Overview

- The Indian Media and Entertainment (M&E) industry is a sunrise sector for the economy and is making high growth strides.

- Proving its resilience to the world, the Indian M&E industry is on the cusp of a strong phase of growth, backed by rising consumer demand and improving advertising revenues.

- The industry has been largely driven by increasing digitisation and higher internet usage over the last decade.

- Internet has almost become a mainstream media for entertainment for most people in the country.

Market Dynamics

- The Indian media & entertainment sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.3 per cent to touch Rs 2.26 trillion (US$ 33.7 billion) by 2020, while revenues from advertising is expected to grow at15.9 per cent to INR 99,400 crore (US$ 14.82 billion).

- Over FY 2015 – 20, radio will likely grow at a CAGR of 16.9 per cent, while digital advertising will grow at 33.5 percent.

- The largest segment, India’s television industry, is expected to grow at a CAGR of 15 per cent, while print media is expected to grow at a CAGR of 8.6 per cent.

- India is one of the highest spending and fastest growing advertising market globally. The country’s expenditure on advertising is expected to grow more than 12 per cent in 2016, and accelerate to 13.9 per cent in 2017, based on various media events like T20 Cricket World Cup, the Indian Premier League (IPL) and State elections.

- Television segment, which continues to hold the highest share of spending, is expected to grow by 12.3 per cent in 2016 and 12.5 per cent in 2017, led by increased spending by packaged consumer goods brands and e-commerce companies.

- The Foreign Direct Investment (FDI) inflows in the Information and Broadcasting (I&B) sector (including print media) in the period April 2000 – March 2016 stood at US$ 4.98 billion, as per data released by Department of Industrial Policy and Promotion (DIPP).

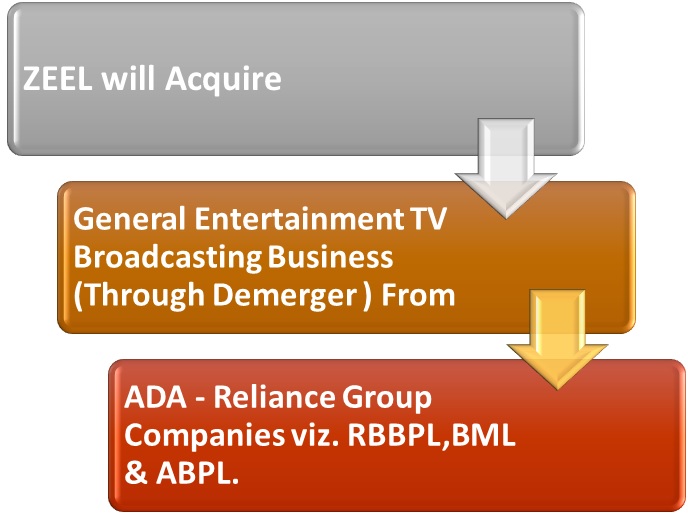

One of the recent activities in this industry is Zee Entertainment Enterprises Ltd. (ZEEL) to acquire the General Entertainment Broadcasting Business Undertaking of Reliance Group Companies (ADA Group) through a scheme of demerger and execution of definitive agreement in relation to such acquisition.

CURRENT CAPITAL STRUCTURE& BRIEF INFORMATION:

ZEEL

Zee Entertainment Enterprises Ltd. (ZEEL) is an Indian media and entertainment company based in Mumbai. It is part of the Essel Group. The Company has 35 channels serving Indian content across India and 169 countries. Current Market Capitalisation value of ZEEL is INR 45,755.78 crore

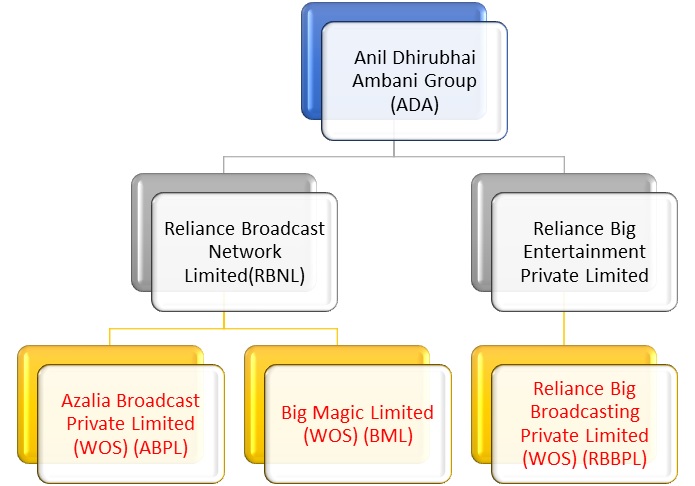

Reliance

| Company Name | Business |

| RBBPL | Owning and operating non-news and current affairs satellite television channels. |

| BML | Acquiring content from producers and third parties to be broadcasted by BML on the channels owned and operated by it. |

| ABPL | Owning and operating a non-news and current satellite television channel under name and style of “Big Thrill”. |

TRANSACTION:

The Composite Scheme of Arrangement approved by the Board of ZEEL on November 23, 2016, provides for:

