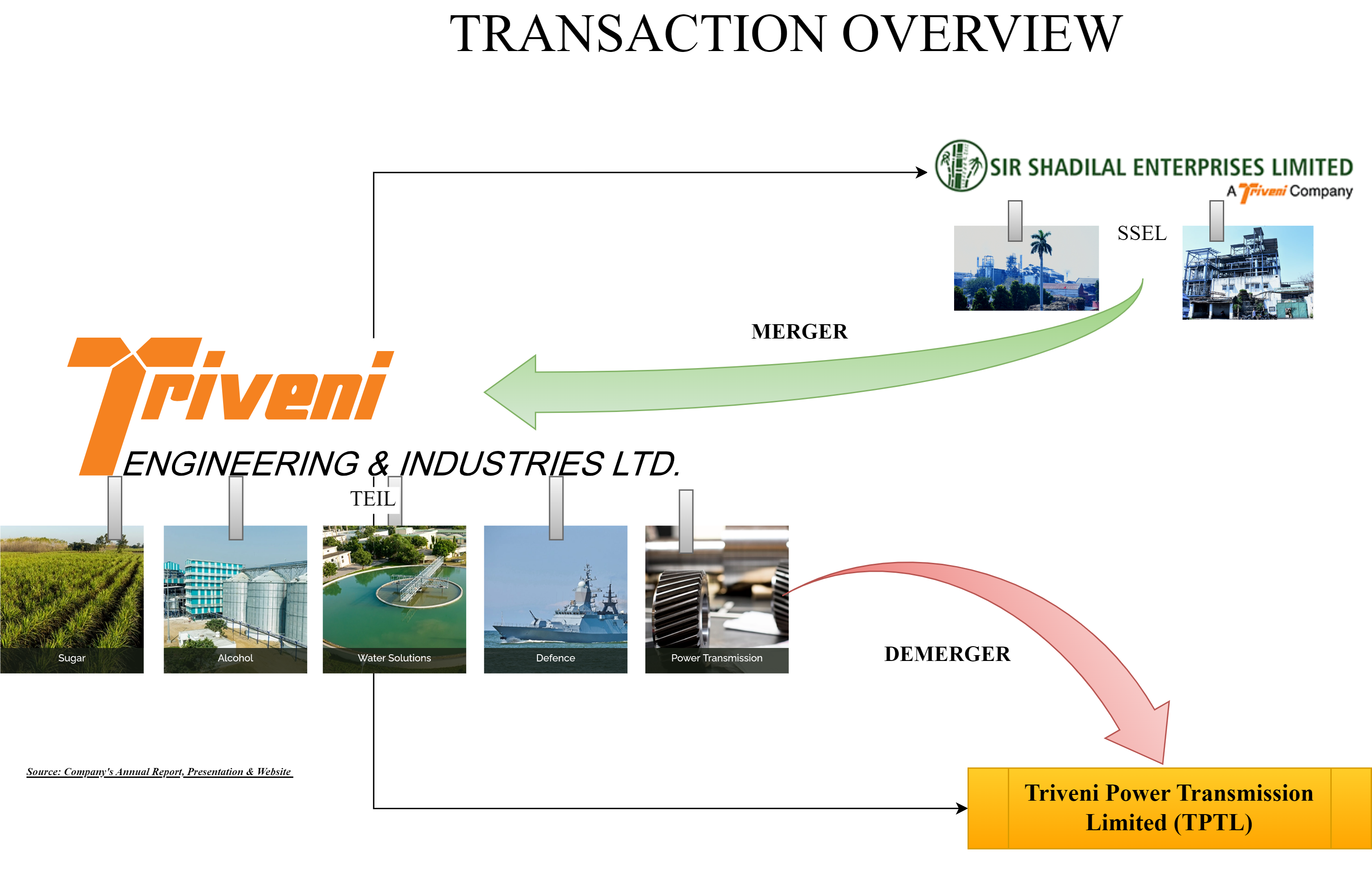

The Board of Directors of Triveni Engineering & Industries Limited announced the consolidation of its recently acquired listed company followed by the separation of its power transmission business.

Triveni Engineering & Industries Limited (“TEIL” or “Demerged Company” or “Transferee Company”) is engaged in three business verticals:

- Sugar & allied business

- Power Transmission Business

- Water Business

The shares of TEIL are listed on nationwide bourses.

Sir Shadi Lal Enterprises Limited (“SSLEL” or “Transferor Company”) is engaged in the sugar & distillery business. Distillery business mainly consists of the manufacturing of spirits, Alcohol & Ethanol. The equity shares of SSLEL are listed on BSE Limited.

In 2024, TEIL to expand its sugar business acquired 25.43% equity shares from erstwhile promoters for a consideration of INR 35 crore. Pursuant to the acquisition, TEIL made an open offer which did not garner any response from public shareholders. Thereafter TEIL acquired remaining stake for a consideration of INR 44.83 crore from erstwhile promoters of SSLEL making its total equity stake 61.7%.

