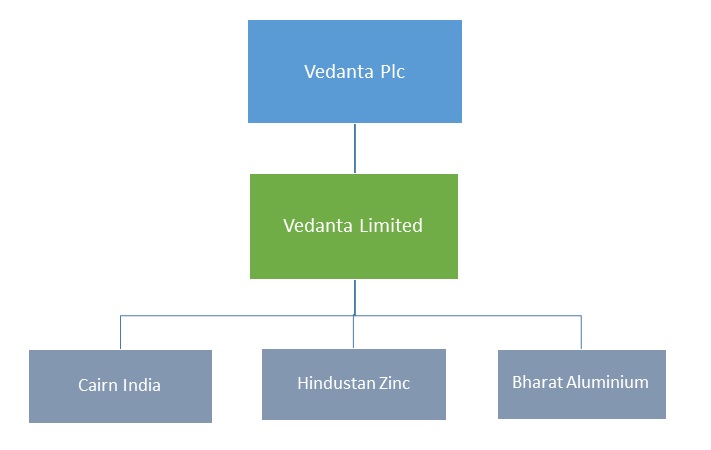

London Stock Exchange-listed Vedanta Resources PLC, India’s biggest diversified natural-resources company, agreed to combine two of its Indian listed businesses — Vedanta Ltd. and Cairn India Ltd.—in an all-share deal that frees up billions in cash for the debt-laden company and simplifies the group’s structure.

ABOUT VEDANTA PLC

Mr. Anil Agarwal founded Vedanta Resources Plc, a diversified global resources company. The group produces aluminium, copper, zinc, lead, silver, iron ore, oil & gas and commercial energy.Vedanta has operations in India, Zambia, Namibia, South Africa, Ireland, Liberia, Australia and Sri Lanka.

ABOUT VEDANTA LIMITED

Vedanta Limited is a diversified natural resources company, whose business primarily involves exploring and processing minerals and oil & gas. The Company produces oil &gas, zinc, lead, silver, copper, iron ore, aluminium and commercial power and has a presence across India, South Africa, Namibia, Ireland, Australia, Liberia and Sri Lanka.

In 2007, Vedanta Resources Plc, acquired 51% controlling stake in Sesa Goa Ltd. (iron ore producer and exporters), from Mitsui & Co. Ltd. In 2012, Sesa Sterlite was created by merging of its group company Sterlite into Sesa Goa. The merger was aimed at creating world’s seven largest global diversified natural resources major. Recently, the company changed its name from Sesa Sterlite to Vedanta Limited.

Vedanta Ltd is listed on both National Exchanges in India and has ADRs listed on the New York Stock Exchange.

