In a move to create a monopoly in digital cinema distribution network and in-cinema advertising platform, In November 2017 Chennai-based Qube Cinema Technologies and Mumbai-headquartered UFO Moviez announced the merger of their businesses. Even after part of the scheme was approved by the Chennai NCLT bench, the scheme was rejected by the Mumbai NCLT in the last week of January 2019.

We had covered this article in our January 2018 issue and details of the proposed merger are as below.

UFO Moviez India Limited (UFO) is India’s largest digital cinema distribution network and in-cinema advertising platform in terms of number of screens. UFO operates India’s largest satellite-based, digital cinema distribution network using its UFO-M4 platform, as well as India’s largest D-Cinema network. Their offerings include Digital Cinema System, UFO Framez, Club Cinema and IMPACT Ticketing Platform. UFO Moviez is listed on BSE.

Qube Cinema Technologies Private Limited (QCTPL) is engaged in the business of providing technology in film, video and audio, including digital cinema distribution, editing, production and sound.

Other companies involved in the scheme:

| Company | Business of the company |

| QubeDigital Cinema Pvt Ltd (QDCPL) (SPV created for the transaction) | Providing technology in film, video and audio, including digital cinema distribution, editing, production and sound. |

| Moviebuff Pvt Ltd (MPL) | MPL is engaged in the business of operating a backend platform for dynamically creating and playing back customised content at scheduled times. It shows cases movie trailers and movie related content on its website. |

| PJSA Technosoft Pvt Ltd (SPV created for the transaction) | Providing technology in film, video and audio, including digital cinema distribution, editing, production and sound. |

Proposed Rationale

- To give exit to the existing Private Equity Investors in QTCPL, it was decided that UFO and India Advantage Fund S4 I, a fund managed by ICICI Venture Funds Management Company Ltd (“INVESTOR”) shall purchase an aggregate of 53.20% of the share capital of QTCPL from these PE Investors.

- The promoters of UFO were supposed to continue to be promoters of the combined entity and the promoters of Qube were not going to play the role of promoters of the combined entity.

- In case of UFO, post-merger in public shareholding category the promoters of Qube would have had 11.93% stake post-merger and ICICI Venture(non-promoter) would have had a 13.44% stake post-merger.

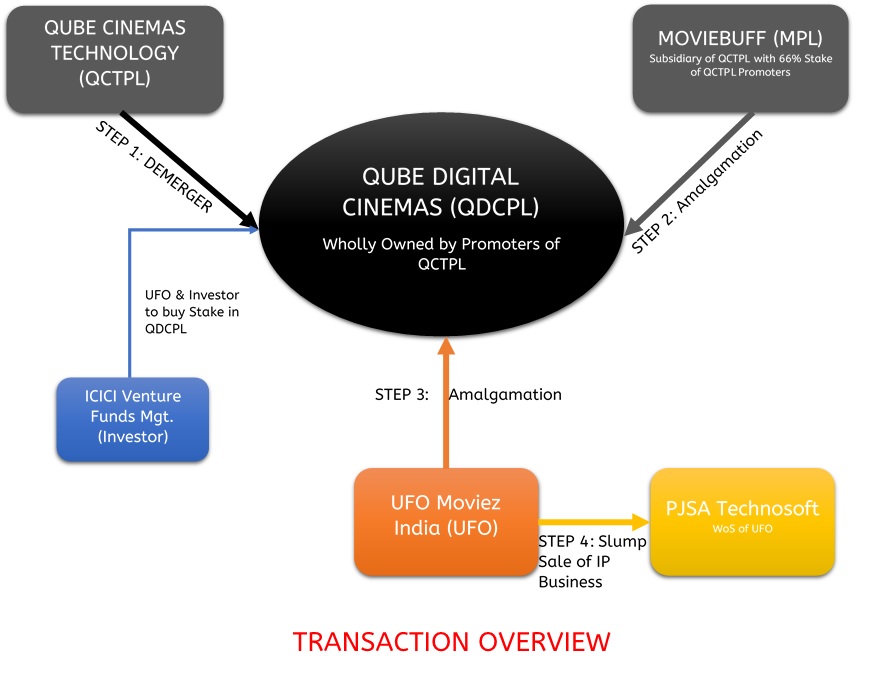

Proposed Transaction

| Transaction Steps | Details | NCLT ORDER |

| Step 1 | Demerger of QCTPL’s entire business (except Studio DPS Business) that is based on deployment and use of the intellectual properties and its immovable properties defined below from QCTPL into QDCPL. | Accepted and cleared by Chennai NCLT |

