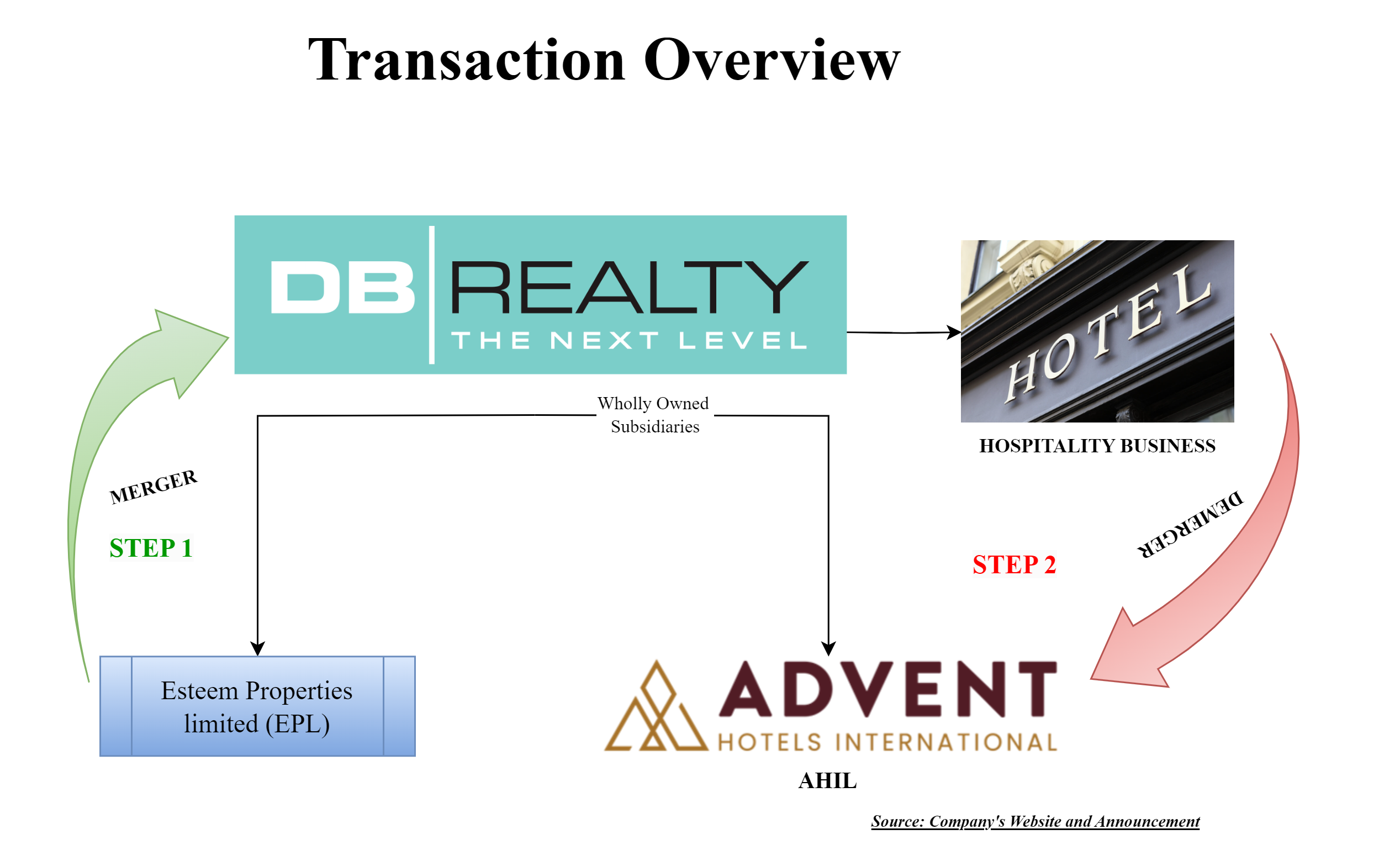

Recently, Valor Estate Limited (Earlier known as DB Realty Limited) announced separate listing of its “Hospitality Business” through demerger along with the amalgamation of its wholly owned subsidiary.

