This article covers two schemes together as both the schemes are identical, with the same appointed date, filed at the same time and having the same Transferee Company. Further, the Transferee Company is loss-making and Transferor Companies are profit-making. Further Tata Steel Ltd is the holding company of all the three companies. Now let us analyse interesting aspects of both the scheme.

Overview of Companies:

Tata Steel Long Products Limited (TSLPL) is a listed company and engaged in the business of production and marketing of sponge iron, which is a single end use (steel making) and a single grade product. It has also one of the largest specialty steel plants in India in the SBQ (special bar quality) segment with an annual capacity of one million tons per annum. On April 9, 2019, TSLPL acquired the steel division of Usha Martin Limited, pursuant to the Business Transfer Agreement (BTA) for total consideration of ₹ 4,525 crore.

The Indian Steel & Wire Products Limited (ISWPL) is engaged in the business of manufacturing wire rods, TMT rebars, wires and wire products as an external processing agent of Tata Steel Limited and also in the manufacturing and direct marketing of welding products, nails, rolls and castings.

Tata Metaliks Limited (TML) is a listed company and engaged in the business of manufacture and sale of pig iron and ductile iron pipes and its allied accessories in its manufacturing plant located at Kharagpur, West Bengal.

The Transaction:

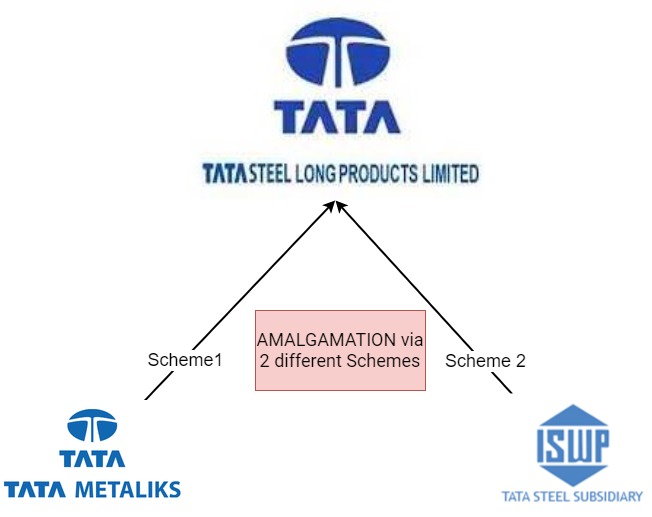

TSLPL filed two separate schemes for amalgamation of the above companies with itself.

- Scheme 1: Amalgamation of TML with TSLPL.

- Scheme 2: Amalgamation of ISWPL with TSLPL.

Appointed date for the transactions is opening of business hours on April 1, 2020,

Rationale of the Scheme

Various rationales mentioned in the scheme are as usual for synergy and other commercial advantages. It seems reason for the reverse merger i.e. merger of profit-making companies in loss-making company, though apparently look for tax benefits, but in reality, it is regulatory reasons. It seems legally it is difficult to transfer mainly the mining rights and assets acquired in the acquisition by TSLPL from Usha Martin Ltd and to comply with conditions imposed to get benefits and write off as part of the resolution plan approved by the Honorable NCLT.

TSLPL owns mines as follows:

- Iron ore mine in Barajamda, Jharkhand (acquired from Usha Martin Limited)

- A coal mine under development phase at Hazaribagh

As there are restrictions in transfer of mining rights under applicable laws, it is not viable to merge TSLPL and ISWPL in TML. TSLPL was allotted coal mine in 2006 in Radhikapur which was cancelled by the Supreme Court in 2014 and TSLPL spent ₹ 180 crore to develop the said mines till to March 31, 2020. As per the Supreme Court judgement, the successful bidder will be called upon to pay to the prior allottee the expenses incurred by the prior allottee towards land and mine infrastructure. So, if TSLPL is merged into TML, TML may not be able to recover the cost and compensation which TSLPL would have received.

Net worth of TML as at end of FY 2020 is ₹ 919 crore while the net worth of TSLPL at end of FY 2020 is ₹ 2016 crore. TSLPL has more assets and transfer of those assets because of the scheme will not only have more hassles because it acquired substantial assets from Usha Martin Ltd as some of the assets are yet to be transferred and registered in the name of TSLPL. Higher immovable properties will now attract higher stamp duty and other transfer costs.

No doubt present scheme leads to higher paid-up capital post-merger as against if merger would have been into TML. The table below are the comparable figures based on the swap ratio filed with the stock exchanges. But because of the constrained mentioned above, the management must have selected TSLPL as transferee company.