| Step 2 | Amalgamation of MPL into QDCPL in which MPL’s entire business will be consolidated with QDCPL. | |

| Step 3 | Amalgamation of QDCPL into UFO. | Rejected by Mumbai NCLT |

| Step 4 | In consideration of transaction mentioned in step 3, UFO and India Advantage Fund S4 I, together will acquire 53.20% of the share capital of QDCPL from certain non-promoter shareholders, thereby giving them the exit. | |

| Step 5 | Slump Sale of IP Business from UFO to PJSA. |

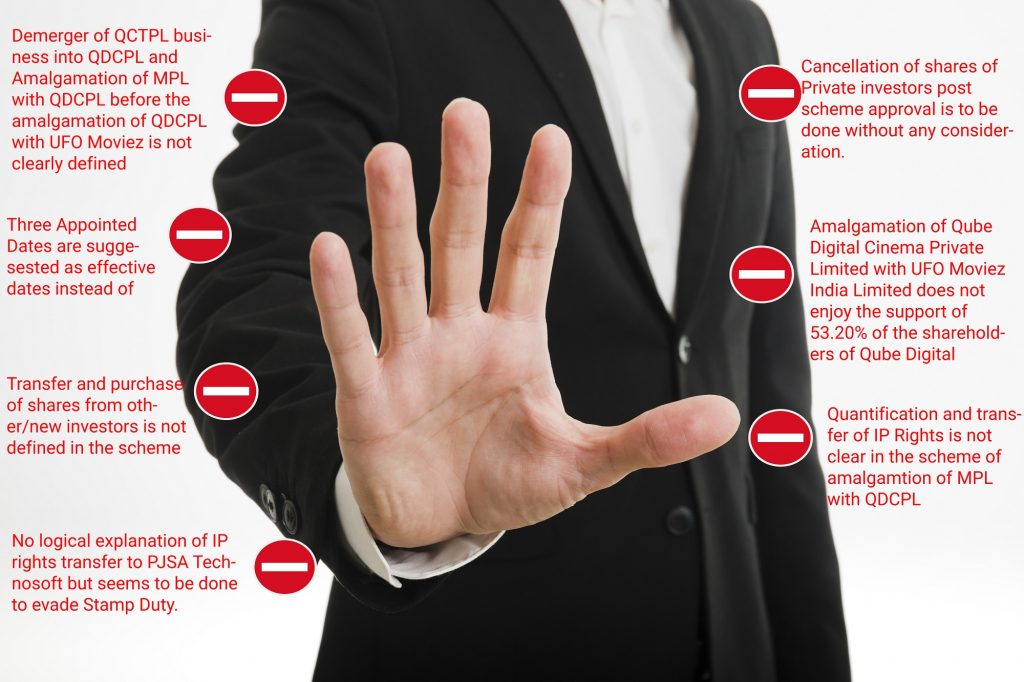

Several objections were raised by Regional Director for rejecting the scheme.

Prominent/Relevant 0bjections

- The three Appointed Dates are suggested as the effective date which is not in accordance with the provision of Section232(6) which requires an appointed date which should be clearly stated in the scheme.

- The reason for

amalgamation of MPL with QDCPL which was incorporated in the year 1996 and is not carrying on any business till 31st December 2017 except for holding IP rights. The clause of IP rights is not quantified and captured in the Financials as at 31st December 2017, nor an explanation given in the rationale in the scheme. - The transaction of sale of shares by sellers; Nomura Asia Investment (MB) Pvt Ltd, CSI BD (Mauritius), Intel Capital Corporation and Streetedge Capital LP and purchase of shares by UFO and New investors as per clause 24 of the Scheme is being done as part of the scheme which is beyond the scope of Section 230-232 of the Companies Act, 2013 as this being independent cause of action for which tribunal approval is not required and hence to be deleted as part of the scheme. Further, new investors are not defined in the scheme.

- The purpose of Demerger of QCTPL business into QDCPL and Amalgamation of MPL with QDCPL before the amalgamation of QDCPL with UFO Moviez is not clearly defined in the Scheme when it could have been directly achieved by demerging QCTPL business into UFO Moviez.

- UFO in

the clause 6.1 of the scheme has inter alia mentioned that upon the Scheme becoming effective,the 2571 , 790 and 790 equity shares of INR 10/- each held by Intel Capital Corporation, CSI BD (Mauritius) andPayone Enterprises Private Limited respectively in the Demerged Company shall standcancelled and reduced without any consideration.