Valor Estate Limited (“VEL” or “Demerged Company” or “Transferee Company”) is interalia engaged in:

- Real Estate business which consists of a portfolio of Saleable assets & residential category, annuity assets in the commercial category and land banks for future development

- Hospitality business which consists of developing and owning multiple luxury hotel properties.

VEL’s equity shares are listed on nationwide bourses.

Esteem Properties Limited (“EPL” or “Transferor Company”) is a wholly-owned subsidiary of VEL which is engaged in the development of real estate. Currently, the company owns 5.4 acres of developable land in Sahar, Mumbai.

Shiva Realtors Suburban Private Limited (Being renamed as Advent Hotels International Limited) (“AHIL” or “Resulting Company”) is a wholly-owned subsidiary of VEL. Just before announcing the demerger, AHIL acquired subsidiaries engaged in the Hotel business from VEL.

Recent Transactions:

Entry into Hospitality Business:

Till September 2023, VEL was engaged only in real estate business. In order to diversify the existing business, VEL decided to foray into Hospitality business. VEL acquired following entities from promoter group to enter hospitality segment:

- 50% equity stake in Bamboo Hotels & Global Centre (Delhi) Private Limited a joint venture between Prestige Hospitality and VEL Promoters is constructing a hotel complex comprising the St. Regis (189 rooms) and the Marriott Marquis (590 rooms) in Delhi for a consideration of INR 608 crore.

- 100% equity stake of Goan Hotels & Realty Private Limited engaged in operating a hotel in Goa for a consideration of INR 1410 crore.

- Acquisition of 75% equity stake (with an option to acquire additional 12.5% stake) in BD&P Hotel (India) Limited which is operating Hilton Hotel in Mumbai for a consideration of 339 crore.

VEL done a Qualified Institutional Placement to fund the consideration to acquire a stake in companies engaged in the hospitality segment.

Re-organization of AHIL:

Till March 2024, AHIL was held 48.33% by VEL and the remaining stake was held by others. Post March, VEL acquired the remaining stake making, AHIL its wholly-owned subsidiary. Further, the only key investment on VEL as on 31st March 2024 was in the nature of equity shares of “Neelkamal Realtors Suburban Private Limited” with nil revenues.

On 6th June 2024, VEL entered into a share purchase agreement which inter-alia provided for the transfer of:

- 50% equity interest in Bamboo Hotel and Global Centre (Delhi) Private Limited for a consideration of INR 608 crore.

- 100% equity interest in Goan Hotels & Realty Private Limited for a consideration of INR 1410 crore.

The consideration for selling the investment is the same as VEL paid for acquiring stake in these companies. Interestingly, VEL transferred the stake in such entities on the same date of the announcement of demerger. It is pertinent to note that, through demerger, stakes in these entities would have transferred to AHIL. However, pursuant to the transfer before demerger, VEL will receive the consideration for such transfer. In light of no significant assets, it is not clear how AHIL will fund this acquisition.

The Proposed Transaction:

The board of directors of VEL on their board meeting held on have approved a composite scheme of arrangement (“Scheme”) which inter-alia provides for the demerger of “Hospitality Business” & merger of wholly owned subsidiary with VEL.

The proposed transaction shall be effective in the following chronological order:

- Merger of EPL with VEL as on Appointed date 1;

- Demerger of “Hospitality Business” of VEL to AHIL as on Appointed Date 2.

Appointed Date 1 means the opening hour of 1st April 2024 and Appointed Date 2 means opening hour of 1st April 2025. The reason for keeping the prospective Appointed Date for the demerger of Hospitality business could be considering the tax aspect (apart from commercial aspect) which is discussed later on.

“Hospitality Business” includes the hospitality and hotel business of VEL undertaken by way of inter alia owing, licensing, operating, managing, servicing, marketing and supervising operations of hotels and also includes VEL’s direct investments in the Hospitality business.

