UFO Moviez India Limited (UFO) is a public limited company incorporated on June 14, 2004. It is India’s largest digital cinema distribution network and in-cinema advertising platform in terms of number of screens. UFO operates India’s largest satellite-based, digital cinema distribution network using its UFO-M4 platform, as well as India’s largest D-Cinema network. Their offerings include Digital Cinema System, UFO Framez, Club Cinema and IMPACT Ticketing Platform. UFO Moviez is currently having a market cap of Rs 1,456 Crores on BSE.

Qube Cinema Technologies Private Limited (QCTPL) is a company incorporated on 1st January 1986. It is engaged in the business of providing technology in film, video and audio, including digital cinema distribution, editing, production and sound.

Other companies involved in the scheme are:

| Company | Business of the company |

| Qube Digital Cinema Pvt Ltd (QDCPL), incorporated on 11th October 2017. | Providing technology in film, video and audio, including digital cinema distribution, editing, production and sound. |

| Moviebuff Pvt Ltd (MPL), incorporated on 4th November 1996. | MPL is engaged in the business of operating a backend platform for dynamically creating and playing back customised content at scheduled times. It showcases movie trailers and movie related content on its website. |

| PJSA Technosoft Pvt Ltd, incorporated on 17th October 2017. | Providing technology in film, video and audio, including digital cinema distribution, editing, production and sound. |

(All the companies belong to the same industry)

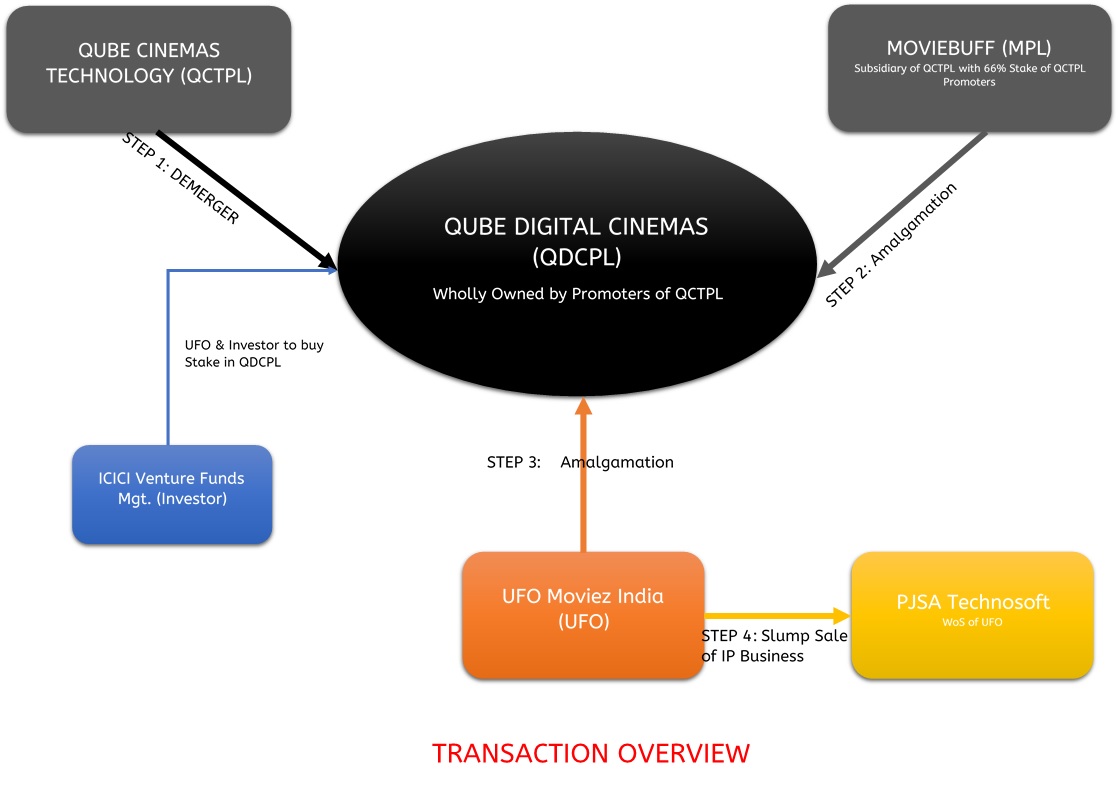

Transaction

| Stages of Transaction | Details |

| Step 1 | Demerger of QCTPL’s entire business (except Studio DPS Business) that is based on deployment and use of the intellectual properties and its immovable properties defined below from QCTPL into QDCPL. |

| Step 2 | Amalgamation of MPL into QDCPL in which MPL’s entire business will be consolidated with QDCPL. |

| Step 3 | Amalgamation of QDCPL into UFO. |

| Step 4 | In consideration of transaction mentioned in step 3 UFO and India Advantage Fund S4 I, together will acquire 53.20% of the share capital of QDCPL from certain non-promoter shareholders, thereby giving them the exit. |

| Step 5 | Slump Sale of IP Business from UFO to PJSA. |

Please note that QDCPL currently has no business activity, it appears that QDCPL is just a vehicle created for the purpose of transfer of QCTPL and MPL’s businesses into UFO.

