TITAGARH Group is a leader in manufacturing of heavy engineering equipment, like freight wagons, railway castings – bogies and couplers. The group is operated in India and Europe through several subsidiaries and joint ventures.

Titagarh Wagons Limited (TWL) is in the business of manufacturing of rail rolling stock including railway wagons, passenger coaches, steel castings of various configurations, shipbuilding, bridges and special projects for defence establishment of India and other heavy engineering equipment/ product. The Shares of the TWL are listed on NSE and BSE. The market cap of TWL is around Rs 600 crore.

CIMMCO Limited (CIMMCO) a public limited company incorporated in the year 1943 under the Companies Act, 1913 under the name Texmaco (Gwalior) Limited. Thereafter the name of the company changed several times with the current name changed in the year 2010. The shares of CIMMCO are listed on NSE and BSE. The majority shares of CIMMCO (74.89%) are held by TWL. The market Cap of CIMMCO is around 65 crore.

CIMMCO is mainly into the business of manufacturing of railway wagons and heavy engineering projects/products with manufacturing facility at Bharatpur, Rajasthan.

Titagarh Capital Private Limited (TCPL), a NBFC registered with Reserve Bank of India and a private limited company originally incorporated in the year 1994 with name and style as under Flourish Securities and Finance Private Limited. The name of the company changed to TCPL in the year 2012. TCPL is 100% subsidiary of TWL.

TCPL is engaged in the business of leasing of wagons, investments, and other non-depositing accepting non-banking financial activities.

TWL, CIMMCO and TCPL belong to Titagarh Group. Titagarh group contains various divisions viz Railway, Defence, Tractor, Heavy Earth Moving and Mining Equipment Division, Bailey Bridge Division.

Brief History:

- CIMMCO Ltd. is very old company which was registered in the year 1943 and was mainly engaged in manufacturing of railway wagons and heavy engineering products with manufacturing facilities located at Bharatpur (Rajasthan). The name of the company was changed to CIMMCO Birla Limited (CBL) in the year 1994. In the year 2000, the company was declared sick by the Board for Industrial & Financial Reconstruction (BIFR) and the operations of the CIMMCO was suspended at its manufacturing plant.

- TWL entered into an agreement for acquisition, revival and rehabilitation of the sick Cimmco Birla Ltd (CBL) with BIFR for the consideration of Rs 35 crore.

The Transaction:

The board of directors of TWL, CIMMCO and TCPL approved a proposal of amalgamation of entire undertaking and business of CIMMCO and TCPL with TWL.

The appointed date of the transaction is April 1, 2019. Following the completion of the merger, CIMMCO and TCPL will get dissolved without winding up.

Rationale for the Scheme:

CIMMCO and TWL are listed on same stock exchanges and all the three companies are into similar and ancillary business. Following are the key benefits behind this scheme.

- To consolidate similar business by way of group reorganisation.

- To improve & achieve greater operational efficiency & synergy by combining activities, pooling up resources, business expertise and processes.

- To compete in increased competitive industry by optimum utilisation of manpower having diverse skills, talent, management expertise, experiences.

- It will help to undertake large projects on the basis of better economic control, increased financial strength, enhancement in flexibility.

SWAP Ratio:

- For every 24 equity shares of Rs. 10 each of CIMMCO, TWL will issue 13 equity shares of Rs 2 each.

- TCPL is 100% subsidiary of TWL, hence no consideration is payable.