Demerger of General Entertainment Television Business of Reliance Big Broadcasting Private Limited, Big Magic Limited, and Azalia Broadcasting Private Limited and vest the same with Zee Entertainment Enterprises Private Limited. Appointed date proposed in the draft Composite Scheme of Arrangement is close of business hours of March 31st, 2017.

| Name of the Company | Business which is going to be Demerged |

| RBBPL | The General Entertainment Television Business |

| License for Non-News and current affair channels as follows; | |

| 1) | Big Magic – Comedy Programs’ Channel |

| 2) | Big Ganga – Bhojpuri Channel (mainly in Bihar and Jharkhand) |

| 3) | Big Magic Punjab |

| 4) | Big Gaurav |

| 5) | Big Magic HD |

| BML | Acquiring content from producers and third parties |

| ABPL | General Entertainment TV broadcasting division |

| Non-news and Current affair channel – Big Thrill- Action Programs’ Channel |

Unlisted Preference Shares of Face Value of Rs.10 each of the resulting company i.e. ZEEL will be issued to all Equity and Preference Shareholders of RBBPL, BML, and ABPL.

| Consideration to be issued | |||

| in numbers | |||

| Existing Share Capital | RBBPL | BML | ABPL |

| Equity of Rs 10/- | 10,000 | 50,000 | 7,11,42,854 |

| Preference | 30,45,00,000 | 50,00,00,000 | – |

| New Shares of ZEEL to be issued | Re1/- | Rs.10/- | |

| Unlisted Preference Shares of Rs.10/- | |||

| For Equity Shares | 10,000 | 50,000 | 12,70,433 |

| Swap Ratio | 1.00 | 1.00 | 0.02 |

| For Preference Shares | 9,33,954 | 17,44,716 | – |

| Swap Ratio | Very Negligible |

The scheme does not provide for Merger of any subsidiary entity with the company.

RATIONALE:

- Anil Ambani Group (Reliance Companies):

- Will reduce debt of the company.

- It is part of their strategy to reduce exposure in non-core businesses and work towards further reducing debt under Reliance Capital.

- The group is shifting focus to four core business areas viz. defence, financial services, power, and telecom.

- Media is not going to be the driving force in future anyway.

- Zee Entertainment Enterprises Limited (ZEEL):

- BIG Magic – access to comedy genre enhancing Zee’s customer offerings.

- BIG Ganga, a leading Bhojpuri channel – syncs with Zee’s strategy of expanding into the regional markets which offers attractive growth potential.

- Not only be complementary to current business but accelerate its growth too.

- Reaching out to a much-increased audience base and will keep them engaged on different media platforms.

- This acquisition shall bring about the desired business diversity

- and will help in achieving the sound financial objectives at an accelerated pace.

- this investment will enhance value for all stakeholders.

FINANCIALS

Overall Segment reporting of RBNL as per AS 17 is as follows;

| Particulars (As on 31.03.2016) | Radio Broadcasting | Television |

| Segment Revenue | 33,418.45 | 5,569.89 |

| Inter Segment Revenue | -2,217.69 | -97.85 |

| Total Income | 31,200.76 | 5,472.04 |

| Segment Result | 12,690.79 | -26,575.40 |

| Other Information | ||

| Segment Assets | 59,519.36 | 18,278.33 |

| Segment Liabilities | 47,862.68 | 81,998.03 |

| Net Assets | 11,656.68 | -63,719.70 |

Segment wise Financials of Reliance Broadcasting Private Limited are not available but we see it in a whole, the financial position is as follows;