Sources:- Company Data, hu Research

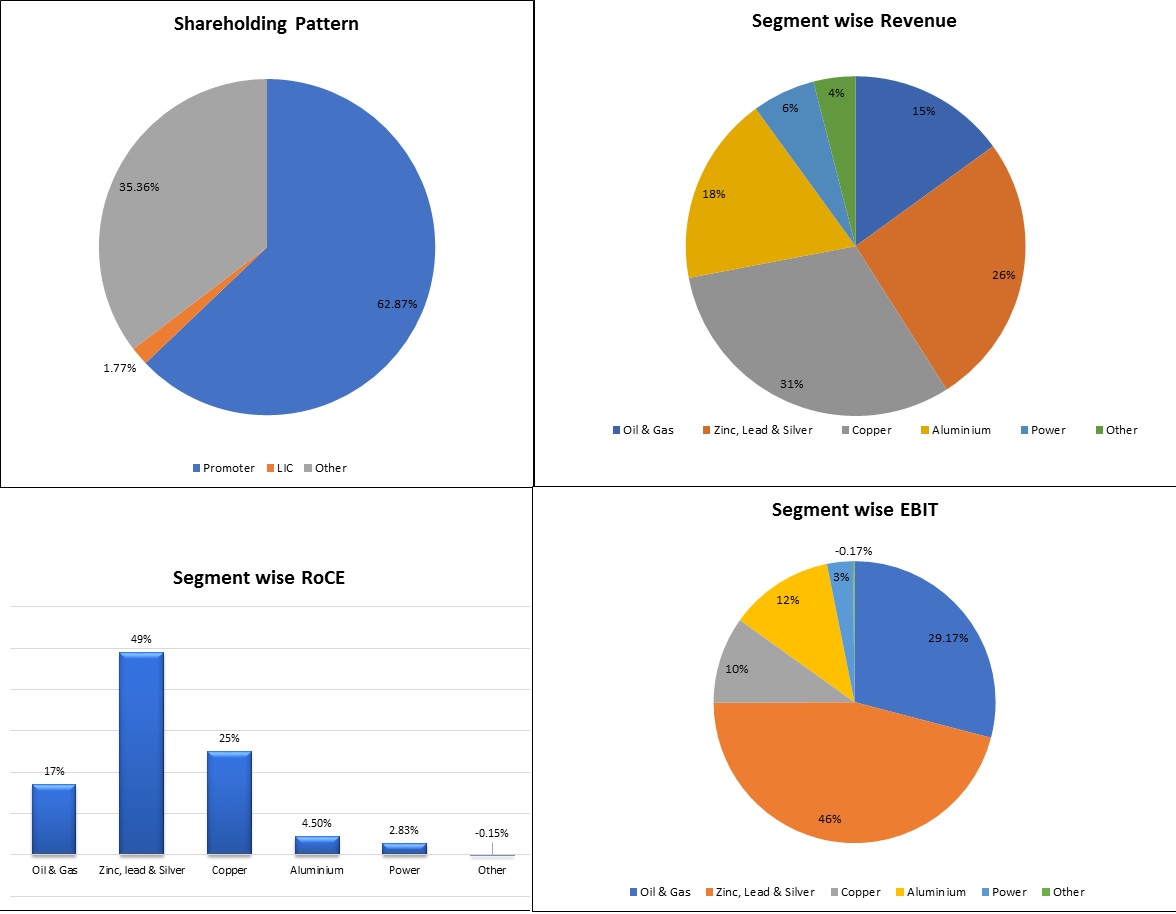

Due to a ban on mining in 2012, Vedanta’s Iron ore business revenue has fallen from INR 7516 crore in FY 2012 to INR 275 crore. Its EBIT from the same segment is in red from INR 3334 crore in FY 2012. However earlier this year, the Goa state government issued an order revoking its 2012 order that had halted the over 60-year-old-mining industry in Goa. The new order will pave the way for Vedanta for a resumption of mining activities in the state.

ABOUT CAIRN INDIA

Cairn India is one of the largest independent oil & gas exploration and production companies in India. It operates 27% of India’s domestic crude oil production and to date has opened 4 frontier basins with numerous discoveries. Cairn India has a portfolio of 9 blocks – one block in Rajasthan, which contains multiple assets, two on the west coast and four on the east coast of India and one each in Sri Lanka and South Africa. Oil and gas are currently being produced from Rajasthan, Ravva and Cambay.

In 2010, Vedanta Limited acquired a majority stake in Cairn India from Cairn Energy. Currently, Vedanta directly owns 23.67% of Cairn India. Earlier this month, Vedanta Bought 4.94% Cairn Share from its wholly owned subsidiary Twinstar Mauritius Holdings Limited.

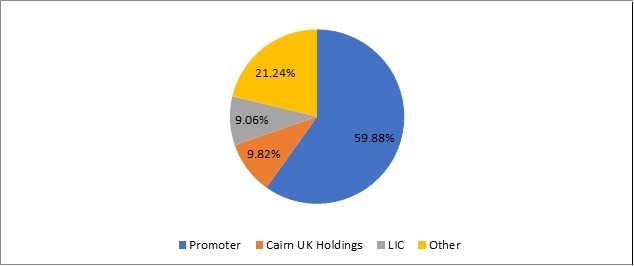

Current Shareholding Pattern of Cairn India

Source: Company Data, hu research

THE TRANSACTION

On completion, minority shareholders of Cairn India will receive for each equity share held:

- One equity share in Vedanta Limited of face value INR 1 each

- One 7.5% Redeemable Preference Share (RPS) in Vedanta Limited with a face value of INR 10 each.

RPS would have the following key terms:

- Dividend of 7.5% per annum payable annually at the end of each financial year

- Tenure – 18 months from issuance

- Redeemable at face value of INR 10 per share for cash at the end of the tenure

- Listed on the NSE

No shares will be issued to Vedanta Limited or any of its subsidiaries for their shareholding in Cairn India. Cairn India’s BSE and NSE listings will be cancelled following completion of the Transaction. The Transaction is expected to close in the first quarter of CY 2016.

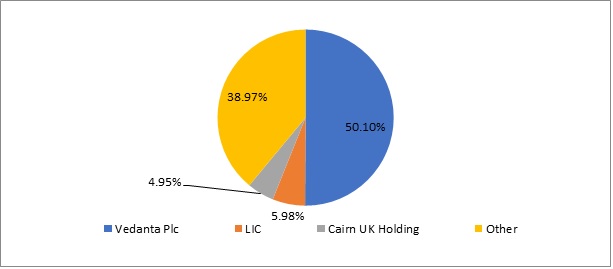

Shareholding Pattern Post Transaction

Source: Company Data, hu research

RATIONALE

The merger will result in a few main synergies to Vedanta & Cairn India.

Diversified Portfolio

Cairn will get exposure to well invested Tier-1 metals and mining assets of Vedanta. Currently, Cairn is only into Oil & Gas segment. The merger will add Zinc, Copper, and Aluminium in its portfolio. Hence those shareholders of Cairn who are willing to have diversified portfolio will be happy with this deal but those who like to have investment only in Oil & Gas will be disappointed.

