The board of directors of Vardhman Textiles Limited, at its meeting held on August 13, 2019, considered and approved the scheme of arrangement amongst VMT Spinning Company Limited, VTL Investments Limited, Vardhman Nisshinbo Garments Company Limited, Vardhman Acrylics Limited with Vardhman Textiles Limited.

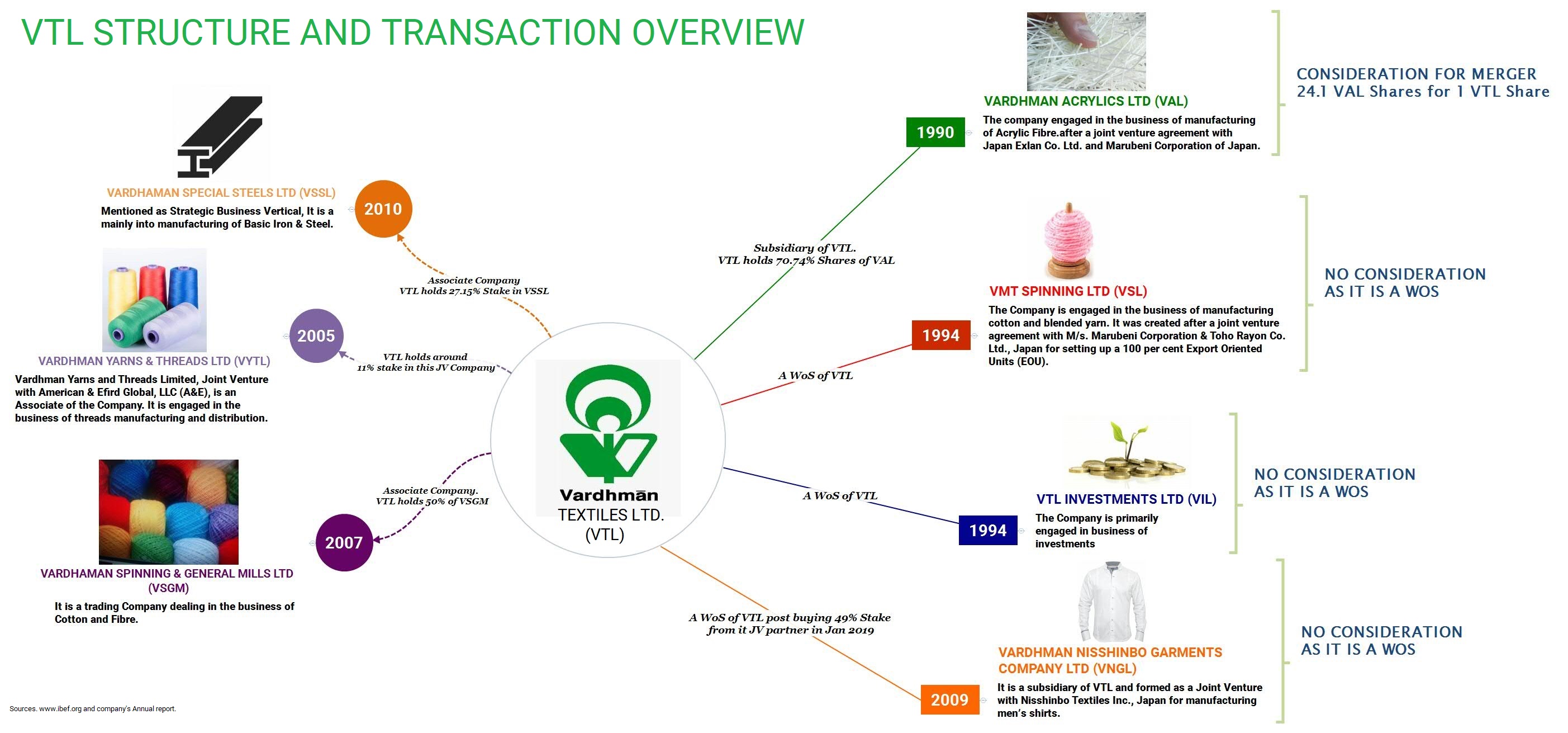

Vardhman Textiles Limited (VTL) is a listed company engaged in the business of manufacturing cotton yarn, synthetic yarn and woven fabrics. The group is sixty years old started with 6000 spindles to manufacture yarns. Every decade it went into diversification, expansion and joint ventures. As on date, it is one of the largest vertically integrated textiles group in India manufacturing fibre, yarn, sewing threads, fabrics and garments (mainly shirts). Because of multiple takeover, joint ventures, and corporate restructuring, it has multiple companies operating in similar or complementary businesses.

VMT Spinning Company Limited (VSL) is a wholly-owned subsidiary of VTL. The company is engaged in the business of manufacturing cotton and blended yarn.

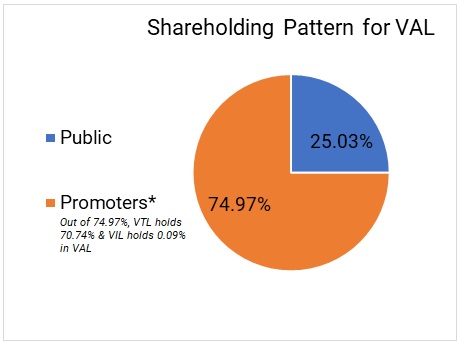

Vardhman Acrylics Limited (VAL) is a listed company, listed on the National Stock Exchange of India Limited. VAL is engaged in the business of manufacturing acrylic fibre. The company has set up an 18000 TPA acrylic staple fibre and tow production plant at Jhagadia, Gujarat, India.