Shareholding pattern:

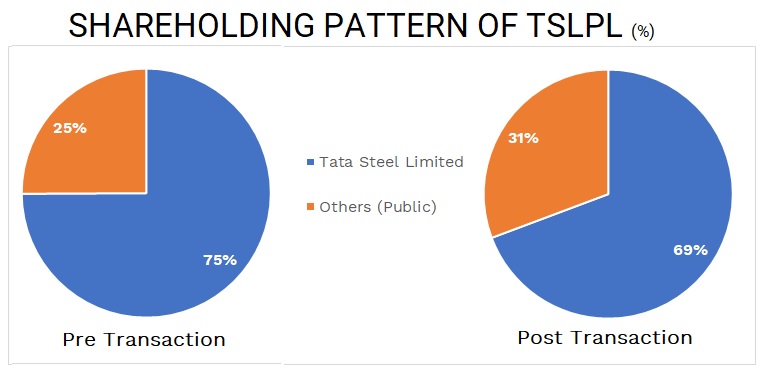

Tata Steel Limited (TSL) is holding companies of all the three companies. Post-merger shareholding of TSL in TSLPL will decline by 6%.

Shareholding pattern of TSLPL

However, if in both the schemes, Transferee company would have been TML, total paid-up capital will be lower by circa 1.4 crores shares.

Table 1: Shareholding pattern comparison with 2 different transferee companies

| Transferee Company | TATASTEEL LONG PRODUCTS LIMITED | TATASTEEL METALIKS LIMITED |

| Shareholders | Nos. | Nos. |

| Tata Steel Limited | 6,00,92,936 | 5,02,97,946 |

| Others (Public) | 2,66,44,999 | 2,22,79,340 |

| Total | 8,67,37,935 | 7,25,77,286 |

Taxation:

Though the merger whether in the present form or alternative scheme of merger into TML will accelerate claim of carried forward losses. So, the structure of the scheme is immaterial from income tax angle.

Losses:

Both amalgamating companies namely ISWPL and TML are generating goods profits and paid a tax of ~ ₹ 46 crore in FY 2019-20. However, on other side the TSLPL incurred loss of ₹516 crores in FY 20 but in Dec quarter of FY20-21 it generated profit of ₹ 304.3 crores.

Financials

Now let us go through the financial statements of TSLPL. In FY 2019-20, TSLPL without considering Usha Martin Limited it generates cash flow from operating activities amounting to ₹ 71.85 crore which turns into negative ₹335.66 crore. Further in FY 2019-20, it issued equity shares of ₹1479.69 crore and borrowed ₹ 2643.67 crore for its buyout of steel division of Usha Martin Limited.

Table 2: Cash flow statement of TSLPL for FY-19-20 (All figs in ₹ crores)

| Particulars | TSLPL (2020) | USHA (2020) | TSLPL (excluding USHA Martin) |

| Revenue | 3571.31 | 2668.60 | 902.71 |

| (Loss)/Profit before tax before exceptional | -369.06 | -533.24 | 164.18 |

| Depreciation and amortisation expense | 310.79 | 300.02 | 10.77 |

| Cash flow | -58.27 | -233.22 | 174.95 |

| Dividend | 5.34 | ||

| Gain on sale of Investment | 2.78 | ||

| Interest Income | 39.16 | ||

| Cash flow from operating activities | 71.85 |

Financial Statements of Transferor companies:

| Particulars | 2019-20 (₹ in Crores) | |||

| Tata Metaliks Limited | The Indian Steel & Wire Products Ltd | TSLPL (excluding Usha Martin | Consolidated (Excluding USHA Martin) | |

| Revenue | 2,051 | 279 | 903 | 3,232 |

| PBT | 201 | 39 | 164 | 404 |

| PAT | 166 | 28 | – | 194 |

| Tax Expenses | 35 | 11 | – | 46 |

Why file two different schemes?

TSLPL decided to file two different schemes to achieve the same strategic objectives and rationales. So even if approval of anyone scheme is delayed, TSLPL can go ahead with the integration of the other scheme, as both the schemes are not dependent and conditional on each other approval. Compliances required for merger of unlisted company into listed company are different and detailed. Further compliances like taking approval of shareholders may not be necessary as it is unlisted company and finally ultimate holding company in all three cases is Tata Steel Ltd.

Conclusion:

As compared to ultimate holding company i.e. Tata Steel Ltd, all three companies are very small. Ultimately, all these companies will consolidate with Tata Steel Ltd. At present, license regulations for mines restricts transfer of ownership or entails large cost hence it seems the management is not making attempt to consolidate with Tata Steel Ltd.

Add comment