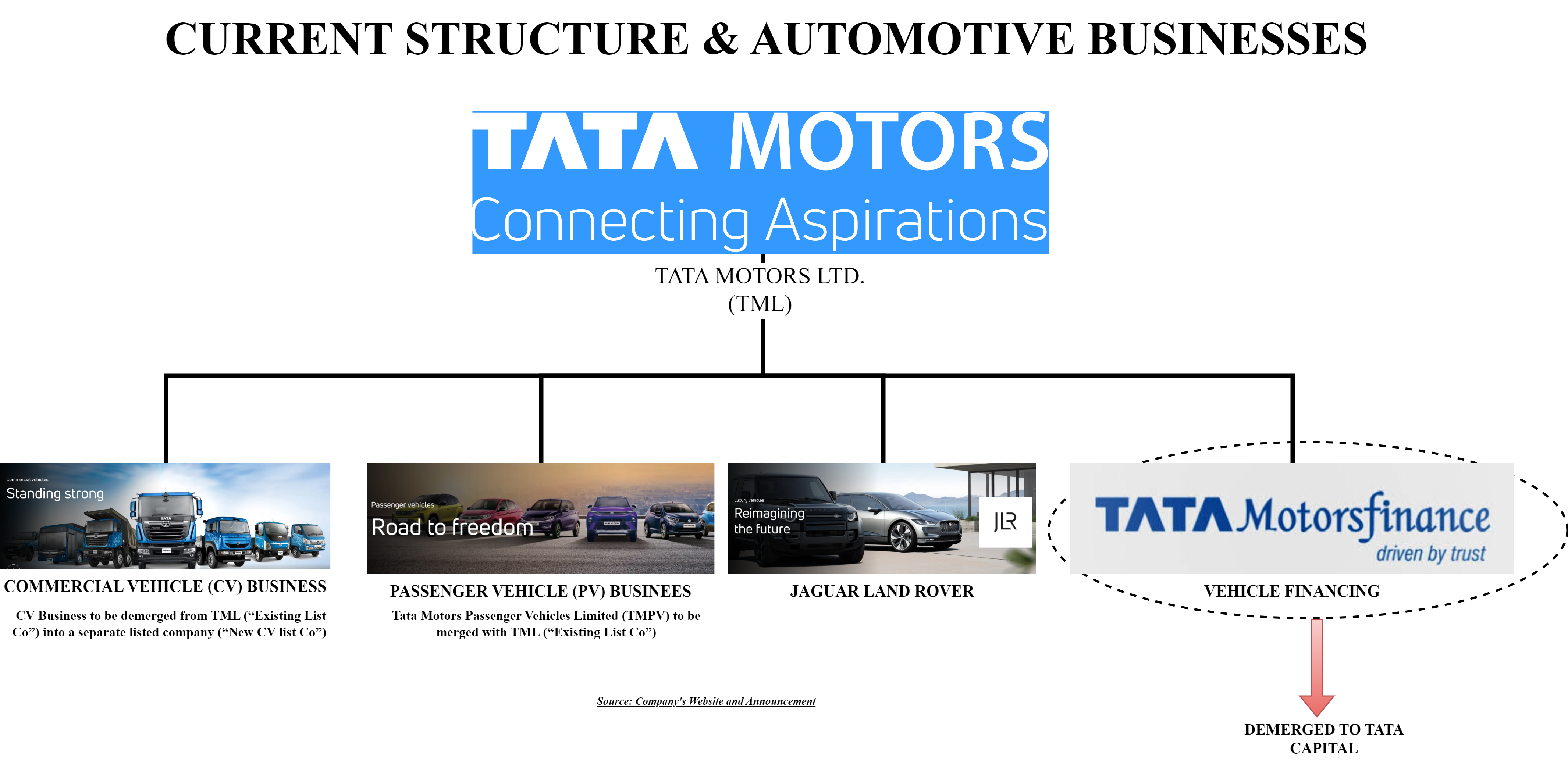

After streamlining types of shares and making total paid-up capital as normal equity shares & transfer of finance business, Tata Motors Limited is now ready to execute its marque restructuring which will pave the way for the separation of passenger & commercial vehicle business.

TATA MOTORS LIMITED (“TML” or “Demerged Company” or “Transferee Company”) is a well-known Indian company engaged in manufacturing passenger & commercial vehicles. The equity shares & non-convertible debentures of TML are listed on the NSE and BSE.