Details of Demerged business

Intellectual Properties (IP) business means the following businesses of QCTPL:

| Name of IP business | Brief details of the IP businesses |

| Movie Buff | Moviebuff offers the most exhaustive database of movie related information to an Indian movie-going audience. |

| Moviepass | Moviepass provides identity management services across multiple websites like Justickets and Moviebuff and other B2C offerings. It is just like mobile ticket pass. |

| Cheers | Cheers offers big screen greeting cards for cinema audiences |

| Slydes | Slydes provides a backend service that manages any kind of JIT DCP creation and scheduling on screen. |

| html2DCP | This is not defined as it is for internal use only. |

| iCount hardware and software | iCount is a software which detects the number of occupied seats in a theatre or auditorium. |

| Qube XP E-Cinema hardware & software | The Qube XP-E can play MPEG-2 format. The Qube XP-E Digital Cinema Server is aimed at the non-DCI E-Cinema and Pre-show markets |

| Qube Xi Integrated Media Block | The Qube Xi Integrated Media Block (IMB) is designed to seamlessly integrate into any Series 2 DLP Cinema™ projector and work in 2K and 4K resolutions. |

| Qube Cast | QubeCast is designed to primarily handle multicast transfers and is simply the best solution on the market for digital cinema networks. QubeCast consists of a server component and a client component, each separately licensed. |

| Qube Central | This is no longer in active development. This is to be replaced by Qube Wire & Transformer |

| Qube Master Pro, Xpress & Xport | This is in minimal development phase. This will be replaced by Wire Master. |

| Transformer | This is in design phase. |

| Qube Wire | With Qube Wire distributors can manage their DCP assets, assign territorial rights and have their DCPs and Keys delivered to any theatre in the world. |

| Qube Wire Desktop applications | This is technically related to Qube Wire |

| Qube Wire Partner, Festival & Theatre Appliances & Software | This is technically related to Qube Wire |

| Wire safe applications and Software | This is under development and will be released only for internal use. |

| Wire Master | This is under development and not yet released. |

| Qube Account | This comes under one of the products of Qube cinema. |

MPL business means the divisions, undertakings, businesses, activities and operations of MPL relating to operation of a backend platform for curating and playing back customised template messages as per viewer choices based on customer chosen schedules on chosen front-end playback devices and marketing the offering directly to end customers or through chosen channels and platforms.

There are 19 immovable properties related to QCTPL business, that will be demerged from QCTPL to QDCPL and eventually in UFO.

Valuation

Statement of consideration (excluding ESOP)

| Sr no: | Particulars (excluding ESOP) | Nos of Shares | Amounts (Rs) |

| 1. | QDCPL shall issue 1 equity share of Rs 10 for every 1 equity share of Rs 10 held in QCTPL | *91,26,285 | 9,12,62,850 (at FV Rs 10 per share) |

| 2. | QDCPL shall issue 1 equity share of Rs 10 for every 1 preferred share of Rs 10 of series A and B and 1.6386 equity shares of QDCPL of Rs 10 for every 1 series C preferred shares held in QCTPL of Rs 10. | 74,43,611 | 9,54,63,439 (at FV Rs 10 per share for each class) |

| 3. | QDCPL shall issue 76,381 equity shares of Rs 10 for every 100 equity shares of Rs 10 held in MPL | 7,80,003 | 78,00,028 (at FV Rs 10 per share) |

| 4. | UFO and India Advantage Fund S4 I, a fund managed by ICICI Venture Funds Management Company Ltd (“INVESTOR”) shall purchase an aggregate of 53.20% of the share capital of QTCPL from certain non-promoter shareholders of QCTPL, who no longer wish to participate in the demerged business of QCTPL #(“Seller”) at a price of Rs 302.647 per share | UFO: 38,75,531 Investor: 71,03,984 |

UFO: 117,29,17,831 Investor: 214,99,99,446 (at Rs 302.647 per share) |

| 5. | On slump sale of IP business PJSA will pay UFO a lump sum amount. The consideration shall be discharged by PJSA by issuing equity shares of Rs 10 to UFO. | 2,35,00,000 | 23,50,00,000 (at FV Rs 10 per share) |

*Excluding 2571, 790, 790 eq shares of INR 10/- held by Intel Capital Corporation, CSI BD (Mauritius), Payone

# “Seller” means 4 private equity investors who are existing shareholders of QCTPL and post demerger they will become shareholders of QDCPL. Thereafter UFO and Indian Advantage Fund S4 I, will buy their 53.20% of share capital of QCTPL at Rs 302.647 per share. Hence in this manner exit to private equity shareholders will be given.

