Recently, TVS Holdings Limited announced the completion of its demerger of non-ferrous gravity and pressure die castings business along with the amalgamation of its holding company & other group entity. The entire transaction was highly intricated however, was so perfectly aligned & executed in accordance with commercial understanding.

Most family arrangement becomes complicated when you have companies both private and listed involved as part of transaction however recent implementation of family arrangement of TVS group clearly stands exception to this. Despite having multiple businesses & family tranches, the entire scheme of things being executed without any significant hurdle.

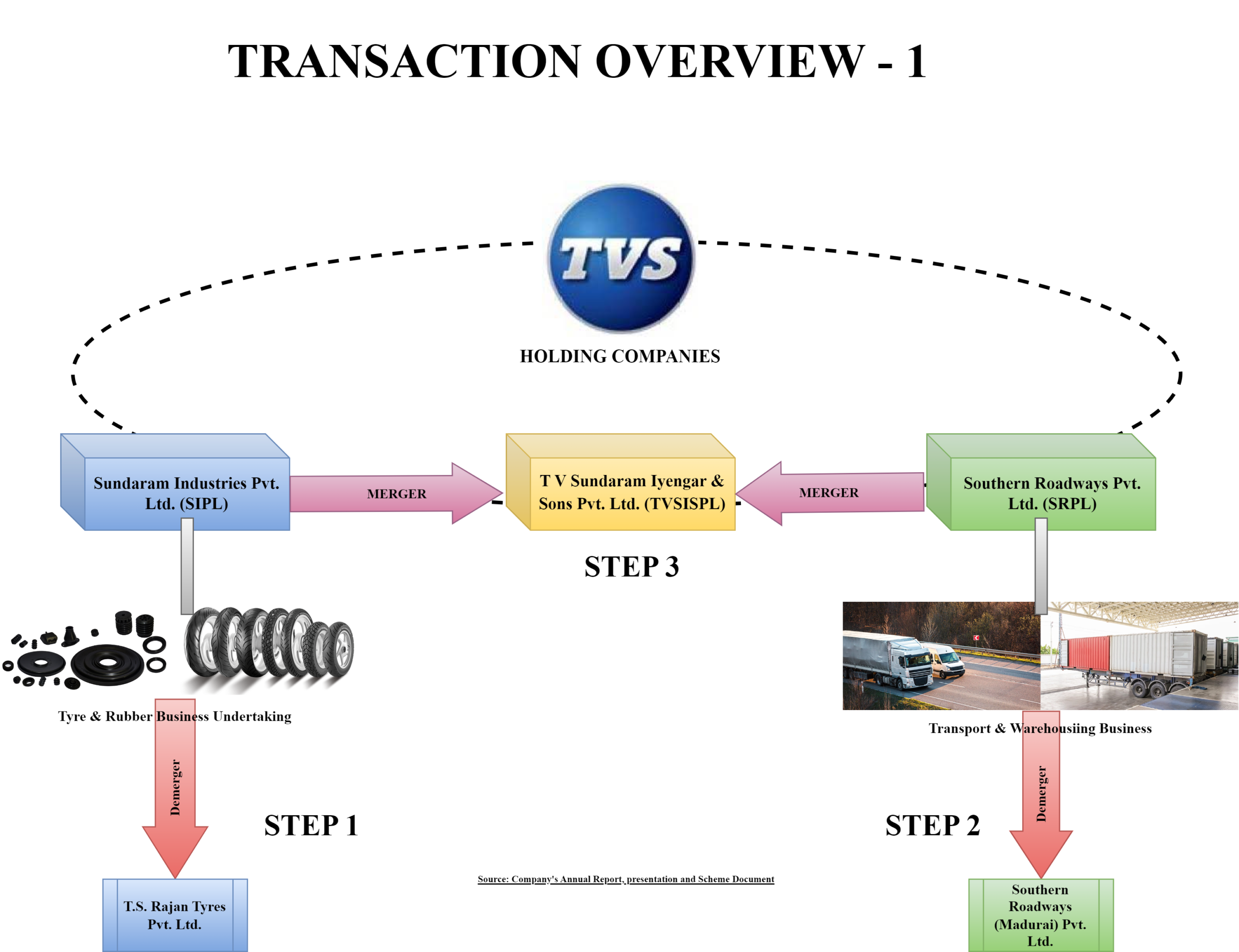

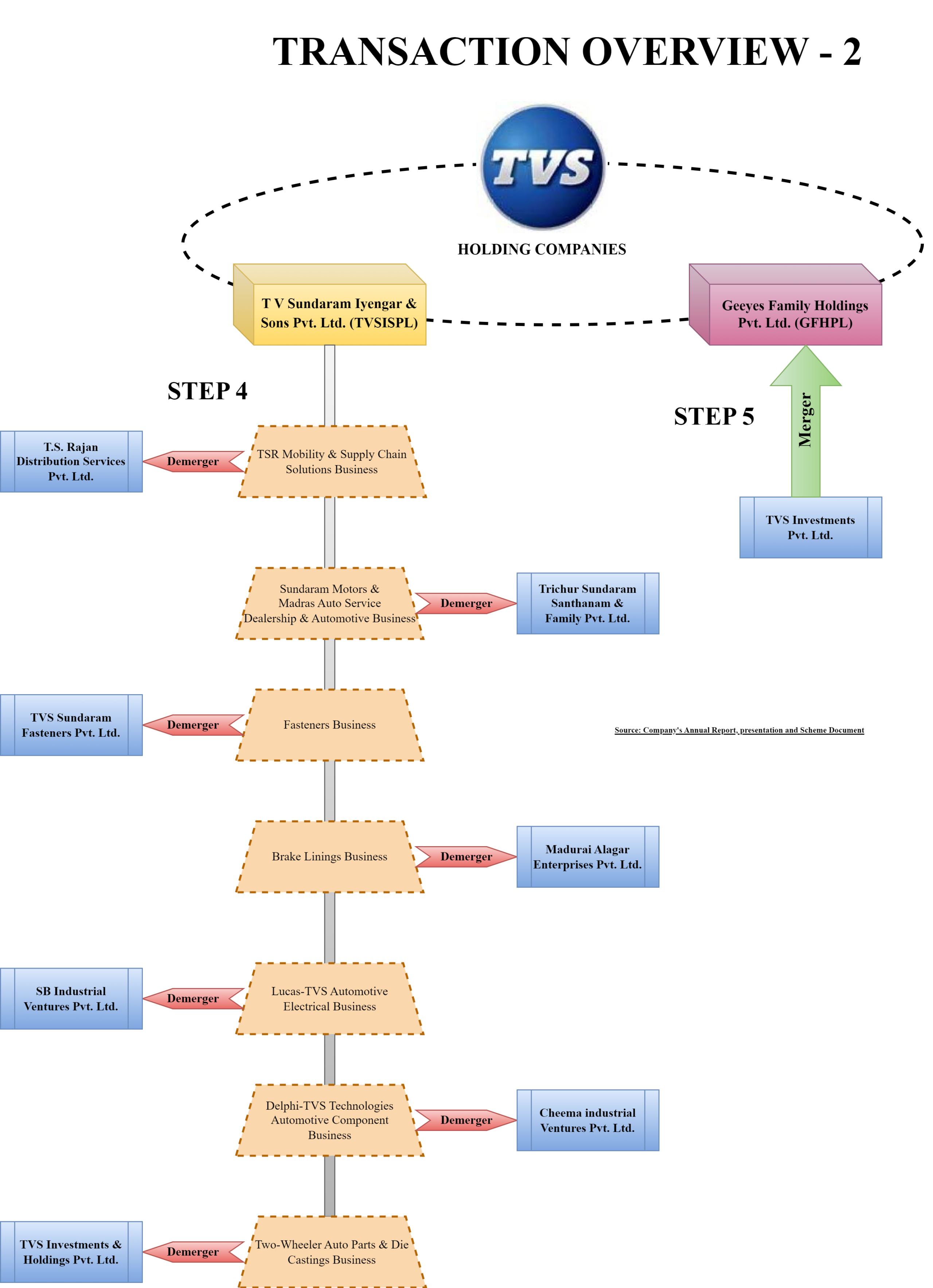

The family arrangement is being carried by way of two key transactions:

- First, mega restructuring involving 14 companies (with multiple demergers & mergers) being executed through a single composite scheme.

