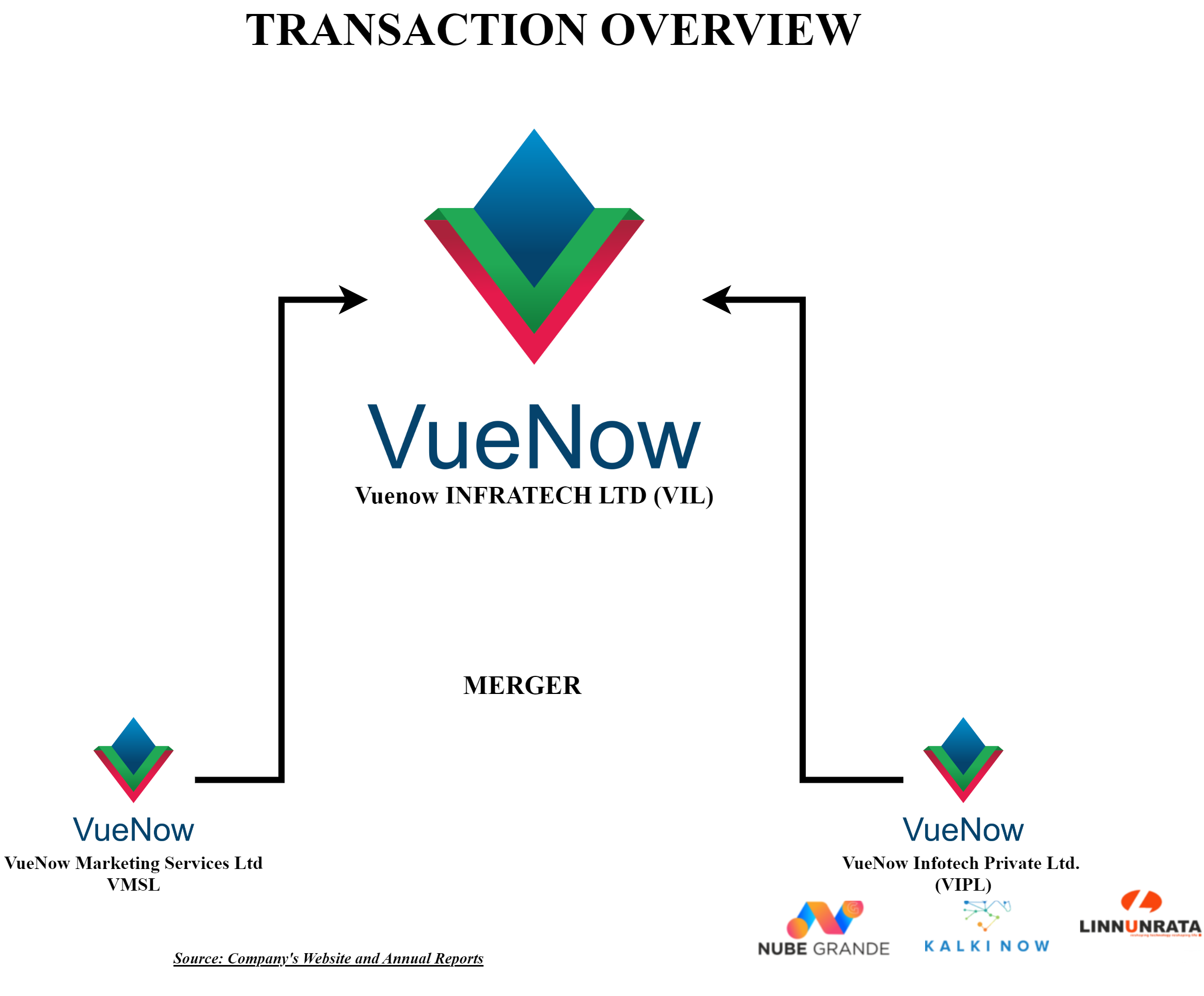

Recently, Vuenow Infratech Limited, a BSE listed company, announced the merger of two private companies itself. Though the company is small (rather miniscule), recent past events & some of the facts related to private entities make the transaction interesting.

Vuenow Infratech Limited (“Transferee Company” or “VIL”) was incorporated under the name “Good Value Irrigation Limited” in 1993. In 2023, the existing promoter “Rahul Bhargav” acquired a controlling stake in VIL from erstwhile promoters. Consequently, the name of the company changed to VIL.

Post-acquisition, VIL changed its object clause to deal in information technology & related products. It is worth considering that the revenue of VIL for the Financial Year 2023 was ‘nil’. The equity shares are listed on BSE Limited while the registered office of VIL is in the state of Maharashtra.