Some of the recent corporate restructurings by TML:

- Subsidisation of Passenger Vehicle Business under brand name “TATA” in India

- Initial Public Offering of one of its subsidiaries, Tata Technologies Limited

- Extinguishment of Differential Voting Shares by Issuing Ordinary Equity Shares

- Transfer of subsidiary engaged in Vehicle Finance Business to Tata Capital Limited through merger

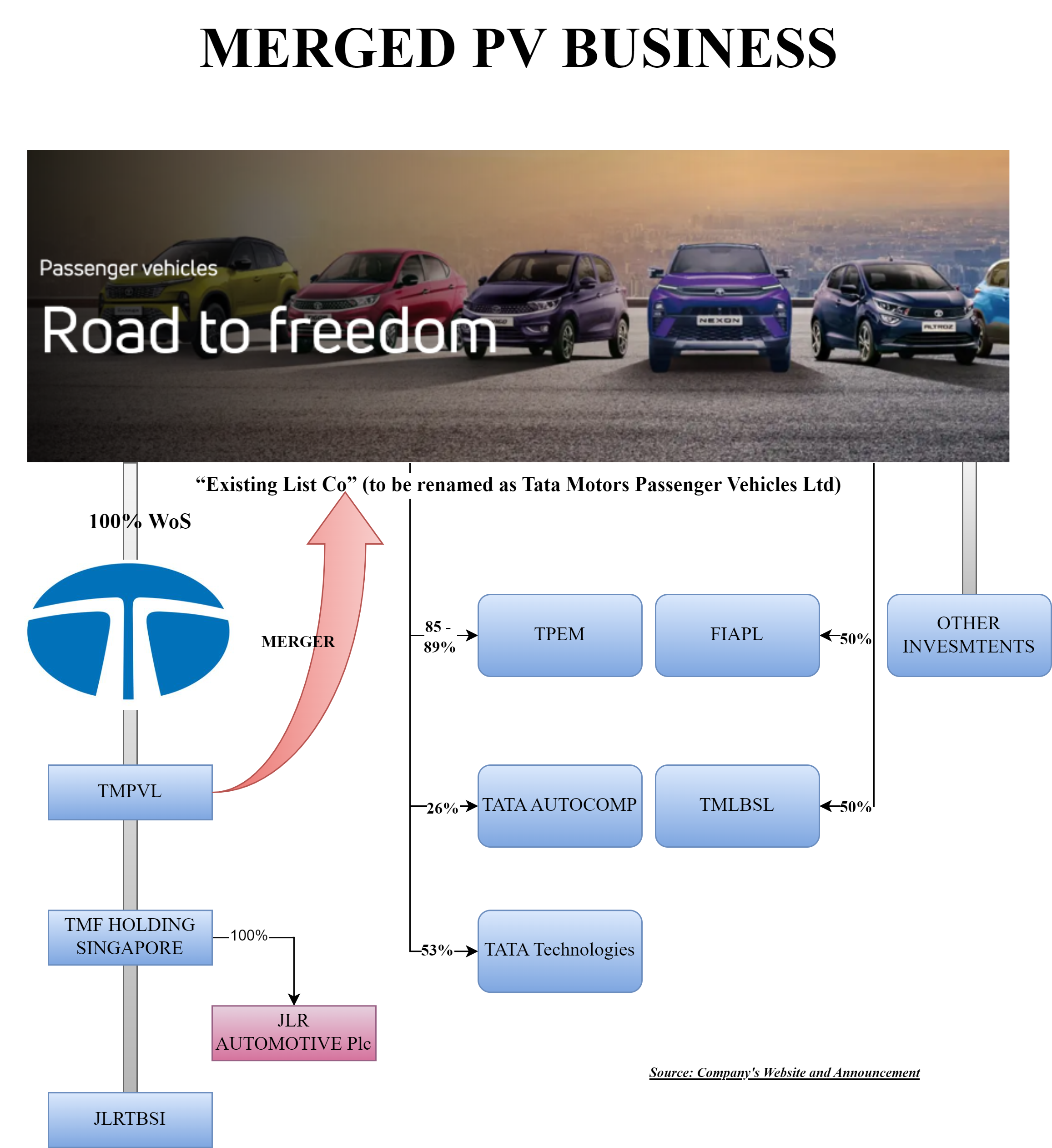

TATA MOTORS PASSENGER VEHICLES LIMITED (“TMPVL” or “Transferor Company”) is a wholly owned subsidiary of TML engaged in the manufacturing of Passenger Vehicles.