- Second being the complex restructuring carried by listed TVS Holdings Limited which facilitated merger of the group entity & holding company along with demerger of non-ferrous gravity and pressure die castings business.

Though, the second part is with respect to only one of the family members of TVS group and being executed independently with listed entity involvement, one may believe that the same was executed as integral part of the larger family arrangement as TVS Holdings Limited being the largest part of TVS entity (TVS Holdings Limited is holding 50.26% equity interest of TVS group’s flagship company TVS Motors Company Limited)

TVS Holdings restructuring was not only to pave the way for separation of TVS Motors ownership from non-ferrous gravity and pressure die castings business, but it also effectively parked the consideration payable by the T.S. Srinivasan family to other members into a listed company for getting the sole control of the flagship business.

The family arrangement & its background:

The TVS Group, which consisted of businesses, was started by the original founder, Shri T.V. Sundaram Iyengar, and his lineal descendants constitute the TVS Family. The TVS Family has been engaged, for more than a century, in a diverse range of businesses (businesses operating in diversified fields including two-wheeler and automotive component manufacturing, automotive dealerships, distribution of automotive parts, financial services, logistics services, electronics, textiles and needles) through various entities.

Branches of the TVS Family had invested in such entities directly or through T V Sundram Iyengar & Sons Private Limited, Sundaram Industries Private Limited, and Southern Roadways Private Limited (hereinafter collectively referred to as the “TVS Holding Companies”).

The various businesses/ entities of the TVS Group were traditionally managed by members of the different branches of the TVS Family.

Before implementation of the scheme, it was being managed by third/fourth generation, to avoid any clashes or difference the members of the TVS family entered into memorandum of family arrangement (“MFA”) dated 10 December 2020 executed between various members of the TVS family. Pursuant to the MFA, it was decided to split the ownership structure across different family branches.

The biggest challenge what appears was dividing the ownership with optimal duties & taxes as the ownership into various businesses were held through TVS Holding Companies. The solution which worked out was mega restructuring between 14 entities.

Part I: Different facets of mega restructuring:

A single composite scheme of arrangement was executed by the group involving 14 private entities. Interestingly, no listed entities were made party to this complex scheme and thus were executed timely and without any significant challenge.

The transaction involved multiple demergers & mergers which will place each business into the respective group’s company and will collapse the common holding companies.

The diagrammatic representation of the transaction has been given below:

As one can notice, multiple transactions were executed through a single scheme to achieve separation of ownership between various family branches.

To avoid any doubt, each of the demerger undertakings was clearly defined with the inclusion of strategic investments in private & listed companies which formed part of the undertakings.

The scheme inter-alia also included a list of members of various groups, details of immovable properties etc. as its annexure. The Appointed Dates were divided clearly which will give the desire result and sequential re-organization/transfer. The scheme also shifted the execution cost (including the stamp duty) on respective resulting/transferee company.

Post approval of all necessary regulators, Hon’ble National Company Law Tribunal, Chennai Bench sanctioned the scheme and the order made effective dated January 6, 2022.

Post allotment of shares, it seems that respective groups swap shares between themselves to get sole control of respective businesses. In all, it was a well executed super complex scheme.

Brand & non-compete agreement

All the companies have able to establish its significance on account of “TVS” brand. For any family arrangement, sharing of brand becomes an essential element. The group executed brand agreement 29th January 2021 to record their understanding in respect of the use, adoption, registration of “TVS” and/or “Sundaram” and/or “Sundram” trademarks and several other trademarks which contain additional elements other than the Word Mark (including as either a prefix or suffix).

In addition, the members of the TVS family on 29 January 2021 also executed a Non-Competition Agreement. As mentioned in the press release by TVS Holdings Limited, this is a limited period agreement intended to protect the businesses carried out by each family group prior to the family arrangement.

Being private documents, no other details are available in public domain.

Part II: Restructuring Scheme by TVS Holdings Limited

Immediately post effectiveness of the mega scheme, on February 9, 2022, TVS Holdings Limited announced a composite scheme of arrangement which inter-alia provided for:

- Issuance of non-convertible redeemable preference shares as bonus shares amounting to circa INR 2500 crore;

- Demerger of non-ferrous gravity and pressure die castings business.

- Merger of TVS Holding Private Limited & VS Investments Private Limited into TVS Holdings Limited (that time Sundram Clayton Limited).

