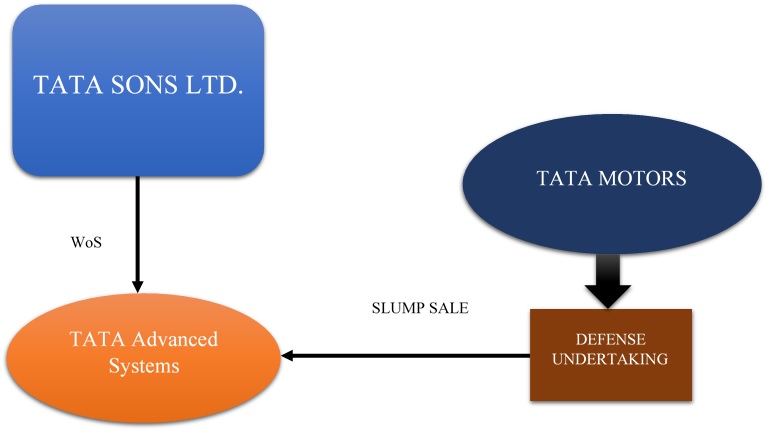

Tata Group is one of the oldest and biggest group in the country. The group has many companies and we always see restructuring happening in the group and subsidiaries year after year. There can be many reasons behind internal restructuring like better group structure, selling of profitable or nonprofitable business, consolidation of similar businesses etc. In a similar restructuring, we are seeing that TATA Motors shall be giving its Defense Business to TATA Advanced Systems via a Slump Sale Transaction.

TRANSACTION:

TATA Motors Ltd. (TML), the Transferor Company has recently on 11th September 2018 filed a draft scheme of Arrangement with the Bombay Stock Exchange proposing to sale the Company’s Defense Undertaking to Tata Advanced Systems Limited (TASL), Transferee Company, a wholly-owned subsidiary of Tata Sons Limited, to be entered into between the Transferor Company, Transferee Company and their respective members and/or creditors, as the case may be, pursuant to the provisions of Sections 230 to 232 of the Companies Act, 2013 and the rules made thereunder. The Scheme provided for transfer of the Company’s Defense Undertaking to the Transferee Company at an upfront consideration of minimum 100 Crores (to be adjusted for capex incurred and changes in working capital) plus a deferred consideration of 3% on future revenue share from identified set of projects for a period of 15 years from April 1, 2019. However, the deferred consideration will be maximum upto 1750 Crores.

STRUCTURE:

DEFENSE UNDERTAKING:

The ”Defense Undertaking” of the TML is the business as a going concern as on the Appointed Date, pertaining to the manufacture and/or sale of products and/or services that are designed, used, developed or modified for the Ministry of Defense, the Ministry of Home Affairs, United Nations peacekeeping agencies and equivalent entities outside India engaged in internal and external security of those countries and including its assets and liabilities as mentioned in the Scheme.

However, the Defense Undertaking has not covered Excluded Liabilities and Excluded Contracts. It is clearly mentioned that if the Transferor Company has executed any contract/agreement/purchase order/any other commitment pursuant to Invitation for Expression of Interest for Project FICV issued on 16 July, 2015 by the Directorate General Mechanized Forces, Integrated Headquarters, Ministry of Defense(Army), the same will not be transferred.

Further those liabilities which do not pertain to Defense Undertaking are excluded from the liabilities being transferred to the TASL. Also, the liabilities related to litigations/claims pertaining to Defense Undertaking, whether present or future, which are attributable to the period prior to Appointed Date are also been excluded from being transferred to the Transferee Company and the same will be rest with the Transferor Company.

RATIONALE OF THE SCHEME:

- Tata Motors is not able to expand as no focused management for the defense business considering that its core business is struggling with concentrated market of automobile in India.

- Hence, TML thinks it will be able to monetize the value of its investments made in the design and development of the various products for defense.

- On top of that, TML will be able to participate in the future growth opportunities in defense business through earn out consideration.

- There are future growth opportunities for defense business. Since TASL is in the business of production and assembly of systems, sub-systems and solutions used in the aerospace and defense industry, similar to that of Defense Undertaking, this slump sale will facilitate the TASL for focused investments, better capital allocation and scaling up of operations, execution of larger and more complex projects across air systems, land systems and control weapon systems and will also help in achieving cost synergies.

COMMENCEMENT DATE, APPOINTED DATE & EFFECTIVE DATE:

Commencement Date as defined in the Scheme is 27th July 2018. Appointed and Effective Date are same, and this will be the last date by which all the conditions as mentioned in the Scheme are fulfilled or by which all the approvals are obtained like

- Observation Letter or NOC from Stock Exchange

- Approval of Competition Commission of India

- Approval of requisite majority of Share Holders/Creditors

- Approval of majority public Share Holders of Transferor Company

- Receipt of NCLT Order

- CTC of NCLT Order filed with ROC

- Approval of a Third Party & its registration with a Government Authority

- Transferee Co.’s registration as seller on Govt e-marketplace platform

- Execution of Leave & License Agreement between Transferor & Transferee Company

- Supply Agreement between Transferor & Transferee Company to supply to Transferee Company for end use of defense customers.