Vuenow Marketing Services Limited (“Transferor Company 1” or “VMSL”) has the main object of carrying the business of running, operating, managing, advising on and supplying information technology related products and services. The equity shares of VMSL are not listed and the registered office of VMSL is located in the state of Uttar Pradesh.

Vuenow Infotech Private Limited (“Transferor Company 2” or “VIPL”) main object is carrying the business of running, operating, managing, advising on and supplying information technology related products and services. The equity shares of VIPL are not listed and the registered office of VIPL is located in the state of Uttar Pradesh.

Both VMSL & VIPL are owned & controlled by different shareholder/s than Mr. Rahul Bhargav.

Recent Past of VIL:

In May 2023, controlling interest of VIL was acquired by Mr. Rahul Bhargav from erstwhile promoters for INR 0.10 (ten paise only) per share. Pursuant to the change of control, an open offer was being made for INR ten paisa per share, but no significant response was fetched from the public shareholders. Of course, out of total public shareholding at that time, only 12.83% of the holding was in demat form.

Immediately after acquisition, the name & object clause of the company was changed. The Board of Directors was changed, and Rahul Bhargav was appointed as Managing Director.

VIL announced that it will explore merger opportunities with VMSL & VIPL. Further on investor day in June 2023, VIL announced its ambitious plan to achieve at least INR 70 crore revenue for FY 2024 (VIL’s revenue for 10 months ended FY-24 was circa INR 20 crore).

In August 2023, VIL made a preferential allotment to Mr. Sukhwinder Singh Kharour aggregating to 23.87% (post-issue size) equity stake at face value. Sukhwinder Singh Kharour has been shown as a non-promoter in all preferential share allotment related documents and is currently classified as a public shareholder.

VIPL & VMSL are owned & promoted by Sukhwinder Singh Kharour. Website of VIL shows Mr. Rhaul Bhargav as ‘Cofounder & Managing Director’ of VIL while Sukhwinder Singh Kharour as the Founder & CEO of VIL. Even the name of all companies involved in the transaction starts and showcase as “Vuenow group” which is being founded by Sukhwinder Singh Kharour.

Recently, VIL also acquired a data center for an aggregate consideration of INR 9.25 crore with annual turnover capability of INR 16 crore. Also, surprisingly it announced a dividend of INR 0.50 (fifty paisa) per share.

Proposed Transaction

The board of directors of VIL, VIPL and VMSL at their respective board meetings, approved the merger of VMSL & VIPL with VIL.

Some of the rationale as envisaged in the scheme:

- Direct access to profitable businesses

- Greater financial strength

- Pooling of talents

- Other generalized benefits

The appointed date for the transaction is 1st April 2024 or such other date as may be mutually agreed in writing between the companies and fixed by the Board of the Companies.

Capital Structure & Swap Ratio:

Merger of VMSL with VIL:

In aggregate 1,12,50,724 [One Crore Twelve Lakhs Fifty Thousand Seven Hundred and Twenty-Four] equity shares of Face Value of Rs. 10/- (Rupees Ten) each fully paid-up of VIL will be issued and allotted to the shareholders of the VMSL on the Record Date.

Merger of VIPL with VIL

In aggregate 7,30,000 [Seven Lakhs Thirty Thousand] equity shares of Face Value of Rs. 10/- (Rupees Ten) each fully paid-up of VIL will be issued and allotted to the shareholders of VIL on the Record Date.

Tentative Shareholding pattern

| Particulars | VIL-Pre | VIL-Post | VMSL | VIPL |

| No. of Paid-up shares | 2,25,77,700 | 3,51,82,224 | 1,12,50,724 | 1,00,000 |

| Face Value | 10 | 10 | 10 | 10 |

| Rahul Bhargav | 36.7% | 24.20% | – | – |

| Sukhwinder Singh Kharour | 23.27% | NA | 2.92%* | 99% |

| Other/Public | 51.03% | NA | 97.08% | 1% |

*: along with others. NA: Not availableAs per the return of allotment filled by VMSL, VMSL issued 1,08,84,058 equity shares on right basis to 3162 persons at a consideration of INR 75 per share aggregating to circa INR 81 crore in May 2023. As a result, the paid-up capital of VMSL increased substantially and the holding of the existing promoter group (Sukhwinder Singh Kharour & others) decreased to circa 2.92% from 100%. The number of shareholders before right issue was only 6 and right issue was made to 3162 persons. One may need to ponder whether right issue to more than 200 persons amounts to “Deemed Public Issue”?

Recently, after the announcement of the merger, Mr. Rahul Bhargav sold 12,00,000 equity shares of VIL consisting of 5.17% of total paid up value to Mr. Arminder Singh. Due to this, his shareholding in the company got reduced from 41.87% to 36.7%.