Geographical Expansion

Currently, Cairn India has 9 blocks in its portfolio. Its three core producing blocks are onshore Rajasthan block, offshore Cambay (Near Gujarat) and Ravva (Eastern Coast) blocks, all in India. However, Vedanta is having global exposure. Apart from India where it earned 60% of its total revenue in FY 2015, it has good exposure in China, Far East Asia, Middle East, Europe and African Country. This will help Cairn India to expand its footprint in other countries.

Economies of scale

As said earlier, Cairn India is having core three blocks in Rajasthan, Cambay and Ravva. Vedanta also operates in these areas. Near Rajasthan and Cambay block Vedanta having its Zinc lead-silver blocks and near Ravva Aluminium and Iron blocks. At both the places Vedanta having its own captive thermal power plant.Coming together will help both the companies to utilise resources of each other. After deal Cairn will able to use Captive power plant of Vedanta, besides there could be saving on the part of logistics’, and entities can effectively use the human resource.

Better Capital Allocation

The deal will enable merged entity to use present surplus cash more efficiently. No doubt in future also surplus cash generated by any segment can be used for any other segment without legal compliances. It is likely to enable merged entity to borrow at fine rate because of improved net worth, enlarged and diversified asset cover and lower debt-equity ratio. Most important, for Vedanta Ltd., which has struggled to reduce its consolidated INR 72,000 crore debt, the deal would give it unfettered access to the around INR 17,000 crore cash reserves held by debt-free Cairn India.

Less Complex Structure

The merger would also make Vedanta’s U.K.-listed holding company less complex and enhance value for the ultimate holding company.

VALUATION

The transaction implies a premium of 7.3% to Cairn India’s Friday close of 180.75 rupees.

| Particulars | Vedanta | Cairn |

| Stock price as on 12.06.2015 | 184 | 180.75 |

| Average last 6 months closing price | 199 | 215 |

Source: -BSE, hu research

The said transaction implies premium of 7.33% to Cairn India’s 12.06.2015 ( the immediate day before merger announcement). However, if we consider an average of last 6 months closing price, cairns minority shareholders are incurring a loss of about 2.80%. Oil prices have fallen sharply due to supply side pressure. Oil prices are decided by international demand and supply. Due to the subdued performance of oil industry Cairn India’s shares have fallen badly. However, swap ratio looks neutral as Vedanta could have considered its future earnings from iron ore business which had stopped due to the ban on mining.

Why RPS

One RPS is to be allotted by Vedanta to each shareholder of Cairn India. As per the company, the reason for doing so is to sweeten the deal for Cairn Shareholders. Another reason for doing so is, If Vedanta wouldn’t have offered RPS, Vedanta had to offer higher swap ratio instead of 1:1 to get the nod from minority shareholders of Cairn which would have resulted in a decrease in Vedanta Plc shareholding below 50%, losing their majority over Vedanta Resources.

FINANCIAL

INR in Crore

| Particulars | Vedanta -Standalone | Vedanta-Consolidated (Excluding Cairn) | Cairn |

| As per 31st March, 2015 | |||

| Shareholders Fund | 34,057 | 53,875 | 58,870 |

| Long Term Borrowing | 21,770 | 52,052 | 0 |

| Capital Employed (Shareholders Fund+ Long Term Borrowing) | 29,739* | 105,927 | 58,870 |

| Total Revenue | 32,502 | 59,063 | 14,646 |

| EBIT | 5,625 | 10,101 | 7,762 |

| EBIT % | 17.31% | 17.10% | 53.00% |

| PAT | 1,927 | 581# | 4,479 |

| RoCE | 18.91% | 9.54% | 13.18% |

| RoE | 5.66% | 1.08% | 7.61% |

| Short Term Debt | 13,113 | 19,940 | 0 |

| Total Debt | 34,883 | 71,965 | 0 |

| Finance Cost | 3,655 | 5,658 | 0 |

*:- Capital Employed is after deducting investment in subsidiaries.

#:- After minority interest and share in associates but before exceptional items.

CONCLUSION

Vedanta Group always tried to simplify its group structure by consolidating its businesses under one roof. After Sesa Goa- Sterlite merger in 2012, now they came up with Vedanta – Cairn merger. Consolidation as proposed definitely improves value for investors in Vedanta PLC, London. Its impact on minority shareholders of both Vedanta India and Cairn India may not be positive considering both are in different commodity businesses with substantially different ROCE. So right fully, LIC, a minority shareholder of Cairn, raised its concern over the valuation of the merger and the debt of merged entity. So some regulatory hurdles are likely as The Companies Act, 2013, requires that 75% of minority shareholders (out of total minority shareholders who voted)should vote in favour of the deal. In the case of Cairn India, out of 40% public holding, LIC holds more than 9% which will end up holding about 6% (including its pre-merger holding of1.77% in Vedanta) in the merged entity. Hence though LIC is having a concern on a valuation of Cairn India, hence we don’t think LIC will vote against the merger. Merged Vedanta will be in a better position to raise funds to require for acquiring balance stake from Central government in Hindustan Zinc and BALCO, if they wish to do so.