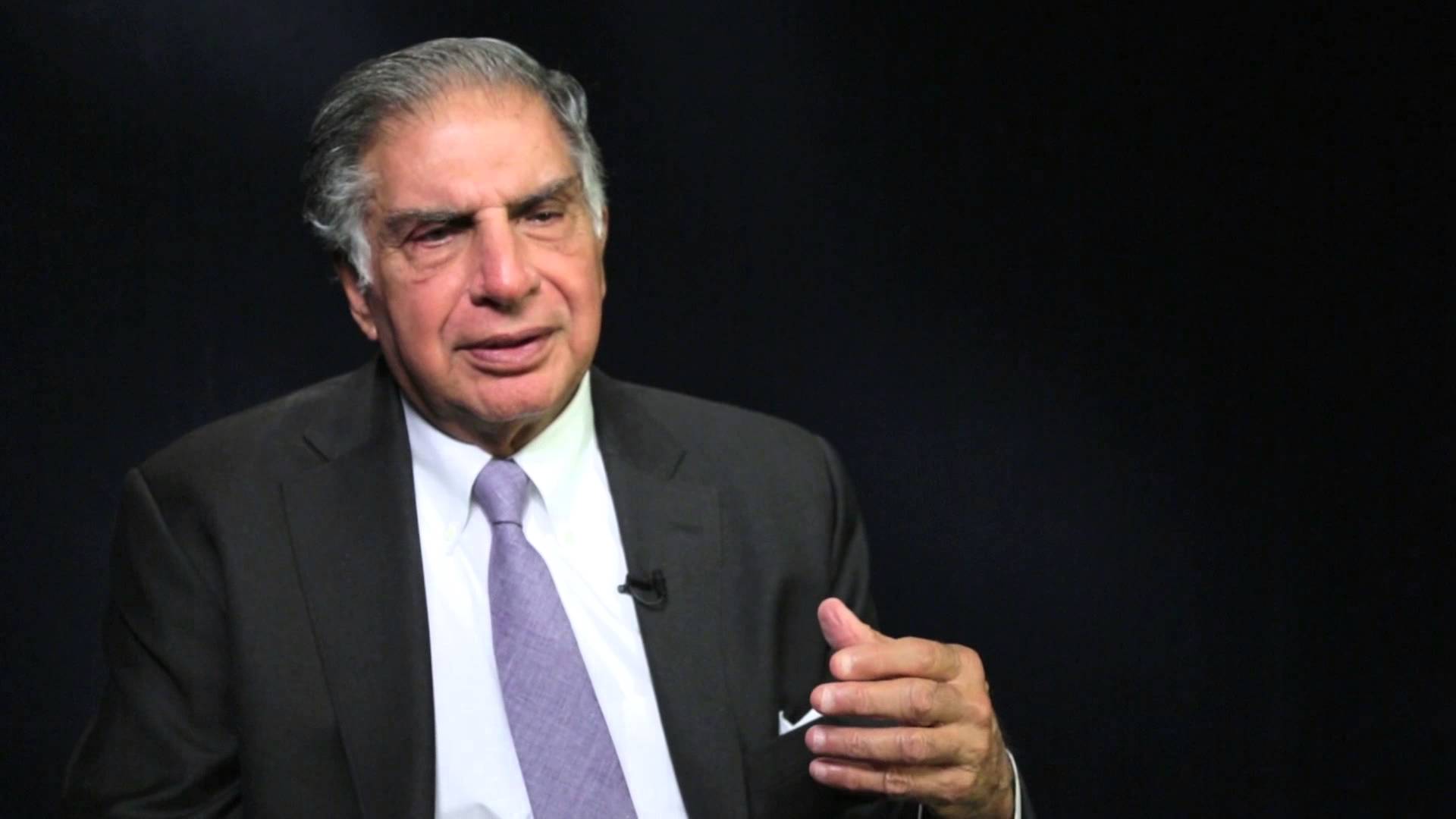

Ratan TATA‘s long-standing but unrealized dreams may finally be getting wings. Nearly six decades after the Indian government divested the TATA’s of their majority holding in Air India by nationalizing the airline, TATA Sons, and Singapore Airlines announced plans in September 2013 to set up a new New Delhi-based full-service carrier, pledging a combined $100 million to get it going. TATA Sons will pump in $51 million for a 51 percent stake and Singapore Airlines (SIA) will invest $49 million for the remaining 49 percent in the Joint Venture. The announcement has not only surprised the aviation industry but evoked tremendous interest.

TATA’s Aviation Journey so far:

There is a long history of TATA and SIA wanting to launch aviation business in India. TATA Group had founded the TATA Airlines in 1932 which had heralded the birth of civil aviation in India. But the airline was nationalized in 1953 and was named as Air India. Singapore Airlines (SAI) began with the incorporation of Malayan Airways Limited (MAL) on 1st May 1947, by the Ocean Steamship Company of Liverpool, the Straits Steamship Company of Singapore and Imperial Airways. The airline’s first flight was a chartered flight from the British Straits of Singapore to Kuala Lumpur on 2 April 1947 using an Airspeed Consultwin engined aircraft. Since its inception, SIA has grown by leaps and bounds. Today Singapore Airlines flies to 62 destinations in 35 countries on six continents from its primary hub in Singapore.