As per the post-shareholding pattern given by VIL, Rahul Bhargav continues to be promoter while Sukhwinder Singh Kharour will continue to be public shareholder with stake likely to be higher than what Rahul Bhargav will hold in the merged entity.

Accounting Treatment:

As per the accounting treatment envisaged under the scheme, VIL shall account for the merger in its books of accounts as per Accounting Standard (AS)- 14 on Accounting for Amalgamations. The same is also certified by the statutory auditor of VIL. However, the key question arises whether any listed company is allowed to follow Accounting Standards instead of Ind-AS? Further recording of all assets & liabilities transferred from VMSL & VIPL will be done basis the fair value as on Appointed Date.

Valuation

The appointed valuer has done the valuation of VIL through mix of net asset, discounted cash flow basis and market multiple basis. Interestingly there is a wide difference between the valuation so done through above three methods & price at which preferential allotment was done some few months before.

| Particulars | Arrived Price per share |

| Net Asset Value | 2.95 |

| PE Ratio Multiple | 6.57 |

| DCF | 179.37 |

| Preferential Allotment made in August 2023 | 10 |

Projections attached to the valuation report suggest profit before taxes of VIL to increase from INR 3.31 crore in FY 24 to INR 322 cr in FY 29. One needs to evaluate whether giving weightage to such a differential valuation range is justified. Based on the weightage assigned, the weighted price per share of VIL is derived as 92.37 per share. The market price of VIL as on 12th April 2024 was INR 14.40 per share (being the 52 week high).

The valuation of VMSL & VIPL has been done based on net asset method. Final arrived valuation of all the companies is as follows:

| Particulars | Amount in ₹ Crores |

| VIL | 208 |

| VMSL | 102 |

| VIPL | 6.8 |

Please note that the current valuation of VIL is circa 22 crores. Further, the right issue made by VMSL in May 2023 was for INR 75 per share. Financials

VIL

INR in Crore

| Particulars | Amount for 10 months ended 31st January 2024 |

| Revenue | 19.60 |

| EBITDA | 3.75 |

| PAT | 2.57 |

| Net worth | 6.84 |

| Receivables | 23.30 |

| Provisions | 15.80 |

VIL had nil revenue & trade receivables for FY 2023. Interestingly, current receivables as on 31st January 2024 are more than the revenue VIL did in 10 months. Please note that the receivables as on 31 March 2023 was ‘nil’. Further, there is sharp increase of provisions to INR 15.80 crore reason of which is not known.

For both companies, there is huge advances from customers which are given as advance to suppliers. Interestingly the similar figure for FY 2023 were substantially lower for both entities:

INR in Crore

| Particulars | VMSL | VIPL |

| Short term loans & advances | 120 | 0.02 |

| Other current liabilities | 298 | 3.84 |

| Total Assets | 392 | 139 |

One may need to understand the business model in detail & consider why super growing businesses have been merged with the small, listed company than separate listing.

Conclusion:

- Though revival & growth is always better and value accretive for shareholders, one may need to consider the chronology of events & nitty-gritties in this case. While analyzing the deal we encountered the following questions: The reason/intention for takeover of VIL was to provide for listing to VIPL & VMSL through the merger?

- Are Mr. Rahul Bhargav & Sukhwinder Singh Kharour connected? As per various early press releases & VIL website, Mr. Rahul Bhargav is shown as COO & Sukhwinder Singh Kharour as CEO.

- If they are connected, whether preferential allotment made to Mr. Sukhwinder Singh Kharour truly amounts to allotment made to public shareholder & open offer as per SEBI takeover code regulation was not required while preferential allotment made to him in August 2023?

- Reasons for significant right issue in VMSL in 2023? The shareholding pattern provided along with the scheme does not provide any details of person to whom the rights shares were issued however, as per the valuation report, 100% holding of VMSL as on 31st January 2024 is with promoter and promoter group. Thus, can it be assumed that the person/s are also being classified as promoter along with Mr. Sukhwinder Singh Kharour in VMSL.

- The shareholding of Rahul Bhargav will likely to be lower than new shareholders however, as shown in shareholding pattern, Sukhwinder Singh Kharour will continue to be a public shareholder.

- One needs to carefully consider the valuation assigned to each entity and swap ratio derived thereon.

- VIL’s account for the transaction as per accounting standards & not as per Ind-AS is in line with the prevailing accounting provisions.

- VIL’s website showcases different information than information mentioned in the scheme & related documents. As per scheme documents, VIL/its subsidiaries don’t hold any equity shares of VMSL or VIPL. However, as per the website, both VMSL & VIPL are wholly owned subsidiaries of VIL.

VIL being listed entity should ensure that all disclosures are available in the formats as given by SEBI/Exchange. It will be a miracle if authorities approve the scheme with a set of documents available on the BSE website. It will be really interesting to see how the merger and shareholding pattern pans out in future.