Please note: Pursuant to QDCPL merger, shareholders of QDCPL, except UFO shall be issued 13 equity shares of Rs 10 for every 17 equity shares of Rs 10, held by QDCPL.

Tax Implications

With respect to slump sale of IP business by UFO to PJSA one can make reference to the case CIT v R.R. Ramkrishna Pillai (66 ITR 725) in which the Supreme Court made the clear distinction between sale and exchange, held that transfer of assets in consideration for the allotment of shares of that company is an exchange and not sale. Slump Exchange is not taxable under section 2(42C) of the Income Tax Act.

Accounting Treatment

Since the transaction involves entities which are ultimately controlled by the same party before and after the transaction, the transferor companies involved in this scheme will account as per Ind AS 103 Business Combinations.

Shareholding Pattern

| Name of the Company | Pre-Scheme | Post Scheme | ||||

| Particulars | Nos of Shares | % Share holding | Particulars | Nos of Shares | % Share holding | |

| UFO Moviez Pvt Ltd | Promoters | 77,65,452 | 28.13% | Promoters | 77,65,452 | 19.21% |

| Public | 1,98,35,349 | 71.87% | Public | 3,26,53,793 | 80.79% | |

| Total | 2,76,00,801 | 100.00% | Total | 4,04,19,245 | 100.00% | |

| PJSA Technologies Pvt Ltd | Promoters | 10,000 | 100% | Promoters | 2,35,10,000 | 100% |

| Non-promoters | – | 0% | Non Promoters | – | 0% | |

| Total | 10,000 | 100% | Total | 2,35,10,000 | 100% | |

Observations

- The promoters of UFO will continue to be promoters of the combined entity and the promoters of Qube are not going to play the role of promoters of the combined entity.

- In case of UFO, post-merger in public shareholding category the promoters of Qube will have 11.93% stake post-merger and ICICI Venture(non-promoter) will have a 13.44% stake post-merger.

- There is no change in shareholding of Qube Cinema Technologies Pvt Limited post scheme.

- QDCPL and MPL will be dissolved without winding up post scheme.

Synergy benefits to the combined entity

- UFO and Qube are engaged in the business of digital cinema distribution and operate in cinema advertising platforms. Considering the existing entertainment and advertising market dynamics, the proposed merger of the two companies will lead to robust growth opportunities in India and globally and will create greater value for their respective shareholders.

- UFO currently uses MPEG4 technology for the transmission of content into e-Cinema theatres whereas Qube uses MPEG2 technology for e-Cinema theatres and has also developed its own DCI compliant servers. Going forward, it is expected that the combined entity will develop and deploy both D-Cinema and e-Cinema systems that incorporate the best features of the multiple technologies available to the company and will thus be in a position to offer its clients viz: the film industry and advertisers a comprehensive bouquet of services.

- Both UFO, with ~4,000 advertising screens, and Qube, with ~3,300 advertising screens, have large advertising networks. The two companies also have complementary geographical strengths with Qube having a deeper penetration in South India and UFO having a similar presence in the rest of India. The merged business will therefore be able to offer a pan India in-cinema advertising network covering over 7,300 screens, significantly improving the overall value proposition for clients. The two companies also have complementary strengths in terms of client base, presenting attractive cross-sell opportunities.

- Qube has developed a self-service single-window content and digital rights management platform for movies called Qube Wire. This service is currently in the process of commercialization but is already in operation on a limited-scale serving select clients. UFO, in addition to its screen network in India, also has a network of screens overseas. The combined network, post-amalgamation, will allow faster monetization of Qube Wire and other IP based Qube products, both within India and internationally.

- The combined entity is also expected to leverage ICICI Venture’s significant prior experience as a private equity investor in new age businesses, including media and technology.

Conclusion

It is strategic call by promoters of both the companies in the process losing absolute control over the company in terms of ownership as both the promoters together post-merger will hold only 31% against holding of 28% of present promoters in the merged entity and very valuable assets with huge potential will be parked in the subsidiary. UFO will retain the top talent force in PJSA. All in all, one can say that QDCPL and PJSA were the vehicles created for this merger in order to have tax optimization and transaction cost minimizations. Therefore, it’s safe to comment that this restructuring was well planned and seems to be rightly timed to grow in the in cinema advertising market as TIGER 2 to compete with PVR the Tiger 1!