Some of the rationale’s for proposed demerger:

- Each business has a differentiated strategy, risk & return profile- and fund-raising requirements.

- Hospitality business has evolved substantially and now ready to operate as independent listed entity.

- To attract the right set of investors for hospitality business.

Swap Ratio & Share Capital:

As EPL is a wholly-owned subsidiary of VEL, there will not be any consideration discharged by VEL for the merger. For demerger of hospitality business, AHIL will issue:

- 1 fully paid-up equity share of INR 10 each for every 10 equity shares of INR 10 each of VEL.

- 1 fully paid-up preference share of INR 10 each for every 10 preference shares of INR 10 each of VEL.

Share Capital of VEL & AHIL is as follows:

| Particulars | VEL | AHIL (Post) |

| No. of Equity Share capital | 53,77,89,378 | 5,37,78,938 |

| Face Value | 10 | 10 |

| Promoter Stake | 47.44% | 47.44% |

| No. of 8% Redeemable Preference Share Capital of INR 10 each (Pre) | 7,17,55,740 | NA |

| No. of 8% Redeemable Preference Share Capital of INR 10 each (Post) | 6,45,80,166 | 71,75,574 |

Please note that pursuant to the demerger, existing paid up capital of AHIL held by VEL will get cancelled and new shares will be issued to the shareholders of VEL as on the record date. The scheme inter-alia provides for the reduction & re-organization of preference capital of VEL in the following manner:

- Every 1 preference share having a face value of INR 10 each shall stand reduced to 1 preference share having a value of INR 9 each and post reduction.

- Every 10 such preference shares having face value of INR 9 each shall be consolidated into 9 preference shares of INR 10 each.

Effectively, preference shares will be reduced to an extent of preference shares issued by the resulting company.

For illustrative purposes:

| Particulars | No. of Preference Shares | Value |

| Preference shareholder holding 100 preference shares of VEL of INR 10 each before demerger | 100 | 1000 |

| Preference shares issued by Resulting Company (10 preference shares of INR 10 each) | 10 | 100 |

| Reduction of face value of VEL preference shares from INR 10 to INR 9 each | 100 | 900 |

| Consolidation of 10 preference shares into 9 preference shares of INR 10 each | 90 | 900 |

Please note that almost entire portion of preference shares are issued to non-promoters.Further, the Scheme also provides for reduction of the Securities Premium Account of VEL post demerger. It is not clear how exactly the same will be executed.

Financials:

Income Tax Aspects:

As per section 2(19AA) of the Income Tax Act, 1961, demerger will be tax-neutral if certain conditions mentioned therein are fulfilled. One of the critical conditions is demerger of “undertaking” is essential to qualify as a tax-neutral demerger. Though undertaking is not explicitly defined under the act, through many past courts/tribunal rulings, one can consider undertaking as a separate business activity and not a mere investment.

Presently, it appears that the Hospitality business of VEL is nothing but investments in other companies carrying “Hospitality Business”. It may happen that VEL may start hospitality business by starting construction of one of the proposed hotels on its own land and capital work in progress along with investments may be termed to be an “undertaking”. One of the likely reasons for keeping the prospective appointed date could be to start construction activity till the appointed date/acquisition of certain property.

Conclusion:

VEL has gone through a lot of turbulence in the past. In 2023, it forayed into the hotel business with acquisition of promoter owned entities. One of the key reasons was the diversification of the business. However, immediately upon completion of transaction, VEL announced the demerger of “Hospitality Business” stating both businesses are matured. One really needs to ponder whether the acquisition was truly to achieve diversification or indirect listing through demerger.

Certain steps of the transaction also need to be pondered. On the day of demerger announcement, VEL sold key entities engaged in the hospitality business to the resulting company which were anyways going to get transferred. However, due to the transaction, the resulting company will now have to pay consideration to VEL which would not have accrued if the transfer were made as a part of demerger. The consideration for transfer remains the same as the acquisition cost.

It will be interesting to see how the hospitality business grows after the demerger.