These conditions to be fulfilled within 1 year from the commencement date or date fixed by Board of Directors (BODs) of both companies. If for any other reason, this scheme cannot be implemented, BODs of both co. can waive condition 7,8 or 9 above. That means, the time gap between commencement date & appointed/effective date can be maximum of 1 year.

IMPLEMENTATION PERIOD:

The period between the Commencement date and the Appointed/Effective date is termed as Implementation period during which Transferor Co. is required to carry on the business of Defense Undertaking in its Ordinary Course of business. If Transferor Company wants to take decision during this period, it is required to take consent of Transferee company if that decision regards to:

i. Incurring of Capital Expenditure/commitment more than Rs. 2 crores or borrowings, with respect to Defense Undertaking

ii. Transfer/Licensing of Technology relating to Intellectual Property of Models specified separately in the Scheme excluding components, parts, aggregates of Transferor Company used for these Models.

iii. Entering into or termination of any supply contract and/or customer contracts relating to Defense Undertaking or submission of any bids, having value in excess of Rs. 3 Crores.

iv. Appointment of any new dealers or selling agents relating to Defense Undertaking

v. Change/modify organizational structure of Defense Undertaking existing on commencement date.

vi. Sale, transfer, assign, mortgage, pledge, hypothecate, grant any security interest in, subject to any encumbrance or otherwise dispose of, any asset pertaining to Defense Undertaking.

vii. Take/commit to take any action resulting in occurance of any of the above (i) to (vi).

This clause is placed to protect the interest of Transferee Company to receive the defense undertaking on appointed date in the similar form as it was at the time of commencement date.

PRODUCTS PERTAINING TO DEFENSE UNDERTAKING:

There is annexure to the Scheme viz. Products pertaining to Defense Undertaking which is divided into two parts, Part A & Part B, for the very reason that the Tata Motors is not going to transfer Intellectual Property rights with respect to the products/models covered under Part A of the Annexure. Accordingly, TASL will have only right to sale in respect of Products covered in Part A of the Annexure and it can manufacture and sale products covered in Part B of the Annexure.

VALUATION:

The valuer has arrived at enterprise value of Rs. 209.70 crores of the Demerged undertaking based on net asset value as on 31st Dec 2017. However, the transaction commencement date is in July 2018 but effective will be after 5 days form the last date of approval from various authorities subject to maximum 1 year from the commencement date (including SEBI NCLT, competition commission, Public shareholders, ministries of defence registration on government e-marketplace platform, etc.).

The other methods are ignored considering that the segment is small and also not profitable further the specialized defense projects are yet to commence and there is limited visibility in terms of revenue and profits. And to note that the capital employed for Defence undertaking which principally comprises of the intangible assets and tangible assets are minor considering the value-added operations are outsourced. Further that there are no Long-Term Loan liabilities specifically identified for the undertaking. Accordingly, capital employed is equal to net assets value of the undertaking.

CONSIDERATION:

The sale consideration is Rs. 100 crores which is subject to adjustment for expenditure for design and development & working capitals as on effective date plus earn our consideration accruable as 3% of revenue of the projects transferred maximum up to 1,750 crores over period of 15 years.

The purpose of taking valuation report based on assets and liabilities as on 31st December 2017 and how it is relevant for the purpose of the approval of the scheme is not clear.

ACCOUNTING:

The Transferor company is recording at the book value. So, any gains above the net assets value will be transferred to profit and loss account. However, to note is that major of the consideration will be accruing as per earn-out consideration in the future years. Therefore, all the gains for the company will be accrued in the future years.

TAXATION:

The scheme of arrangement is defined under slump sale as per Income Tax Act 1961. However, consideration receivable for future will be taxable as business income under Income Tax Act 1961.

SHARES SALE TO TRANSFEREE COMPANY FOR SALE OF AEROSPACE BUSINESS:

TAL Manufacturing Solutions Ltd.(TAL), a TATA group company has also transferred its aerospace business to the Transferee Company, not by way of Slump Sale but by way of sale of entire shareholding of the Transferor Company in TAL to the Transferee Company i.e. Share Sale.

CONCLUSION:

On the onset, it looks that TATA Group is trying to consolidate defense related business in one entity to derive synergies and create capabilities to execute large projects. As TATA Motors as on date does not have capability to execute large orders, the IP created over the years can be better utilized by The TATA Advanced Systems Ltd which also now has the Aerospace Business from TAL Manufacturing Solutions.