RBBPL

All figures in Rs. Crores

| Particulars | 30th Sep 2016 | F.Y. 2015-16 | F.Y. 2014-15 | F.Y. 2013-14 |

| Revenue | 28.03 | 61.17 | 32.98 | 12.18 |

| Other Income | 0.04 | 0.54 | – | 0.06 |

| Total | 28.07 | 61.71 | 32.98 | 12.24 |

| Expenditure | ||||

| PBDT | -1.90 | -6.47 | -12.27 | -7.29 |

| PBDT% (margin) | -6.78 | -10.58 | -37.20 | -59.85 |

| PAT | -1.93 | -6.54 | -12.59 | -7.64 |

| PAT% (margin) | -6.89 | -10.69 | -38.17 | -62.73 |

| Net Worth | 12.59 | 14.52 | 21.05 | 4.28 |

| RONW | -15.33 | -45.04 | -59.81 | -178.50 |

| EPS | -1,931.00 | -6,537.00 | -12,590.37 | -7,642.50 |

ZEEL

All figures in Rs. Crores

| Particulars | 30th Sep 2016 | F.Y. 2015-16 | F.Y. 2014-15 | F.Y. 2013-14 |

| Revenue | 2,453.62 | 4,206.50 | 3,426.18 | 3,075.67 |

| Other Income | 25.71 | 222.66 | 227.29 | 184.56 |

| Total | 2,479.33 | 4,429.16 | 3,653.47 | 3,260.23 |

| Expenditure | -1,623.70 | -3,030.62 | -2,381.49 | -2,044.20 |

| EBIT | 855.63 | 1,398.54 | 1,271.98 | 1,216.03 |

| EBIT% (margin) | 34.87 | 33.25 | 37.13 | 39.54 |

| PAT | 498.10 | 859.33 | 831.77 | 772.33 |

| PAT% (margin) | 20.30 | 20.43 | 24.28 | 25.11 |

| Net Worth | 3,887.00 | 5,039.00 | 4,588.00 | 3,968.00 |

| RONW | 22.01 | 27.75 | 27.72 | 30.65 |

| Capital Employed | 7,008.78 | 5,081.40 | 4,628.10 | 3997.20 |

| RoCE (%) | 12.21 | 16.91 | 17.97 | 30.42 |

| EPS | 7.43 | 7.15 | 7.94 | 6.71 |

ANALYSIS

RELIANCE:

All three companies were incurring losses and hence RELIANCE ADA GROUP decided to hive off businesses and in the process reduces its debt. This decision was to avoid growing losses so that energy, time and cost to be invested in media sector could be diverted in some other businesses giving sufficient returns to the company.

ZEEL (Essel Group Company)

Acquisition of 49 % stake in 92.7 BIG FM,

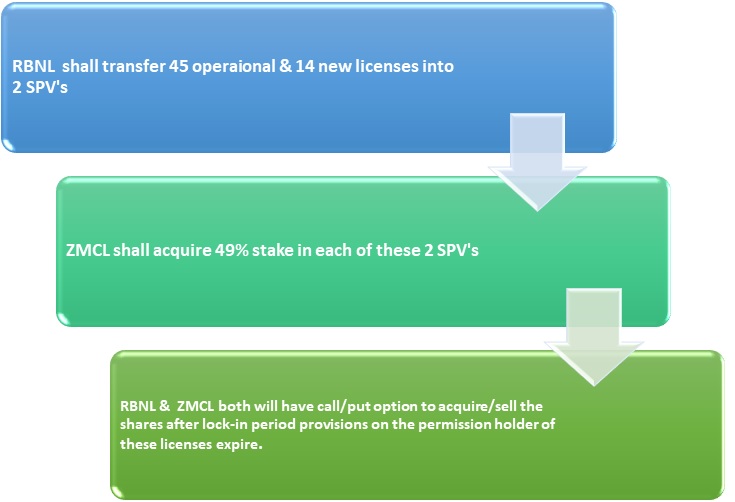

- The Board of Directors of Zee Media Corporation Limited (ZMCL) has approved acquisition of 49 per cent stake in 92.7 BIG FM, the radio broadcasting business of Reliance Broadcast Network Limited (RBNL) and the execution of definitive agreements in relation to such acquisition.

- Reliance Broadcast Network Limited runs the largest network of FM radio channels in India 45operational licenses (issued under Phase II and migrated to Phase III) and 14 new licenses (issued under Phase III).

- The FM channels are being broadcast under the brand “92.7 BIG FM”, reaching to 45 cities, 1200towns and over 200 million people. It reaches out to around 43 million listeners per week and engages with a large number of national and local advertisers.

- Reliance Broadcast Network Limited shall be transferring the 45 operational and 14 new licenses into two SPVs respectively along with the assets and liabilities.

- ZMCL shall acquire 49 per cent stake in each of these two SPVs. ZMCL and Reliance Broadcast Network Limited shall also have a call/put option to acquire/sell the balance51 per cent after the lock-in provisions on the permission holder of these licenses expire.

- As per Ministry of Information and Broadcasting (MIB) regulations, at least 51 per cent shareholding needs to be held by the permission holder for a minimum period of 3 years from the date the channels were operationalised.

- The lock-in period for the 45 operational licenses shall expire on 31st March 2018, whilst the lock-in period for the 14 licenses shall expire after the expiry of 3years from the day all 14 licenses shall have become operational, which is expected to be around March 2020.

The combined value of both these transactions is INR 1900 crore.

TAXATION

Since Scheme talks of compliance demerger u/s 2(19AA) of Income Tax Act,1961, it will not only be a tax neutral demerger but the shares issued by ZEEL to Reliance Group Companies will also comply u/s 2(41A) of Income Tax Act,1961.

ACCOUNTING TREATMENT

In the books of RBBPL, BML, and ABPL is as follows;

The demerged company has adjusted net assets transferred to maximum extent possible against the capital reserve in books of respective companies. In case of deficit, the same shall be charged to Profit & Loss account.

In the books of ZEEL:

Zeel shall record asset & liability of demerged undertaking at their respective fair values.

The surplus/deficit between the value of Net Assets pertaining to Demerged Undertaking and the amount of Preference Shares issued shall be credited to Capital Reserve Account/ debited to Goodwill.

Zeel Shall account for preference shares issued to the shareholders of the Transferor company at par in its books of accounts.

CONCLUSION

This demerger has taken place out of no choice as Reliance is not able to grow its business neither can fund companies in the media sector. Hence it is just increasing the quantum of debts with no return on capital employed. For ZEEL, this demerger will help in quick expansion and they can approach to larger share of media market with more variety and innovative ideas.