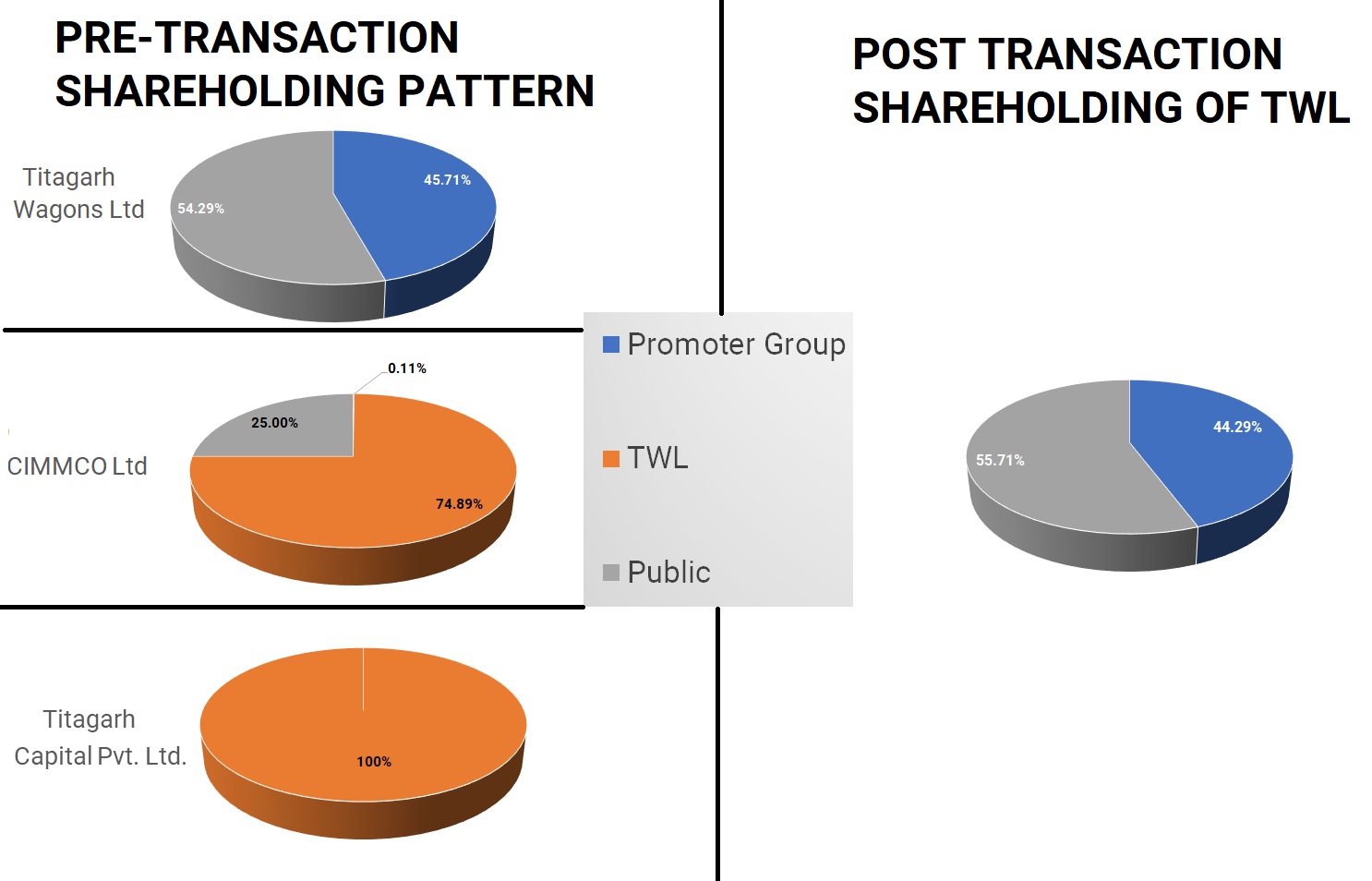

Shareholding Pattern:

As per valuation, the fair value of CIMMCO is approx. Rs. 108 crore and the fair value of TWL is approx. Rs 846 crore. which is almost eight times higher than CIMMCO.

Financials

Table 1: Financials FY 18-19 of all 3 companies (All Figs in INR Crores)

| Particular | TWL | CIMMCO | TCPL |

| Income from operations | 910.11 | 257.18 | 0.66 |

| Total Income | 932.2 | 273.82 | 0.67 |

| Total Expenditure | 892.61 | 272.88 | 0.83 |

| PBT and exception item | 39.59 | 1.04 | -0.16 |

| PAT | -82.87 | 27.81 | -0.16 |

| EPS | -7.7 | 10.17 | 1.08 |

| Fixed Assets | 328.85 | 272.68 | 10.35 |

| Loan (Secured + Unsecured) | 175.93 | 120.14 | 4.9 |

| Net worth | 804.56 | 190.18 | 25.34 |

- TWL increases in operational income due to in revenue from shipbuilding during the FY19 owing to execution of the prestigious orders received from Indian Navy and National Institute of Ocean Technology (NIOT).

- However, the FY19 on a standalone basis ended with loss due to exceptional items being impairment in the investment of subsidiary company in France consequent to it being referred for rehabilitation process.