In the 1990s, SIA and TATA had come together to start an airline but the plan got shelved by government policy changes. In 2000, TATA and SIA partnered again to buy 40 percent of Air India in the strategic disinvestment of Air India but that proposal too collapsed. The JV is an effective third attempt by both the companies to enter into in Indian Airspace. This follows an earlier decision in February to begin a low-fare airline in collaboration with AirAsia Bhd and Arun Bhatia of Telestra Tradeplace Pvt. Ltd.

The introduction of a new airline with a strong fleet would lead to increased competition and lower fares

The Deal:

TATA Group and SIA have submitted a joint proposal for approval of the Foreign Investment Promotion Board which will entail an investment of $100 million. Singapore Airlines’ US$49 million investment in the new airline will be funded from internal resources. SIA approached TATA Group with the proposal to start an airline in the country. The TATA Group and Singapore Airlines (SIA) have assured the government that the foreign carrier would not raise any loan in India to capitalize the JV and further funding beyond its $49-million initial investment will come in as per business requirements. Upon receipt of all necessary approvals from the FIPB under this proposal, the JV company shall be capitalized to the extent of 50 crores. Singapore Airlines will make its investment through subscribing to the share capital of the joint venture company or by purchasing the existing shares of the joint venture held by the TATAs.

To begin with, the joint venture company will have a three-member board. While Mak Swee Hah will be Singapore Airlines’ sole nominee, TATA Sons will be represented by Prasad Menon and Mukund Rajan. Menon will be the chairman of the Company. In addition, the substantial ownership and effective control of the JV Company will remain with TATA. Also, the SIA will have minority representation on the board and will not be in a position to exercise ‘de facto control’ of the venture.

Synergies:

The principal activity and contribution of SIA will be to provide access to the global network of SIA, providing the necessary technical expertise and know-how, providing access to the tools training and best practices of SIA in the aviation industry in the manner to be naturally agreed between the applicants, provide for secondment of personnel for developing the expertise and making reasonable efforts for the JV (joint venture) company to benefit from the economies of scale offered by vendors to SIA in relation to procurement of aircraft, engineering services, spares and infrastructure.

TATA’s contribution to the company would include providing knowledge of the Indian market (including knowledge of the customers and related market support), providing for secondment of personnel, working towards creating synergies between the TATA SIA Airlines Ltd and other affiliates of TATA on a best effort basis, making reasonable efforts to benefit from economies of scale offered to vendors to TATA in relation to goods and/ or services as may be required by the JV company from time to time.

The introduction of a new airline with a strong fleet would lead to increased competition and lower fares. Since the JV Company will hire Indian residents to assist in establishing its operations in India, this would create jobs especially for young people and provide for their training. This will enhance the development of Indian employees and contribute to human resources development in India. With its $49 million investment (49 percent of the JV) in the full-service airline, SIA will attempt to tap the premium market in the country, dominated by Jet Airways after the collapse of Kingfisher Airlines, and create a hub in New Delhi, to link the Americas with Australia, one of its stronger markets. It would have to do this amidst increasing competition from Gulf carriers and low-cost carriers.

Why a JV?

In September last year, the government allowed overseas airlines to invest up to 49% in local airlines. Previously, foreign investors, but not airlines, had been allowed to hold up to a 49% stake in local airlines. As per the guidelines issued by the government, following limitations were imposed on such investments:

- To be eligible for a scheduled operator status, the company has to be one registered and having its principal place of business within India, with its chairman and at least 2/3rd of its directors being citizens of India. The “substantial ownership and effective control” of such company must be vested in Indian nationals.

- The 49% limit incorporates both FDI and investments by the foreign institutional investors (FII).

Thus, for a foreign airline to operate a passenger airline in India forming a JV seems to be a good option. The JV not only provides an option to operate an airline in India but also gives the foreign airline an opportunity to enhance and increase its existing market share in the Indian Market.

What’s in it for Singapore Airlines?

India is amongst the fastest growing aviation markets in the world. As per CAPA (Centre for Asia-Pacific Aviation), SIA’s capacity share in the India market is only 3.1%, which is behind Air India, Jet Airways and Emirates, whose market share stands at 12.5%, 11.45%, and 10.3% respectively. The JV would help SIA in not only securing traffic from India but also it could launch new flights to Europe and North America from New Delhi. SIA could also use India as a Second hub, i.e. it could potentially fly some of its passengers to secondary destinations via India, providing a wider network and thus closing the gap with other carriers which offer a wider range of destination. Thus, taking a shot at India seems like a good bet for SIA.

Open Sky:

The domestic market is divided between low-cost airlines — IndiGo, SpiceJet, Jet Konnect and GoAir – which hold over 60 per cent market share, with the legacy carriers Air India and Jet Airways accounting for the rest. The TATAs have stated in unequivocal terms that the new airline will be a full-service carrier. The reality, though, is that its operations will be restricted to the domestic market because current regulations do not permit an airline to fly internationally till it has met two primary conditions: five years of domestic operations, and a fleet of 20 aircraft.

