NCRPS as a bonus, SCL may have issued debentures as a bonus. This might have provided tax efficiency to SCL as it may have been able to claim interest paid on debenture as an expenditure. The merger of THPL may come with a potential tax risk to SCL on account of the previous group’s corporate restructuring.

Multiple Appointed Dates and clubbing of issuance of NCRPS as a bonus with the merger & demerger usher in increased complexity for the transaction. The Scheme has been designed in such a way that it will not only simplify the holding structure but will also facilitate the smooth & fair transfer of any amount due under the group’s corporate restructuring.

Currently, SCL derives its substantial value from its holding in TVS Motors. No doubt, the separation of operational business from investments of TVS Motors will usher in increased focus & growth for the operational business of SCL. Going ahead, management will plan to collapse the holding-subsidiary structure for its flagship company TVS Motors by merging the remaining SCL with TVS Motors. Till the final merger with TVS Motors, SCL will continue to trade at a discount and minority shareholders have to wait to reap the maximum benefits of the scheme.

Add comment