Triveni Power Transmission Limited (“TPTL” or “Resulting Company”) is incorporated to facilitate the proposed demerger of the power transmission business of TEIL. As on date, TPTL is a wholly owned subsidiary of TEIL.

The Proposed Transaction

The board of directors of TEIL, SSLEL and TPTL approved a composite scheme of arrangement which inter-alia provides for:

- Merger of SSLEL with and into TEIL and the consequent issuance of equity shares by TEIL to the shareholders of the SSLEL

- Demerger by way of transfer and vesting of the Power Transmission Business Undertaking of TEIL to TPTL and the consequent issuance of equity shares by TPTL to the shareholders of TEIL

The Power Transmission Business (“PTB”) of TEIL consist of gears and defence business segment. The gears business involves OEM and aftermarkets while defence involve OEM & providing defence business solutions.

The appointed date for the merger is April 01, 2025, or such other date as may be approved by NCLT and for the demerger it will be Effective Date, or such other date as may be mutually agreed by the Demerged Company and the Resulting Company, or such other date as may be directed by the NCLT. Thus, demerger will be given effect much after the consolidation of SSLEL. This may be some assets & liabilities of SSLEL getting transferred to TPTL as a part of “PTB” undertaking.

As mentioned in the scheme, the proposed transaction will be given effect in the chronological order as mentioned above. Thus, the shareholders of SSLEL will also get a chance to participate in the PTB undertaking of TEIL.

Rationale for the Proposed Transaction

- Both TEIL and SSLEL have manufacturing verticals of sugar and distillery; therefore, the proposed merger would lead to the consolidation of all operations pertaining to the manufacture of sugar, alcohol, and ethanol in one entity

- It will result in the reduction of the multiplicity of entities, thereby reducing compliance costs of multiple entities viz., statutory filings, regulatory compliances, labour law/ establishment related compliances.

- The PTB and the Residual Business of TEIL address different market segments with unique opportunities and dynamics in terms of business strategy, customer set, geographic focus, competition, capabilities set, talent needs and distinct capital requirements.

- PTB has attained a significant size, scale and has a large headroom for growth in its market. As PTB is entering the next phase of growth, the transfer and vesting of the PTB Undertaking into the Resulting Company pursuant to this Scheme would result in focused management attention and efficient administration to maximize its potential.

Share Capital & Swap Ratio

For the merger of SSLEL, TEIL will issue 100 equity shares of INR 1 each for every 137 equity shares of SSLEL while for the demerger, TPTL will issue 1 equity share of INR 2 each for every 3 equity shares held by the shareholders of TEIL.

The swap ratio for the demerger has been decided based on the stake TPTL wants to maintain in TEIL. Generally, in the demerger of the listed entity, existing shares of demerged company in the resulting company get cancelled and mirror image shareholding has been created. However, in the proposed demerger, the existing shares of TEIL will not get cancelled and TEIL will have 30% equity stake in TPTL post demerger. There could be several reasons for doing so including:

- Recover money invested by TEIL in PTB undertaking till date by selling its stake in TPTL in future or flexibility to infuse more funds if required in future;

- Enhanced control over TPTL (Promoters stake in PTPL will be 72% against 60.58% in TEIL);

- Offering greater stake to acquirer if in future existing promoters wish to divest PTB business

Please note that the above demerger still qualifies to be a tax-neutral demerger as it complies with the provisions of Section 2(19AA) of the Income Tax Act, 1961.

Changes in shareholding pattern:

Because of the retention of 30% stake by TEIL, the promoter’s effective stake in TPTL will be increased to 72.36% compared to 60.58%.

Financials

There is no clarity given by the management on division of unallocable assets & liabilities of INR 425 crore & INR 1157 crore respectively between PTB & remaining business. Further, PTB is going under expansion on account of which the segmental assets have been increased from INR 226 crore on 31st March 2024 to INR 309 crore on 31st December 2024.

Power Transmission Business is margin accretive and has better return on capital employed. Sugar & Distillery business has been cyclical its return can change drastically on Y-o-Y basis.

Valuation

TEIL acquired a controlling stake in SSLEL at equity valuation of INR 130 crore translating to INR 235 per share. While arriving at swap ratio, the relative value of per share of SSLEL is determined as circa INR 334 per share translating to total valuation of INR 175 crore.

Conclusion

The scheme achieves consolidation of sugar business and at the same time creates focus entity for the Power Transmission Business Undertaking by demerger of the undertaking into Wos but with a change that Triveni maintains 30% stake in the demerged company by not cancelling shares already owned by Triveni before the demerger. It can facilitate the promoter to raise further funds without worrying about losing control of the new company.