In 2020, TML announced subsidisation of “Passenger Car Business” under the brand name “TATA” in India (excluding Jaguar & Land Rover) pursuant to a Scheme of Arrangement as a going concern on a slump sale basis to TML Business Analytics Services Limited (now TMPVL) for a lump sum consideration of INR 9,417 crores. The consideration was discharged through an issue of equity shares by TMPVL to TML.

TML COMMERCIAL VEHICLES LIMITED (“TCVL” or “Resulting Company”) is incorporated to facilitate the proposed demerger. Currently, TCVL is a wholly-owned subsidiary of TML.

The Proposed Transaction

The Board of Directors of Tata Motors Limited at its Meeting has approved a Composite Scheme of Arrangement amongst TML, TCVL and TMPVL and their respective shareholders under Sections 230-232 of the Companies Act, 2013 (“Scheme”) which, inter alia, provides for:

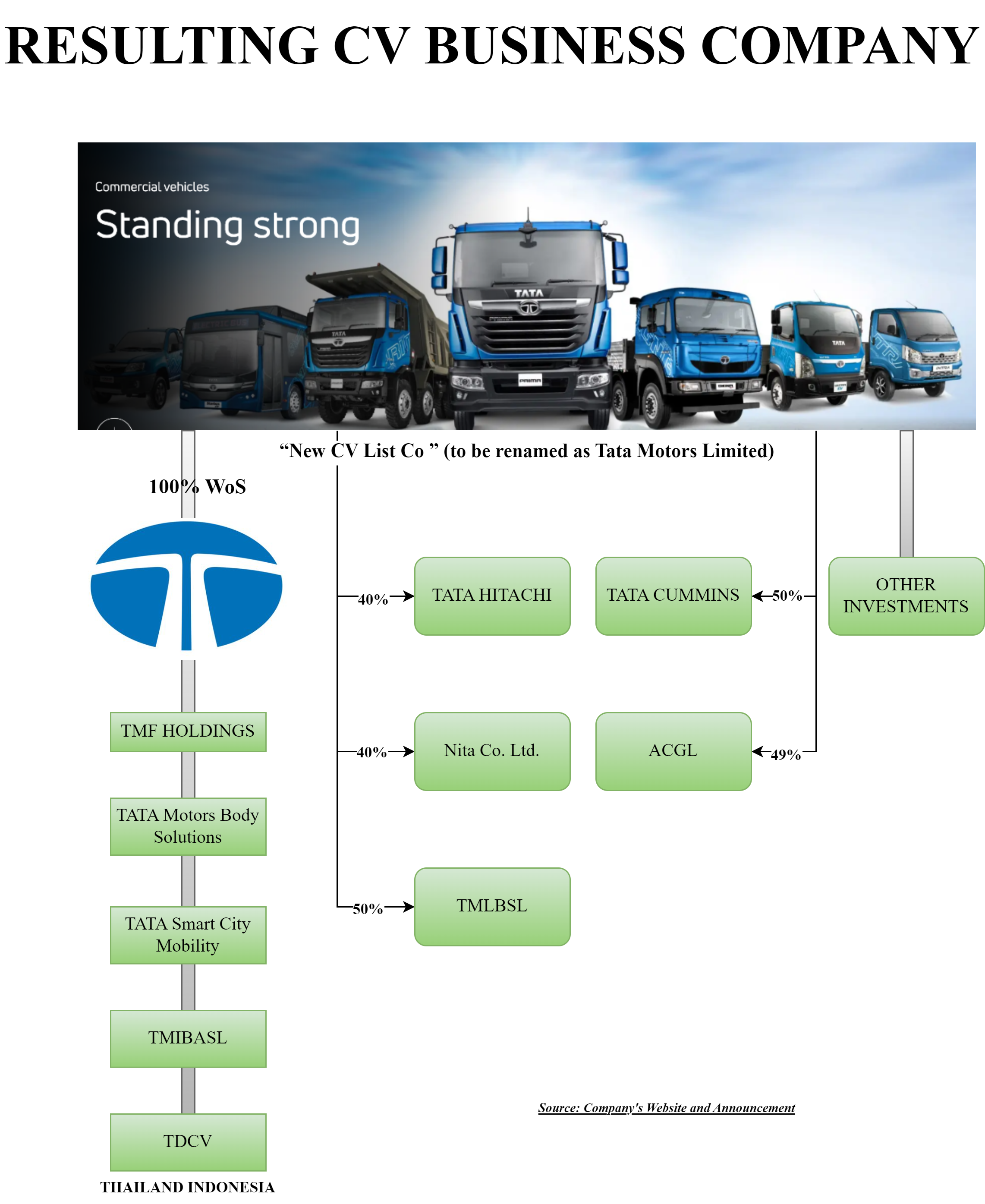

- demerger of the Commercial Vehicles Business from TML to TCVL, and

- merger of TMPVL with TML

“Commercial Vehicles Business” means all business activities carried out, directly or indirectly, by TML and/ or through any of its subsidiaries/ joint ventures/associates, and in each case, relating to (a) development, design, manufacture, procurement, assembly, sale, services, annual maintenance contracts and distribution of commercial vehicles (including new and/or refurbished vehicles), and sale of related parts and accessories, (b) commercial vehicle related digital businesses including FleetEdge, E-Dukaan, Fleet Verse, etc., (c) offering an extensive range of integrated, smart and e-mobility solutions in the commercial vehicles space, and (d) other related businesses including equipment business (construction, earth-moving machinery etc.), commercial vehicle finance and contract manufacturing of commercial vehicles and parts under any subsisting arrangement, in each case, in India and/ or abroad.

The “Appointed Date” for the demerger & merger will be the opening of business hours on July 1, 2025.

Some of the key rationale as proposed under the scheme for separation:

- The distinctive profile and established business model of the Commercial Vehicles Business and Passenger Vehicles Business makes it suitable to be housed in separately listed entities,

- Allowing sharper strategic focus in pursuit of their independent value creation trajectories

- better and efficient control and management for the Commercial Vehicles Business and the Passenger Vehicles Business

- Unlock value for the overall business portfolio through price discovery

- right operating architecture for both companies with a sharper focus on their individual business strategies and clear capital allocation

Share Capital & Swap Ratio