VTL Investments Limited (VIL), a NBFC, is a wholly-owned subsidiary of VTL. VIL is a. VIL holds investment in equity shares of VTL (1.75%), Vardhaman Special Steels Limited (VSSL) – 1.06% and VAL – 0.09%.

Vardhman Nisshinbo Garments Company Limited (VNGL) is a wholly-owned subsidiary of VTL. VNGL is engaged in the business of manufacturing and sale of garments (mainly shirts). During the financial year 2018-19, VTL acquired 68,60,000 shares representing 49% of equity share capital of Vardhman Nisshinbo Garments Company Limited (VNGL) from its joint venture partner namely M/s. Nisshinbo Textile Inc. on January 23, 2019, for a consideration of 1.37 crores. Accordingly, VNGL has become a wholly-owned subsidiary of the Company w.e.f. January 23, 2019.

The Transaction

From Appointed date as 1st April 2020, VTL has decided to merge its 3 wholly-owned subsidiaries and one listed subsidiary VAL to consolidate its operation and collapse insignificant listed entity into one.

Swap Ratio

As VSL, VIL & VNGL are the wholly-owned subsidiaries of the VTL, no shares will be issued on the merger of VSL, VIL & VNGL with VTL. In case of VAL, VTL will issue 1 (One) equity share of INR 10 for every 24.1 (Twenty-Four point one) equity shares of VAL of the face value of INR 10 (Indian Rupees Ten) each fully paid upheld by the shareholders of the VAL on the Record Date.

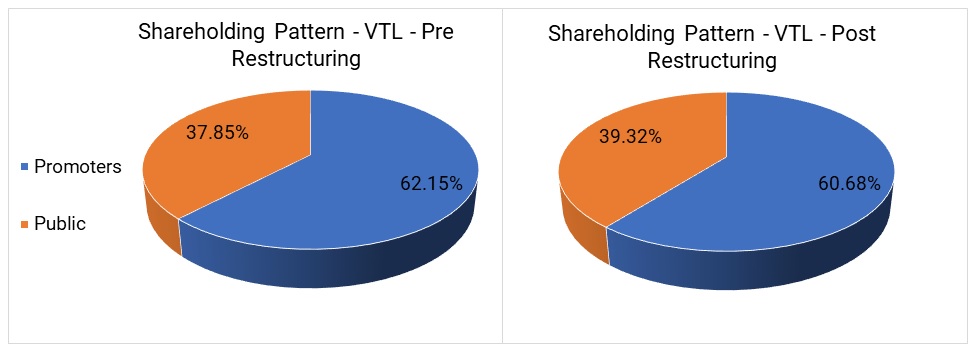

Shareholding Pattern

Financials for FY 2019-20

INR in crore

| Particulars | VTL | VMT | VAL | VNGCL | VTL |

| Revenue | 6 | 232 | 392 | 73 | 6,414 |

| PBT | 5 | 25 | 47 | 1 | 990 |

| Networth | 53 | 125 | 334 | 20 | 5,239 |

| Loans | – | 24 | – | 39 | 2,238 |

| EPS | 11.24 | 8.91 | 4.29 | 0.9 | 121.13 |

Related party transactions of VTL with its subsidiary companies

| Particulars | 2019 | 2018 |

| Sale | 34 | 10 |

| Purchases | 184 | 158 |

Related party transaction of Val with VTL

| Particulars | 2019 | 2018 |

| Sale | 108 | 86 |

| Purchases | 9 | 6 |

Conclusion

For all the companies, as Vardhman group, who are the sole promotors, makes sense to have consolidation leading to easier compliances, operational efficiencies and complimentary business from the one company. It will also lead to the simplification of holding structure for the group.

The proposed move will lead to integration of complementary businesses into holding company. VIL holds some of the equity shares of the group companies. As a result of the merger, those shares will get cancelled and, in some instances, VTL will directly hold shares in group companies.

The proposed merger will help consolidation of entities and in the process VTL can also have some tax benefits in the form of carry-forward losses for VNGL.

Significant revenues of VAL come from VTL. The proposed consolidation will help in reduction of listing compliances for the group and transfer pricing & Goods & Service Tax implications of inter-group transactions. Simultaneously, the move will also help VAL for its proposed Capacity Enhancement Programme.

Apart from the obvious rationales/ benefits, if one sees the group for last five years, there is hardly any increase in revenue or profitability. In fact, VAL’s business since inception is almost stagnant. it’s market cap is just around 5% of VTL’s market cap. As there is limited investors’ interest, shares of both the companies are considered as infrequently traded and hence the market cap is almost equal to book value. In fact, fair value of both the listed companies shares considered for the swap ratio report is 30% to 60% higher than market price on the stock exchanges. Post-merger, because of additional liquidity and integrated business will most likely lead to better investor’s interest and value creation for all concerned. In short, consolidation is win-win from all angles and for all the stakeholders.

Add comment