Accounting Treatment:

As per the scheme of Arrangement, the Amalgamation shall be accounted as per “Pooling of Interest Method” in accordance with Indian Accounting Standard (IND AS 103), Business combination and other accounting principles prescribed under the Companies (Indian Accounting Standards) Rules, 2015 as prescribed under Section 133 of the Companies Act, 2013.

Competitive Edge and Prospects:

- The consolidated order book of the Group for the current year is around Rs 5,500 crore which is more than double of what it was last year. Out of the said orders, TWL has an order book of Rs 2,200 crore, CIMMCO has order book of 800 crore and Italian order book stands around Rs 2,000-2,500 crore.

- TWL has won the tender of Indian Railways, the largest customer of the company, to supply 5,058 wagons valued at Rs 1560 crore. The order is almost 50% of total tender issued by railways which is for 11,790 wagons.

- Titagarh, along with its WOS Titagarh Firema SpA have won tender for the design, manufacture, supply, testing, commissioning of passenger rolling stock comprising electrical multiple units and training of personnel for the Pune Metro Rail Project. From this project TWL will get order value of approx. Rs 1,125 crore shortly.

- TCPL does not have any substantial operations hence the management decided to merge TCPL with TWL and it appears TWL is not interested in continuing with the leasing & Investment business.

- TWL will provide total 34 train sets having three cars each, as per contract with Pune Metro which will be supplied by the company in a span of 160 weeks. As per the tender documents, first three Car Prototype Metro Trainset is to be supplied in 78 weeks and the balance 33 train sets in several phases over 160 weeks. The total revenue will spread over term of this tender.

- As per Railway contract, one third quantity i.e. 1686 Wagons is to be supplied within six months. The supply for all the wagons to be completed before February 2020. Further Italian subsidiary Titagarh Firema SPA has awarded with supply of 54 units of metro valued at about Rs 1,741 crore to the company Ferrovia Circumetnea, Italy. Apart from manufacturing wagons, the company is also bidding for building of high-end naval vessels for the Indian Navy

- Earlier the company was operating at 15% EBITDA margin level but considering current high competition, the company is operating around 8 to 10% EBITDA margins level. The company, competing globally with Alstoms-France, Siemens Mobility-Germany, Stadlers-Switzerland, in India the chief competitor is BEML Limited, there is no new competitor in Indian Market though there are couple of new players like Intel but it’s not impacting drastically on competition landscape.

- CIMMCO and TWL are in same line of business and both having key customer Indian Railways. The uncertainty in timely placement of wagons procurement orders by Indian Railways impacting adversely on business of these companies. But recently, TWL is awarded with a big order by Indian Railway further bureaucracy hurdles needs to be overcome so as to timely execution of placed orders.

- The company stretches its global reach and presence through factories in India, Italy and France with offices also in Singapore and Dubai.

- Order intakes from Railways, increased momentum in private sector orders and turnaround in the overseas keeping the company to maintain its leadership in the market.

Operational & Compliance Benefits

- There is requirement of large working capital in the business of manufacturing of Wagons. CIMMCO has already borrowed 63% of its net worth, while in the case of TWL and TCPL the percentage of borrowing is very less compared to their net worth. Following the scheme, TWL will increase its borrowing power, by which need of large Working Capital will somehow be accomplished.

- TWL and CIMMCO are listed entities listed on same stock exchanges i.e. BSE and NSE, the burden of duplicity in compliances under Companies Act, Listing Agreements and such other regulatory bodies will go off.

- Following the merger related party transaction (Purchase and sales) amounting to Rs. 105 crore (approx.) will be eliminated which is currently reflecting in the standalone financials of respective companies.

- There will not be any impact on labour compliances, since CIMMCO will merge into TWL and Manufacturing will continue. It is just shifting of Compliance Burden from CIMMCO to TWL.

Conclusion

The merger is in fact, a simple consolidation of similar business in a single entity by group reorganisation. All three entities have an identical business models. TWL is leading manufacturer of Wagons & Coaches, Specialized Equipment’s & Bridges, Shipbuilding. CIMMCO is subsidiary company of TWL and also carrying manufacturing activities broadly categorized as Wagon Manufacturing, Engineering & Project Division, Hydro-Mechanical Division, Specialized Product whereas TCPL, 100% subsidiary of TWL is engaged in the business of leasing of Wagons, manufactured by CIIMCO and TWL. By this Arrangement, TWL will close diversified business and will focus on core areas of manufacturing of Wagons and Shipbuilding as TWL is receiving numerous orders for the same.

Add comment