- Dealing with future (non- existing) shares, that are going to be allotted or even before they are allotted is something very fishy in the present case. So, the entire transaction regarding unallotted shares and the way it is taking place, though influences the Scheme, is not made part of the same because the Petitioners know that the same is not transparent and a great deal of crucial information must be kept under the carpet. Hence what happens to the unallotted/ non- existing shares of UFO is not quite transparent and this cannot

to be taken into consideration because shares are not existing as on the date of Share Purchase Agreement nor the shareholders are provided with complete information about the Scheme.In this regard, this bench is of the view that the Scheme is intelligently devised to contravene the provisions of Section 68 of the Companies Act, 2013 and is influencing the stock– market, which affects

public interest. In this regard. this Bench is of the view that as admitted by the Petitioners thatSPA is outside the Scheme, any material relating to this must be deleted in toto from the Scheme because it affects the Scheme overall. Further, it is also observed that the amalgamation of Qube Digital Cinema Private Limited with UFO Moviez India Limited does not enjoy the support of 53.20% of the shareholders of Qube Digital Cinema Private Limited. Here in the present case, instead of adopting an easy method to deal with the disagreeing shareholders of the company, the parties concerned chose a circuitous route which will violate various provisions of law and by violating the basic business ethics. Herein this case, the proposed confluence of both the groups is not to the agreement of all the parties concerned andstill the Promoters chose to work out a circuitous method to somehow get rid of the persons who are not in agreement with them. The logical conclusion that can be deduced from the above isthat, there is no consensus ad idem between all the stakeholders and the public and there is some unknown and unearthed ulterior motive behind the entire Scheme and the same is presented to this Court by gold plating the entire container consisting of malefic contents. One, it is not logical, two, it is unfair and three, it is highly camouflaged to conceal the real intention behind it.

- It is

well settled law that directors are not the owners of the assets of the company. However, immediately on incorporation, the directors of the company transferred the assets (IP Rights) of the company in total disregard of their duties as directors and thedevise of incorporation of a Corporate entity is used forillegal /improper purpose. QDCPL ismere sham as it is used as a Special Purpose Vehicle to transfer IP rights without any consideration by adopting “pooling of interest method”. The incorporation is mainly aimed to evade statutory obligation of payment of stamp duty by not disclosing/declaring any value to IP Rights. The entire transactions i.e. transfer of IP rights are camouflaged under the guise of commercial prudence. The value of IP rights is not at all mentioned in the Balance Sheet of Moviebuff Private Limited. The Company has successfully attempted for non-payment of stamp duty to the extent ofvalue declared at a later stage. The same IP rights are subsequently valued at Rs. 23.5 crores by adopting Fair Value Method. It is clear that the company has used the device of incorporation forillegal or improper purpose. It is furthermore important to mention that the unaudited balance sheet as at 31.12.2017 of Moviebuff Private Limited (MPL) does not indicate any value or existence of IP rights. There is no clarification of IP rights MPL to be transferred to QDCPL on Pooling of Interest method. - The point here is, PJSA Technosoft Pvt Ltd. is again an alter ego of UFO Moviez India Ltd. This transaction between holding

company and its sole subsidiary need not be so confusing in nature and if at all the IP rights of MPL are available with practically negligible or of no value, the PJSA Technosoft Pvt. Ltd can straight away acquire them in a straight method without being routed through QDCPL and the holding company, i.e. UFO Moviez India Ltd. There is no logical explanation from the Petitioners as to why the IP rights without any value at the initial stage, suddenly acquires a huge value and are sold at a high price through a Slump Sale just because the same had passed through different hands at different stages.

Petitioners Defence

The petitioner cited the following two decisions in defense for approval of the scheme;

- In Bombay High Court: Re: Pmp Auto Industries Ltd. – Court Judgment [[1994]80CompCas289(Bom)]

- In Gujarat High Court: Re: Maneckchowk And Ahmedabad … vs Unknown on 10 December, 1969

Both the above judgments must be respected at all costs since if the intentions on the part of the Petitioners are clear, unambiguous and not deceitful, the courts must not create any obstacles to the fairness and the business prudence on the part of the Petitioners.

But, here is a case, first everything is camouflaged, nothing is fair, and everything is evasive and illegal. So, with utmost respect to the above citations we say that the Petitioners cannot cite the above judgments to mislead this bench.

Conclusion

Under the Companies Act, 1956, the scheme was generally approved by the Honourable High court if shareholders and creditors with requisite majority approved the scheme and no proactive role was played by all authorities. There is sea change in approach and application of laws by Honourable National Company Law Tribunal.

In interpretations of various provisions from different

Add comment