Upon the Scheme becoming effective and in consideration of the transfer and vesting of the Demerged Undertaking from TML to TCVL in terms of the Scheme, each shareholder of the TML whose name is recorded in the register of members and records of the depository as a shareholder of TML as on the Record Date shall be issued and allotted 1 (one) share of TCVL (face value of INR 2/- each fully paid up), for every 1 (one) share of TML (face value of INR 2/- each fully paid up).

Effectively, the shareholding pattern of TML will be a mirror image in TCVL.

Financials for FY 2024

JLR though accounts for the largest pie in overall TML, has cyclicality and dependent on overall performance in the global market mainly Europe & China. The margins in JLR can go north-south depending on its performance in foreign markets. Considering the commercial vehicle is stable and provides excellent Return on Capital Employed for the Company.

Accounting Treatment:

TML shall give effect to the Scheme in its books of accounts in accordance with Appendix A to the Indian Accounting Standards 10 notified under Section 133 of the Act read with the Companies {Indian Accounting Standards) Rules, 2015 and the generally accepted accounting principles in India. Upon the Scheme becoming effective and from the Appointed Date, TML shall transfer all the assets and liabilities, at their respective carrying amounts, pertaining to the Demerged Undertaking as appearing in the books of accounts of TML, being transferred to and vested in TCVL.

It is also mentioned that, Upon the Scheme becoming effective and from the Appointed Date, the carrying value of the Cost of Hedging Reserve and Hedging Reserve (forming part of "Other Components of Equity" in the Statement of Changes in Equity) pertaining to Demerged Undertaking as appearing in the books of accounts of TML, will be reclassified to profit or loss as a reclassification adjustment. The carrying value of fair value reserve in relation to equity instruments carried at fair value through Other Comprehensive Income shall be transferred to retained earnings.

Conclusion

TATA Motors passenger vehicle business is dependent on performance in overseas markets. While the commercial vehicle business is significantly focused in India. The group being aware that both business verticals require a different strategy for growth with its different risks & returns.

This transaction of segregation of CV and PV business initiated by the management will help to focus on respective businesses.

Further, CV business there is the possibility of making various kinds of vehicles for logistics, defence, hospitality, passenger transport, buses etc. No doubt this restructuring is likely to create value for all stakeholders in the long run.