When TATA-SIA comes in, it will be two monoliths joining hands and coming up with a formidable airline. The Indian market already has quite a few players but they don’t have big pockets like those of TATA-SIA. While most aviation players lost money, the market is ripe for innovation in premium services. SIA is not a stranger to innovation and has been able to hold on to its branding. It was the first to fly the superjumbo Airbus A380 and will be one of the first to fly the extended version of Boeing 787, which promises to cover up to 90 percent of all wide-bodied aircraft routes from 2018 onwards. But it is true TATA-SIA will have to build up their market share from scratch.

The exit of Kingfisher Airlines has created a void in the full-service carrier (FSC) space. India now has only two full-service domestic airlines—Air India (AI) and Jet Airways. The TATA Sons and Singapore Airlines JV will enhance options for passengers. The difference in economy class fares on FSC and low-cost carriers (LCC) is negligible. Also currently the business class seats are too overpriced. With the duration of most domestic flights being around 2 hours, the perceived luxury is for a very short duration. At the same time, there would be many travelers who don’t care for services and fare offered is the sole determinant of their choice. TATA Sons and Singapore Airlines will, therefore, compete with both FSCs and LCCs.

As every coin has two sides, there are some negatives as well. The Indian market is highly price-sensitive. Jet and AI are forced to attune their strategies with market needs. Even though they offer superior amenities, they are not able to compete with the low-cost airlines and command a premium on fares. This will be tough to handle. The cost of operating in India is quite high, as are ATF prices and airport charges. The problem gets compounded due to the propensity of Indian consumers to fly at a lower cost. This affects covering up of the operational cost and profit. This situation will become more challenging once AirAsia India comes in with its aggressive and innovative marketing strategy—the size of the cake for full-service carriers is set to diminish further.

AirAsia v. Singapore Airlines:

Following government allowing overseas airlines to invest in local airlines since last September, TATA Sons announced a venture with Malaysia’s AirAsia Bhd to form a local low-fare airline. AirAsia will hold a 49% stake in it and TATA Sons 30%. The balance will be held by Arun Bhatia of Telestra Tradeplace Pvt. Ltd. There have been concerns whether the new JV would be in conflict with TATA’s tripartite joint venture despite clarifications from TATA about keeping AirAsia in the loop. TATA Sons says that the AirAsia and the Singapore Airlines ventures will cater to different market segments—one will be an ultra-low fare airline while the other will be a premium airline.

In that context, TATA has managed to get two of the best partners possible—AirAsia has the lowest unit cost in the world and Singapore Airlines’ expertise in running a full-service airline is unrivalled. AirAsia India will compete against low-fare carriers that have over 60% market share while TATA-Singapore Airlines will have to fight off rivals Air India and Jet Airways in the full-service space.

The current rules do not stop a company from operating a low cost as well as the full-service airline. As long as the two airlines don’t have the same board members and management team and the synergies in operations and maintenance are carried out under proper commercial contracts, there should be no problem. Also, AirAsia Group CEO Tony Fernandes has said that he has no issue with the new TATA-SIA JV. At the same time, TATA-AirAsia and TATA-SIA are targeting different markets with different strategies. It is true globally. But the question is whether that philosophy will hold well in India where full-service and low-cost carriers are slugging it out with hardly any tariff difference.

Conclusion:

TATA group is known for its quality. Thus, its force into the aviation industry would help in not only increasing the competition but in also improving the standard of services being provided. TATA-SIA needs to focus on keeping its cost structure low when building its full-service airline. If the current rule of domestic airlines having to wait 5 years before flying abroad is scraped; the TATA’s would suddenly find that their long-standing dream has fructified. The TATA-Singapore Airlines venture will first need the FIPB approval before it applies for an NOC from the aviation ministry and subsequently a flying permit. Though it’s still a long road ahead for the TATA-SIA JV, the Indian Aviation scenario is definitely up for some interesting time ahead.

Joint venture should be between partners who bring something to the table which the other does not have and also at the same time it benefits its end users i.e. customers. So it is imperative for TATA to look for different JV partner to create value for Indian passengers. In the case of AirAsia, TATA is a just financial investor. In the process, it will reduce the risk of AirAsia to operate in the Indian market and also help them to understand Indian customers so that they can compete with low-cost airlines in India and it is easy to scale up its operations. So basically TATA having knowledge of Indian market has left operating control with AirAsia management to enable them to duplicate their lowest cost model in India.

As far as Singapore Airlines JV is concerned both are equal partners in terms of bringing strategic inputs and financial contribution to bringing value to its customers. In fact, it not only can take away share from some of its Indian competitors but also from foreign competitors like Emirates. Further, the brands together can become one of the best airlines brand in Asia–Pacific.

Thus, both the JVs have different but the compelling business case and the current arrangement is between seasoned and experienced partners. The success of both marriages though apparently does not look complimentary and the first impression can be that it will most likely, be a cause of conflict of interest which can result in turmoil ahead. But considering synergies created, we believe both JV will be a huge success if the business plan is well thought off and implemented or allowed to be implemented without any regulatory hurdle.