Demerger of non-ferrous gravity and pressure die castings being normal activity to unlock value for stakeholders, what invited attention was issuance of bonus non-convertible redeemable preference shares and merger of VS Investments Private Limited into TVS Holding Limited (“VS”).

VS was not engaged in any business activity & was not connected with TVS Holdings Limited. The intention behind the VS merger was to park the loan of circa INR 1650 crore raised by the promoters into TVS Holdings Limited. Most likely the loan was raised to compensate the other members of the family for getting sole control of the flagship business.

The public shareholders were incentivized for approval of the scheme through issuance of bonus preference shares of significant amount. But one of the key reasons for issuance of preference shares as bonus was out of promoter’s necessity to pay-off/settle the loan raised for family arrangement.

Through the merger of TVS Holdings Private Limited (erstwhile Holding Company of TVS Holdings Limited), promoters individually received preference shares as bonuses which were issued to TVS Holdings Private Limited (being shareholder). Immediately after receipt, these preference shares were transferred to settle the loan taken form VS Investment by the promoters. VS Investment funded the loan through outside borrowing. By merging VS Investment into TVS Holdings, significant preference shares issued to promoters were knocked off, but liability of VS Investment (loan taken) was transferred to TVS Holdings. Interestingly, the loan taken by VS Investment was secured against the pledge of shares of TVS Holdings Limited.

Of course, the loan was parked in the listed company in lieu of extinguishing/cancellation of significant preference shares issued to promoters being shareholders of TVS Holdings Limited.

Again, the entire scheme was being given effect orderly with different appointed dates. This envisaged beautiful placing the loan raised by the promoters in listed company with minimum tax implications.

We have covered the above in an article in our April Issue (free to read)

Stake sale in TVS Motors for preference shares:

As mentioned earlier, the issuance of preference shares as a bonus was part of the scheme. TVS Holdings Limited realized the requisite amount through selling its stake in TVS Motors Company Limited. TVS Holding sold circa 7.1% equity stake in TVS Motors in the market for consideration of circa INR 2100 crore. Interestingly the value of the same stake now accounts for circa INR 6500 crore (thrice what they realized two years ago).

In late 2022, Srinivasan Trust (promoter) also sold circa 0.5% stake in TVS Motors and realized INR 262 crore. It appears, all selling was indirectly to fund the family arrangement.

Additionally, promoters also sold some of their stake in TVS Holdings Limited.

Tax Aspect:

Essentially, the entire family arrangement & both transactions were designed to have optimal tax outflow.

- Demergers & Mergers likely to be tax neutral in accordance with section 47 of the Income Tax Act (provided it complies with the conditions mentioned therein).

- Selling of shares of TVS Motors by TVS Holding Limited & Srinivasan Trust: likely to be taxable event.

- Swapping of shares between promoters: If compliant with relative definition, then tax neutral otherwise taxable event.

- Issuance of preference shares as bonus: Though issuance may not be deemed to be taxable event, redemption of the same will attract tax.

- Transfer of preference shares by promoters against loan liability: This really needs detailed discussion however prime facie it appears to be taxable event.

One of the key tax risks remain will be for any reasons if the mega restructuring was deemed to be not compliant with the provisions of section 2(19AA) of the Income Tax Act, 1961, the tax liability will now shift to TVS Holdings Limited which will be substantial. However, it appears even safeguarding was taken by the group.

Legal Implications of the transaction:

One of the key considerations while structuring the transaction was implications of open offer as envisaged under the Securities and Exchange Board of India (SEBI) Takeover Code. Though no listed company was involved directly as a part of mega restructuring, there was indirect change of control between family members. However, as there was an inter-se promoter change of control & the same was pursuant to the scheme of arrangement, the specific exemption for open offer was provided as section 10 of the takeover code.

Conclusion

It is a smoothly (both in terms of compliances and tax leakages) executed family settlement with clear and defined ownership and management of various group businesses by members of TVS third generation family members. It is like giving a platform to each group of family members to grow in line with their own vision and priorities. Most important, it did not compromise the interest of the public shareholders in any way. Now it will be the last step where TVS Motors and TVS holdings are merged to create value for the shareholders of TVS Holdings Ltd.